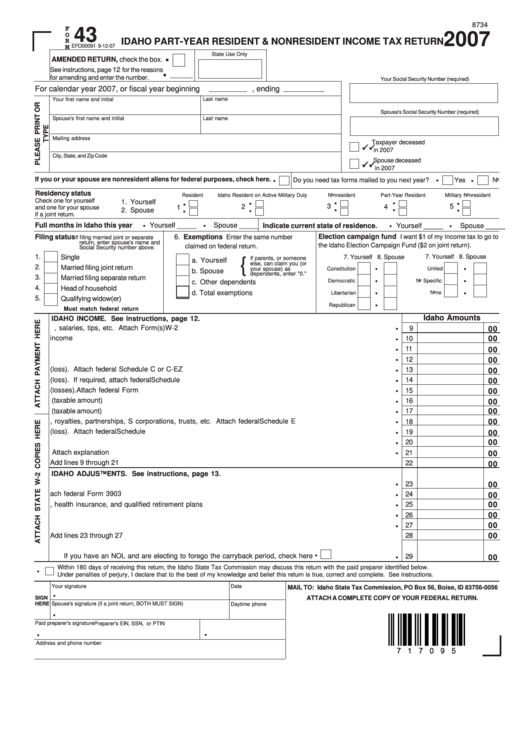

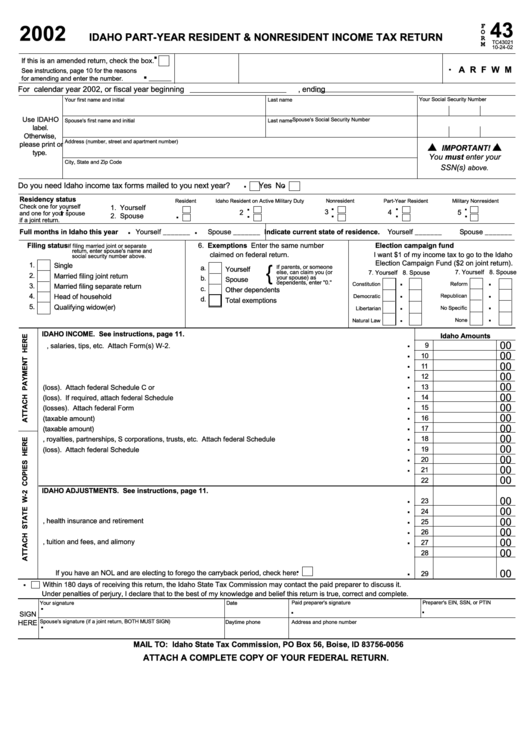

Idaho Form 43

Idaho Form 43 - Web line 25 idaho form 43 is not calculating correctly. I earned 50% of my income and paid 50% of my taxes to each state. This form is for income earned in tax year 2022, with tax returns due in april 2023. Sign, mail form 40 or 43 to one of. 40, 43, 39r, 39nr, tax tables. I am filing an idaho state tax form 43. 40, 43, 39r, 39nr, tax tables. Web fuels taxes and fees forms. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Web amounts allocated or apportioned to idaho.

Individual income tax forms (current) individual income tax forms (archive) property tax forms. Web return, you may fi le form 43 to claim a refund of the grocery credit allowed to the resident. Web idaho criminal rule 43. Web i moved from idaho to south carolina july 1, 2019. You must complete form 43. Web istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the fairness of the tax system. 40, 43, 39r, 39nr, tax tables. Form 39nr complete form 39nr if you're fi ling a form 43. Web the employment & labor law section has sought to help its members and all members of the idaho state bar during the past two to three years by sponsoring and co. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip.

Web istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the fairness of the tax system. State use only see page 15 of the instructions for. Yourself _____ spouse _____ 7. Web the employment & labor law section has sought to help its members and all members of the idaho state bar during the past two to three years by sponsoring and co. If you're fi ling a form 40, complete form 39r. You aren't required to include a copy of the federal return. Web by signing this form, i certify that the statements i made on this form are true and correct. 40, 43, 39r, 39nr, tax tables. I earned 50% of my income and paid 50% of my taxes to each state. Web amounts allocated or apportioned to idaho.

