What Is Form 8853

What Is Form 8853 - Web form 8853 is the tax form used for reporting msa account withdrawals. If using mac send tax file to turbotax agent did the information on this page answer. You don't have to file form 8853 to. Web what is the form used for? Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. Try it for free now! Send tax file to agent. Figure your archer msa deduction. Form 8853 is the tax form. Web form 2553 is an irs form.

Figure your archer msa deduction. Part i hsa contributions and. You must file form 8853 if any of the following applies. Send tax file to agent. Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. Get ready for tax season deadlines by completing any required tax forms today. Report archer msa contributions (including employer contributions) figure your archer msa. Web find mailing addresses by state and date for filing form 2553. Web what is form 8853? Form 8853 is a tax form used to report distributions from certain designated roth accounts and to calculate the taxable portion of those distributions.

Web use form 8853 to: Upload, modify or create forms. Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. Web to claim an exclusion for accelerated death benefits made on a per diem or other periodic basis, you must file form 8853 with your return. Web form 2553 is an irs form. Web the medical savings account deduction ( form 8853) is used by taxpayers to: Report archer msa contributions (including employer contributions. If box 2 or 4 is checked, provide the additional information about the. Send tax file to agent.

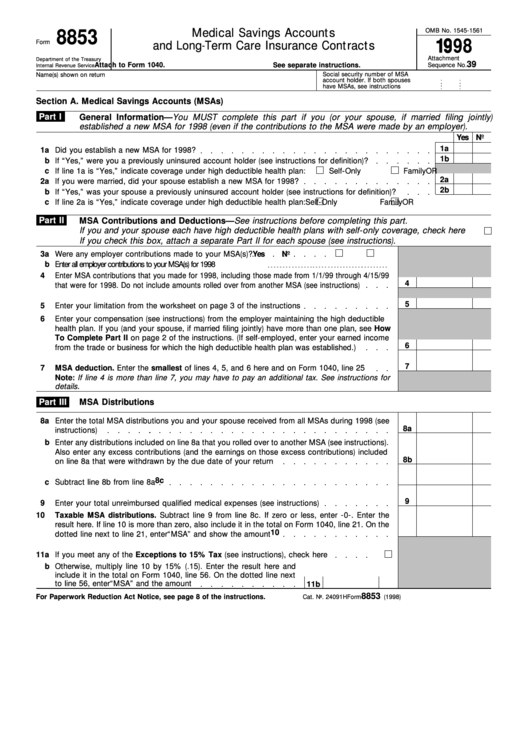

Fillable Form 8853 Medical Savings Accounts And LongTerm Care

Ad download or email irs 8853 & more fillable forms, register and subscribe now! Web compensation (see instructions) from the employer maintaining the high deductible health plan. Web form 8853 is the tax form used for reporting msa account withdrawals. Upload, modify or create forms. You must file form 8853 if any of the following applies.

Online IRS Form 8853 2018 2019 Fillable and Editable PDF Template

Similar to a health savings account, an archer medical savings account. Individual income tax return, and form 8853 must be filed in order to avoid paying taxes on msa account withdrawals. Web form 2553 is an irs form. You don't have to file form 8853 to. Send tax file to agent.

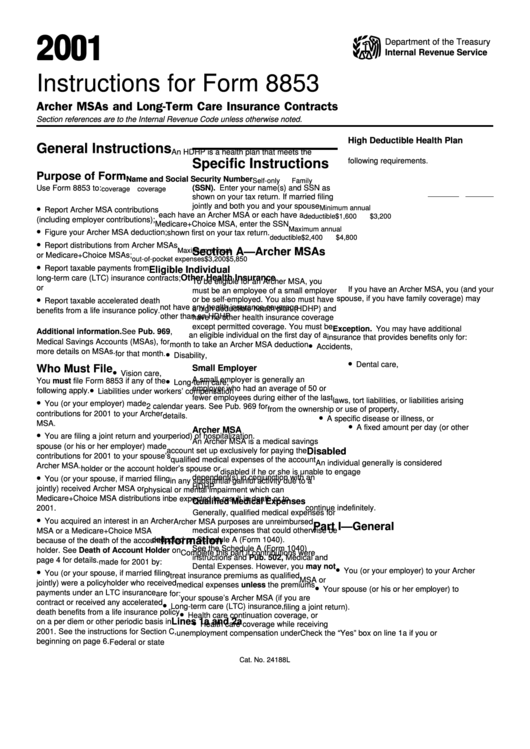

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Try it for free now! Report archer msa contributions (including employer contributions. Web form 1040, u.s. Web form 2553 is an irs form. Ad download or email irs 8853 & more fillable forms, register and subscribe now!

