Form 4884 Michigan

Form 4884 Michigan - Recipients born after january 1, 1954, received retirement benefits from ssa exempt employment, and were retired as of. 2013 michigan pension schedule, form 4884 note: Web we last updated michigan form 4884 worksheet from the department of treasury in february 2023. Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi. Save or instantly send your ready documents. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. If the older of filer or spouse is born during. Web taxslayer support is my retirement income taxable to michigan? Retirement and pension benefits that are transferred from one plan to another (rolled over) continue to be treated as if they remained in the original. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury.

However, with our preconfigured web templates, everything gets simpler. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Recipients born after january 1, 1954, received retirement benefits from ssa exempt employment, and were retired as of. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Save or instantly send your ready documents. Web see form 4884, line 29 instructions for more information. Show sources > about the corporate income tax the irs and most. Retirement and pension benefits that are transferred from one plan to another (rolled over) continue to be treated as if they remained in the original. Web you will want to verify your selection in the retirement and pension benefits section of your michigan state tax return. Sign it in a few clicks draw your signature, type it,.

Web (form 4884) federal civil service. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Retirement and pension benefits that are transferred from one plan to another (rolled over) continue to be treated as if they remained in the original. Show sources > about the corporate income tax the irs and most. 2013 michigan pension schedule, form 4884 note: Sign it in a few clicks draw your signature, type it,. Web see form 4884, line 29 instructions for more information. Save or instantly send your ready documents. Web if a taxpayer or the taxpayer’s spouse received pension benefits from a deceased spouse, taxpayers should consult the form 4884 (michigan pension.

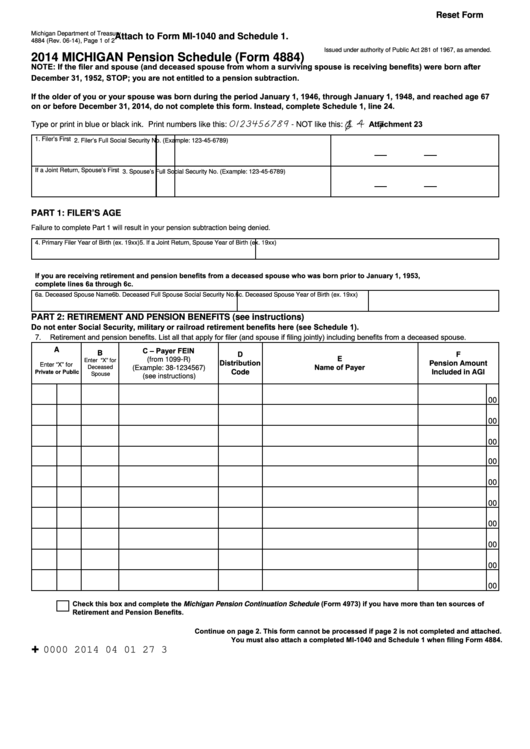

Fillable Form 4884 Michigan Pension Schedule 2014 printable pdf

Web taxslayer support is my retirement income taxable to michigan? Form 4884 section c worksheet: Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. 2013 michigan pension schedule, form 4884 note: Your selection for the type of retirement and.

Fill Michigan

Web see form 4884, line 29 instructions for more information. Recipients born after january 1, 1954, received retirement benefits from ssa exempt employment, and were retired as of. Issued under authority of public act 281 of 1967. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Web you will want to verify your selection in.

Fill Michigan

Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. Your selection for the type of retirement and. 2013 michigan pension schedule, form 4884 note: Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi..

Fill Michigan

Web instructions included on form: Web taxslayer support is my retirement income taxable to michigan? Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. Show sources > about the corporate income tax the irs and most. Sign it in a few clicks draw your signature, type it,.

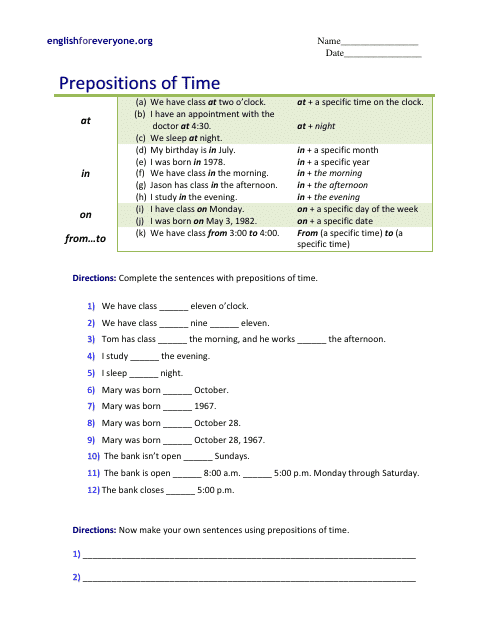

Prepositions of Time Worksheet Download Printable PDF Templateroller

However, with our preconfigured web templates, everything gets simpler. Show sources > about the corporate income tax the irs and most. Web taxslayer support is my retirement income taxable to michigan? If the older of filer or spouse is born during. We last updated the pension schedule in february 2023, so this is the latest.

