What Is Form 8938

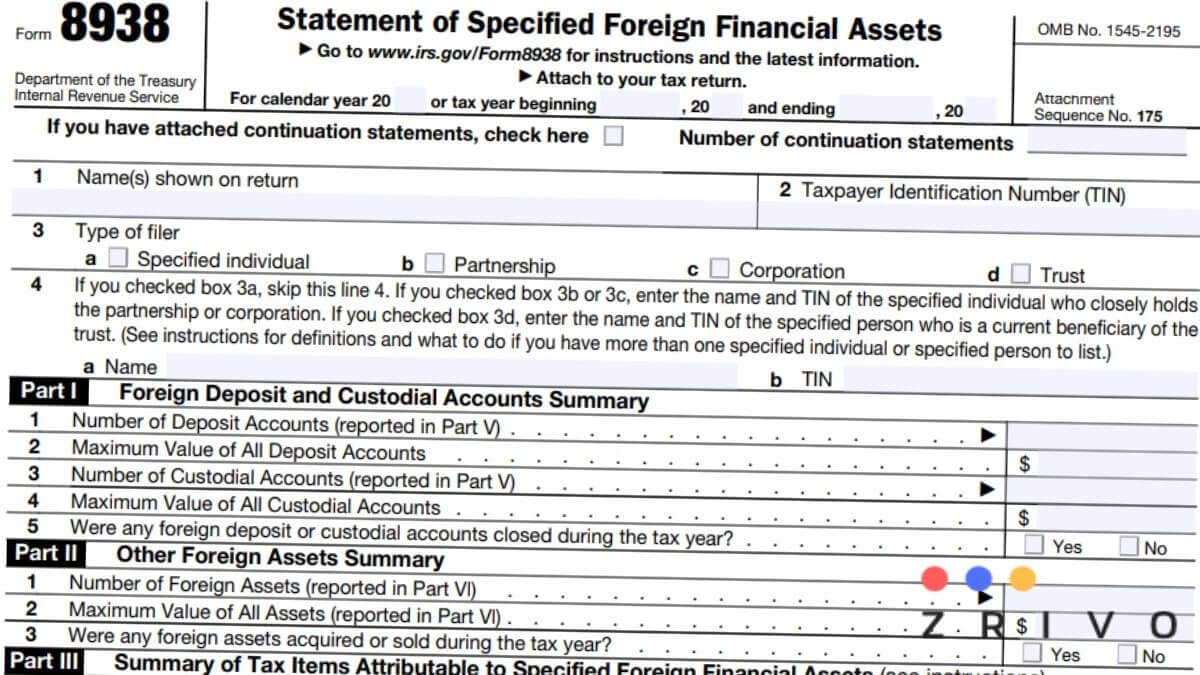

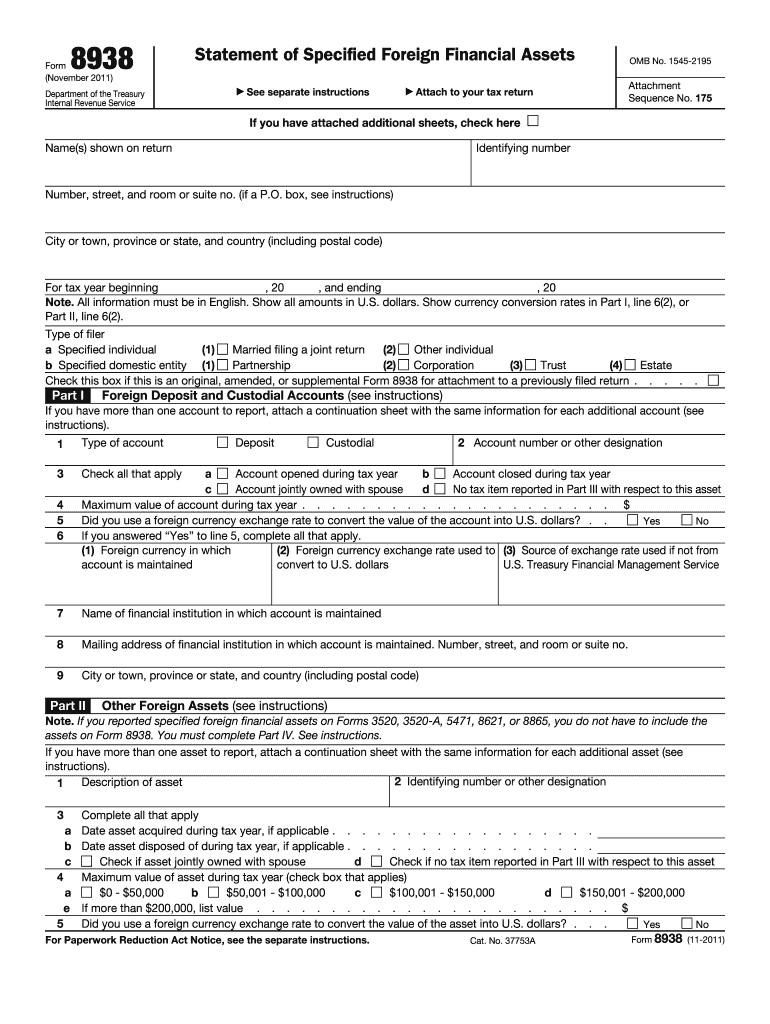

What Is Form 8938 - Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Web form 8938 is used by certain u.s. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only available to those using turbotax deluxe or higher. You must file form 8938 with your annual tax return by tax day if it's required. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Back to top specific examples: For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d.

Back to top specific examples: Define irs form 8938 on march 18, 2010, president obama signed the foreign account tax compliance act (fatca) into law, and form 8938 was one of the new forms created. Web the irs form 8938 is one of the measures to crack down on unreported form assets. Web how do i file form 8938, statement of specified foreign financial assets? Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? You must file form 8938 with your annual tax return by tax day if it's required. Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). It is part of fatca, an act passed by the obama administration in 2010 to curb foreign tax evasion. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only available to those using turbotax deluxe or higher.