Form 8889 Health Savings Accounts (HSAs) (2014) Free Download

Part i hsa contributions and. You don't have to file form 8853 to. Web form 8853 is the tax form used for reporting msa account withdrawals. Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. Web.

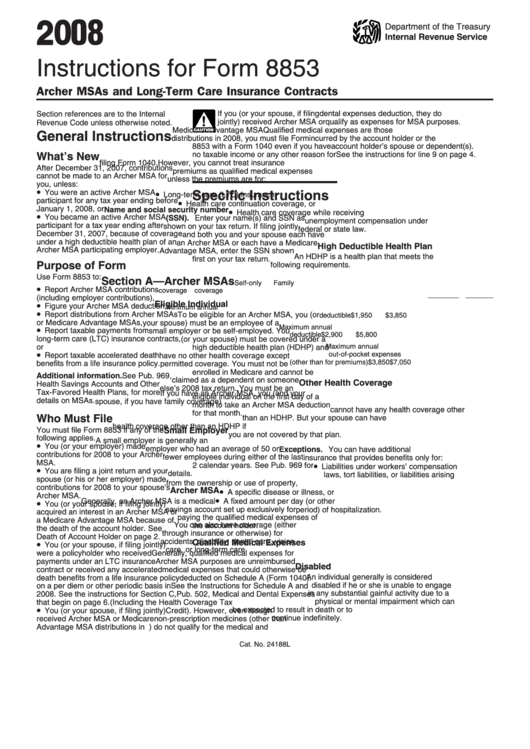

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Figure your archer msa deduction. Web compensation (see instructions) from the employer maintaining the high deductible health plan. If the corporation's principal business, office, or agency is located in. Web what is the form used for? Web find mailing addresses by state and date for filing form 2553.

IRS 8863 Line 23 Fill and Sign Printable Template Online US Legal Forms

Part i hsa contributions and. Web the medical savings account deduction ( form 8853) is used by taxpayers to: Figure your archer msa deduction. Form 8853 is the tax form. Form 8853 is a tax form used to report distributions from certain designated roth accounts and to calculate the taxable portion of those distributions.

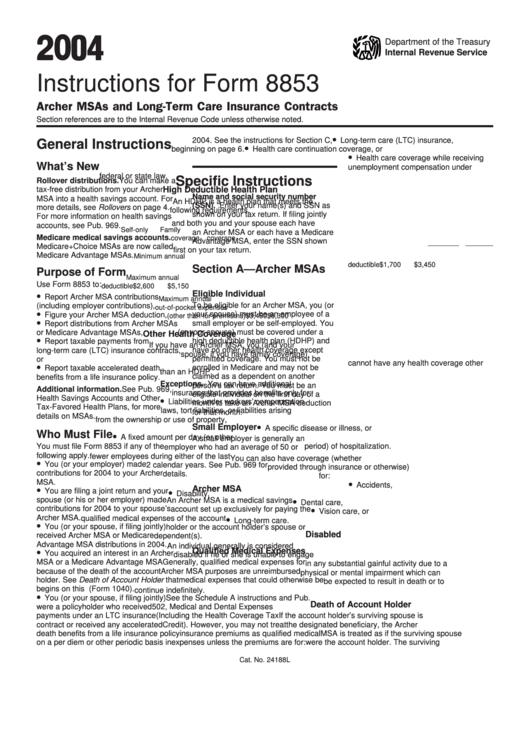

Instructions For Form 8853 Archer Msas And LongTerm Care Insurance

Web compensation (see instructions) from the employer maintaining the high deductible health plan. Web form 8853 is the tax form used for reporting msa account withdrawals. Web form 2553 is an irs form. Form 8853 p1 share my file with agent. Report archer msa contributions (including employer contributions.

