When Is Form 982 Required

When Is Form 982 Required - Web what is form 982? The forgiven debt may be excluded as income under the insolvency exclusion. (for additional information, see the instructions for part ii.). Web the rules are complicated and form 982 is required. Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form. This form is for income earned in tax year 2022, with tax returns due in april. Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Generally, if you owe a debt to. Web a taxpayer is insolvent when his or her total liabilities exceed his or her total assets.

Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form. Web do i have to complete the entire form 982? Web a taxpayer is insolvent when his or her total liabilities exceed his or her total assets. Web required partnership consent statements. The forgiven debt may be excluded as income under the insolvency exclusion. Web what is form 982? The irs has a tool called the interactive tax assistant that can help determine if cancelled. (for additional information, see the instructions for part ii.). Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments.

Web a taxpayer is insolvent when his or her total liabilities exceed his or her total assets. Web required partnership consent statements. The irs has a tool called the interactive tax assistant that can help determine if cancelled. This is because you received a benefit. This form is for income earned in tax year 2022, with tax returns due in april. The forgiven debt may be excluded as income under the insolvency exclusion. Web to enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040) select: (for additional information, see the instructions for part ii.). Generally, if you owe a debt to. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later).

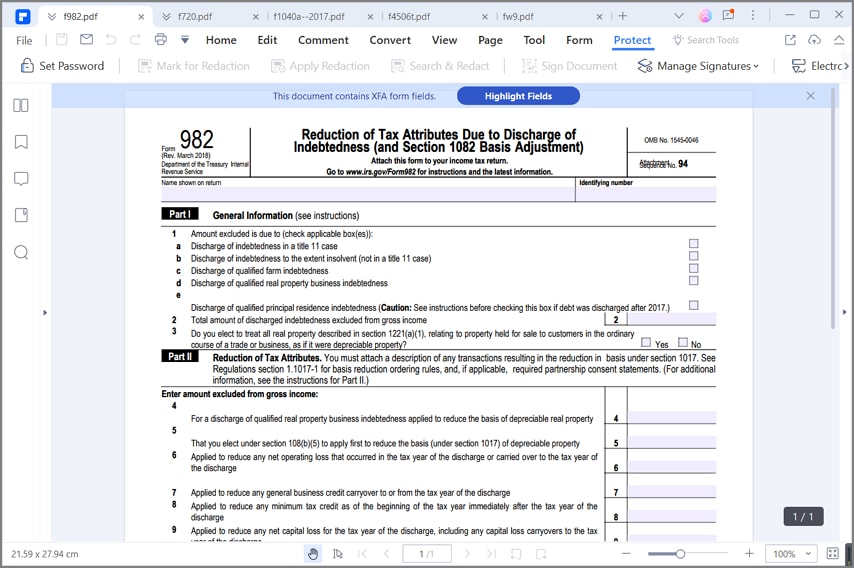

IRS Form 982 How to Fill it Right

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web the rules are complicated and form 982 is required. Web to enter form.

