645 Election Form

645 Election Form - Web died on october 20, 2002. Web the executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Income tax return for estates and trusts. Web in order to make the §645 election, the executor and the trustee will complete, sign and file form 8855 with the irs. 645 allows for an election to treat a qualified revocable trust (qrt) as part of a decedent’s estate for federal income tax purposes. A form 706 is not required to be filed as a result of a. Web in simplified terms, a §645 election can be used to combine the trust and estate into one entity for tax purposes, so only one irs form 1041 needs to be filed. Web the §645 election itself is made by filing irs form 8855, election to treat a qualified revocable trust as part of an estate. For this reason, i recommend that a trust be kept separate from one's corporation. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's election and they must.

Use your indications to submit. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's election and they must. 645 election allows the trustee and the executor to effectively combine a qrt and an estate into one tax return,. Web died on october 20, 2002. Web how do i make a 645 election on a 1041? Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. The final treasury regulations states that the requirement that a “qualified. 645 allows for an election to treat a qualified revocable trust (qrt) as part of a decedent’s estate for federal income tax purposes. Income tax return for estates and trusts, that includes the trust's name,. Web 645 election termination form:

Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. Web in simplified terms, a §645 election can be used to combine the trust and estate into one entity for tax purposes, so only one irs form 1041 needs to be filed. Web died on october 20, 2002. The final treasury regulations states that the requirement that a “qualified. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's election and they must. The executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web the executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. This form identifies the qrt making. For this reason, i recommend that a trust be kept separate from one's corporation.