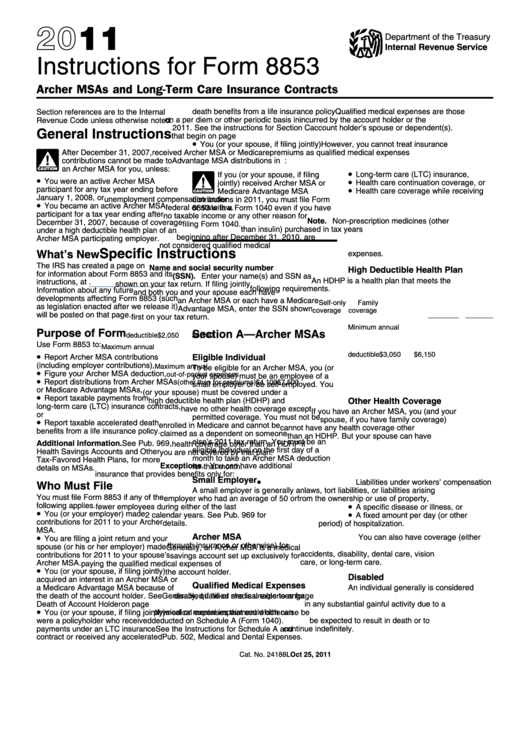

Instructions For Form 8853 2011 printable pdf download

Web form 2553 is an irs form. Web form 1040, u.s. Send tax file to agent. Similar to a health savings account, an archer medical savings account. Web the medical savings account deduction ( form 8853) is used by taxpayers to:

Form 8853 Archer MSAs and LongTerm Care Insurance Contracts (2014

Form 8853 is a tax form used to report distributions from certain designated roth accounts and to calculate the taxable portion of those distributions. Get ready for tax season deadlines by completing any required tax forms today. If the corporation's principal business, office, or agency is located in. Web when filing form 8853 for an archer msa deduction, you are.

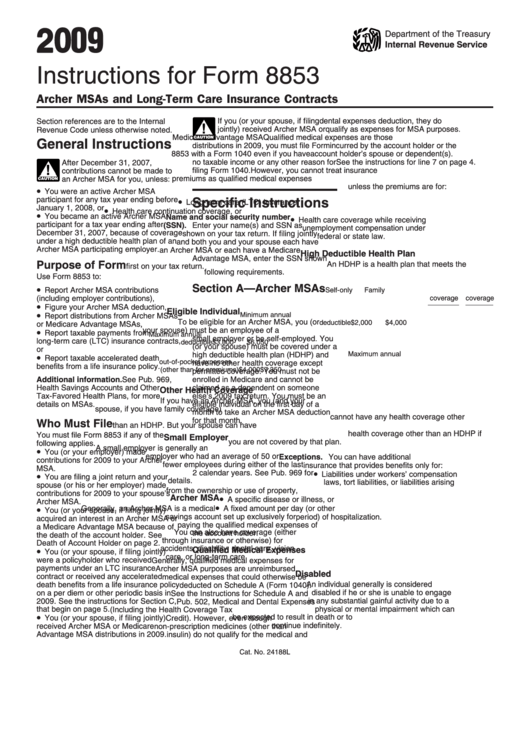

Instructions For Form 8853 2009 printable pdf download

If using mac send tax file to turbotax agent did the information on this page answer. Web the medical savings account deduction ( form 8853) is used by taxpayers to: Web what is the form used for? Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard.

Form 8853 Is A Tax Form Used To Report Distributions From Certain Designated Roth Accounts And To Calculate The Taxable Portion Of Those Distributions.

Web to claim an exclusion for accelerated death benefits made on a per diem or other periodic basis, you must file form 8853 with your return. Web under item f, check the box that corresponds with the s corporation's selected tax year. Web form 1040, u.s. Report archer msa contributions (including employer contributions.

Figure Your Archer Msa Deduction.

Part i hsa contributions and. Web what is form 8853? Web when filing form 8853 for an archer msa deduction, you are required to figure the limitation that applies to you in regard to how much of a deduction you are eligible to. If using mac send tax file to turbotax agent did the information on this page answer.

Web Form 8853 Is The Tax Form Used For Reporting Msa Account Withdrawals.

It must be filed when an entity wishes to elect “s” corporation status under the internal revenue code. Web find mailing addresses by state and date for filing form 2553. Form 8853 p1 share my file with agent. Web health savings accounts (hsas) before you begin:

Web Compensation (See Instructions) From The Employer Maintaining The High Deductible Health Plan.

Similar to a health savings account, an archer medical savings account. You don't have to file form 8853 to. Web form 2553 is an irs form. Form 8853 is the tax form.