Web form 8938, statement of specified foreign financial assets. Web about form 8938, statement of specified foreign financial assets. Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d. It is part of fatca, an act passed by the obama administration in 2010 to curb foreign tax evasion. Define irs form 8938 on march 18, 2010, president obama signed the foreign account tax compliance act (fatca) into law, and form 8938 was one of the new forms created. If you are a beneficiary of the foreign trust, you may have to file form 8938 to report your interest in. Back to top specific examples: Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web what is form 8938?

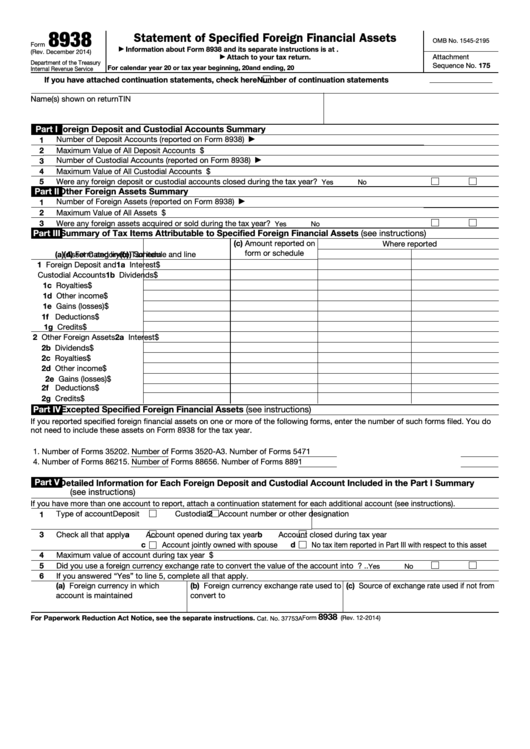

Fillable Form 8938 Statement Of Specified Foreign Financial Assets

Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Here’s everything you need to know about this form: Web about form 8938, statement of specified foreign financial assets. Use form 8938 to report your specified foreign.

Form 8938, Statement of Specified Foreign Financial Assets YouTube

Specified individuals and specified domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold Web the irs form 8938 is one of the measures to crack down on unreported form assets. Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938.