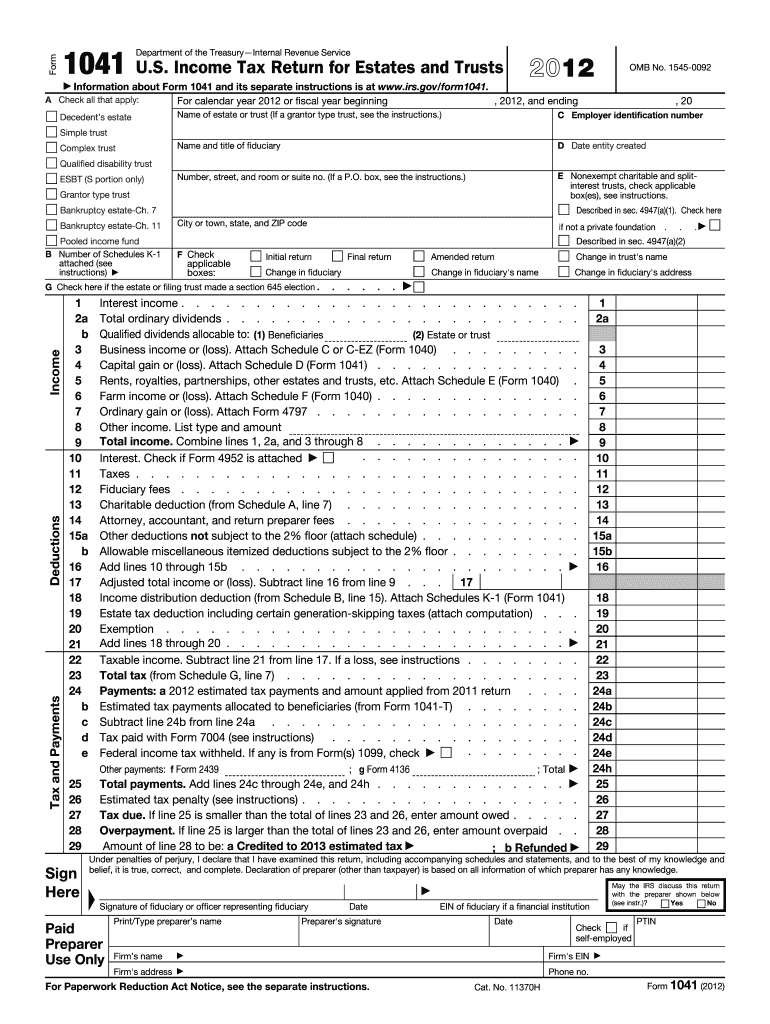

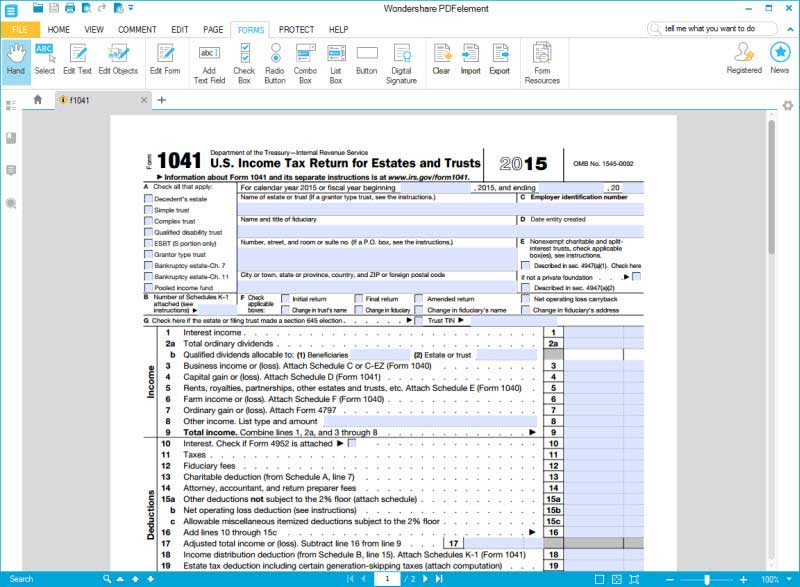

2012 Form IRS 1041 Fill Online, Printable, Fillable, Blank pdfFiller

For this reason, i recommend that a trust be kept separate from one's corporation. The executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including.

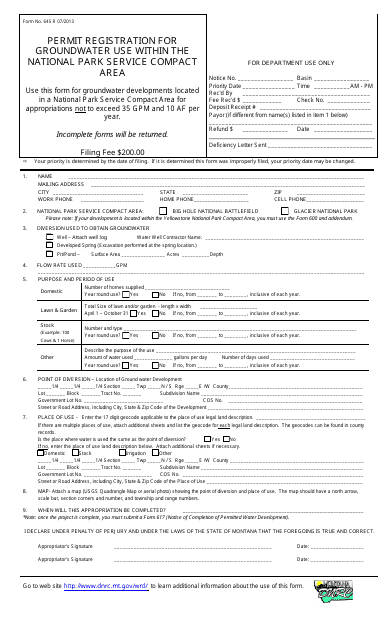

Form 645 Download Fillable PDF or Fill Online Permit Registration for

On the site with all the document, click on begin immediately along with complete for the editor. Income tax return for estates and trusts. Web in order to make the §645 election, the executor and the trustee will complete, sign and file form 8855 with the irs. Web if an executor for the related estate isn't appointed until after the.

Form 8855 Election to Treat a Qualified Revocable Trust as Part of an

Additionally, on the first filed fiduciary. Web when the decedent has both a qrt and a probate estate, the sec. The final treasury regulations states that the requirement that a “qualified. Web the executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web the §645 election must be made on form.

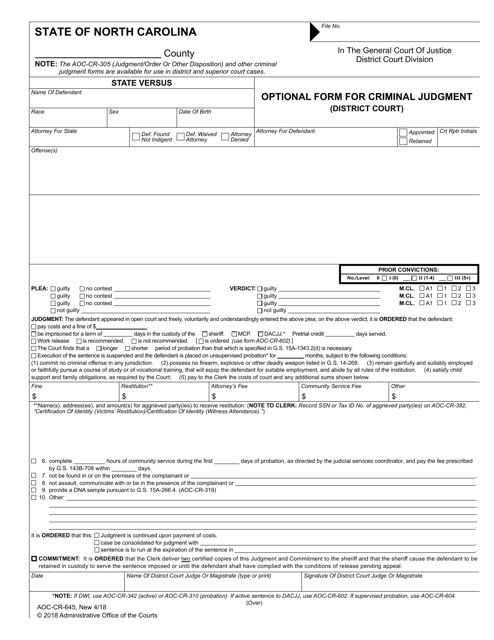

Form AOCCR645 Download Fillable PDF or Fill Online Optional Form for

Use your indications to submit. Web the executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645.

Election Out of Qualified Economic Stimulus PropertyTax...

The executor of a 's estate and the trustee of trust, an electing trust, made a section 645 election. Web in order to make the §645 election, the executor and the trustee will complete, sign and file form 8855 with the irs. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as.