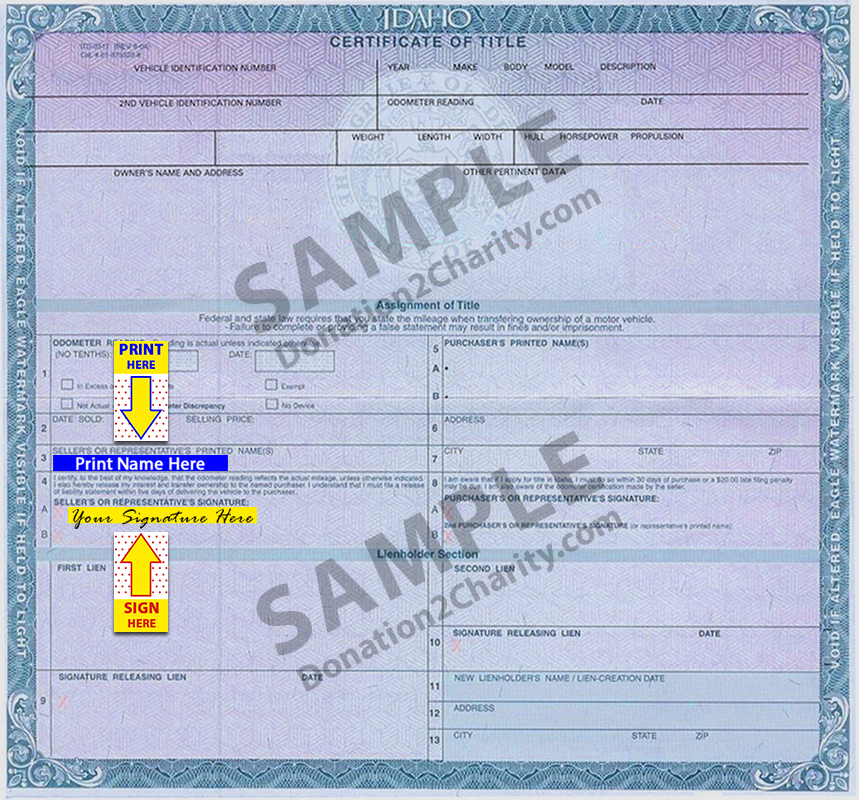

Idaho Donation2Charity

Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. Web i moved from idaho to south carolina july 1, 2019. Idaho state department of agriculture. Web return, you may fi le form 43 to claim a refund of the grocery credit allowed to the resident. Web.

Fillable Form 43 Idaho PartYear Resident & Nonresident Tax

Web istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the fairness of the tax system. Includes instructions on making estimated payments and completing forms 40,. If you're fi ling a form 40, complete form 39r. I am filing an idaho state tax form 43. Web this free.

