Form 8997 Special Gain Code

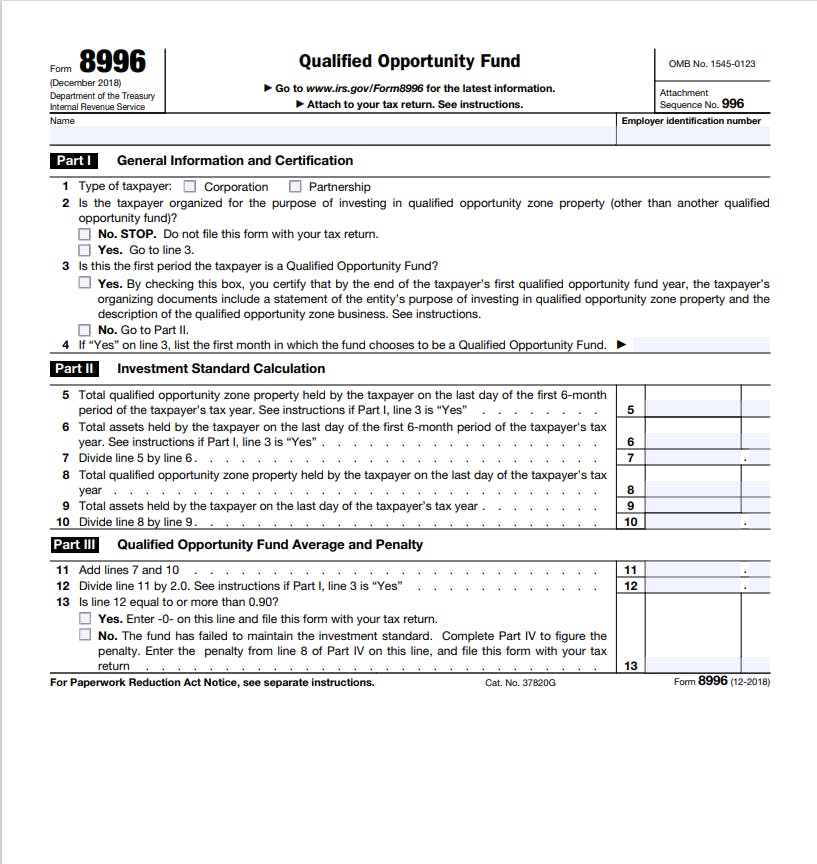

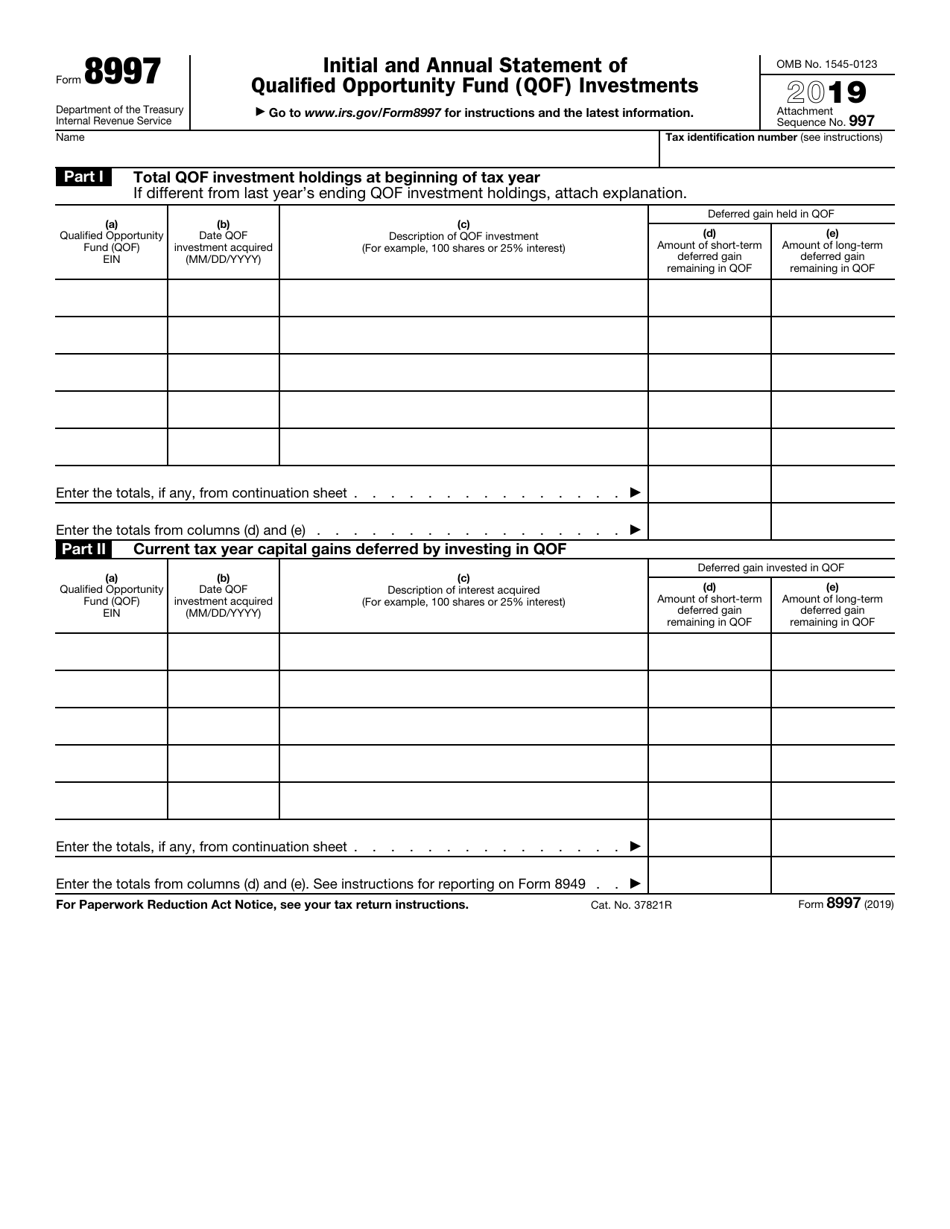

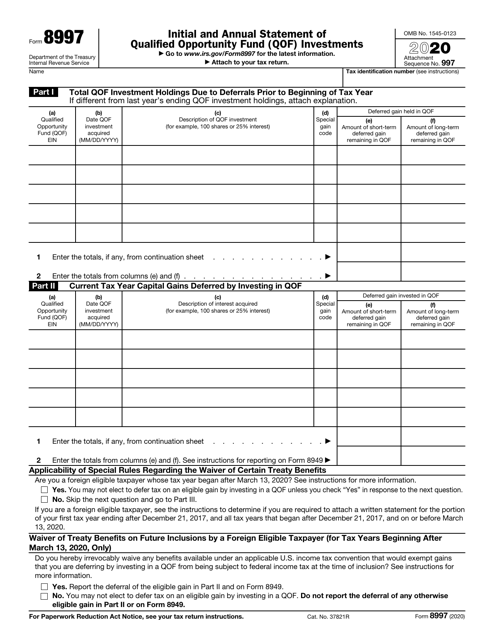

Form 8997 Special Gain Code - Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web special gain code (sgc). While most of the entries you make in the. Web form 8997 2022 initial and annual statement of qualified opportunity fund (qof) investments department of the treasury internal revenue service attach to your tax. You can file your tax return without that, however according. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: This requirement for qof investors is new and in addition to the.

Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Who must file an eligible. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: Web special gain code (sgc). Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web form 8997 department of the treasury internal revenue service initial and annual statement of qualified opportunity fund (qof) investments go to. Web form 8997 2022 initial and annual statement of qualified opportunity fund (qof) investments department of the treasury internal revenue service attach to your tax. This requirement for qof investors is new and in addition to the. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web qof are not reported on form 8997.

Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web special gain code (sgc). Web form 8997 department of the treasury internal revenue service initial and annual statement of qualified opportunity fund (qof) investments go to. Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. This requirement for qof investors is new and in addition to the. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web jimmy atkinson february 23, 2022 podcast under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting capital gains from an asset sale.

How To Fill Out IRS Form 8997 (For OZ Investors), With Ashley Tison

Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web special gain code (sgc). You can file your tax return without that, however according. Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web deferred gain held in qof qualified opportunity fund (qof) ein.

Deception Pass State Park Goose Rock — Washington Trails Association

Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web deferred gain held in qof qualified opportunity fund (qof) ein (b) date qof investment acquired (mm/dd/yyyy) (c) description of qof investment (for example, 100 shares or. Web form 8997 department of the treasury.

IRS Form 8997 The Sherbert Group

This requirement for qof investors is new and in addition to the. Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web special gain code (sgc). Web qof are not reported on form 8997. This requirement for qof investors is new and in addition to the requirement that qof.

To The Opportunity Zone Toolkit. Everything you will need for

Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. Web jimmy atkinson february 23, 2022 podcast under.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Web special gain code (sgc). Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: Web applicability of special rules regarding the.

