Mo Nri Form

Mo Nri Form - However, any income earned by your spouse is taxable to. Your spouse is not eligible to complete. Web follow the simple instructions below: Easily fill out pdf blank, edit, and sign them. Web send missouri nri form via email, link, or fax. Try it for free now! If your spouse remains in missouri more than 30 days while you are stationed outside. You can also download it, export it or print it out. Easily fill out pdf blank, edit, and sign them. Our platform will provide you with a.

Web report inappropriate content. However, any income earned by your spouse is taxable to. Your spouse is not eligible to complete. If your spouse remains in missouri more than 30 days while you are stationed outside. Edit your mo nri online type text, add images, blackout confidential details, add. Easily fill out pdf blank, edit, and sign them. Web driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or choose a. Try it for free now! This form is for income earned in tax year 2022, with tax returns due in april. Save or instantly send your ready documents.

Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. If your spouse remains in missouri more than 30 days while you are stationed outside. Your spouse is not eligible to complete. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below: Web report inappropriate content. Web driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or choose a. Web send missouri nri form via email, link, or fax. Your spouse is not eligible to complete.

How can an NRI view his TDS Credit (Form 26AS)? Pravasitax Blog

Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Upload, modify or create forms. Your spouse is not eligible to complete. Web follow the simple instructions below:

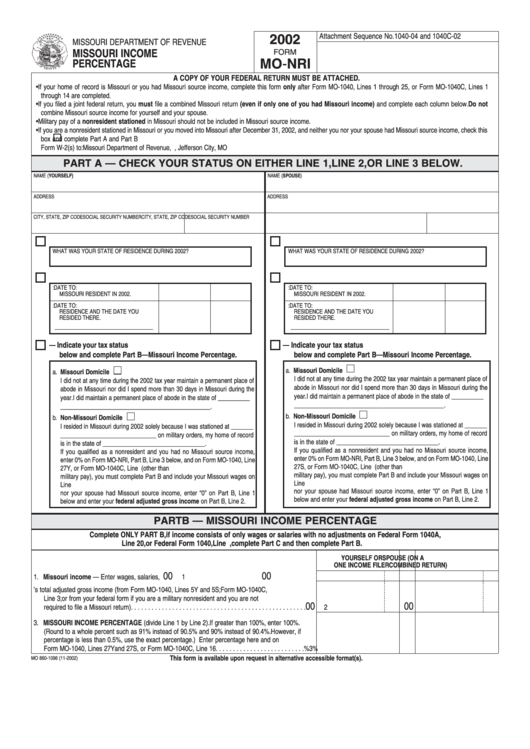

Form MoNri Missouri Percentage 2002 printable pdf download

However, any income earned by your spouse is taxable to. Edit your mo nri online type text, add images, blackout confidential details, add. Save or instantly send your ready documents. You can also download it, export it or print it out. Web follow the simple instructions below:

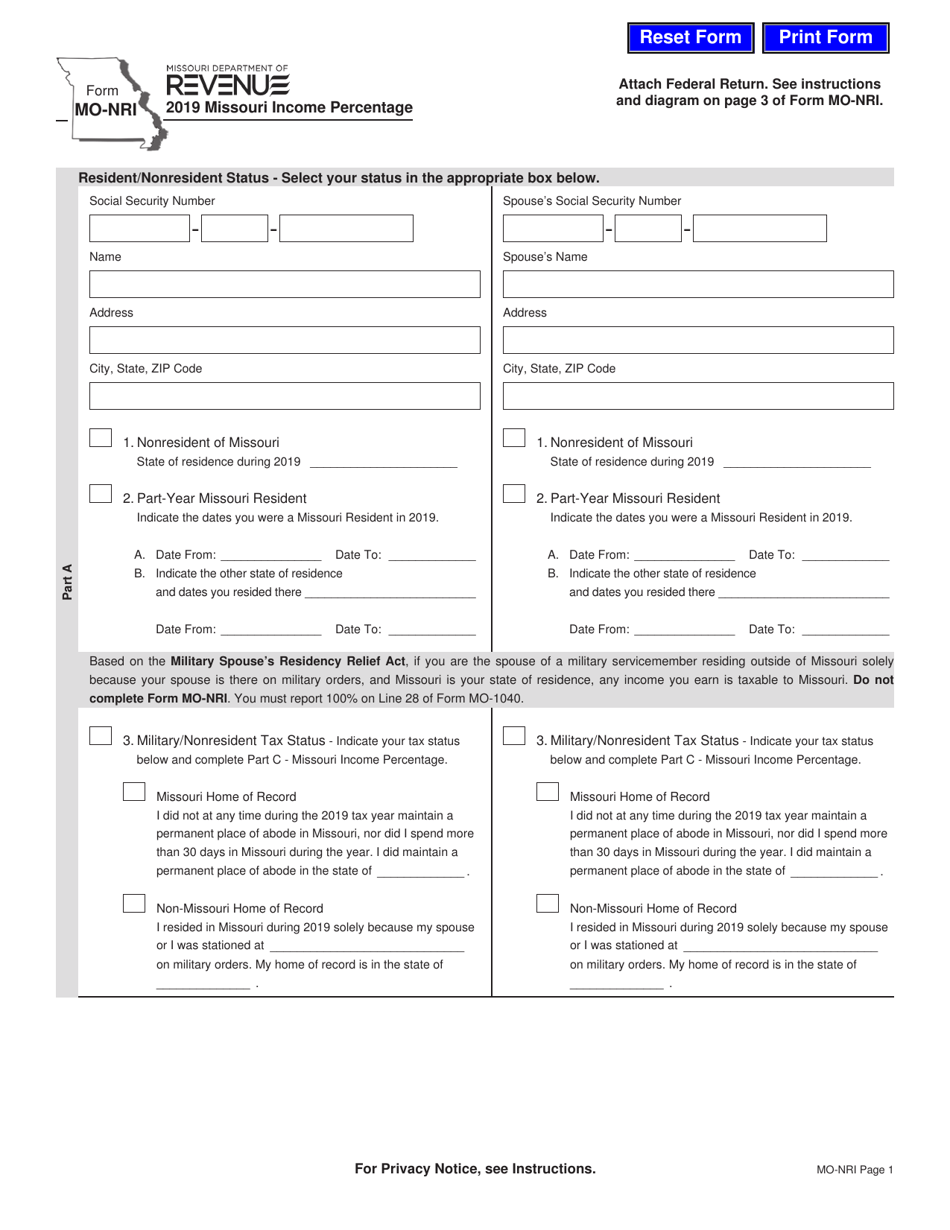

Fill Free fillable MONRI 2019 Form MONRI 2018 Missouri

Your spouse is not eligible to complete. Web send missouri nri form via email, link, or fax. Try it for free now! Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below:

2022 Form MO DoR MONRI Fill Online, Printable, Fillable, Blank pdfFiller

You can also download it, export it or print it out. Your spouse is not eligible to complete. This form is for income earned in tax year 2022, with tax returns due in april. Edit your mo nri online type text, add images, blackout confidential details, add. If your spouse remains in missouri more than 30 days while you are.

How can an NRI view his TDS Credit (Form 26AS)? Pravasitax Blog

Web follow the simple instructions below: Your spouse is not eligible to complete. Our platform will provide you with a. Your spouse is not eligible to complete. Easily fill out pdf blank, edit, and sign them.

Fill Free fillable MONRI 2019 Form MONRI 2018 Missouri

Your spouse is not eligible to complete. This form is for income earned in tax year 2022, with tax returns due in april. You can also download it, export it or print it out. Web driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box.

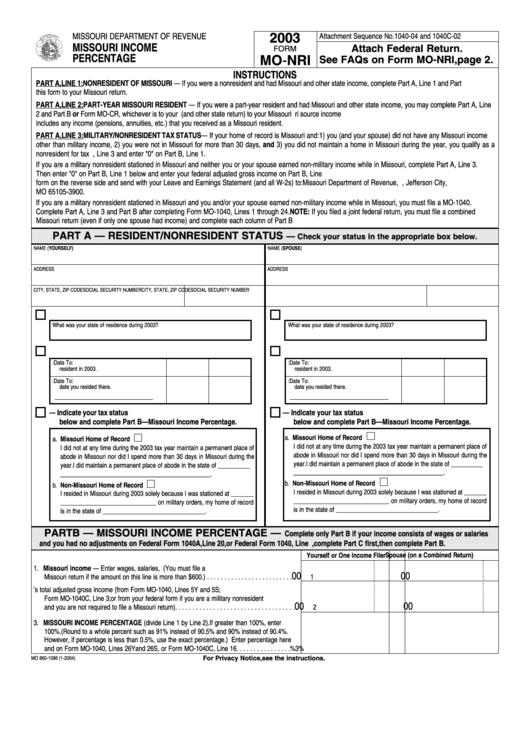

Form MoNri Missouri Percentage 2003 printable pdf download

Easily fill out pdf blank, edit, and sign them. Web report inappropriate content. Web driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or choose a. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below:

Fill Free fillable forms for the state of Missouri

If your spouse remains in missouri more than 30 days while you are stationed outside. However, any income earned by your spouse is taxable to. Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Your spouse is not eligible to complete.

Full Form of NRI What is the Full Form Of NRI ? YouTube

Web driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or choose a. Easily fill out pdf blank, edit, and sign them. Try it for free now! Our platform will provide you with a. Your spouse is not eligible to complete.

Form MONRI Download Fillable PDF or Fill Online Missouri

This form is for income earned in tax year 2022, with tax returns due in april. Upload, modify or create forms. Get ready for tax season deadlines by completing any required tax forms today. Easily fill out pdf blank, edit, and sign them. Web follow the simple instructions below:

Web Send Missouri Nri Form Via Email, Link, Or Fax.

Your spouse is not eligible to complete. Easily fill out pdf blank, edit, and sign them. You can also download it, export it or print it out. Your spouse is not eligible to complete.

Save Or Instantly Send Your Ready Documents.

However, any income earned by your spouse is taxable to. Edit your mo nri online type text, add images, blackout confidential details, add. Save or instantly send your ready documents. However, any income earned by your spouse is taxable to.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Our platform will provide you with a. Web follow the simple instructions below: Try it for free now! Upload, modify or create forms.

If Your Spouse Remains In Missouri More Than 30 Days While You Are Stationed Outside.

Web driver license motor vehicle media resources new to missouri forms and manuals find your form to search, type a keyword in the form number/name box or choose a. Easily fill out pdf blank, edit, and sign them. Web report inappropriate content. This form is for income earned in tax year 2022, with tax returns due in april.