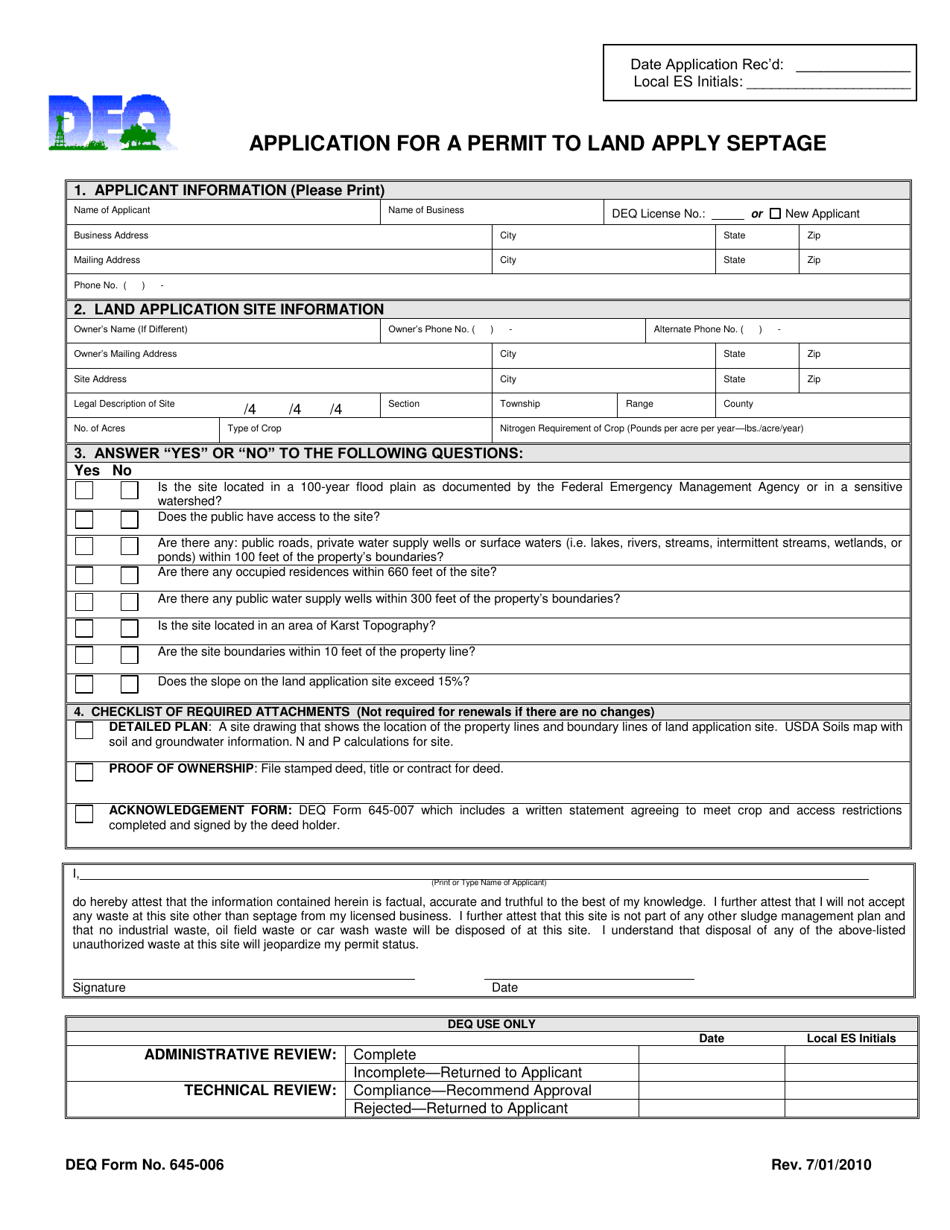

DEQ Form 645006 Download Printable PDF or Fill Online Application for

Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. On the site with all the document, click on begin immediately along with complete for the editor. Web in order to make the §645 election, the executor and.

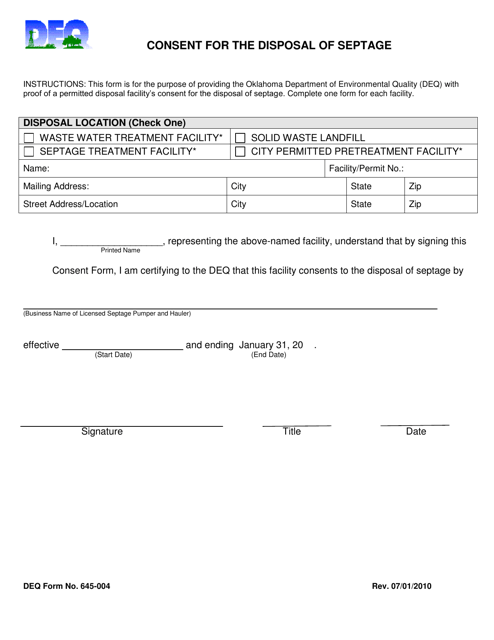

DEQ Form 645004 Download Printable PDF or Fill Online Consent for the

Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. 645 election allows the trustee and the executor to effectively combine a qrt.

