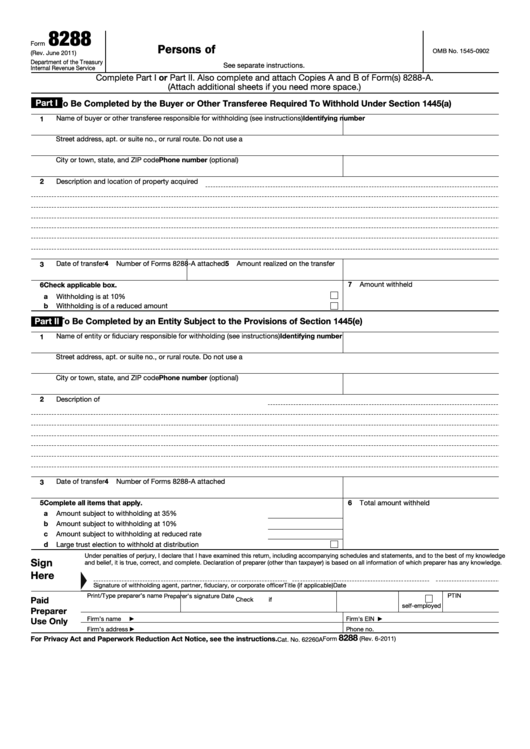

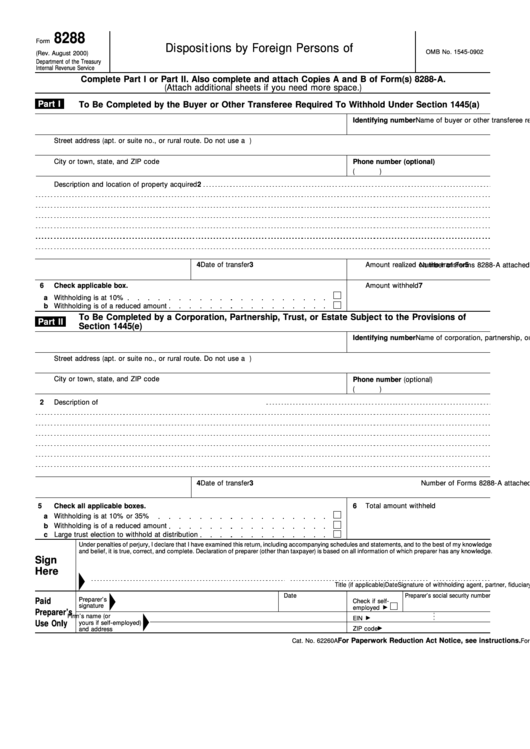

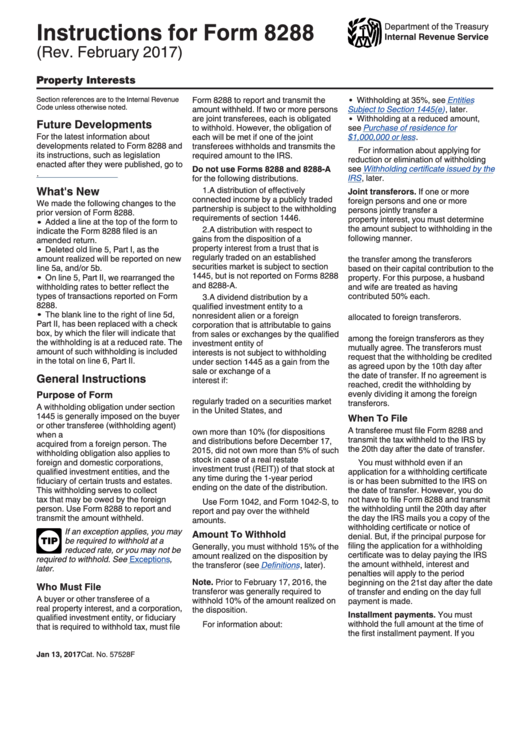

Form 8288 A Instructions

Form 8288 A Instructions - The foreign owner can be a. Real property interests, is a form that shows the firpta withholding allocated to each seller. Attach copies a and b to form 8288, u.s. You must file a u.s. Get ready for tax season deadlines by completing any required tax forms today. What's new we made the following. Web this guide will provide you a complete understanding on how to complete form 8288. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. All forms individual forms information returns. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s.