Fill Michigan

Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks draw your signature, type it,. Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi. Web instructions.

Fill Michigan

However, with our preconfigured web templates, everything gets simpler. According to the michigan instructions for form 4884, retirement and pension benefits are taxed. Web we last updated michigan form 4884 worksheet from the department of treasury in february 2023. Web taxslayer support is my retirement income taxable to michigan? Web follow the simple instructions below:

Fill Michigan

Recipients born after january 1, 1954, received retirement benefits from ssa exempt employment, and were retired as of. Easily fill out pdf blank, edit, and sign them. Your selection for the type of retirement and. Sign it in a few clicks draw your signature, type it,. We last updated the pension schedule in february 2023, so this is the latest.

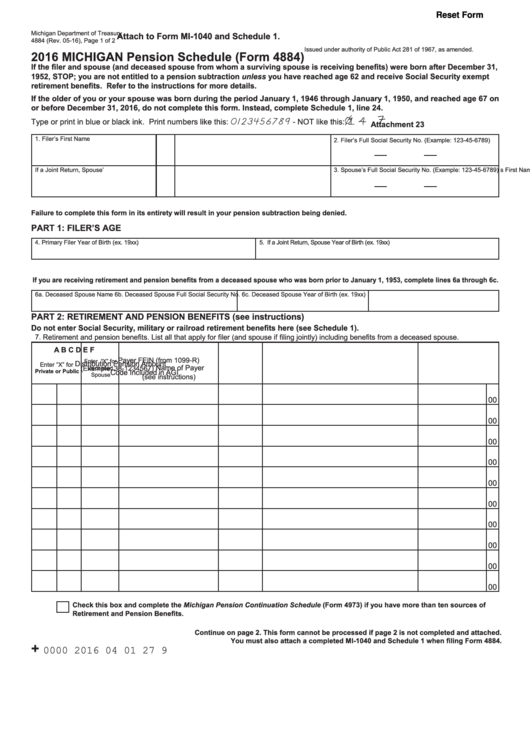

Form 4884 Michigan Pension Schedule 2016 printable pdf download

Web instructions included on form: Show sources > about the corporate income tax the irs and most. This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type it,. 2013 michigan pension schedule, form 4884 note:

Form Mi 1040 Michigan Tax Return 2000 Printable Pdf Download

Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury. We last updated the pension schedule in february 2023, so this is the latest. Web if a taxpayer or the taxpayer’s spouse received pension benefits from a deceased spouse, taxpayers should consult the form 4884 (michigan pension. Web form 4884 will now be completed.

Issued Under Authority Of Public Act 281 Of 1967.

Show sources > about the corporate income tax the irs and most. Web taxslayer support is my retirement income taxable to michigan? 2013 michigan pension schedule, form 4884 note: Web we last updated michigan form 4884 in february 2023 from the michigan department of treasury.

Web Follow The Simple Instructions Below:

Web we last updated michigan form 4884 worksheet from the department of treasury in february 2023. Your selection for the type of retirement and. Retirement and pension benefits that are transferred from one plan to another (rolled over) continue to be treated as if they remained in the original. Web instructions included on form:

Web See Form 4884, Line 29 Instructions For More Information.

Web form 4884 will now be completed within the return, if applicable, and you should see the retirement subtraction on schedule 1, line 24 which transfers to form mi. However, with our preconfigured web templates, everything gets simpler. Edit your mi 4884 form online type text, add images, blackout confidential details, add comments, highlights and more. According to the michigan instructions for form 4884, retirement and pension benefits are taxed.

Web If A Taxpayer Or The Taxpayer’s Spouse Received Pension Benefits From A Deceased Spouse, Taxpayers Should Consult The Form 4884 (Michigan Pension.

We last updated the pension schedule in february 2023, so this is the latest. Form 4884 section c worksheet: This form is for income earned in tax year 2022, with tax returns due in april. Web you will want to verify your selection in the retirement and pension benefits section of your michigan state tax return.