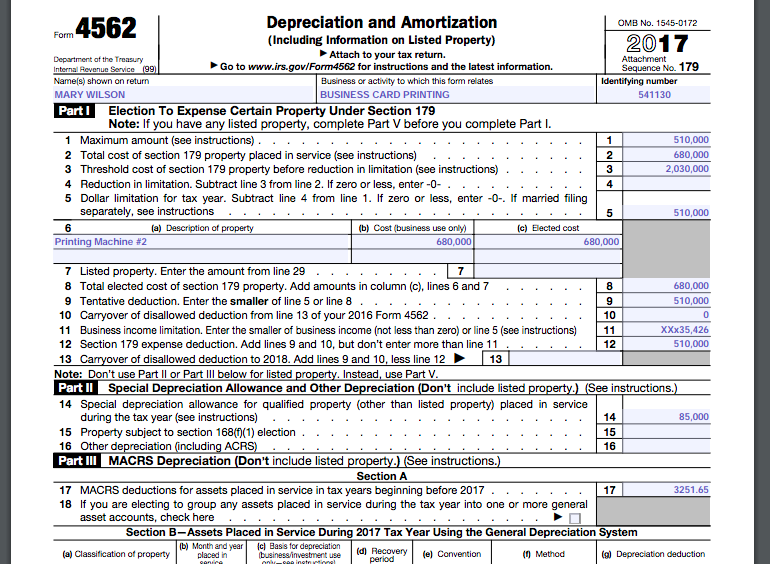

Tax Help Form 4562 Line 12

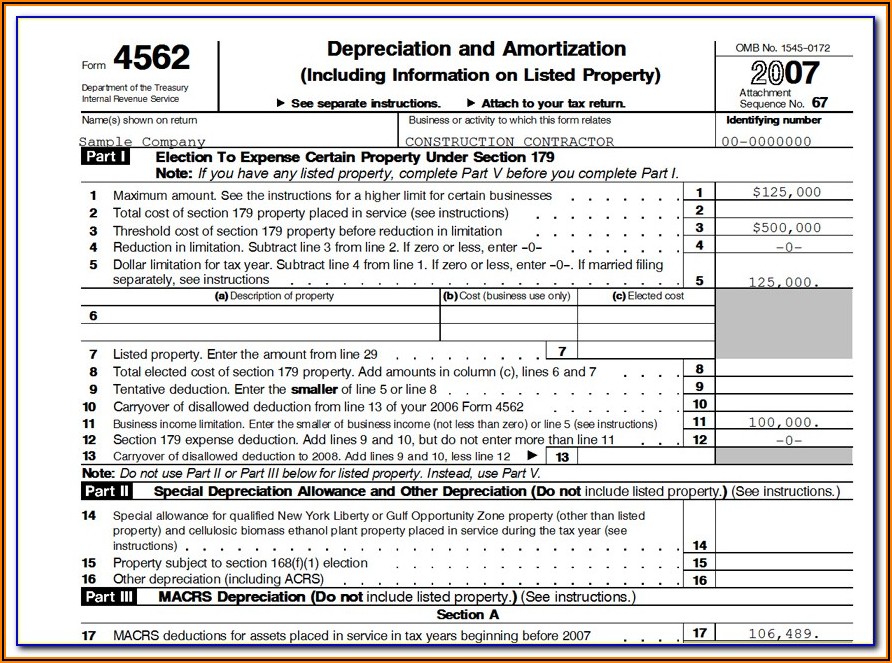

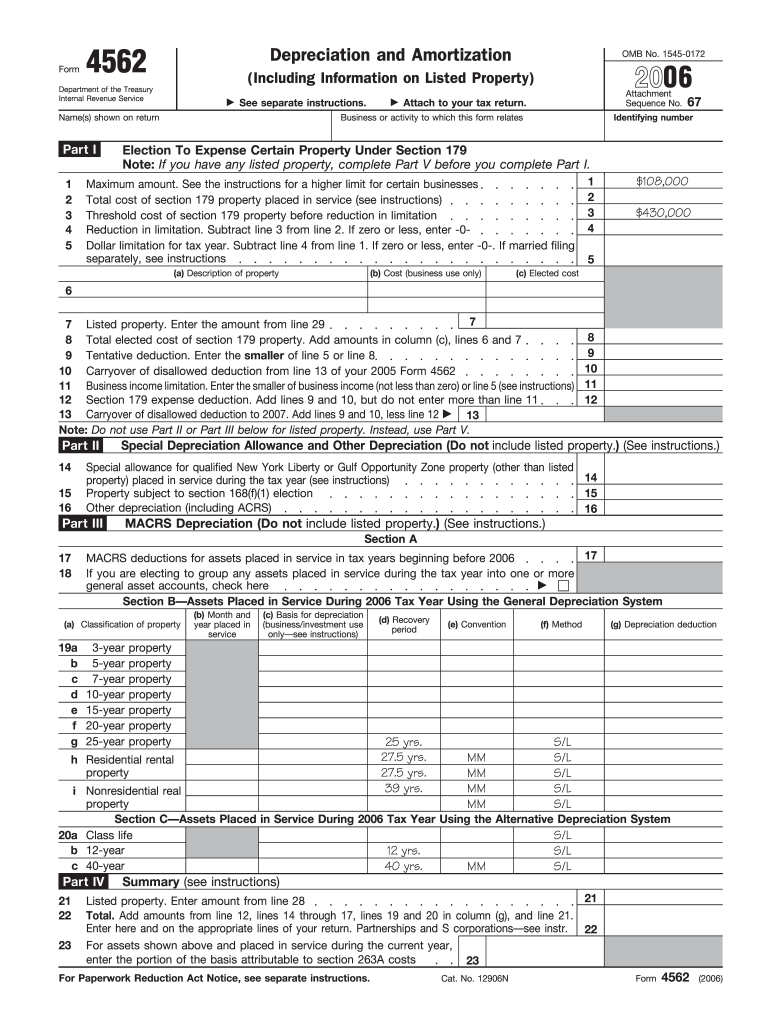

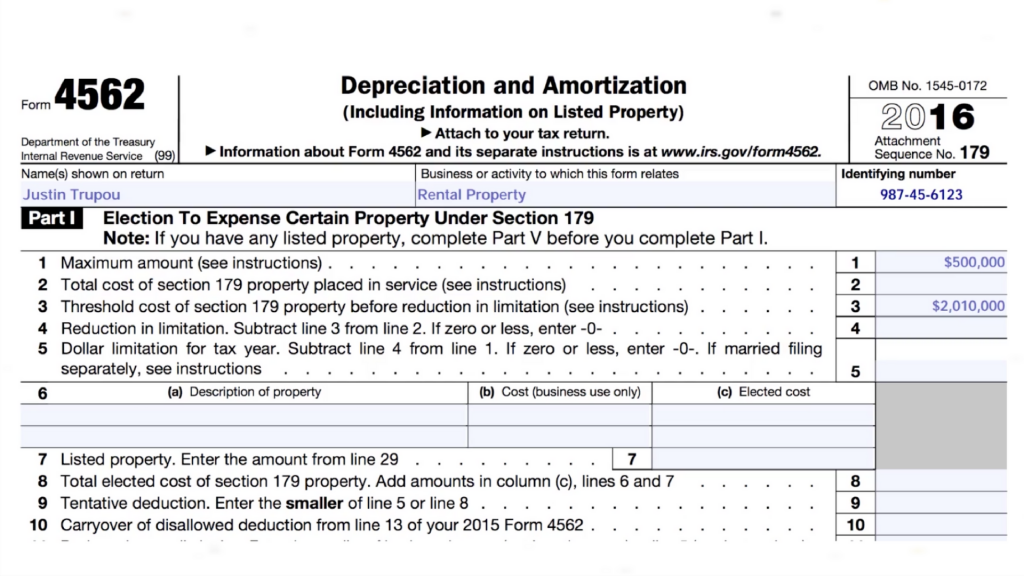

Tax Help Form 4562 Line 12 - Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. If you need more space, attach additional sheets. Depreciation and amortization is an internal revenue service (irs) tax form used to depreciate or amortize property purchased for use in a business. File form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web form 4562, line 17, plus line 19, column g, plus line 26, column h, for property for which you claimed special depreciation on federal form 4562, line 14 or 25, for this tax year,. Each year, you can use the form to deduct the cost of business property that has. Web filing form 4562. Web form 4562 line 12: Web although the description for line 11 of form 4562 depreciation and amortization is business income limitation, the calculation for this line is not strictly based on your.

Web use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Rental real property is not listed property. Line 12 cannot be more than line 11. Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: File form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. Line 11 is 0 but it will not accept line 12 as 0. This error is usually caused by taking less. To complete form 4562, you'll need to know the cost of assets like. Each year, you can use the form to deduct the cost of business property that has. Anyone now how to fix this?

This error is usually caused by taking less. Rental real property is not listed property. File form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. Property placed in service in the current tax. Web although the description for line 11 of form 4562 depreciation and amortization is business income limitation, the calculation for this line is not strictly based on your. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. If you need more space, attach additional sheets. Web you must reallocate the section 179 on one or more activities. Depreciation and amortization is an internal revenue service (irs) tax form used to depreciate or amortize property purchased for use in a business. Taxpayers complete form 8862 and attach it to their tax return if:

Irs Tax Form 4562 For 2014 Form Resume Examples 0g27l11x9P

Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Taxpayers complete form 8862 and attach it to their tax return if: Depreciation and amortization is an internal revenue service (irs) tax form used to depreciate or amortize property purchased for use in a business. Rental real property is not listed.