Get ready for tax season deadlines by completing any required tax forms today. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Complete, edit or print tax forms instantly. All forms individual forms information returns. The foreign owner can be a. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. June 2011) department of the treasury internal revenue service u.s. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. Observe the quick manual in an effort to. Withholding tax return for dispositions by foreign.

Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. The foreign owner can be a. This form is used when there is tax that is withheld on the need of the us real estate. Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Attach copies a and b to form 8288, u.s. Ad access irs tax forms. All forms individual forms information returns. Web what is form 8288. Withholding tax return for dispositions by foreign.

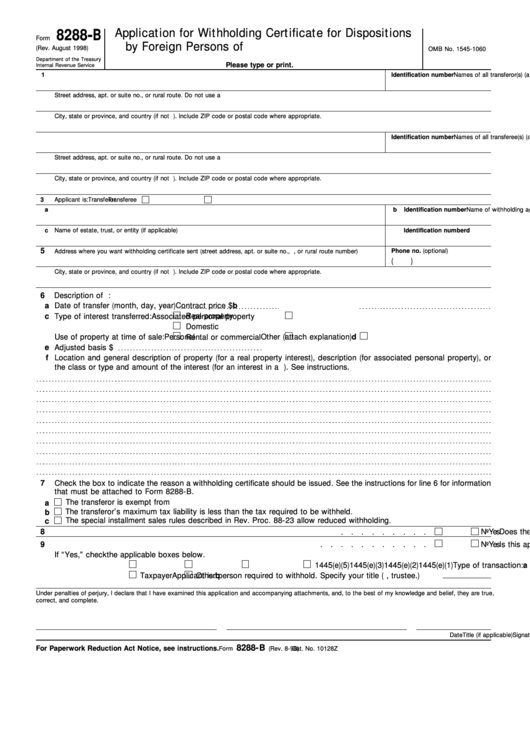

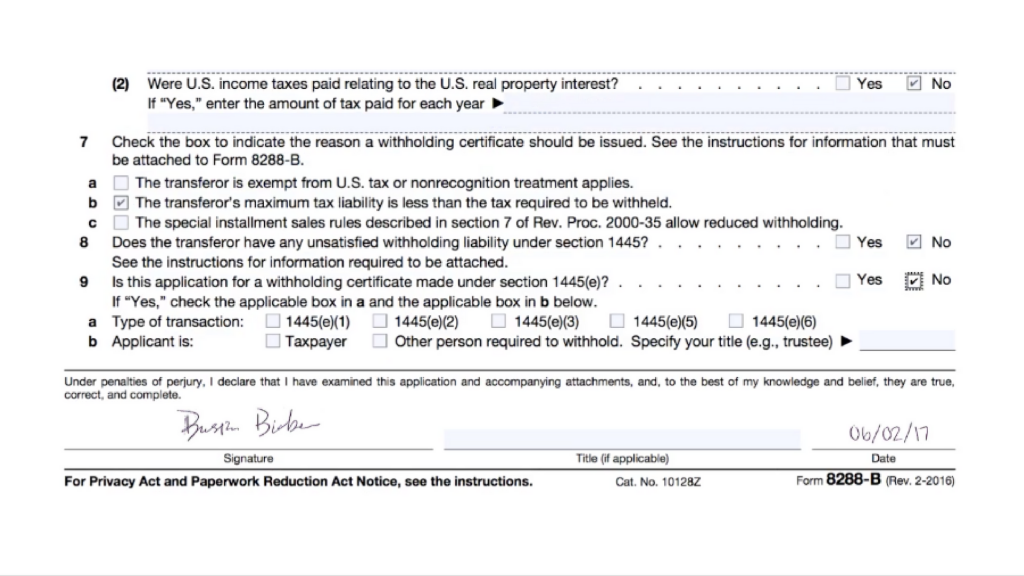

Irs form 8288 b instructions

Attach copies a and b to form 8288, u.s. Web instructions for form 8288 (rev. The foreign owner can be a. Withholding tax return for dispositions by foreign. June 2011) department of the treasury internal revenue service u.s.

