1031 Exchange Form

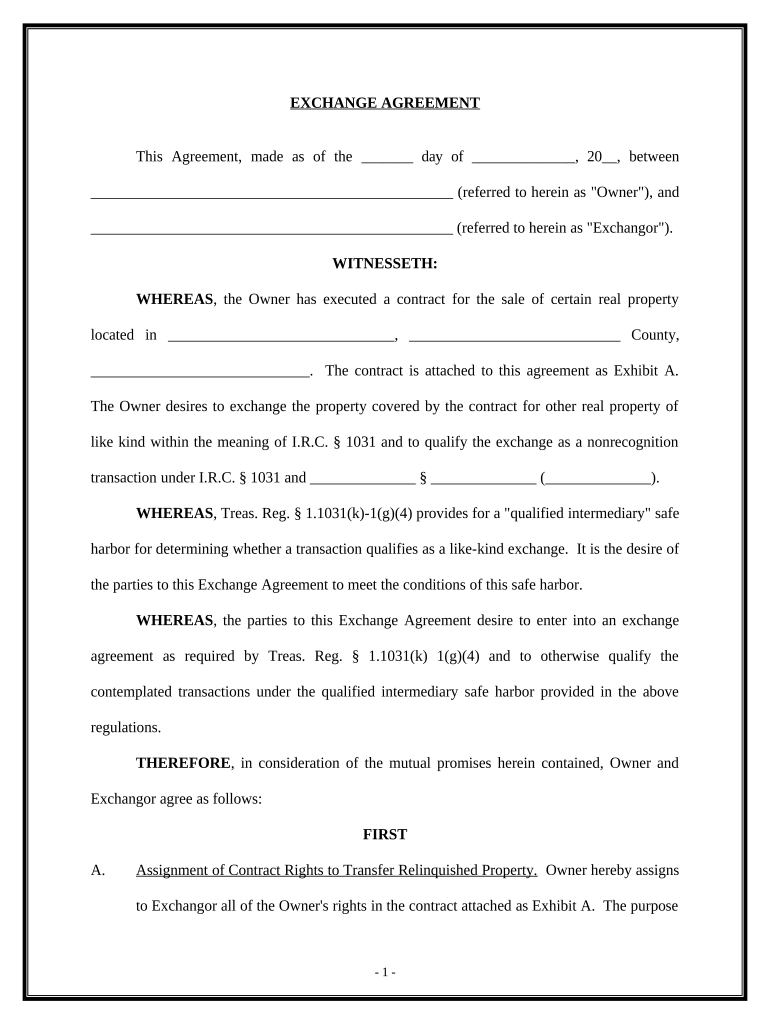

1031 Exchange Form - Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. The term—which gets its name from section 1031 of the internal. 1031 exchanges don’t work to downsize an investment. It only applies to real property held for business or investment purposes exchanged for real property held for business or investment purposes. Addendum b (replacement property) click here to download pdf. Id form (provided for the 45 day identification requirement) So let’s say you bought a real estate property five years ago. Web a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before december 31, 2017, or received replacement property on or before that date. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web a 1031 exchange, named after section 1031 of the u.s.

