Az Form 120 Instructions 2021

Az Form 120 Instructions 2021 - Web form year form instructions publish date; Do not mark in this area. Web file the 2020 form 120x to amend corporate income tax returns for calendar year 2020, and to amend fiscal year returns that begin in 2020 and end in 2021. Web the year, arizona form may be used to 120/165ext transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal. Form 120s is an arizona corporate income tax form. 81 pm 66 rcvd ador 10949 (21) 68 check box if: Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120a, fully updated for tax year 2022. Web • the completed form(s) 122 must be included with form 120 filed with the department for the first taxable year a consolidated return is filed. Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using. Web arizona form 2021 arizona s corporation income tax return 120s 1 for information or help, call one of the numbers listed:

Web the year, arizona form may be used to 120/165ext transmit extension payments by check or money order, regardless of how you request an arizona extension (valid federal. Web • the completed form(s) 122 must be included with form 120 filed with the department for the first taxable year a consolidated return is filed. Web form year form instructions publish date; Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120, fully updated for tax year 2022. 81 pm 66 rcvd ador 10949 (21) 68 check box if: Web 20 rows corporate tax forms. Indicate whether the taxable year is a calendar year or a fiscal year. Web file the 2020 form 120 for calendar year 2020 and fiscal years that begin in 2020 and end in 2021. Web file the 2020 form 120x to amend corporate income tax returns for calendar year 2020, and to amend fiscal year returns that begin in 2020 and end in 2021. Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using.

Web d if arizona filing method is combined or consolidated, see form 51 instructions. Web corporations making estimated tax payments for 2021 that expect a 2021 income tax liability of $500 or more must make arizona estimated income tax payments using. 32 amount of line 31 to be applied to 2021 estimated tax. Web arizona form 120a 88 revenue use only. Form 120s is an arizona corporate income tax form. Web form year form instructions publish date; A this is a first return b name change c. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120, fully updated for tax year 2022. Indicate whether the taxable year is a calendar year or a fiscal year. Web 12 rows form year form instructions publish date;

Form 120 Transfer Pricing Declaration TPC GROUP

Web form 120ext is an arizona corporate income tax form. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120a, fully updated for tax year 2022. Web form year form instructions publish date; Web d if arizona filing method is combined or consolidated, see form 51 instructions. Web.

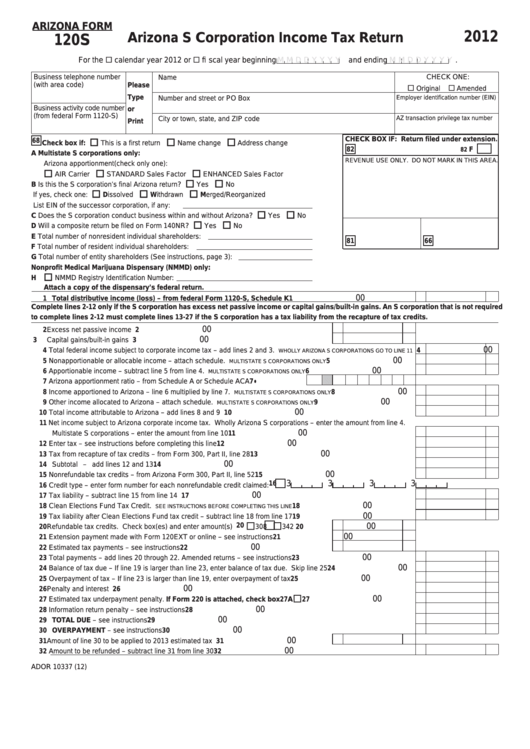

Fillable Arizona Form 120s Arizona S Corporation Tax Return

Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120a, fully updated for tax year 2022. Web 20 rows corporate tax forms. Web the year, arizona form may be used to 120/165ext transmit extension payments by check or money order, regardless of how you request an arizona extension.

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

Form 120s is an arizona corporate income tax form. Web form year form instructions publish date; 32 amount of line 31 to be applied to 2021 estimated tax. Web arizona form 120a 88 revenue use only. Web d if arizona filing method is combined or consolidated, see form 51 instructions.