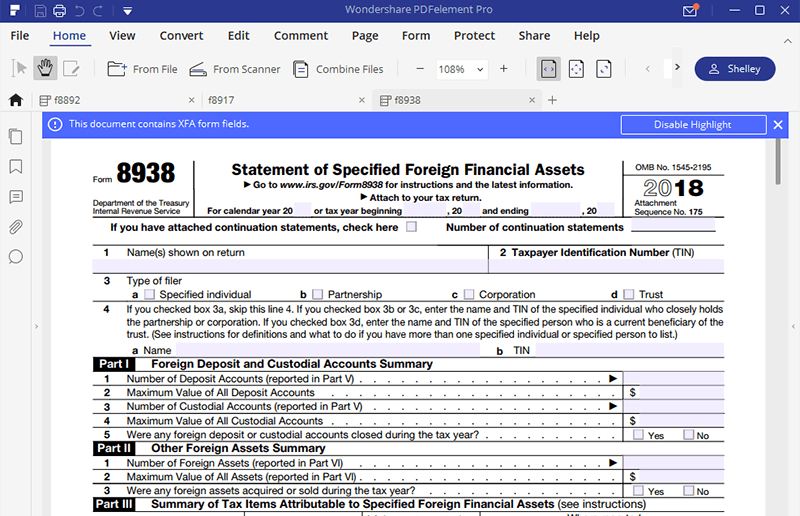

IRS Form 8938 How to Fill it with the Best Form Filler

If you are a beneficiary of the foreign trust, you may have to file form 8938 to report your interest in. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web what is form 8938? For most individual taxpayers, this means they will start.

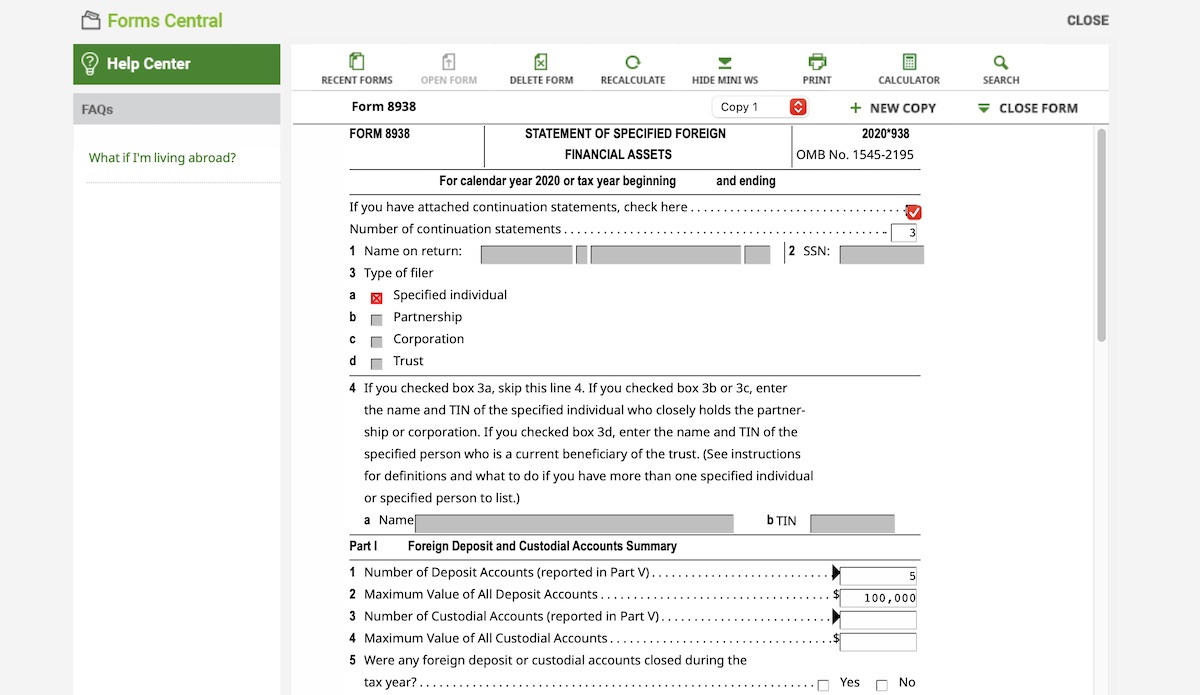

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Web how do i file form 8938, statement of specified foreign financial assets? Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? It is part of fatca, an.

