Income Driven Repayment Form

Income Driven Repayment Form - An idr plan bases your monthly payment on your income and family size. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Send the form via fax or postal mail to your loan servicer. Once the form downloads, fill out and print. If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password). Select the reason you are submitting this form (check only one): Web your loans must be federal direct loans. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Web these repayment plans are unique:

Web these repayment plans are unique: An idr plan bases your monthly payment on your income and family size. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Web your loans must be federal direct loans. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Select the reason you are submitting this form (check only one): Send the form via fax or postal mail to your loan servicer. Once the form downloads, fill out and print. If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password).

Web these repayment plans are unique: Select the reason you are submitting this form (check only one): Web your loans must be federal direct loans. An idr plan bases your monthly payment on your income and family size. If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password). Once the form downloads, fill out and print. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Send the form via fax or postal mail to your loan servicer. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan.

How to Recertify for Repayment Student Loan Planner

Once the form downloads, fill out and print. Web your loans must be federal direct loans. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Web these repayment plans are unique: If you have parent plus loans, you must consolidate your loans to become eligible.

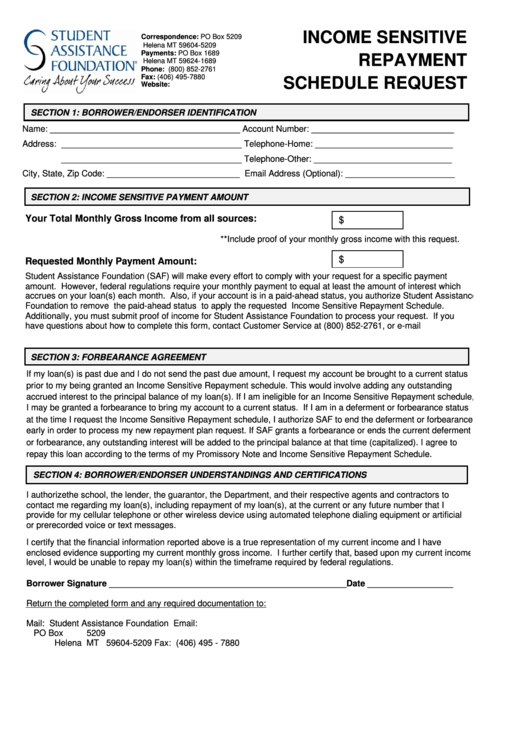

Mohela Form Fill Online, Printable, Fillable, Blank pdfFiller

Once the form downloads, fill out and print. Web these repayment plans are unique: Web your loans must be federal direct loans. Send the form via fax or postal mail to your loan servicer. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf.