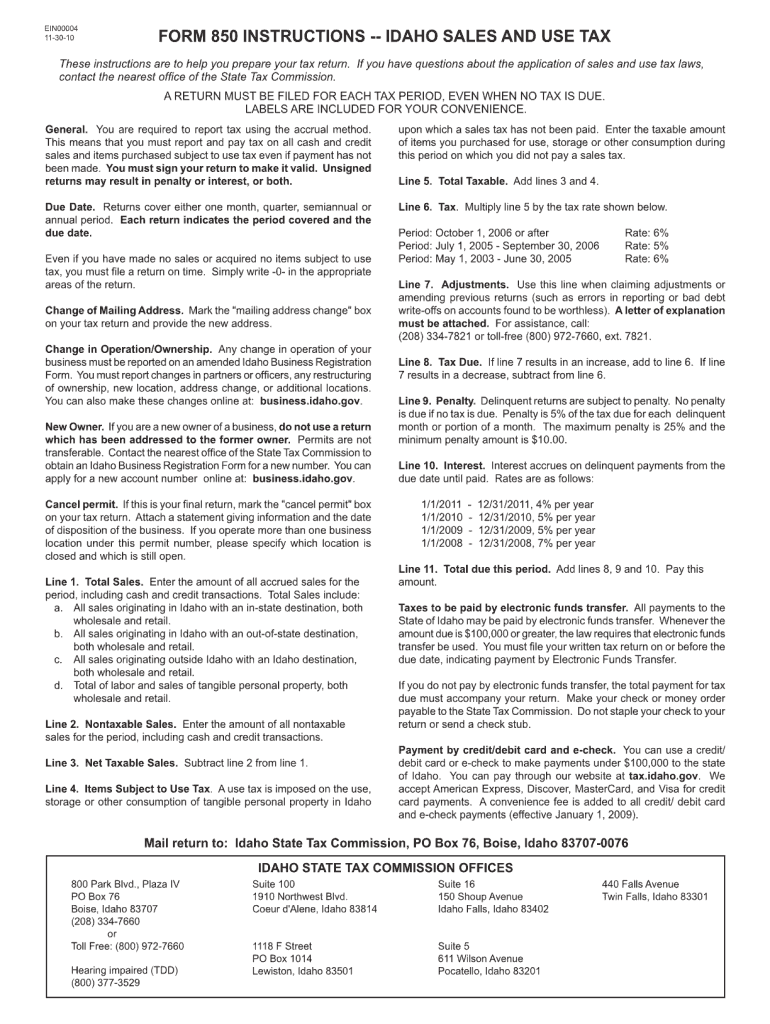

Idaho Form 850 PDF Fill Out and Sign Printable PDF Template signNow

Web this free booklet includes instructions on how to fill out your idaho income tax return. Web use form 43 if you’re a: I earned 50% of my income and paid 50% of my taxes to each state. Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. You must complete form 43.

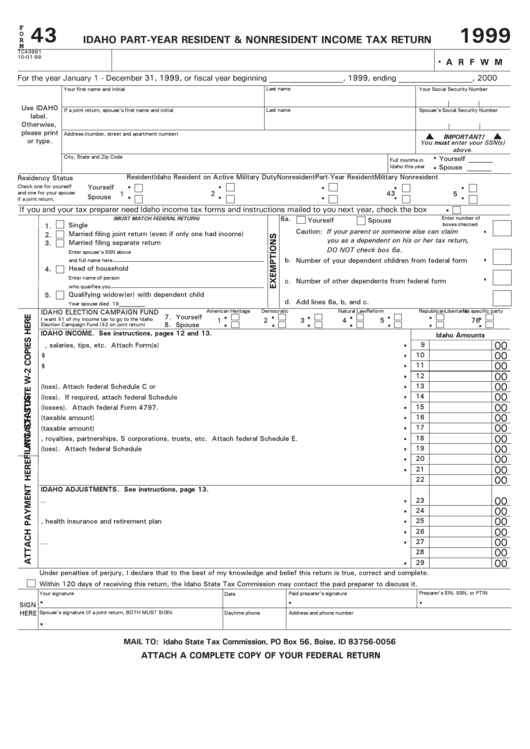

Form 43 Idaho PartYear Resident & Nonresident Tax Return

Individual income tax forms (current) individual income tax forms (archive) property tax forms. Web this free booklet includes instructions on how to fill out your idaho income tax return. I earned 50% of my income and paid 50% of my taxes to each state. Sign, mail form 40 or 43 to one of. Web i moved from idaho to south.

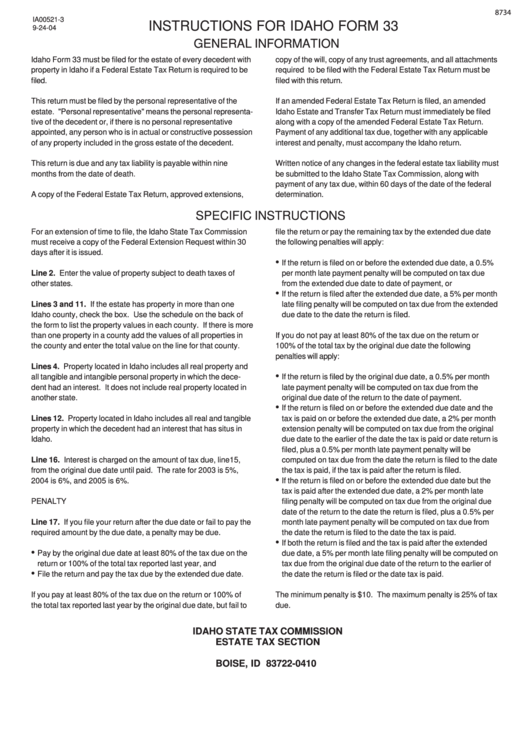

Instructions For Idaho Form 33 Idaho State Tax Commission printable

Web this free booklet includes instructions on how to fill out your idaho income tax return. I am filing an idaho state tax form 43. Web istc informs taxpayers about their obligations so everyone can pay their fair share of taxes, & enforces idaho’s laws to ensure the fairness of the tax system. State use only see page 15 of.