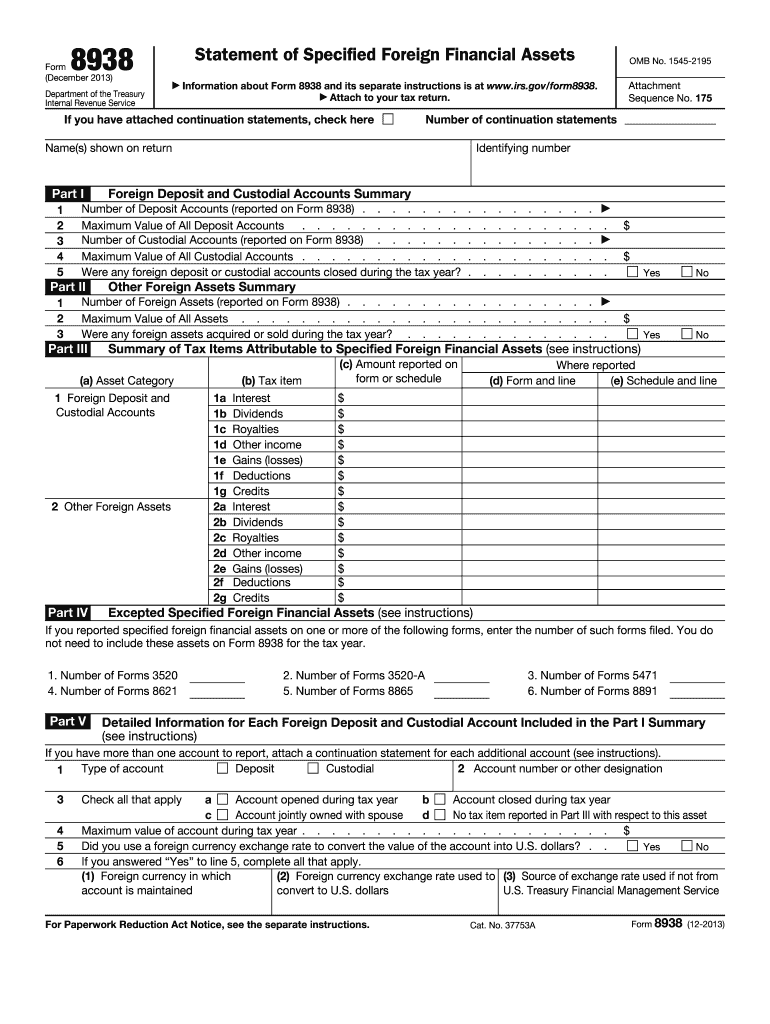

2013 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Define irs form 8938 on march 18, 2010, president obama signed the foreign account tax compliance act (fatca) into law, and form 8938 was one of the new forms created. Web about form 8938, statement of specified foreign financial assets. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial.

Form 8938 Who Needs To File The Form And What's Included? Silver Tax

You must file form 8938 with your annual tax return by tax day if it's required. Web the irs form 8938 is one of the measures to crack down on unreported form assets. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web form 8938 reporting applies for specified foreign financial assets in which the.

Social Security NonTax Considerations « TaxExpatriation

Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Define irs form 8938 on march 18, 2010, president obama.

8938 Form 2021

Specified individuals and specified domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold Web what is form 8938? Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web form.

Form 8938 Blank Sample to Fill out Online in PDF

Back to top specific examples: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. For most individual taxpayers, this means they will start filing form 8938 with their 2011 income tax return. If you are.

2011 Form IRS 8938 Fill Online, Printable, Fillable, Blank pdfFiller

Specified individuals and specified domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold Web how do i file form 8938, statement of specified foreign financial assets? Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad..

Specified Individuals And Specified Domestic Entities That Have An Interest In Specified Foreign Financial Assets And Meet The Reporting Threshold

If you are a beneficiary of the foreign trust, you may have to file form 8938 to report your interest in. Web form 8938 reporting applies for specified foreign financial assets in which the taxpayer has an interest in taxable years starting after march 18, 2010. Web how do i file form 8938, statement of specified foreign financial assets? Web what is form 8938?

It Is Part Of Fatca, An Act Passed By The Obama Administration In 2010 To Curb Foreign Tax Evasion.

Web technically speaking, form 8938 refers to the irs’ statement of specified foreign financial assets filed by us persons with fatca assets that are reportable to the internal revenue service in accordance with internal revenue code section 6038d. Officially called your statement of specified foreign financial assets, form 8938 one of the forms expats use to tell the irs about financial assets they hold abroad. Here’s everything you need to know about this form: You must file form 8938 with your annual tax return by tax day if it's required.

Define Irs Form 8938 On March 18, 2010, President Obama Signed The Foreign Account Tax Compliance Act (Fatca) Into Law, And Form 8938 Was One Of The New Forms Created.

Web form 8938 is used by certain u.s. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web the irs form 8938 is one of the measures to crack down on unreported form assets.

Web About Form 8938, Statement Of Specified Foreign Financial Assets.

Cash or foreign currency, real estate, precious metals, art and collectibles i directly hold foreign currency (that is, the currency isn't in a financial account). Web if you are treated as an owner of any part of a foreign grantor trust, you may have to file form 8938 to report specified foreign financial assets held by the trust. Web form 8938, statement of specified foreign financial assets. Solved • by turbotax • 965 • updated january 13, 2023 filing form 8938 is only available to those using turbotax deluxe or higher.