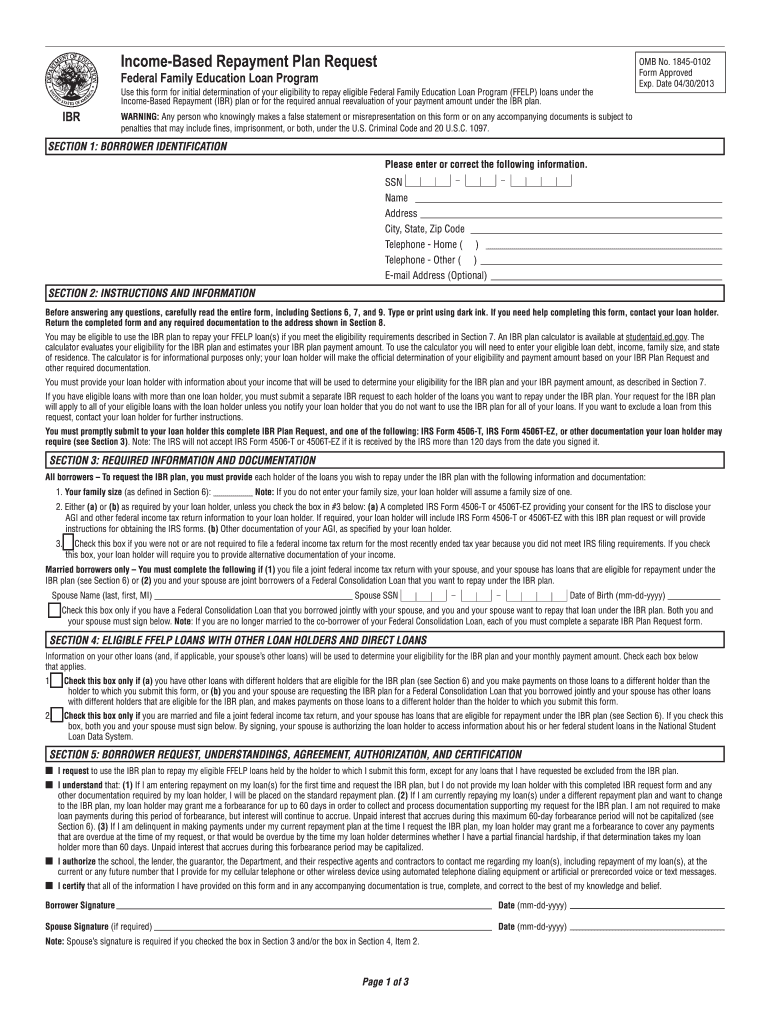

Based Repayment Form ACS Free Download

Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. An idr plan bases your monthly payment on your income and family size. Web your loans must be federal direct loans. If you have parent plus loans, you must consolidate your loans to become eligible for.

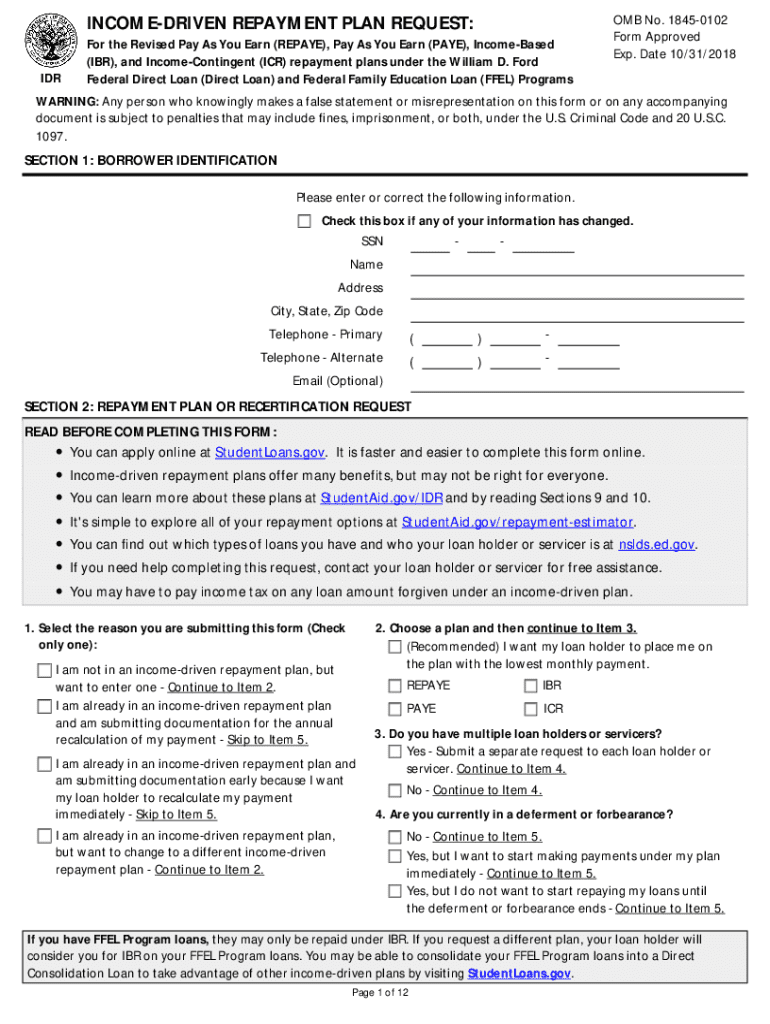

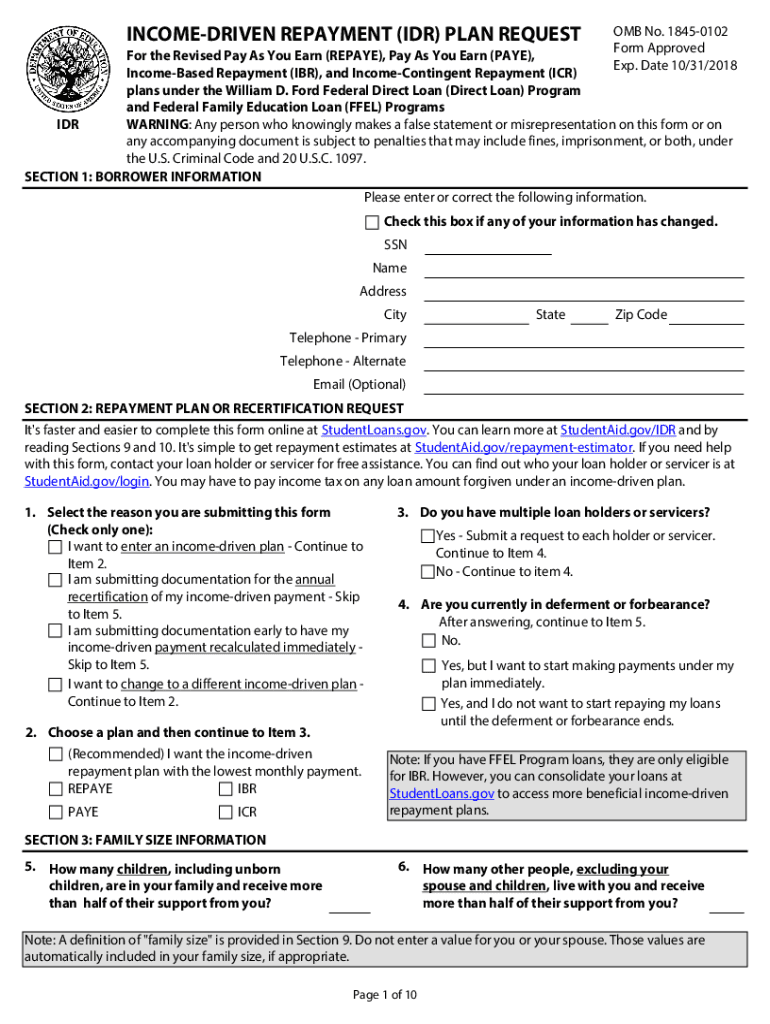

Idr Driven Plan Form Fill Out and Sign Printable PDF Template signNow

Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Web your loans must be federal direct loans. Once the form downloads, fill out and print. Send the form via fax or postal mail to your loan servicer. If you do not know your loan servicer’s.

Based Repayment Form ACS Free Download

If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password). Web your loans must be federal direct loans. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Web these repayment plans are unique: If.

Top Based Repayment Form Templates free to download in PDF format

Web these repayment plans are unique: If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Select the reason you are submitting this form (check only one): If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password). Once the form downloads,.

Idr Driven Repayment Plan Fill Out and Sign Printable PDF

Select the reason you are submitting this form (check only one): An idr plan bases your monthly payment on your income and family size. Once the form downloads, fill out and print. Web these repayment plans are unique: Web your loans must be federal direct loans.

Driven Repayment Form Student Loans In The United States Loans

Select the reason you are submitting this form (check only one): If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Web these repayment plans are unique: Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. Web.

Student Loan Recertification How to Apply for a New Plan

An idr plan bases your monthly payment on your income and family size. If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password). Plus, payments you make on an idr plan.

FREE 6+ Sample Based Repayment Forms in PDF

Web these repayment plans are unique: An idr plan bases your monthly payment on your income and family size. Select the reason you are submitting this form (check only one): Send the form via fax or postal mail to your loan servicer. Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you.

Web Your Loans Must Be Federal Direct Loans.

Plus, payments you make on an idr plan can count toward public service loan forgiveness (pslf) if you meet the other requirements for pslf. If you do not know your loan servicer’s information, log in to studentaid.gov with your fsa id (account username and password). If you have parent plus loans, you must consolidate your loans to become eligible for an idr plan. Send the form via fax or postal mail to your loan servicer.

Web These Repayment Plans Are Unique:

Once the form downloads, fill out and print. An idr plan bases your monthly payment on your income and family size. Select the reason you are submitting this form (check only one):