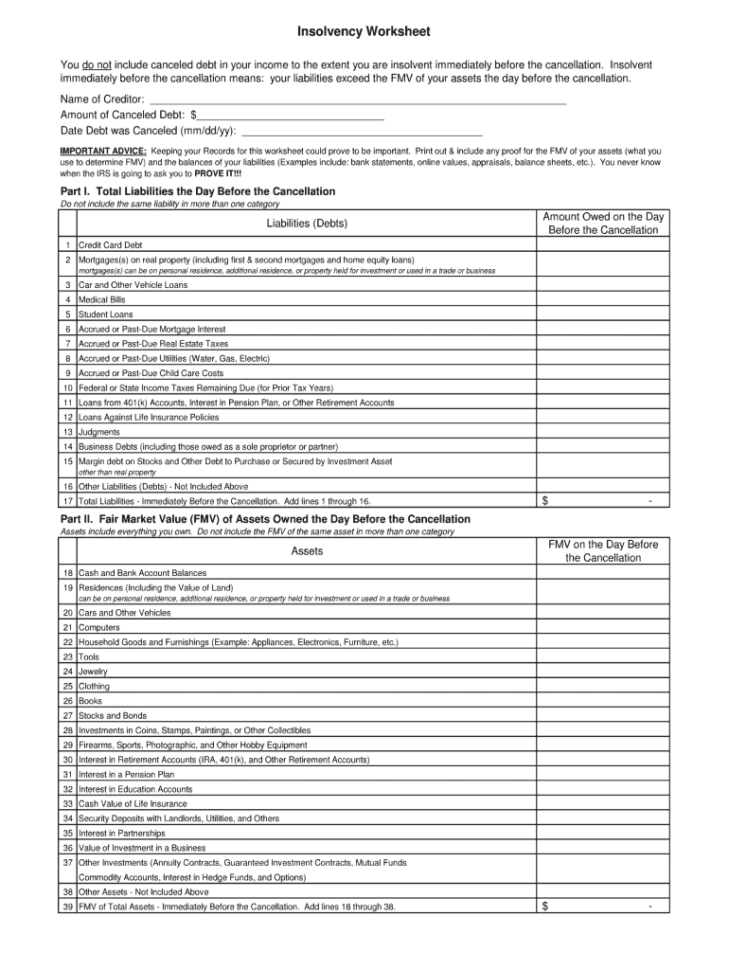

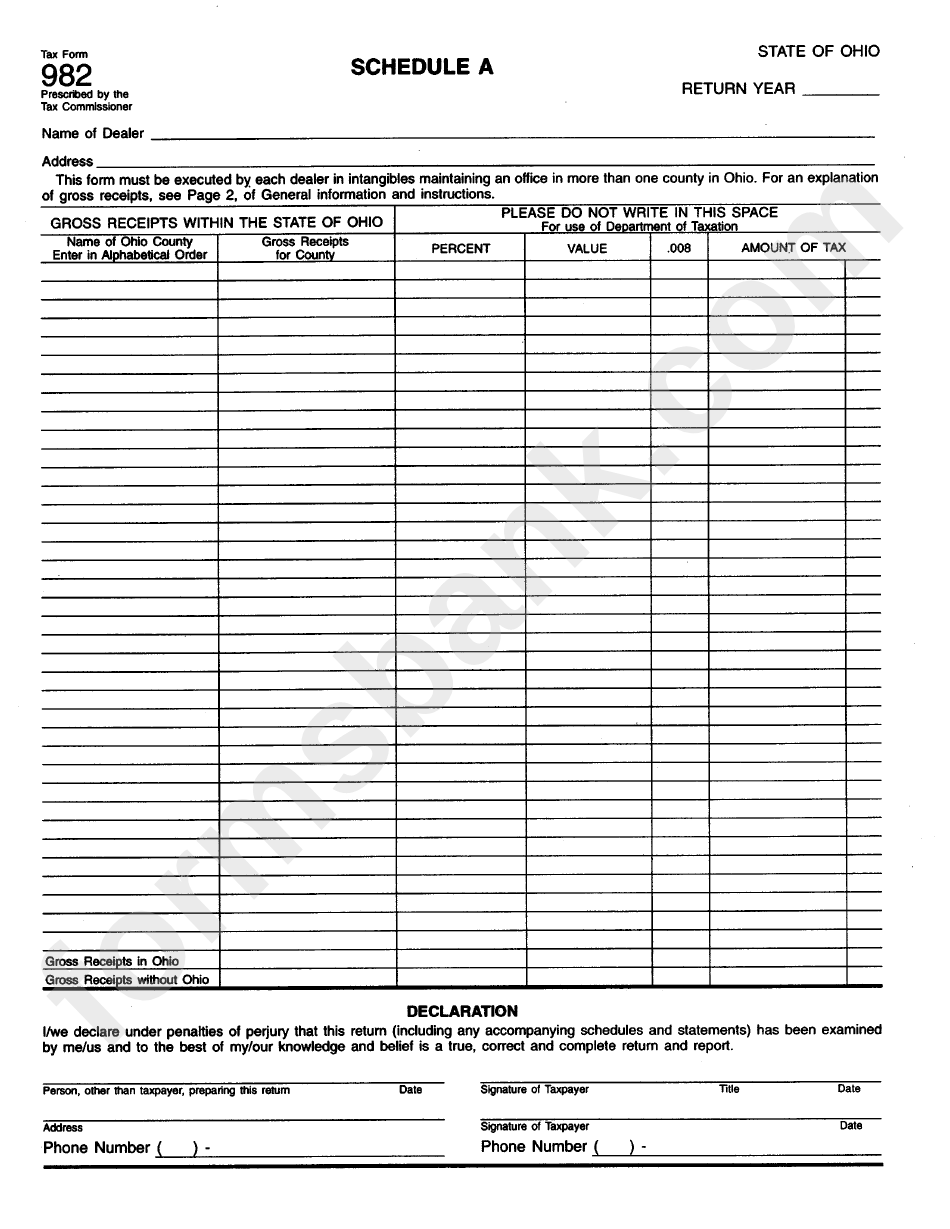

Tax form 982 Insolvency Worksheet

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained.

Form 982 Insolvency Worksheet —

This is because you received a benefit. Web do i have to complete the entire form 982? Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Web form 982 (reduction of tax attributes due to discharge of.

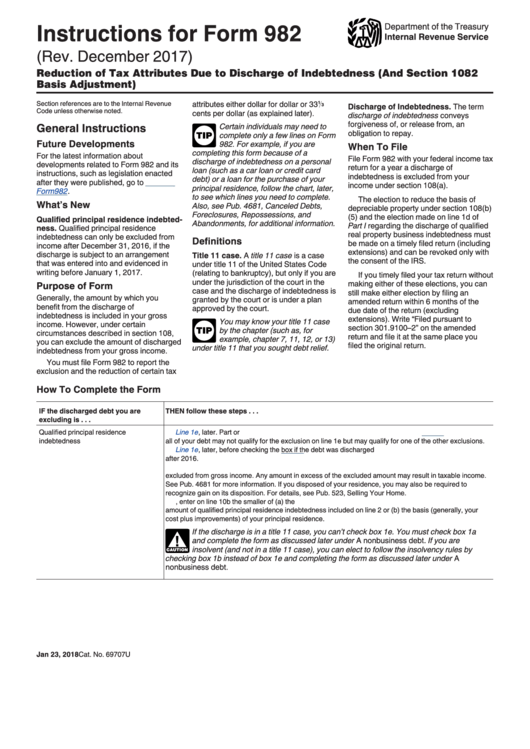

Instructions For Form 982 Reduction Of Tax Attributes Due To

Even if you are not in bankruptcy, if you are insolvent when your debt is discharged, there is no tax. Web required partnership consent statements. This form is for income earned in tax year 2022, with tax returns due in april. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar.

Form 982 Instructions Reasons Why 9 Is Grad Amended Return —

Web the rules are complicated and form 982 is required. Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. The forgiven debt may be excluded as income under the insolvency exclusion. Web we last updated federal form 982 in february 2023 from the federal internal revenue service. Web do i have.