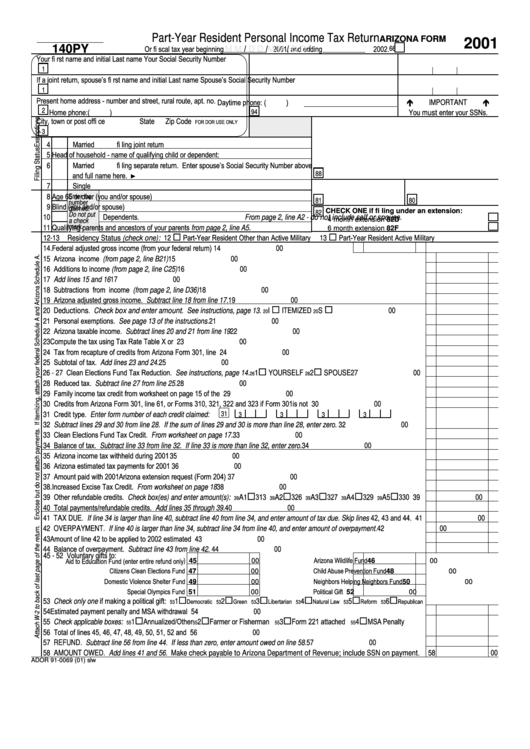

Az Form 140 Py PartYear Resident Personal Tax Return 2001

Web file the 2020 form 120 for calendar year 2020 and fiscal years that begin in 2020 and end in 2021. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120a, fully updated for tax year 2022. 81 pm 66 rcvd ador 10949 (21) 68 check box if:.

Tax Return, AZ Form 140X, For The Specific Year For Which The Taxpayer

Web file the 2020 form 120 for calendar year 2020 and fiscal years that begin in 2020 and end in 2021. Web form year form instructions publish date; 81 pm 66 rcvd ador 10949 (21) 68 check box if: Indicate whether the taxable year is a calendar year or a fiscal year. Web we last updated the arizona corporation income.

Form 1040NREZ

A this is a first return b name change c. Web arizona form 2021 arizona s corporation income tax return 120s 1 for information or help, call one of the numbers listed: Web we last updated arizona form 120s from the department of revenue in may 2021. Web corporations making estimated tax payments for 2021 that expect a 2021 income.

AZ AZNG 3351R 19922022 Fill and Sign Printable Template Online

Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120, fully updated for tax year 2022. Indicate whether the taxable year is a calendar year or a fiscal year. A this is a first return b name change c. 32 amount of line 31 to be applied to.

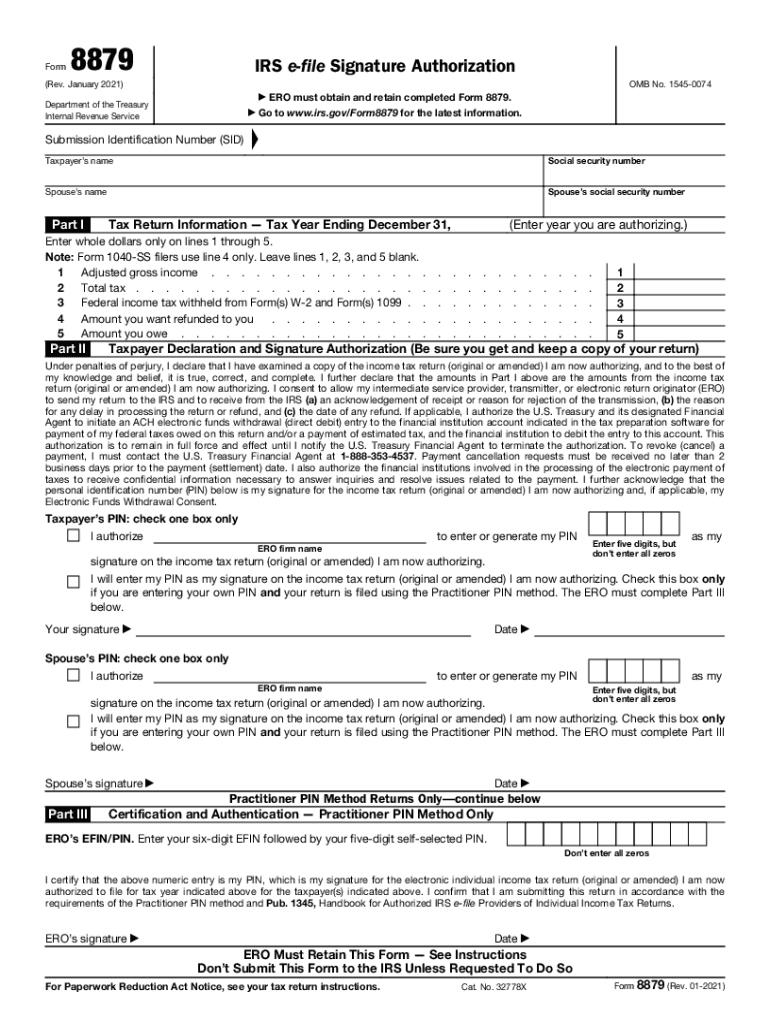

IRS 8879 2021 Fill and Sign Printable Template Online US Legal Forms

Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120, fully updated for tax year 2022. Indicate whether the taxable year is a calendar year or a fiscal year. Web 12 rows form year form instructions publish date; Form 120s is an arizona corporate income tax form. Web.

