Form 1116 Instructions

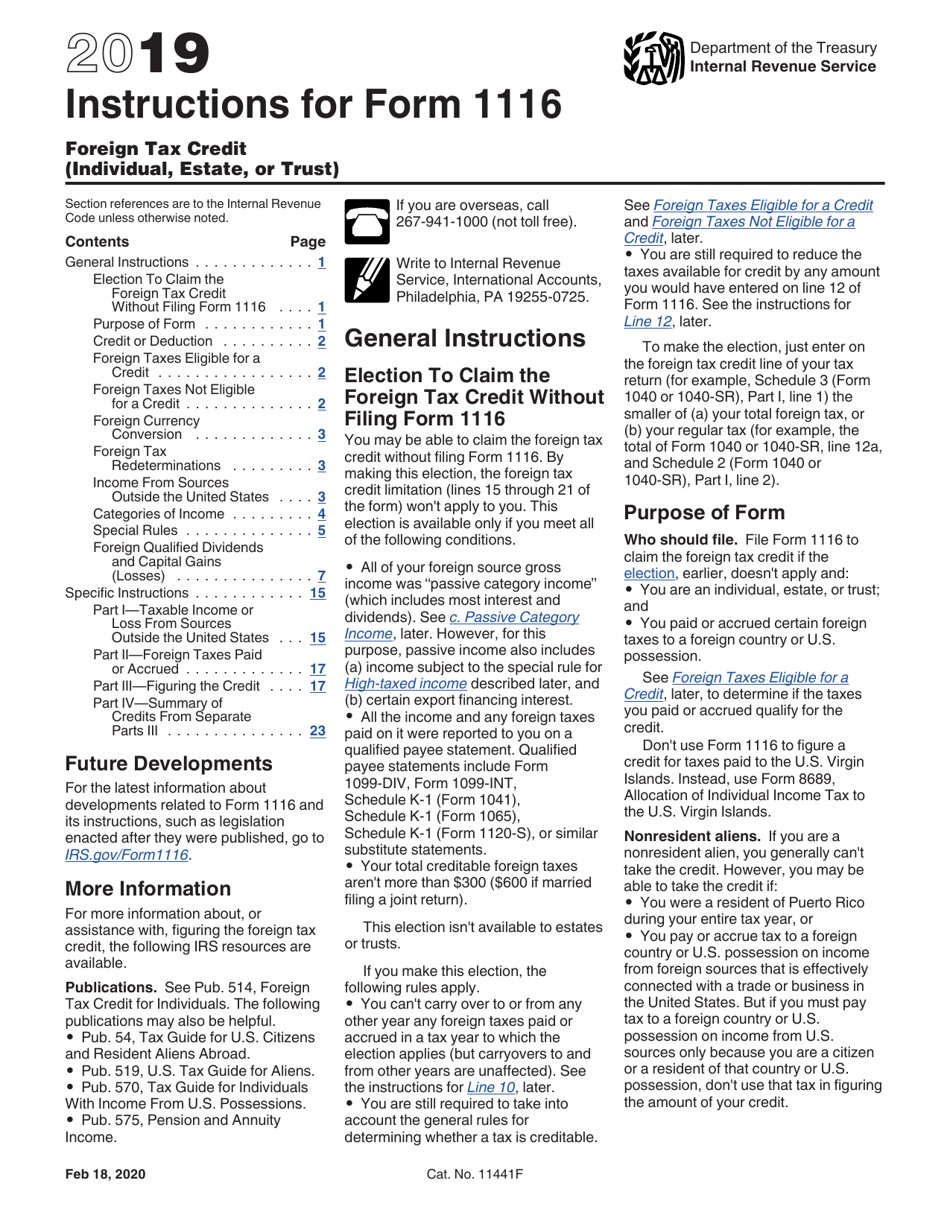

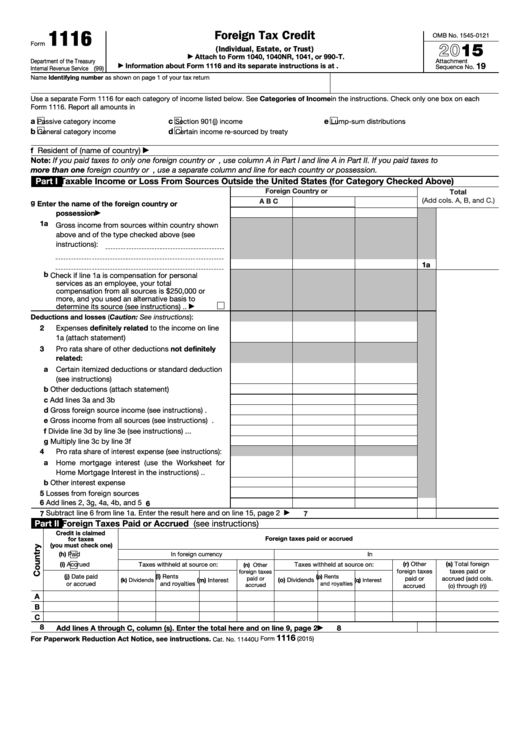

Form 1116 Instructions - Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. The “caution” at the top of the line 1 reconciliation What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule b. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Use a separate form 1116 for each category of income listed below. (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. As shown on page 1 of your tax return. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. All form 1116 filers must choose how they regard their income:

Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web the form 1116 instructions provide the mechanics of how the reclassification is done. If you have only one type of foreign income, you complete just one form 1116. On an accrual basis or a cash basis. Use a separate form 1116 for each category of income listed below. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer. Web overview of form 1116. See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return.

Web you can use the $100 of unused foreign tax credits to reduce your tax bill on the prior and subsequent returns, leaving $25 of excess limit to be used in the future. If you have only one type of foreign income, you complete just one form 1116. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Go to www.irs.gov/form1116 for instructions and the latest information. Use a separate form 1116 for each category of income listed below. Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. A credit for foreign taxes can be claimed only for foreign tax imposed by a foreign country or u.s.

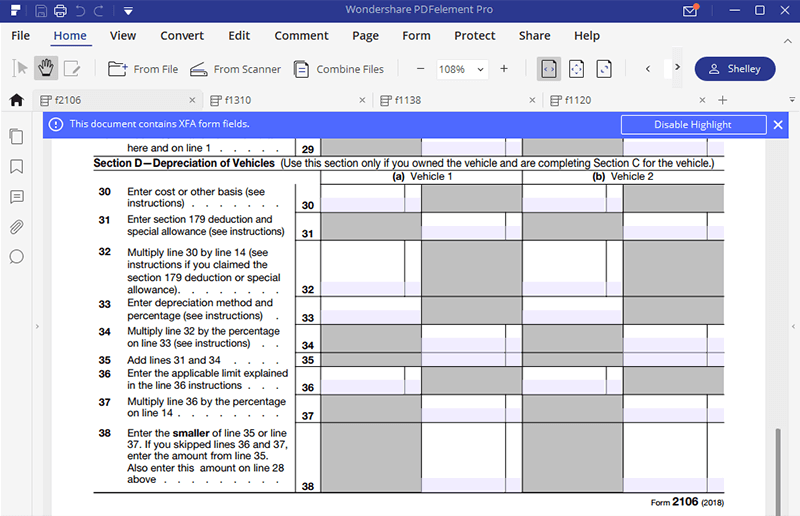

Breanna Form 2106 Instructions 2016

Web the form 1116 instructions provide the mechanics of how the reclassification is done. Go to www.irs.gov/form1116 for instructions and the latest information. As shown on page 1 of your tax return. Web overview of form 1116. On an accrual basis or a cash basis.

Form 1116 Instructions 2021 2022 IRS Forms Zrivo

A credit for foreign taxes can be claimed only for foreign tax imposed by a foreign country or u.s. On an accrual basis or a cash basis. If you record income when you earn it rather than when you get paid, you use the accrual method. (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from.

Download Instructions for IRS Form 1116 Foreign Tax Credit (Individual

Use a separate form 1116 for each category of income listed below. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. On an accrual basis.

Form 1116Foreign Tax Credit

Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. This requires filing an amended tax return for.

해외금융계좌 신고 5 Form 1116 Foreign Tax Credit Sample

Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. This requires filing an amended tax return for the prior year, and you might need to file form 1116 to be eligible for the credit. As shown on page 1 of your tax return. If you record income when you earn.

Form 1116 part 1 instructions

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. If you record income when you earn it rather than when you get paid, you use the accrual method. A credit for foreign taxes can be claimed only for foreign tax imposed by a foreign country or u.s..

Form IT112C (Fillin) New York State Resident Credit for Taxes Paid

All form 1116 filers must choose how they regard their income: (form 1065) refers to the instructions to forms 1116 and 1118 for exceptions from the requirement to report gross income and taxes by foreign country or u.s. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what.

Fillable Form 1116 Foreign Tax Credit printable pdf download

Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. The “caution” at the top of the line 1 reconciliation Web schedule b (form 1116) and its instructions, such as legislation enacted after they were published, go to irs.gov/form1116. Web filing form 1116.

Are capital loss deductions included on Form 1116 for Deductions and

What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule b. On an accrual basis or a cash basis. All form 1116 filers must choose how they regard their income: A credit for foreign taxes can be claimed only for foreign.

Form 1116 part 1 instructions

Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. The “caution” at the top of the line 1 reconciliation Additional information can be found in the form 1040 instructions, form 1116 instructions and publication 514. Use a separate form 1116 for each category of income listed below..

A Credit For Foreign Taxes Can Be Claimed Only For Foreign Tax Imposed By A Foreign Country Or U.s.

As shown on page 1 of your tax return. The “caution” at the top of the line 1 reconciliation This requires filing an amended tax return for the prior year, and you might need to file form 1116 to be eligible for the credit. Web filing form 1116 must be referred to a volunteer with an international certification or a professional tax preparer.

Use A Separate Form 1116 For Each Category Of Income Listed Below.

See schedule c (form 1116) and its instructions, and foreign tax redeterminations, later, for more information. Web schedule b (form 1116) is used to reconcile your prior year foreign tax carryover with your current year foreign tax carryover. Taxpayers are therefore reporting running balances of their foreign tax carryovers showing all activity since the filing of their prior year income tax return. On an accrual basis or a cash basis.

Web You Can Use The $100 Of Unused Foreign Tax Credits To Reduce Your Tax Bill On The Prior And Subsequent Returns, Leaving $25 Of Excess Limit To Be Used In The Future.

Web overview of form 1116. Web use form 1116 to claim the foreign tax credit (ftc) and deduct the taxes you paid to another country from what you owe to the irs. If you record income when you earn it rather than when you get paid, you use the accrual method. Web use schedule c (form 1116) to report foreign tax redeterminations that occurred in the current tax year and that relate to prior tax years.

Additional Information Can Be Found In The Form 1040 Instructions, Form 1116 Instructions And Publication 514.

What’s new line 1 of schedule b has been revised to instruct filers to enter the amounts from the appropriate columns of line 8 of the prior year schedule b. In a nutshell, the high tax passive income on page one, line 1a is backed out of the passive category form 1116 as a negative and then added to the general category form 1116 line 1a of the relevant column and then htko should be notated on our form, the. Web the form 1116 instructions provide the mechanics of how the reclassification is done. Go to www.irs.gov/form1116 for instructions and the latest information.