Form 8288 U.S. Withholding Tax Return for Dispositions by Foreign

This form is used when there is tax that is withheld on the need of the us real estate. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. Withholding tax return for dispositions by foreign. Ad.

Fillable Form 8288 U.s. Withholding Tax Return For Dispositions By

You must file a u.s. June 2011) department of the treasury internal revenue service u.s. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner. What's new we made the following. This form is used when there.

Form 8288 U.s. Withholding Tax Return For Dispositions By Foreign

Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Ad access irs tax forms. Withholding tax return for dispositions by foreign. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in.

Form 8288 U.S. Withholding Tax Return for Dispositions by Foreign

All forms individual forms information returns. A form that one files with the irs providing the information related to the withholding of taxation from the proceeds of the sale of real estate in the united states in. This form is used when there is tax that is withheld on the need of the us real estate. You must file a.

Irs form 8288 b instructions

Web what is form 8288. Web this guide will provide you a complete understanding on how to complete form 8288. What's new we made the following. A form that one files with the irs providing the information related to the withholding of taxation from the proceeds of the sale of real estate in the united states in. Real property interests,.

Fillable Form 8288B (Rev. August 1998) Application For Withholding

Online solutions assist you to organize your document administration and boost the productivity of your workflow. Web what is form 8288. Ad access irs tax forms. This form is used when there is tax that is withheld on the need of the us real estate. Attach copies a and b to form 8288, u.s.

Form 8288 U.s. Withholding Tax Return For Dispositions By Foreign

Online solutions assist you to organize your document administration and boost the productivity of your workflow. States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. What's new we made the following. The foreign owner can be a. Web this guide will provide you a complete understanding on how to complete form 8288.

Instructions For Form 8288 U.s. Withholding Tax Return For

States often have dozens of even hundreds of various tax credits, which, unlike deductions, provide a dollar. What's new we made the following. Complete, edit or print tax forms instantly. A form that one files with the irs providing the information related to the withholding of taxation from the proceeds of the sale of real estate in the united states.

How to Reduce Withholding Taxes on the Sale of U.S. Property Madan CA

All forms individual forms information returns. This form is used when there is tax that is withheld on the need of the us real estate. Real property interests, is a form that shows the firpta withholding allocated to each seller. Complete, edit or print tax forms instantly. What's new we made the following.

Withholding Tax Return For Dispositions By Foreign Persons Of U.s.

You must file a u.s. A form that one files with the irs providing the information related to the withholding of taxation from the proceeds of the sale of real estate in the united states in. Observe the quick manual in an effort to. This form is used when there is tax that is withheld on the need of the us real estate.

Web What Is Form 8288.

Get ready for tax season deadlines by completing any required tax forms today. Attach copies a and b to form 8288, u.s. Web developments related to form 8288 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8288. Withholding tax return for dispositions by foreign.

The Foreign Owner Can Be A.

Real property interests, is a form that shows the firpta withholding allocated to each seller. What's new we made the following. Web this guide will provide you a complete understanding on how to complete form 8288. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s.

Complete, Edit Or Print Tax Forms Instantly.

June 2011) department of the treasury internal revenue service u.s. Web instructions for form 8288 (rev. All forms individual forms information returns. Web an 8288 tax form is a tax form that tells the irs how much money you are paying in taxes when you buy a house in the usa from a foreign owner.