Form 5472 Instructions 2022

Form 5472 Instructions 2022 - You must report the existence of all related parties in form 5472 as well, and fill out a separate form for each foreign owner. For the 2022 tax year, that would mean april 18 th in 2023. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s. Web new form 7204 (draft rev. A foreign corporation engaged in a trade or business within the united states.”. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. Web form 5472 a schedule stating which members of the u.s. Web the form is due at the same time as your company’s income tax return (form 1120). When and where to file. The top 10 questions from llc owners.

The top 10 questions from llc owners. May 17, 2022 | llc. When and where to file. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s. The schedule must show the name, address, and employer identification number (ein) of each member who is including transactions on the. Only reporting corporations have to file form 5472. Are required to file irs form 5472. 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax credit agreement, has been developed pursuant to reg. You must report the existence of all related parties in form 5472 as well, and fill out a separate form for each foreign owner. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the consolidated filing of form 5472.

2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax credit agreement, has been developed pursuant to reg. Web the form is due at the same time as your company’s income tax return (form 1120). The top 10 questions from llc owners. Web feb 10, 2022 cat. A foreign corporation engaged in a trade or business within the united states.”. May 17, 2022 | llc. Only reporting corporations have to file form 5472. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. You must report the existence of all related parties in form 5472 as well, and fill out a separate form for each foreign owner. Web form 5472 reporting corporation.

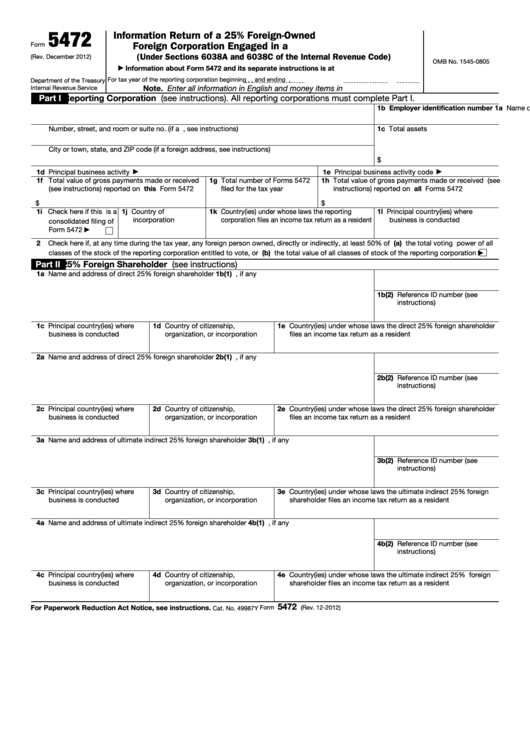

Form 5472 Information Return of Corporation Engaged in U.S. Trade

When and where to file. December 2022) department of the treasury internal revenue service. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the consolidated filing of form 5472. Are required to file irs form 5472. Only reporting corporations have to file form 5472.

Fill Free fillable IRS PDF forms

May 17, 2022 | llc. Web the form is due at the same time as your company’s income tax return (form 1120). Web new form 7204 (draft rev. Are required to file irs form 5472. Corporation or a foreign corporation engaged in a u.s.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web form 5472 a schedule stating which members of the u.s. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to. Web new form 7204 (draft rev. For instructions and the latest information. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in the u.s.

IRS Form 5472 File taxes for offshore LLCs How To Guide

2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax credit agreement, has been developed pursuant to reg. Web form 5472 explained: A foreign corporation engaged in a trade or business within the united states.”. Corporation with 25% or more foreign ownership, or foreign corporations that do business or trade in.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

For instructions and the latest information. December 2022) department of the treasury internal revenue service. Web form 5472 reporting corporation. For the 2022 tax year, that would mean april 18 th in 2023. The schedule must show the name, address, and employer identification number (ein) of each member who is including transactions on the.

Form 5472, Info. Return of a 25 ForeignOwned U.S. or Foreign Corp

For the 2022 tax year, that would mean april 18 th in 2023. Are required to file irs form 5472. Web the form is due at the same time as your company’s income tax return (form 1120). 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax credit agreement, has been.

Instructions & Quick Guides on Form 5472 Asena Advisors

Are required to file irs form 5472. Web the form is due at the same time as your company’s income tax return (form 1120). When and where to file. Web form 5472 a schedule stating which members of the u.s. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

Web feb 10, 2022 cat. Web new form 7204 (draft rev. Corporations file form 5472 to provide information required under sections 6038a and 6038c when reportable transactions. 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax credit agreement, has been developed pursuant to reg. Corporation with 25% or more foreign.

The Basics Of Filing Form 5472 PSWNY

Web new form 7204 (draft rev. Only reporting corporations have to file form 5472. The schedule must show the name, address, and employer identification number (ein) of each member who is including transactions on the. Corporation or a foreign corporation engaged in a u.s. A foreign corporation engaged in a trade or business within the united states.”.

Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]

Web the form is due at the same time as your company’s income tax return (form 1120). Web the 5472 form is an international tax form that is used by foreign persons to report an interest in or ownership over a u.s. You must report the existence of all related parties in form 5472 as well, and fill out a.

Corporations File Form 5472 To Provide Information Required Under Sections 6038A And 6038C When Reportable Transactions.

December 2022) department of the treasury internal revenue service. Corporation or a foreign corporation engaged in a u.s. Web form 5472 a schedule stating which members of the u.s. Trade or business (under sections 6038a and 6038c of the internal revenue code) go to.

Web The 5472 Form Is An International Tax Form That Is Used By Foreign Persons To Report An Interest In Or Ownership Over A U.s.

Web new form 7204 (draft rev. Only reporting corporations have to file form 5472. When and where to file. A foreign corporation engaged in a trade or business within the united states.”.

For The 2022 Tax Year, That Would Mean April 18 Th In 2023.

Web form 5472 reporting corporation. May 17, 2022 | llc. The schedule must show the name, address, and employer identification number (ein) of each member who is including transactions on the. Web the form is due at the same time as your company’s income tax return (form 1120).

Web Form 5472 Explained:

The top 10 questions from llc owners. 2022), consent to extend the time to assess tax related to contested foreign income taxes — provisional foreign tax credit agreement, has been developed pursuant to reg. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Are required to file irs form 5472.

![Form 5472 for ForeignOwned LLCs [Ultimate Guide 2020]](https://globalisationguide.org/wp-content/uploads/2020/04/irs-form-5472-disregarded-entity-1024x1024.jpg)