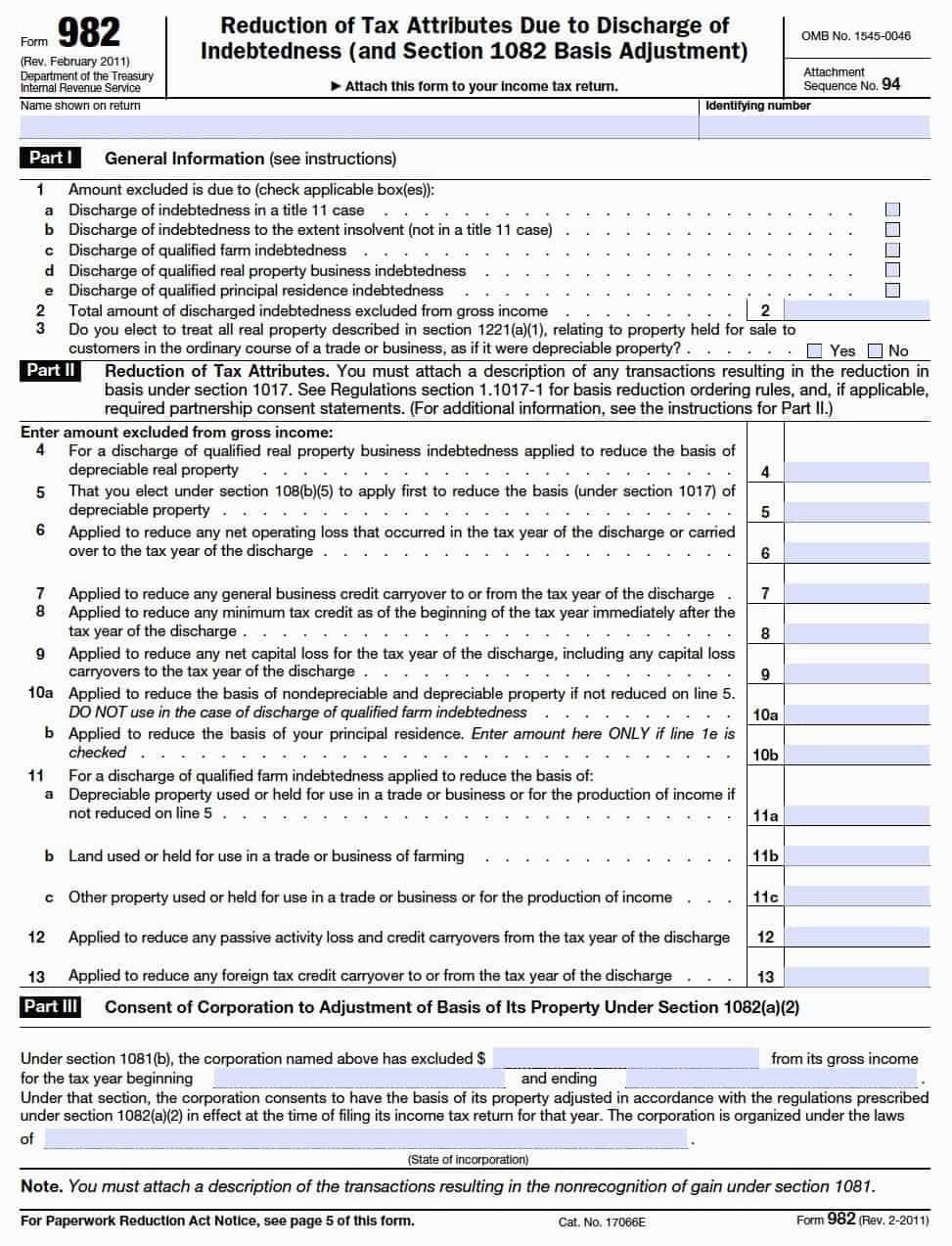

Form 982 Edit, Fill, Sign Online Handypdf

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 33 1 / 3 cents per dollar (as explained later). Even if you are not in bankruptcy, if you are insolvent when your debt is discharged, there is no tax. The forgiven debt may be excluded as income.