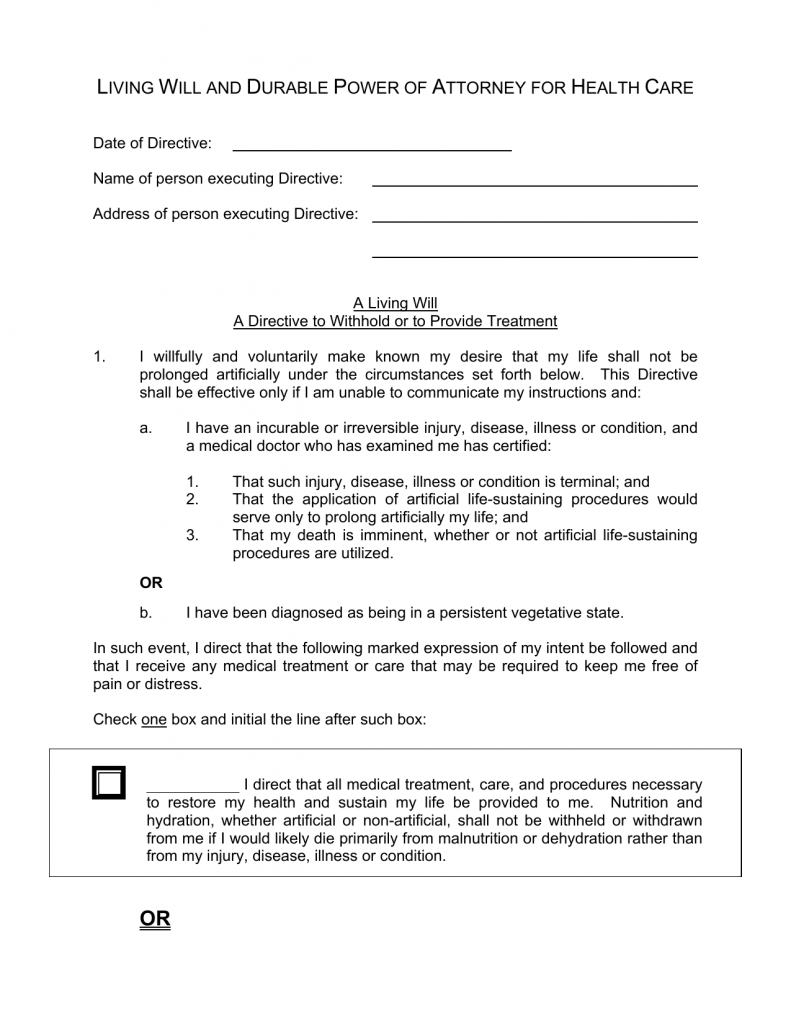

Download Idaho Living Will Form Advance Directive PDF

Includes instructions on making estimated payments and completing forms 40, 43, 39r,. Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. 2020 idaho part year/nonresident income tax return at the top of the form. Web return, you may fi le form 43 to claim a refund.

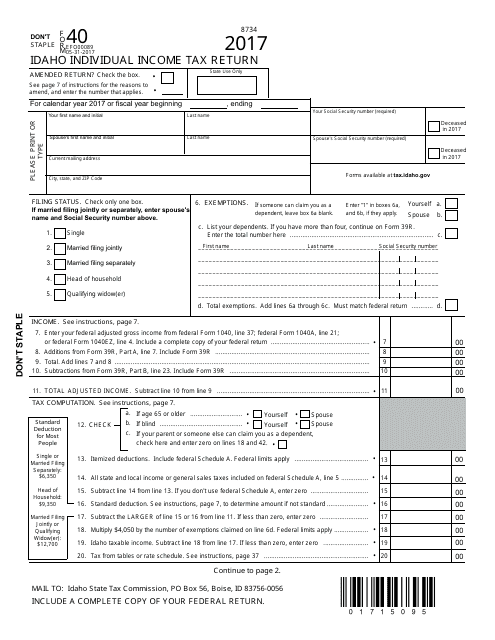

Form 40 Download Fillable PDF or Fill Online Idaho Individual

Should be driven by federal deductions reported on schedule 1 lines 10 and 11 which in my case were 0? Web by signing this form, i certify that the statements i made on this form are true and correct. Individual income tax forms (current) individual income tax forms (archive) property tax forms. 40, 43, 39r, 39nr, tax tables. Web use.

Form 43 Idaho PartYear Resident & Nonresident Tax Return

Web return, you may fi le form 43 to claim a refund of the grocery credit allowed to the resident. I am filing an idaho state tax form 43. Idaho state department of agriculture. Sign, mail form 40 or 43 to one of. Web i moved from idaho to south carolina july 1, 2019.