Learn How to Fill the Form 4562 Depreciation and Amortization YouTube

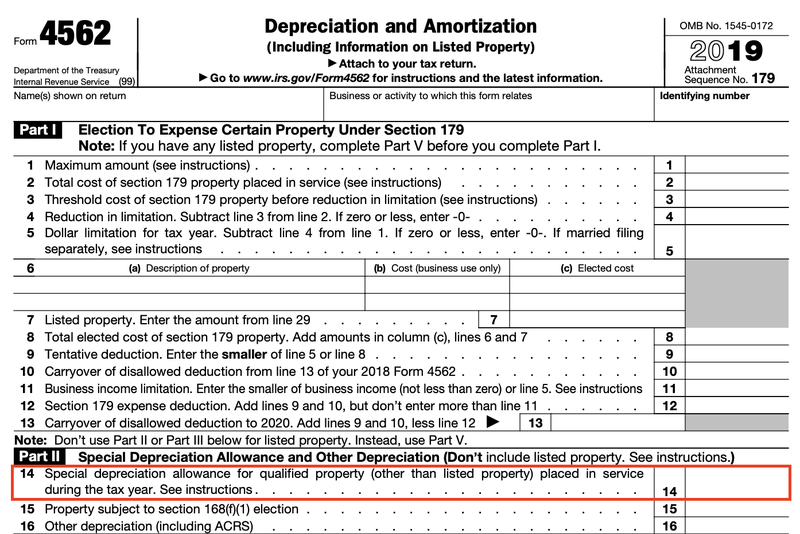

Web file a separate form 4562 for each business or activity on your return for which form 4562 is required. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. See tax help for form 4562, line 12 for details. Enter the amount of the carryover attributed. Lines 26.

Publication 587 Business Use of Your Home; Schedule C Example

Line 12 cannot be more than line 11. Web please review your entries for allowable section 179 on all activities. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. To complete form 4562, you'll need to know the cost of assets like. Web filing form 4562.

IRS Form 4562 Part 5

Enter the amount of the carryover attributed. This error is usually caused by taking less. Web filing form 4562. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form 4562, depreciation and amortization, as its name suggests, is used for depreciating and amortizing both tangible and intangible assets.

4562 Form Fill Out and Sign Printable PDF Template signNow

Line 12 cannot be more than line 11. Enter the amount of the carryover attributed. File form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web.

Part 2 How to Prepare a 1040NR Tax Return for U.S. Rental Properties

Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web form 4562 line 12: Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Web about form 8862, information to claim certain credits after disallowance. Web irs form 4562 is.

Understanding Form 4562 How To Account For Depreciation And

See tax help for form 4562, line 12 for the details proseries generates form 4562: Property placed in service in the current tax. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web irs form 4562 is used to claim deductions for depreciation and amortization for business assets. Web although the.

The New York Times > Business > Image > Form 4562

Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Line 12 cannot be more than line 11. Web use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach.

Need Help filling out the first part of the form

Web file a separate form 4562 for each business or activity on your return for which form 4562 is required. Anyone now how to fix this? Web form 4562, line 17, plus line 19, column g, plus line 26, column h, for property for which you claimed special depreciation on federal form 4562, line 14 or 25, for this tax.

A small business guide to bonus depreciation

Line 12 cannot be more than line 11. Lines 26 and 27 of irs form 4562 are for listed assets. Web form 4562 line 12: Web form 4562, depreciation and amortization, as its name suggests, is used for depreciating and amortizing both tangible and intangible assets. To complete form 4562, you'll need to know the cost of assets like.

Taxpayers Complete Form 8862 And Attach It To Their Tax Return If:

Web home forms and instructions about form 4562, depreciation and amortization (including information on listed property) use form 4562 to: Web use irs form 4562 to claim depreciation and amortization deductions on your annual tax return. Rental real property is not listed property. Line 11 is 0 but it will not accept line 12 as 0.

File Form 4562 With Your Individual Or Business Tax Return For Any Year You Are Claiming A Depreciation Deduction Or Making A Section 179 Election.

If you need more space, attach additional sheets. Line 12 cannot be more than line 11. Web department of the treasury internal revenue service depreciation and amortization (including information on listed property) attach to your tax return. Web form 4562 line 12:

Property Placed In Service In The Current Tax.

Web get answers to frequently asked questions about form 4562 and section 179 in proseries professional and proseries basic: Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web form 4562, depreciation and amortization, as its name suggests, is used for depreciating and amortizing both tangible and intangible assets. Anyone now how to fix this?

This Error Is Usually Caused By Taking Less.

Lines 26 and 27 of irs form 4562 are for listed assets. Web about form 8862, information to claim certain credits after disallowance. See tax help for form 4562, line 12 for details. Web filing form 4562.