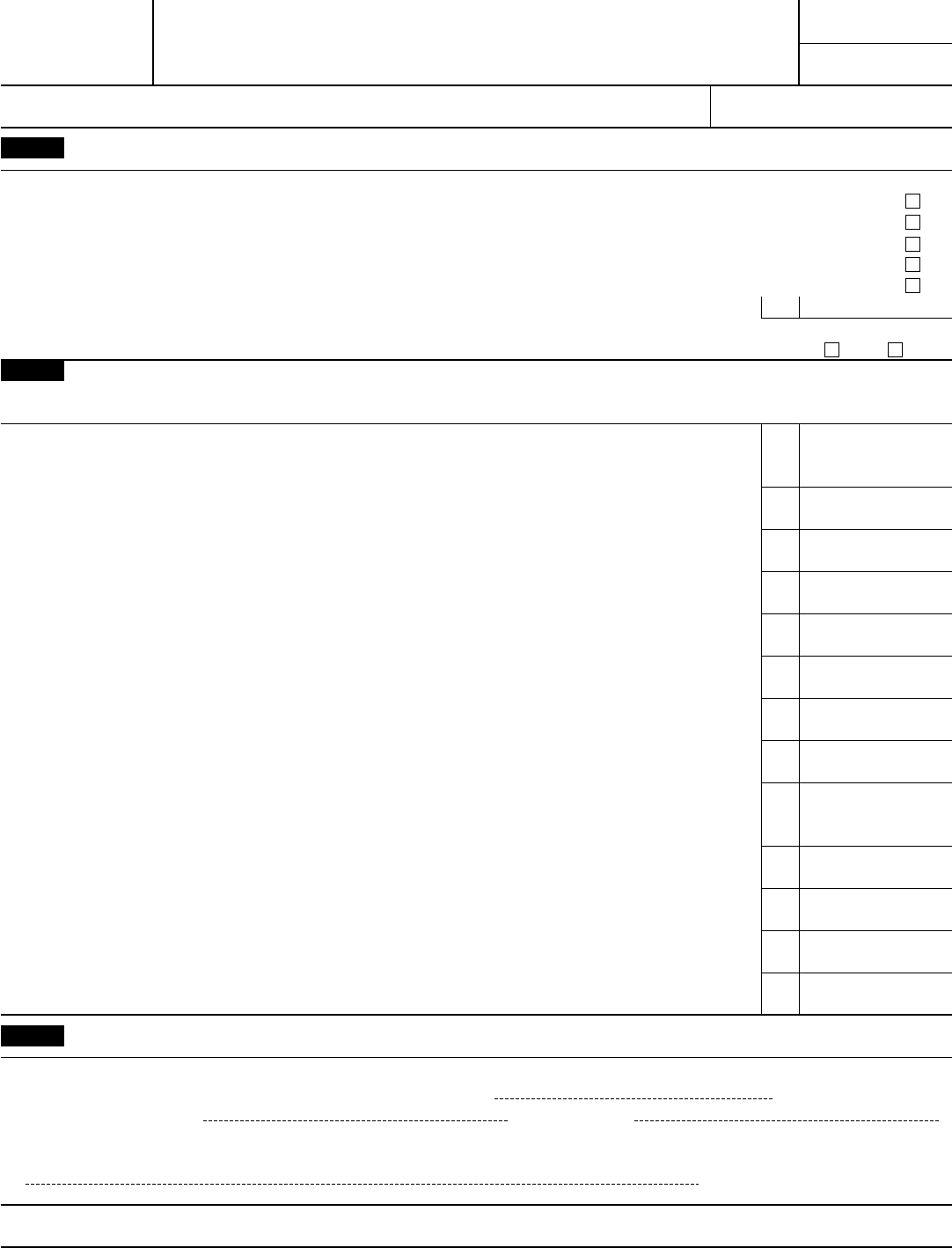

Fillable Form 982 Schedule A Gross Receipts Within The State Of

Even if you are not in bankruptcy, if you are insolvent when your debt is discharged, there is no tax. Web the rules are complicated and form 982 is required. Web to enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web introduction this publication explains the federal tax treatment of canceled.

Form 982 Insolvency Worksheet

Web required partnership consent statements. The forgiven debt may be excluded as income under the insolvency exclusion. Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form. The irs has a tool called the interactive tax assistant that can help.

Form 982 Edit, Fill, Sign Online Handypdf

Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Web to enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. This form is for income earned in tax.

Tax form 982 Insolvency Worksheet Along with 1099 form Utah

Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income. (for additional information, see the instructions for part ii.). Web we last updated federal form 982 in february 2023 from the federal internal revenue service. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled.

Web Form 982 (Reduction Of Tax Attributes Due To Discharge Of Indebtedness) Reports The Amount Of Cancelled Debt To Excluded From Taxable Income.

Web introduction this publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Web the rules are complicated and form 982 is required. Web we last updated federal form 982 in february 2023 from the federal internal revenue service. Web required partnership consent statements.

Generally, If You Owe A Debt To.

(for additional information, see the instructions for part ii.). The irs has a tool called the interactive tax assistant that can help determine if cancelled. Web do i have to complete the entire form 982? Web a taxpayer is insolvent when his or her total liabilities exceed his or her total assets.

The Forgiven Debt May Be Excluded As Income Under The Insolvency Exclusion.

Even if you are not in bankruptcy, if you are insolvent when your debt is discharged, there is no tax. Web we last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) in february 2023, so this is the latest version of form. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income.

Web What Is Form 982?

Web to enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040) select: This is because you received a benefit. This form is for income earned in tax year 2022, with tax returns due in april. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return.