Fill Free fillable forms State of Idaho

Should be driven by federal deductions reported on schedule 1 lines 10 and 11 which in my case were 0? I earned 50% of my income and paid 50% of my taxes to each state. You aren't required to include a copy of the federal return. Idaho state department of agriculture. Web i moved from idaho to south carolina july.

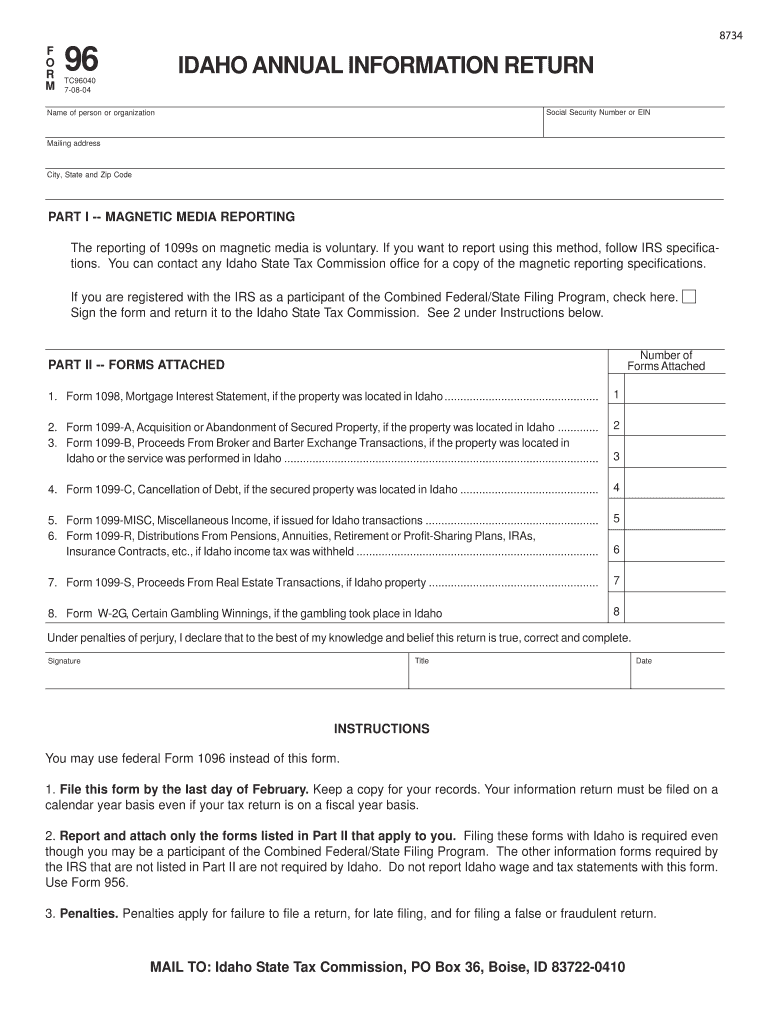

Idaho Form 96 Fill Out and Sign Printable PDF Template signNow

I am filing an idaho state tax form 43. You aren't required to include a copy of the federal return. Individual income tax forms (current) individual income tax forms (archive) property tax forms. You must complete form 43. Web by signing this form, i certify that the statements i made on this form are true and correct.

Except As Otherwise Provided By This Rule, The Defendant Must Be Present At:

State use only see page 15 of the instructions for. Web line 25 idaho form 43 is not calculating correctly. Web by signing this form, i certify that the statements i made on this form are true and correct. Individual income tax forms (current) individual income tax forms (archive) property tax forms.

Idaho State Department Of Agriculture.

Web federal employer identification number (fein) idaho unemployment insurance number (suta) name contact phone number street address contact name city state 8 zip. 40, 43, 39r, 39nr, tax tables. Includes instructions on making estimated payments and completing forms 40,. Yourself _____ spouse _____ 7.

Web Amounts Allocated Or Apportioned To Idaho.

Web idaho criminal rule 43. Form 39nr complete form 39nr if you're fi ling a form 43. Web we last updated idaho form 43 in february 2023 from the idaho state tax commission. Web fuels taxes and fees forms.

Web Return, You May Fi Le Form 43 To Claim A Refund Of The Grocery Credit Allowed To The Resident.

Web the employment & labor law section has sought to help its members and all members of the idaho state bar during the past two to three years by sponsoring and co. This form is for income earned in tax year 2022, with tax returns due in april 2023. Should be driven by federal deductions reported on schedule 1 lines 10 and 11 which in my case were 0? Web this free booklet includes instructions on how to fill out your idaho income tax return.