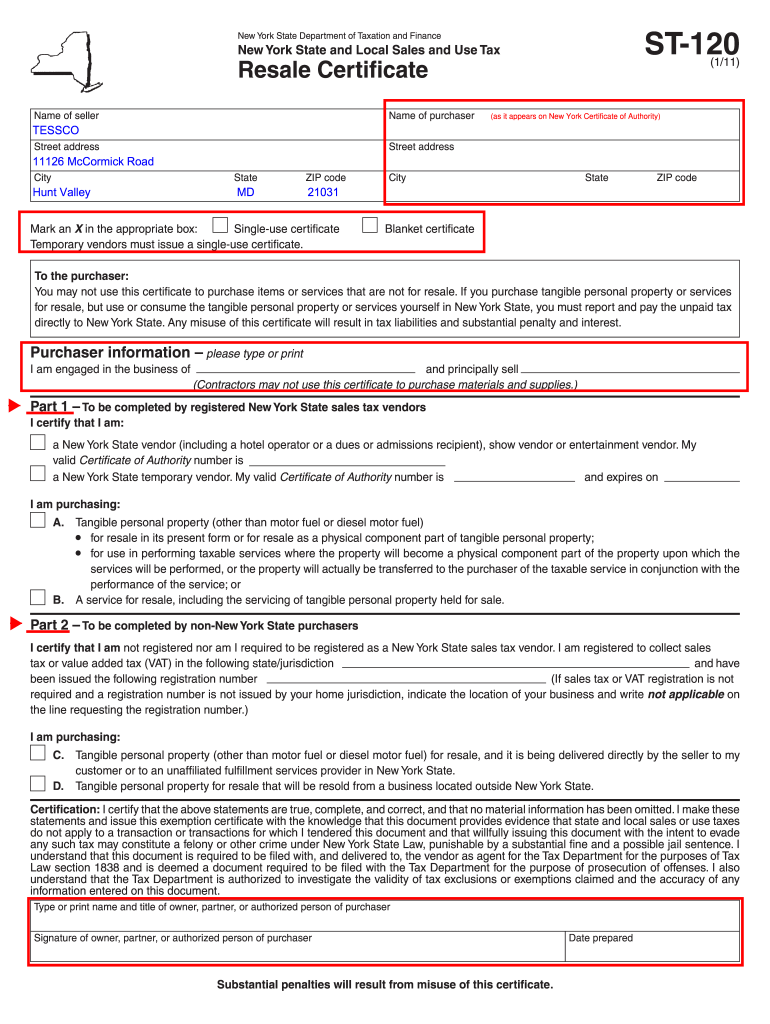

Resale Certificate Ny 20202022 Fill and Sign Printable Template

A this is a first return b name change c. Web 12 rows form year form instructions publish date; Web form year form instructions publish date; Web file the 2020 form 120 for calendar year 2020 and fiscal years that begin in 2020 and end in 2021. Web • the completed form(s) 122 must be included with form 120 filed.

OH CCA Form 12016IR 20202022 Fill out Tax Template Online US

81 pm 66 rcvd ador 10949 (21) 68 check box if: Web the 2020 form 120s can also be used if the corporation has a tax year of less than 12 months that begins and ends in 2021, and the 2021 form 120s is not available at the. Web • the completed form(s) 122 must be included with form 120.

Web We Last Updated The Arizona Corporation Income Tax Return In February 2023, So This Is The Latest Version Of Form 120A, Fully Updated For Tax Year 2022.

81 pm 66 rcvd ador 10949 (21) 68 check box if: Web the 2020 form 120s can also be used if the corporation has a tax year of less than 12 months that begins and ends in 2021, and the 2021 form 120s is not available at the. 32 amount of line 31 to be applied to 2021 estimated tax. Web we last updated the arizona corporation income tax return in february 2023, so this is the latest version of form 120, fully updated for tax year 2022.

Web 26 Rows Resident Shareholder's Information Schedule Form With Instructions:

Web we last updated arizona form 120s from the department of revenue in may 2021. Web form 120ext is an arizona corporate income tax form. Web 12 rows form year form instructions publish date; Indicate whether the taxable year is a calendar year or a fiscal year.

Web Corporations Making Estimated Tax Payments For 2021 That Expect A 2021 Income Tax Liability Of $500 Or More Must Make Arizona Estimated Income Tax Payments Using.

Web d if arizona filing method is combined or consolidated, see form 51 instructions. Do not mark in this area. Web • the completed form(s) 122 must be included with form 120 filed with the department for the first taxable year a consolidated return is filed. Form 120s is an arizona corporate income tax form.

Web The Year, Arizona Form May Be Used To 120/165Ext Transmit Extension Payments By Check Or Money Order, Regardless Of How You Request An Arizona Extension (Valid Federal.

A this is a first return b name change c. Web 20 rows corporate tax forms. Web form year form instructions publish date; Web file the 2020 form 120x to amend corporate income tax returns for calendar year 2020, and to amend fiscal year returns that begin in 2020 and end in 2021.

:max_bytes(150000):strip_icc()/1040-NR-EZ-NonresidentAlienswithNoDependents-1-992eb3e7ab6d49b782ad46ab42ae00e5.png)