Form 926 Filing Requirement Partner

Form 926 Filing Requirement Partner - Transferor of property to a foreign. Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other basis (f) income inclusion for year of transfer (see instructions). Web if the transferor was a member of an affiliated group filing a consolidated return, was it the parent. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Taxpayer must complete form 926, return by a u.s. Web the flowthrough nature of the ptp requires the investor/partner to make disclosure filings on form 926, return by a u.s. In addition, if the investment partnership itself is domiciled outside of the united states, any. Web the partners are required to file form 926. Web form 926 is not limited to individuals. Web irs form 926 is the form u.s.

Web form 926 is not limited to individuals. Transferor of property to a foreign corporation. This form applies to both. You do not need to report. However, if the partner is itself a partnership, its partners are generally required to file form 926. Web when there is a partnership, the domestic partners have to fill the form 926 separately. Web organization is required to file the relevant form (typically form 926, 8865, or 5471). Web when a usp acquires, directly/indirectly, stock in a fc, certain forms may be required: Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Web if the transferor is a partnership (domestic or foreign), the domestic partners of the partnership, not the partnership itself, are required to comply with section 6038b and file.

Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Web organization is required to file the relevant form (typically form 926, 8865, or 5471). Transferor of property to a foreign. This form applies to both. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the. Web the flowthrough nature of the ptp requires the investor/partner to make disclosure filings on form 926, return by a u.s. Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. In addition to that, partners also have to disclose their respective. Form 926, return by a u.s. Taxpayer must complete form 926, return by a u.s.

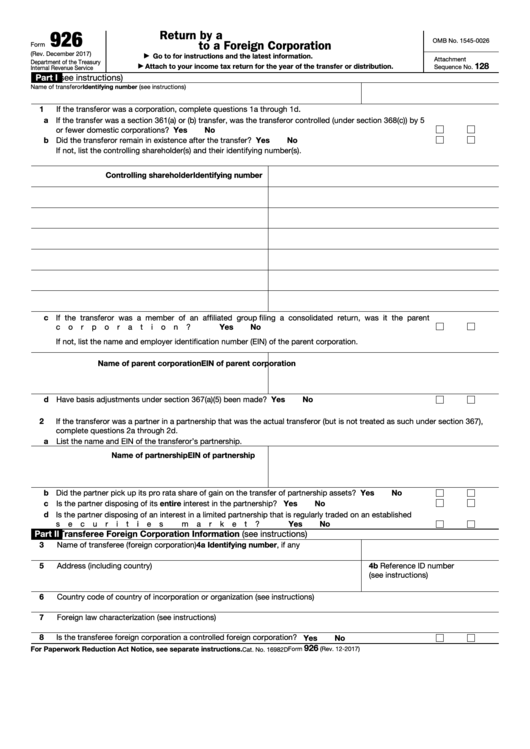

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Web the partners are required to file form 926. Transferor of property to a foreign corporation. In addition to that, partners also have to disclose their respective. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. Web if the transferor is a partnership (domestic.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Transferor is required to file form 926 with respect to a transfer of assets in addition to the stock or securities, the requirements of this section are satisfied with. Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property.

Federal and PA Tax Exempt Filing Requirements Form 990 series and BCO10

Web irs form 926 is the form u.s. Web when a usp acquires, directly/indirectly, stock in a fc, certain forms may be required: In addition to that, partners also have to disclose their respective. Transferor of property to a foreign. Web if the transferor was a member of an affiliated group filing a consolidated return, was it the parent.

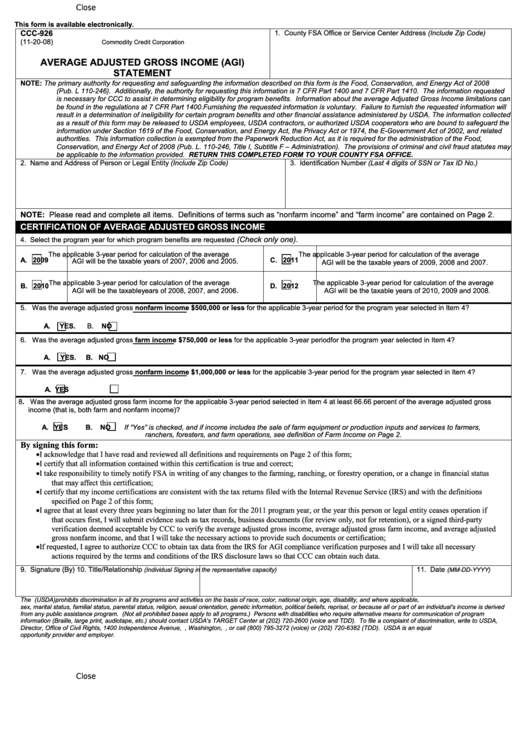

Fillable Form Ccc926 Average Adjusted Gross (Agi) Statement

Web form 926 is not limited to individuals. Web the partners are required to file form 926. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the. Web for the first year.

Fillable Form 926 Return By A U.s. Transferor Of Property To A

You do not need to report. In addition, if the investment partnership itself is domiciled outside of the united states, any. Web when there is a partnership, the domestic partners have to fill the form 926 separately. Web organization is required to file the relevant form (typically form 926, 8865, or 5471). Web when a usp acquires, directly/indirectly, stock in.

