How Do I File Form 990 N

How Do I File Form 990 N - October 24, 2017 | 0 comments. Discover the answers you need here! Uslegalforms allows users to edit, sign, fill & share all type of documents online. When do i need to file? Ad search for answers from across the web with searchresultsquickly.com. Sign in/create an account with login.gov or id.me: Web up to 10% cash back create a new id.me account users without an active irs username credential must register and sign in id.me. Edit, sign and save return org ept income tax form. Just search for your ein, and our system will automatically import your organization’s data from the irs. Web the form 990 allows the irs to check up on a nonprofit in two capacities:

Web why do i need to provide this information? This is may 15 for most nonprofits, which use a calendar year. Below are solutions to frequently asked questions about entering form 990, form 990. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web the form 990 allows the irs to check up on a nonprofit in two capacities: Edit, sign and save return org ept income tax form. Discover the answers you need here! Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Just search for your ein, and our system will automatically import your organization’s data from the irs. Web up to 10% cash back create a new id.me account users without an active irs username credential must register and sign in id.me.

The irs requires a login.gov or. When do i need to file? Sign in/create an account with login.gov or id.me: Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal. Below are solutions to frequently asked questions about entering form 990, form 990. Edit, sign and save return org ept income tax form. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web the form 990 allows the irs to check up on a nonprofit in two capacities: Web why do i need to provide this information? This is may 15 for most nonprofits, which use a calendar year.

Instructions to file your Form 990PF A Complete Guide

Discover the answers you need here! October 24, 2017 | 0 comments. Web up to 10% cash back create a new id.me account users without an active irs username credential must register and sign in id.me. Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n..

Form 990N ePostcard

Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. The group return satisfies your reporting requirement. Below are solutions to frequently asked questions about entering form 990, form 990. Web why do i need to provide this information? Web up to 10% cash back create.