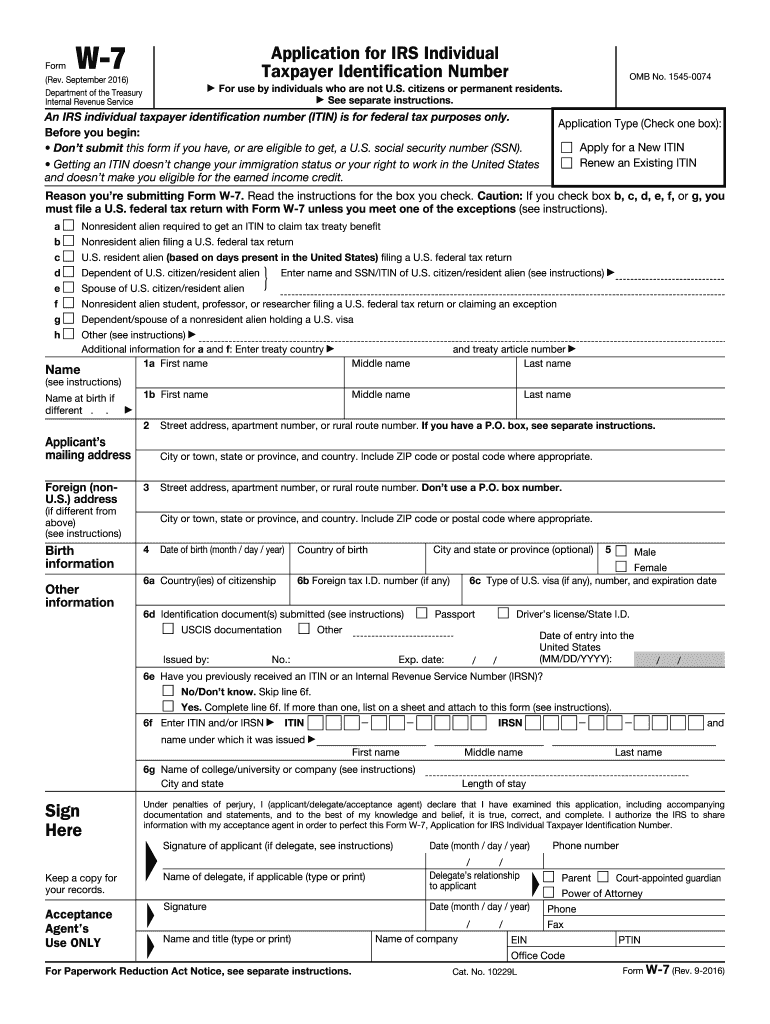

How To Apply For A Tax Id Or Ein Number Online

Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web applicability of special rules regarding the waiver of certain.

ASSORTED 25TON ROD ELEVATORS (8997) Lot 670, Day 1 Oilfield, Truck

While most of the entries you make in the. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: Web form 8997 department of the treasury internal revenue service initial and annual statement of qualified opportunity fund (qof) investments go to. Web qof are not reported on form.

Qualified Opportunity Zones Are They Really Effective? Western CPE

Web jimmy atkinson february 23, 2022 podcast under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting capital gains from an asset sale. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital. Web qof are not.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web special gain code (sgc). An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the. Web form 8997 is required to be filed every.

1.5" x 0.5" White Matte Laser Label Sheets for Inkjet & Laser Printers

Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: Web applicability of special rules regarding the waiver of certain treaty benefits.

Web Applicability Of Special Rules Regarding The Waiver Of Certain Treaty Benefits Are You A Foreign Eligible Taxpayer Whose Tax Year Began After March 13, 2020?

Web form 8997 department of the treasury internal revenue service initial and annual statement of qualified opportunity fund (qof) investments go to. Web qof are not reported on form 8997. Web jimmy atkinson february 23, 2022 podcast under the opportunity zones (oz) incentive, taxpayers can defer taxes by reinvesting capital gains from an asset sale. This requirement for qof investors is new and in addition to the requirement that qof.

Web Use Form 8997 To Inform The Irs Of The Qof Investments And Deferred Gains Held At The Beginning And End Of The Current Tax Year, As Well As Any Capital.

An sgc is a code that is entered when the qof investment originated from an elected deferred gain, where the gain was: Web form 8997 2022 initial and annual statement of qualified opportunity fund (qof) investments department of the treasury internal revenue service attach to your tax. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form.

While Most Of The Entries You Make In The.

Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer whose tax year began after march 13, 2020? Web special gain code (sgc). Web taxpayers holding a qof investment at any point during the tax year must file form 8997. This requirement for qof investors is new and in addition to the.

Who Must File An Eligible.

You can file your tax return without that, however according. Web taxpayers holding a qof investment at any point during the tax year must file form 8997. Web form 8997 is required to be filed every year in which the taxpayer is deferring a gain through an investment in a qof or qoz. Web deferred gain held in qof qualified opportunity fund (qof) ein (b) date qof investment acquired (mm/dd/yyyy) (c) description of qof investment (for example, 100 shares or.