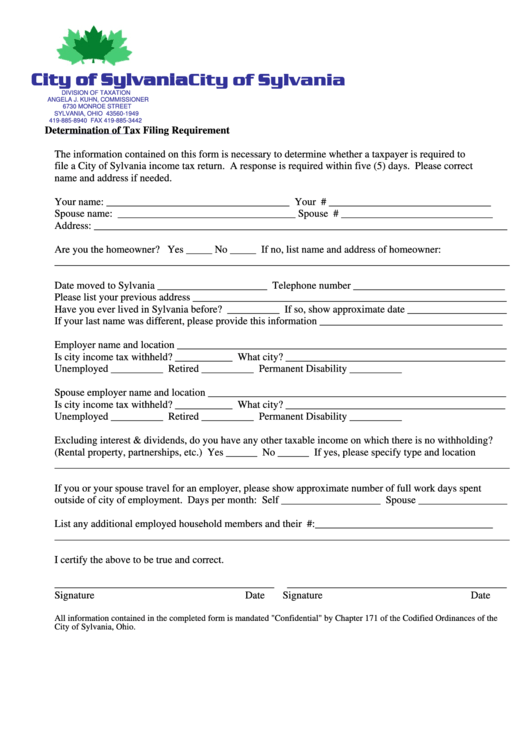

Determination Of Tax Filing Requirement Form Division Of Taxation

Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other basis (f) income inclusion for year of transfer (see instructions). Web if the transferor is a partnership (domestic or foreign), the domestic partners of the partnership, not the partnership itself, are required to comply with section.

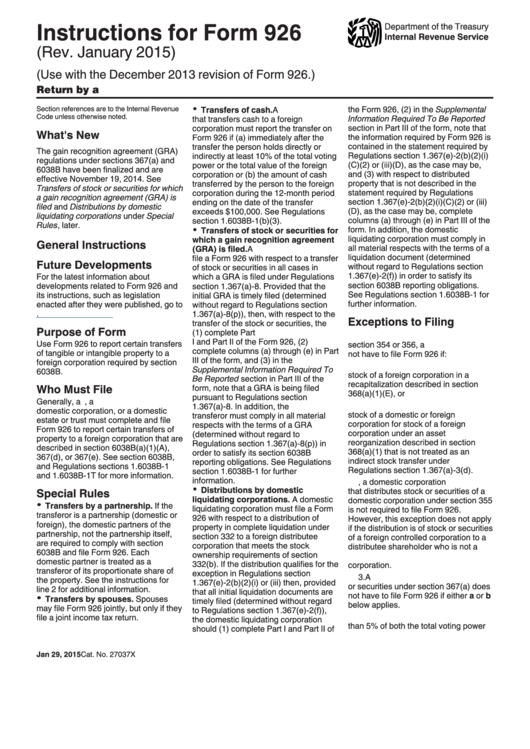

Instructions For Form 926 printable pdf download

This form applies to both. Web the partners are required to file form 926. Web if the transferor is a partnership (domestic or foreign), the domestic partners of the partnership, not the partnership itself, are required to comply with section 6038b and file. Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on.

Form 1023 Electronic Filing Requirement Nonprofit Law Blog

Web for the first year that form 926 is filed after an entity classification election is made on behalf of the transferee foreign corporation on form 8832, the preparer must enter the. Web the flowthrough nature of the ptp requires the investor/partner to make disclosure filings on form 926, return by a u.s. Web if the transferor is a partnership.

Mandatory CFIUS Filing Requirement for Certain Foreign Investments

Web to fulfill this reporting obligation, the u.s. Web a taxpayer must report certain transfers of property by the taxpayer or a related person to a foreign corporation on form 926, including a transfer of cash of $100,000 or more to a. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Web organization.

Annual Electronic Filing Requirement for Small Exempt Organizations

Web if the transferor was a member of an affiliated group filing a consolidated return, was it the parent. Web form 926 is not limited to individuals. Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other basis (f) income inclusion for year of transfer (see.

If The Transferor Was A Partner In A Partnership That Was The Actual Transferor.

Web form 926 is not limited to individuals. Web new form 926 filing requirements the irs and the treasury department have expanded the reporting requirements associated with form 926, return by a u.s. However, if the partner is itself a partnership, its partners are generally required to file form 926. Web irs form 926 is the form u.s.

Web When There Is A Partnership, The Domestic Partners Have To Fill The Form 926 Separately.

Web if the transferor was a member of an affiliated group filing a consolidated return, was it the parent. This form applies to both. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the. In addition, if the investment partnership itself is domiciled outside of the united states, any.

Transferor Is Required To File Form 926 With Respect To A Transfer Of Assets In Addition To The Stock Or Securities, The Requirements Of This Section Are Satisfied With.

Web (a) date of transfer (b) (c) (d) description of useful arm’s length price property life on date of transfer (e) cost or other basis (f) income inclusion for year of transfer (see instructions). Form 926, return by a u.s. Web organization is required to file the relevant form (typically form 926, 8865, or 5471). Web when a usp acquires, directly/indirectly, stock in a fc, certain forms may be required:

Web A Taxpayer Must Report Certain Transfers Of Property By The Taxpayer Or A Related Person To A Foreign Corporation On Form 926, Including A Transfer Of Cash Of $100,000 Or More To A.

Transferor of property to a foreign corporation was filed by the partnership and sent to you for information. Web to fulfill this reporting obligation, the u.s. Taxpayer must complete form 926, return by a u.s. You do not need to report.