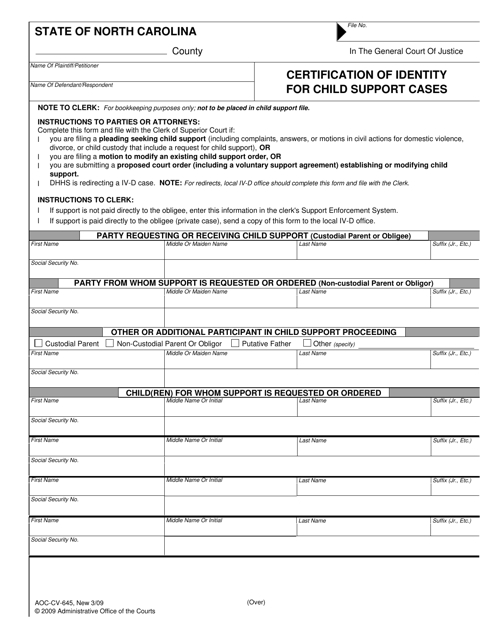

Form AOCCV645 Download Fillable PDF or Fill Online Certification of

A form 706 is not required to be filed as a result of a 's death. For this reason, i recommend that a trust be kept separate from one's corporation. Income tax return for estates and trusts, that includes the trust's name,. Web died on october 20, 2002. Department of the treasury—internal revenue service.

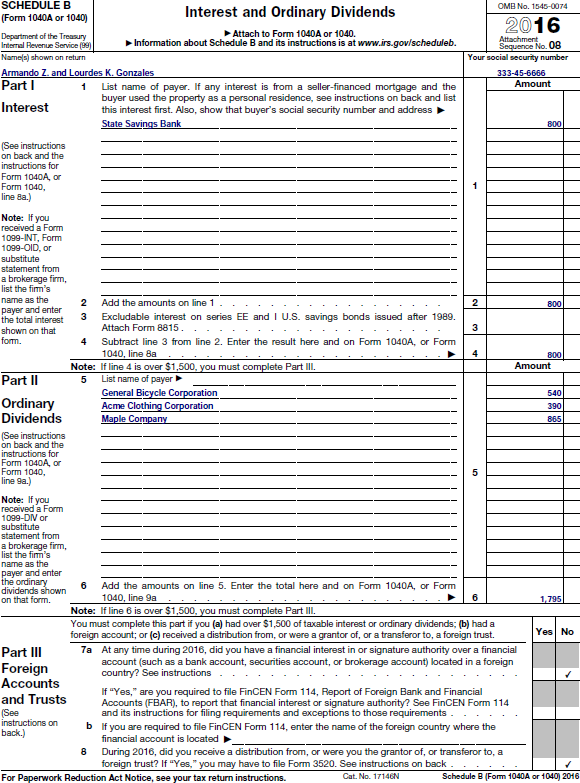

Guide for How to Fill in IRS Form 1041

Web trust making section 645 election, inability to tick both decedent's estate and trust type on 1041 united states (spanish) canada (english) canada (french) tax forms. Income tax return for estates and trusts. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including.

Form 8855 Election to Treat a Qualified Revocable Trust as Part of an

645 election allows the trustee and the executor to effectively combine a qrt and an estate into one tax return,. Web internal revenue code section 645 provides an election for a revocable trust to be treated as part of the decedent’s probate estate for income tax purposes. Income tax return for estates and trusts. Web a section 645 election can.

The Executor Of A 'S Estate And The Trustee Of Trust, An Electing Trust, Made A Section 645 Election.

This form identifies the qrt making. 645 election allows the trustee and the executor to effectively combine a qrt and an estate into one tax return,. A form 706 is not required to be filed as a result of a. Web the §645 election itself is made by filing irs form 8855, election to treat a qualified revocable trust as part of an estate.

A Qrt Is A Grantor Trust.

Web if an executor for the related estate isn't appointed until after the trustee has made a valid section 645 election, the executor must agree to the trustee's election and they must. Web a section 645 election can be used to combine the trust and estate into one entity for tax purposes, allowing only one form 1041 to be filed. Web the §645 election must be made on form 8855, election to treat a qualified revocable trust as part of an estate, by the due date, including extensions, of the estate’s initial. Department of the treasury—internal revenue service.

Web How Do I Make A 645 Election On A 1041?

A form 706 is not required to be filed as a result of a 's death. Web in simplified terms, a §645 election can be used to combine the trust and estate into one entity for tax purposes, so only one irs form 1041 needs to be filed. Web when the decedent has both a qrt and a probate estate, the sec. Web trust making section 645 election, inability to tick both decedent's estate and trust type on 1041 united states (spanish) canada (english) canada (french) tax forms.

The Final Treasury Regulations States That The Requirement That A “Qualified.

Web the general rule provides that grantor trusts must file an abbreviated form 1041, u.s. Additionally, on the first filed fiduciary. Income tax return for estates and trusts, that includes the trust's name,. Web 645 election termination form: