Form 8867 Purpose

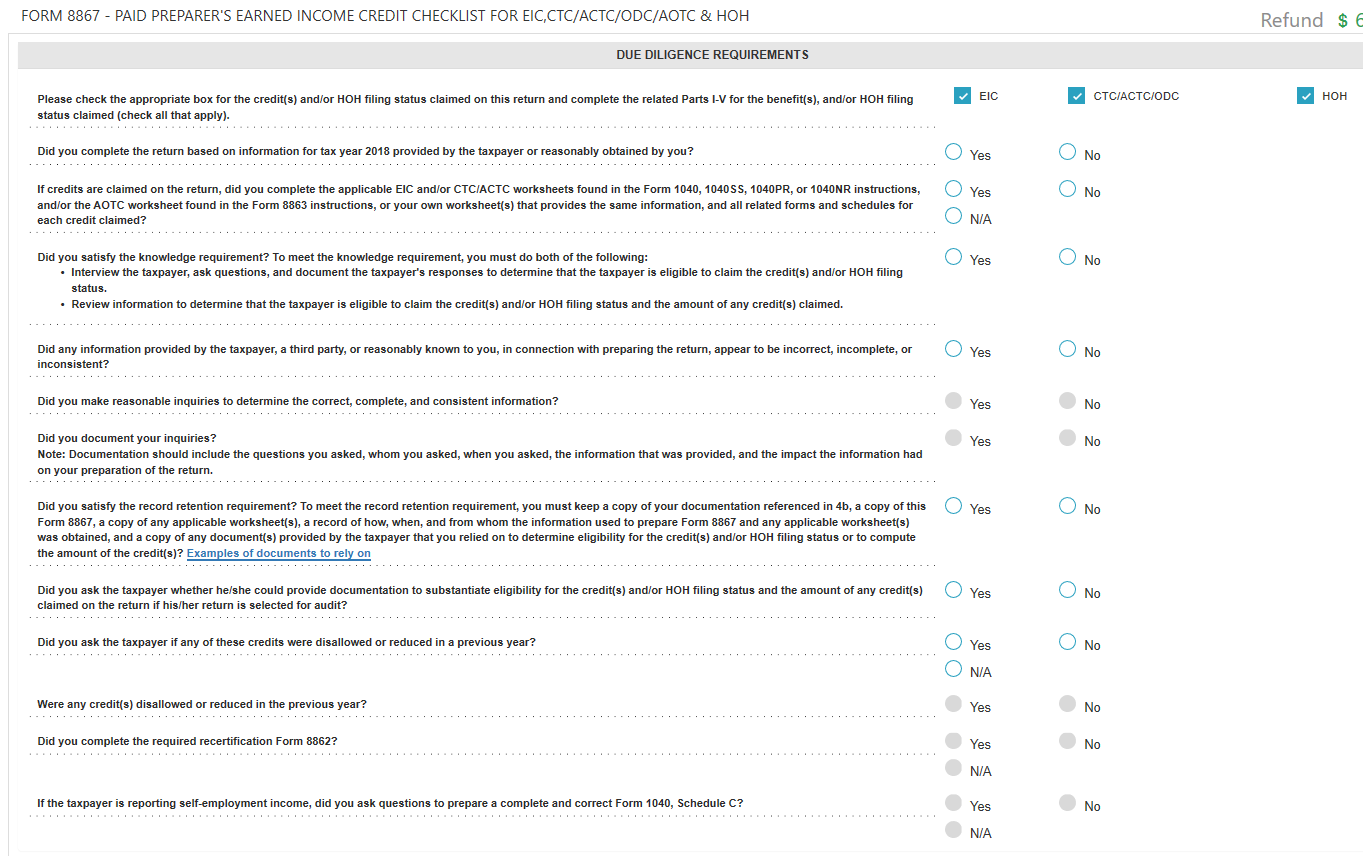

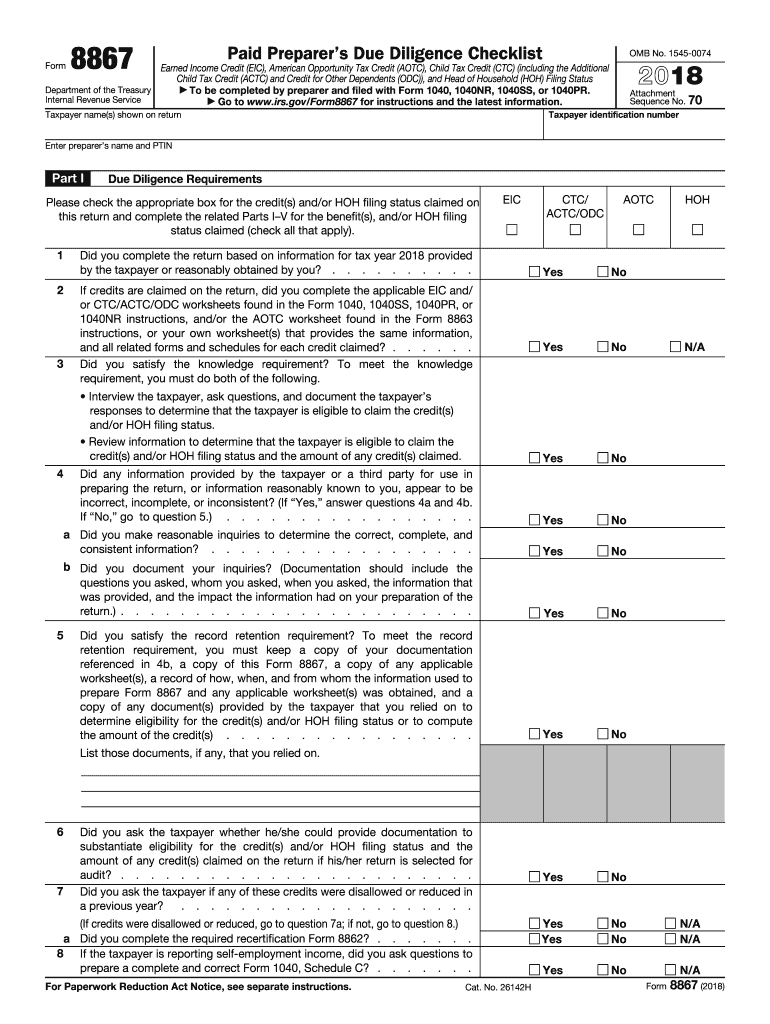

Form 8867 Purpose - Form 8867 must be filed with the return. Web you must complete form 8867 and meet the other due diligence requirements described later in purpose of form. The paid preparer's due diligence checklist is completed and filed with forms 1040, 1040a, 1040ez, 1040nr, 1040ss, 1040pr. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american opportunity tax credit, child. Try it for free now! Web up to $40 cash back irs 8867 form. Earned income credit (eic), american. The form 8867 completed by b as the signing preparer should also be. Specific due diligence actions must be performed when preparing tax returns. December 2021) department of the treasury internal revenue service.

Use this section to provide information for and. Web paid preparer's earned income credit checklist form 8867 (rev. November 2022) form 8867 (rev. Web form 8867 client name and number prepared by date reviewed by date purpose of checklist: Web what is form 8867? Consequences of failing to meet your due diligence Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc, and/or the. Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared,. Web form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing status.if your client received advance. Web referenced in 4b, a copy of this form 8867, a copy of any applicable worksheet(s), a record of how, when, and from whom the information used to prepare form 8867 and any.

November 2022) department of the treasury internal revenue service paid. Get ready for tax season deadlines by completing any required tax forms today. Form 8867 must be filed with the return. The form 8867 completed by b as the signing preparer should also be. Paid preparer’s due diligence checklist. Try it for free now! Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web form 8867 covers the eic, the ctc/actc, and/or the aotc. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american opportunity tax credit, child. Web paid preparer's earned income credit checklist form 8867 (rev.

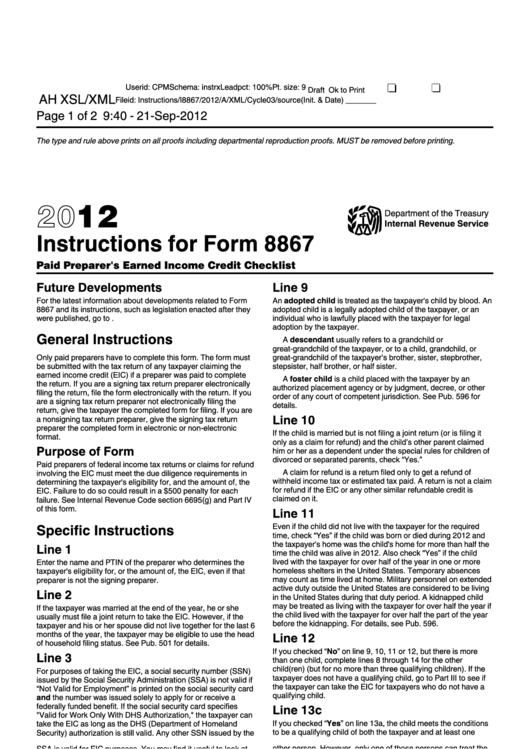

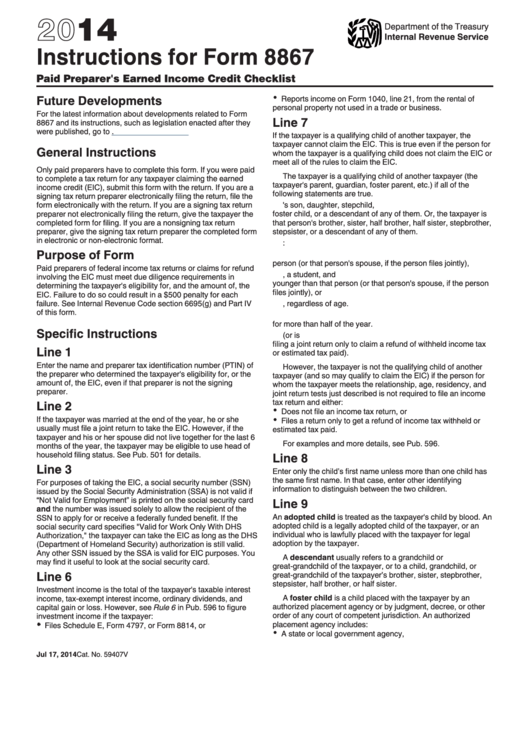

Instructions For Form 8867 Paid Preparer'S Earned Credit

Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. Specific due diligence actions must be performed when preparing tax returns. November 2022) form 8867 (rev. Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the.

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist. Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information. Consequences of failing to meet your due diligence Web what is form 8867? You should check the boxes corresponding to all benefits.

Form 8867 amulette

December 2021) department of the treasury internal revenue service. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american opportunity tax credit, child. Web form 8867 client name and number prepared by date reviewed by date purpose of checklist: Earned income credit (eic), american. Get ready for tax season deadlines by.

Classic View Error Screen

Use this section to provide information for and. Get ready for tax season deadlines by completing any required tax forms today. Web referenced in 4b, a copy of this form 8867, a copy of any applicable worksheet(s), a record of how, when, and from whom the information used to prepare form 8867 and any. Form 8867 must be filed with.

Instructions For Form 8867 Paid Preparer'S Earned Credit

November 2022) department of the treasury internal revenue service paid. Ad upload, modify or create forms. Web form 8867 completed by a as a nonsigning preparer must be provided to b to be filed along with t’s return. Web form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh.

Fill Free fillable F8862 Form 8862 (Rev. November 2018) PDF form

Consequences of failing to meet your due diligence Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web form 8867 client name and number prepared by date reviewed by date purpose of checklist: Web paid preparer's earned income credit checklist form.

Form 8867 Fill Out and Sign Printable PDF Template signNow

Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared,. December 2021) department of the treasury internal revenue service. Earned income credit (eic), american. Form 8867 must be filed with the return. Form 8867 must be filed with the return.

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Web you must complete form 8867 and meet the other due diligence requirements described later in purpose of form. November 2022) form 8867 (rev. Get ready for tax season deadlines by completing any required tax forms today. Web form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing.

Form 8867 Paid Preparer's Earned Credit Checklist (2014) Free

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web what is form 8867? Web the purpose of the form is to ensure that the practitioner has considered all applicable eligibility criteria for certain tax credits for each return prepared,. Web.

Form 8863 Instructions & Information on the Education Credit Form

Form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc, and/or the. December 2021) department of the treasury internal revenue service. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american opportunity tax credit, child. Web form 8867 covers the eic, the ctc/actc, and/or.

Paid Preparer’s Due Diligence Checklist.

Ad upload, modify or create forms. November 2022) form 8867 (rev. The form 8867 completed by b as the signing preparer should also be. Web form 8867 must be filed with the taxpayer’s return or amended return claiming the eic, the ctc/actc/odc, the aotc, and/or hoh filing status.if your client received advance.

Web The Purpose Of Form 8867 Is To Ensure That The Tax Preparer Has Considered All Applicable Eic Eligibility Requirements For Each Prepared Tax Return.

November 2022) department of the treasury internal revenue service paid. Web this checklist is a comprehensive tool to use when preparing form 8867, paid preparer’s due diligence checklist, that is associated with claiming the earned income tax credit,. Web form 8867 client name and number prepared by date reviewed by date purpose of checklist: The paid preparer's due diligence checklist is completed and filed with forms 1040, 1040a, 1040ez, 1040nr, 1040ss, 1040pr.

Form 8867 Must Be Filed With The Taxpayer’s Return Or Amended Return Claiming The Eic, The Ctc/Actc, And/Or The.

Use this section to provide information for and. Consequences of failing to meet your due diligence December 2021) department of the treasury internal revenue service. Specific due diligence actions must be performed when preparing tax returns that include the earned income tax credit, american opportunity tax credit, child.

Web Form 8867 Covers The Eic, The Ctc/Actc, And/Or The Aotc.

You should check the boxes corresponding to all benefits actually claimed on the return that. Web you must complete form 8867 and meet the other due diligence requirements described later in purpose of form. Web up to $40 cash back irs 8867 form. Web due diligence required under the final regulations promulgated under section 6695 on november 5, 2018, completing form 8867 (based on information.