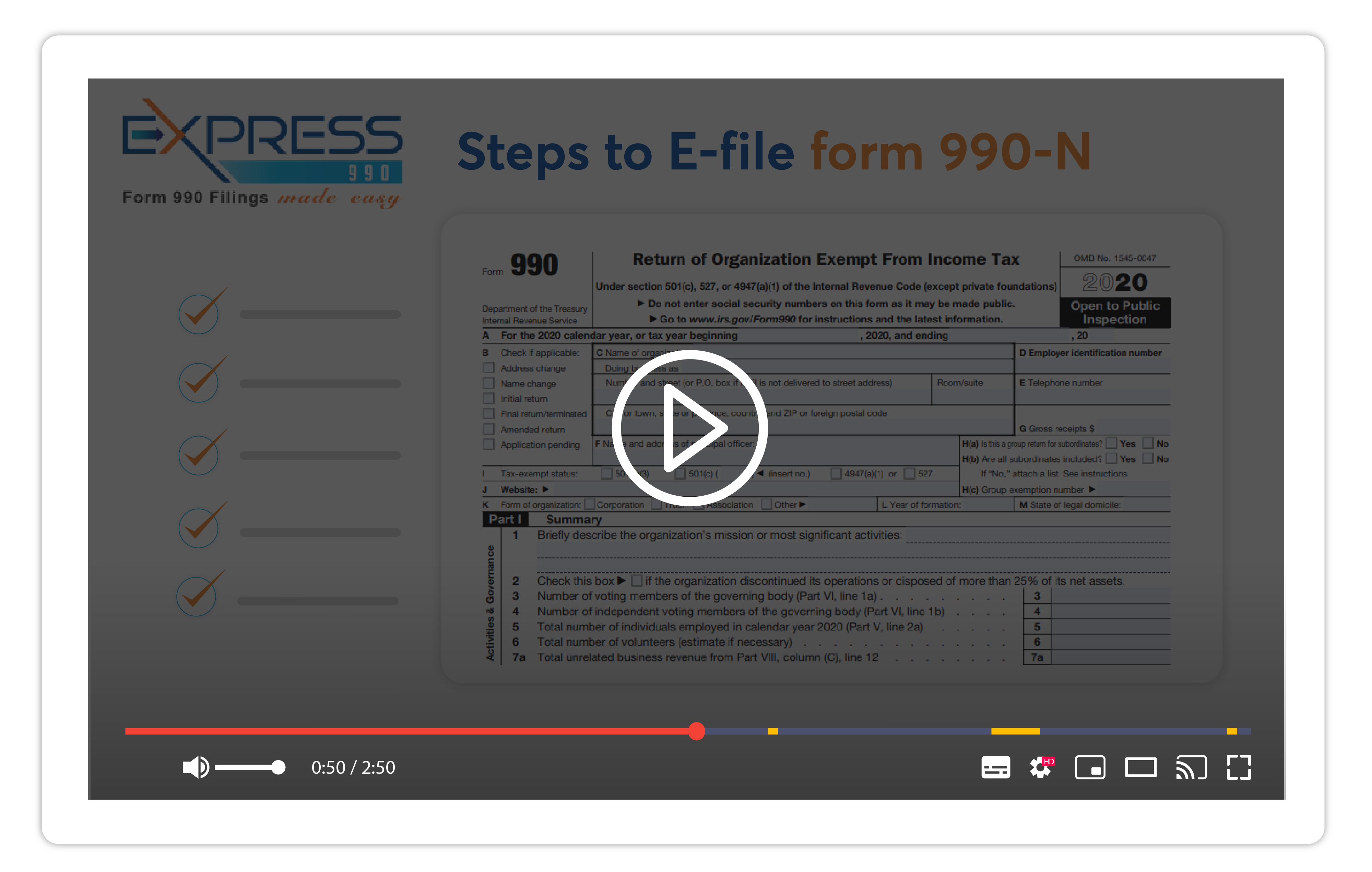

Efile Form 990N 2020 IRS Form 990N Online Filing

Just search for your ein, and our system will automatically import your organization’s data from the irs. Enter organization ein, review, and transmit to the irs! Discover the answers you need here! Uslegalforms allows users to edit, sign, fill & share all type of documents online. This is may 15 for most nonprofits, which use a calendar year.

What is Form 990PF?

Below are solutions to frequently asked questions about entering form 990, form 990. Id.me account creation requires an. This is may 15 for most nonprofits, which use a calendar year. Just search for your ein, and our system will automatically import your organization’s data from the irs. Web form 990 department of the treasury internal revenue service return of organization.

Meet the May 17, 2021 EPostcard Form 990N Deadline In 3 Simple Steps

This is may 15 for most nonprofits, which use a calendar year. When do i need to file? Below are solutions to frequently asked questions about entering form 990, form 990. Web why do i need to provide this information? Id.me account creation requires an.

FAQ Do I Need to File the IRS Form 990EZ? Secure Nonprofit Tax E

Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. Id.me account creation requires an. Enter organization ein, review, and transmit to the irs! When do i need to file? Web why do i need to provide this information?

IRS Form 990 You Can Do This Secure Nonprofit Tax Efiling 990EZ

Uslegalforms allows users to edit, sign, fill & share all type of documents online. October 24, 2017 | 0 comments. Just search for your ein, and our system will automatically import your organization’s data from the irs. Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990.

The Best Form 990 Software for Tax Professionals What You Need to Know

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Below are solutions to frequently asked questions about entering form 990, form 990. Enter organization ein, review, and transmit to the irs! Edit, sign and save return org ept income tax form. October 24, 2017 | 0 comments.

How To Never Mistake IRS Form 990 and Form 990N Again

This is may 15 for most nonprofits, which use a calendar year. Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. The irs requires a login.gov or. Web up to 10% cash back create a new id.me account users without an active irs username credential.

A concrete proposal for a Twin Cities Drupal User Group nonprofit

Discover the answers you need here! Just search for your ein, and our system will automatically import your organization’s data from the irs. Web the form 990 allows the irs to check up on a nonprofit in two capacities: Below are solutions to frequently asked questions about entering form 990, form 990. Web up to 10% cash back create a.

Web Why Do I Need To Provide This Information?

Web up to 10% cash back create a new id.me account users without an active irs username credential must register and sign in id.me. When do i need to file? Enter organization ein, review, and transmit to the irs! Web form 990 department of the treasury internal revenue service return of organization exempt from income tax under section 501(c), 527, or 4947(a)(1) of the internal.

Discover The Answers You Need Here!

Web once you’ve determined your total receipts for the year and they total less than $50,000, you’re ready to file your form 990 n. The irs requires a login.gov or. October 24, 2017 | 0 comments. Uslegalforms allows users to edit, sign, fill & share all type of documents online.

Id.me Account Creation Requires An.

Sign in/create an account with login.gov or id.me: Web the form 990 allows the irs to check up on a nonprofit in two capacities: Edit, sign and save return org ept income tax form. Ad search for answers from across the web with searchresultsquickly.com.

Just Search For Your Ein, And Our System Will Automatically Import Your Organization’s Data From The Irs.

The group return satisfies your reporting requirement. This is may 15 for most nonprofits, which use a calendar year. Below are solutions to frequently asked questions about entering form 990, form 990.