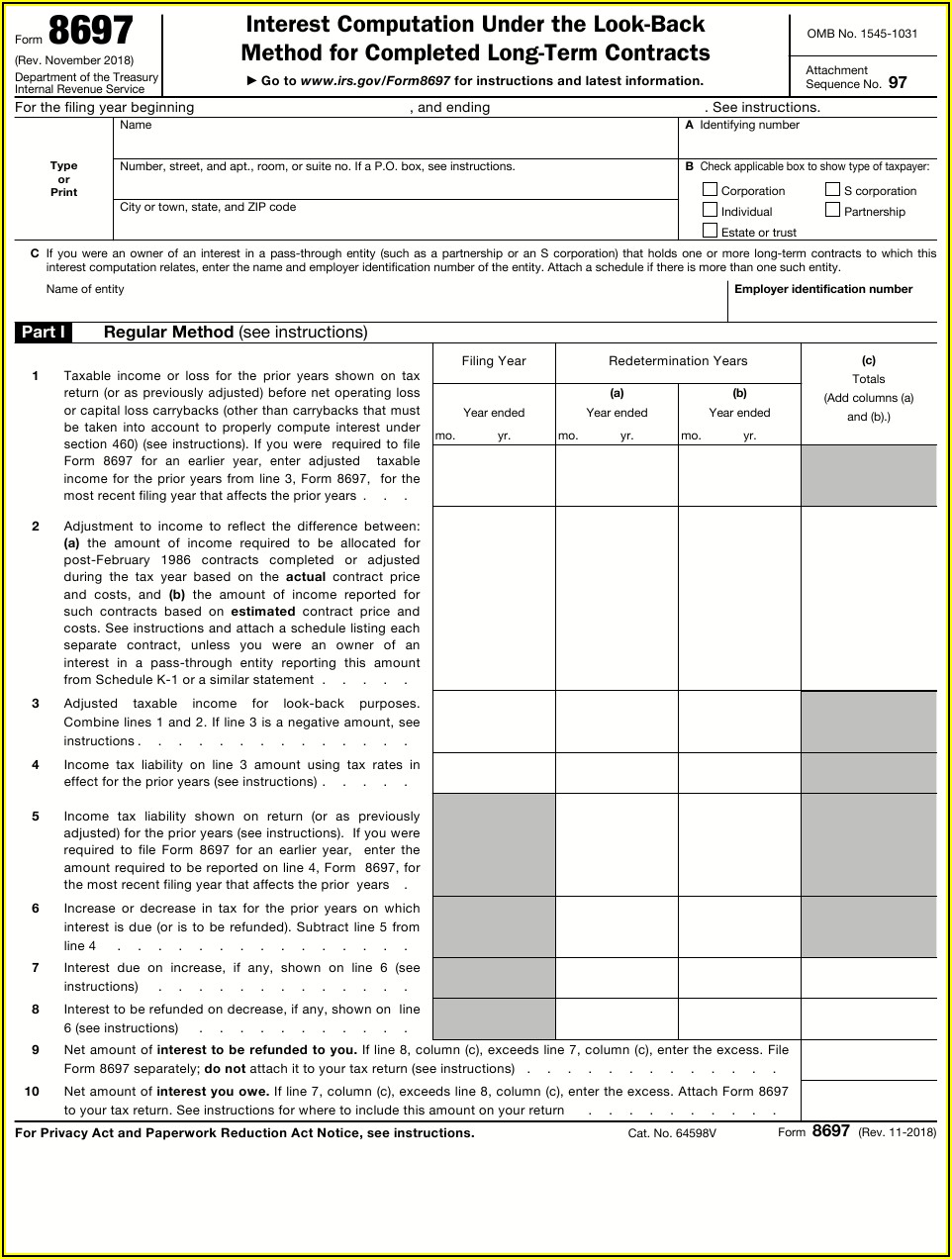

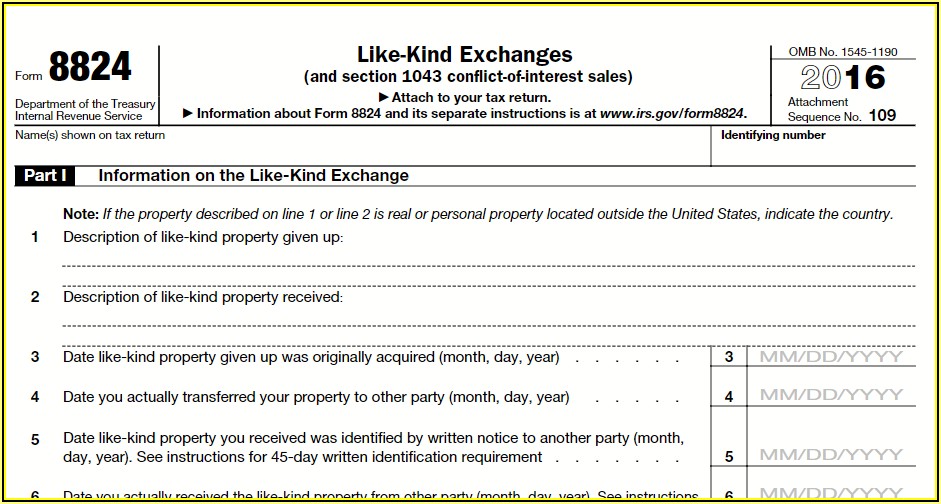

1031 exchanges don’t work to downsize an investment. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. These final regulations address the definition of real property under section 1031 and also provide a rule addressing the receipt of personal property that is incidental to real property received in. The term—which gets its name from section 1031 of the internal. Form 8824 (filed when tax returns are due to document the 1031 exchange) click here to download pdf. Web what is a 1031 exchange? Web a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before december 31, 2017, or received replacement property on or before that date. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred.

Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. Web a 1031 exchange, named after section 1031 of the u.s. It only applies to real property held for business or investment purposes exchanged for real property held for business or investment purposes. Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. Addendum b (replacement property) click here to download pdf. These final regulations address the definition of real property under section 1031 and also provide a rule addressing the receipt of personal property that is incidental to real property received in. Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. Web what is a 1031 exchange? 1031 exchanges don’t work to downsize an investment. Id form (provided for the 45 day identification requirement)

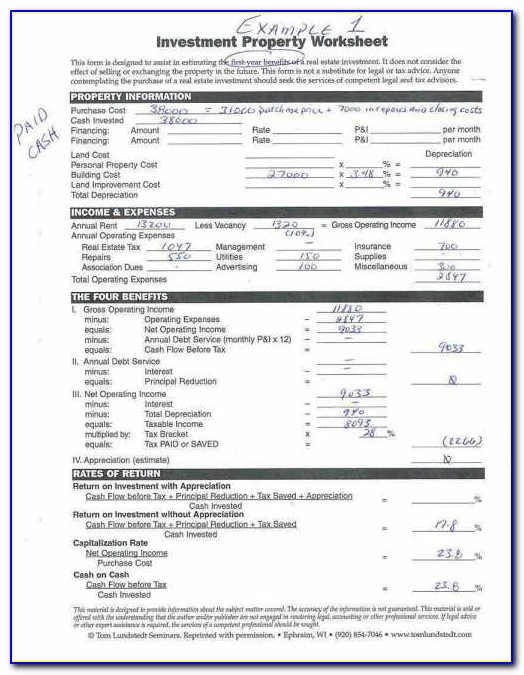

1031 Exchange Worksheet Excel Master of Documents

The term—which gets its name from section 1031 of the internal. Web a 1031 exchange, named after section 1031 of the u.s. Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. 1031 exchanges don’t work to downsize an investment. Web a transition rule in the new law provides that section.

1031 Exchange Order Form

Id form (provided for the 45 day identification requirement) Web what is a 1031 exchange? It only applies to real property held for business or investment purposes exchanged for real property held for business or investment purposes. Addendum b (replacement property) click here to download pdf. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you.

1031 Exchange Documents Form Fill Out and Sign Printable PDF Template

Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. Web a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before december 31, 2017, or received replacement property on.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Web a 1031 exchange is a swap of one real estate investment property for another that allows capital gains taxes to be deferred. The strict rules surrounding 1031 exchanges require the new investment property to be of equal or greater value than the property being sold. See definition of real property, later, for more details. The term—which gets its name.

1031 Exchange Order Form

So let’s say you bought a real estate property five years ago. The term—which gets its name from section 1031 of the internal. These final regulations address the definition of real property under section 1031 and also provide a rule addressing the receipt of personal property that is incidental to real property received in. Basically, a 1031 exchange allows you.

Irs Form Section 1031 Universal Network

Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. So let’s say you bought a real estate property five years ago. Web a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if.

turbotax entering 1031 exchange Fill Online, Printable, Fillable

Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. Addendum b (replacement property) click here to download pdf. Web a 1031 exchange, named after section 1031 of the u.s. Web what is a 1031 exchange? So let’s say you bought a real estate property five years ago.

Tax Form 1031 Exchange Universal Network

Addendum b (replacement property) click here to download pdf. Web a 1031 exchange, named after section 1031 of the u.s. Web what is a 1031 exchange? Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. It only applies to real property held for business or investment purposes exchanged for real.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

See definition of real property, later, for more details. It only applies to real property held for business or investment purposes exchanged for real property held for business or investment purposes. Web a 1031 exchange, named after section 1031 of the u.s. Web what is a 1031 exchange? Basically, a 1031 exchange allows you to avoid paying capital gains tax.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

Id form (provided for the 45 day identification requirement) It only applies to real property held for business or investment purposes exchanged for real property held for business or investment purposes. Form 8824 (filed when tax returns are due to document the 1031 exchange) click here to download pdf. Web a 1031 exchange, named after section 1031 of the u.s..

Web A 1031 Exchange Is A Swap Of One Real Estate Investment Property For Another That Allows Capital Gains Taxes To Be Deferred.

Internal revenue code, is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to. It only applies to real property held for business or investment purposes exchanged for real property held for business or investment purposes. Basically, a 1031 exchange allows you to avoid paying capital gains tax when you sell an investment real estate property if you reinvest your profits into another similar property within a certain period of time. These final regulations address the definition of real property under section 1031 and also provide a rule addressing the receipt of personal property that is incidental to real property received in.

1031 Exchanges Don’t Work To Downsize An Investment.

Web what is a 1031 exchange? Web a 1031 exchange, named after section 1031 of the u.s. Web a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before december 31, 2017, or received replacement property on or before that date. So let’s say you bought a real estate property five years ago.

Addendum B (Replacement Property) Click Here To Download Pdf.

The strict rules surrounding 1031 exchanges require the new investment property to be of equal or greater value than the property being sold. See definition of real property, later, for more details. The term—which gets its name from section 1031 of the internal. Id form (provided for the 45 day identification requirement)

Form 8824 (Filed When Tax Returns Are Due To Document The 1031 Exchange) Click Here To Download Pdf.

Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf.