What Is Form 2555

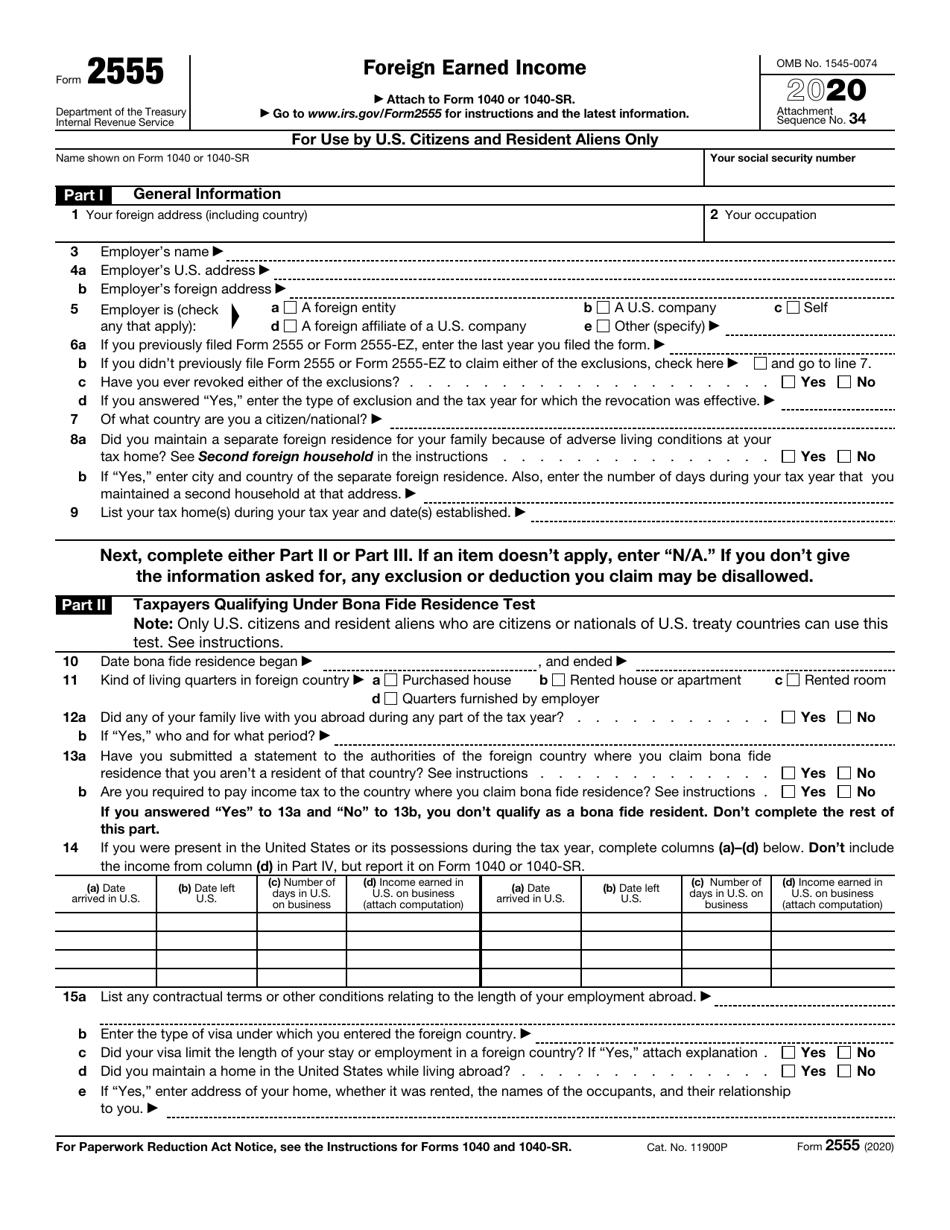

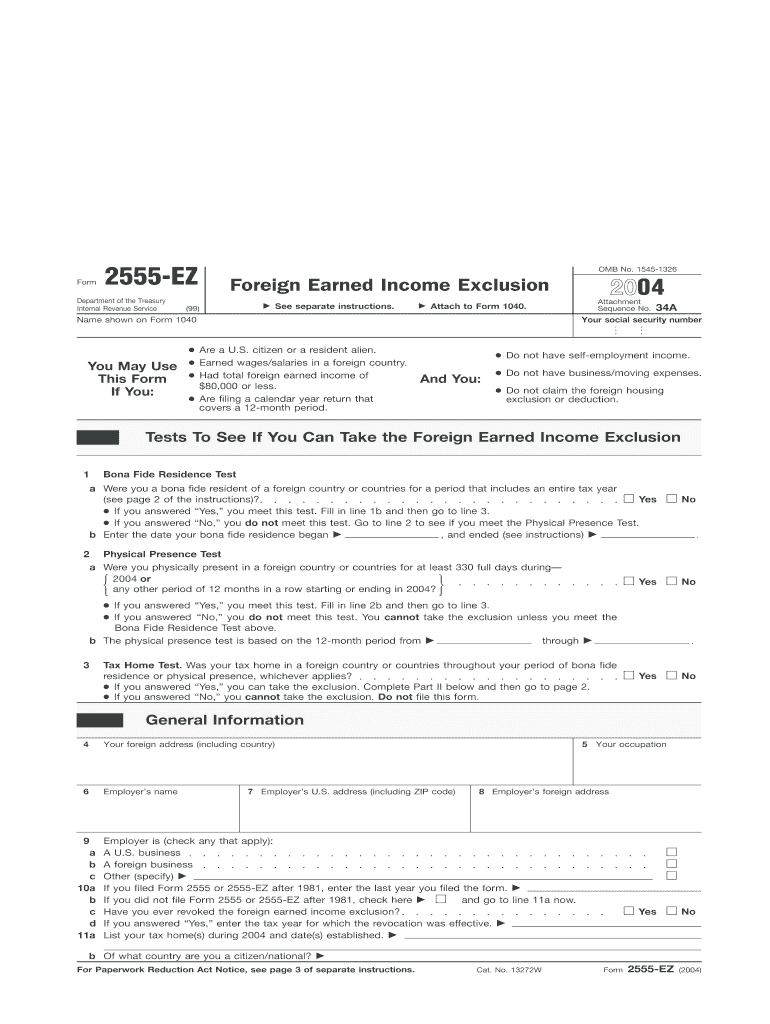

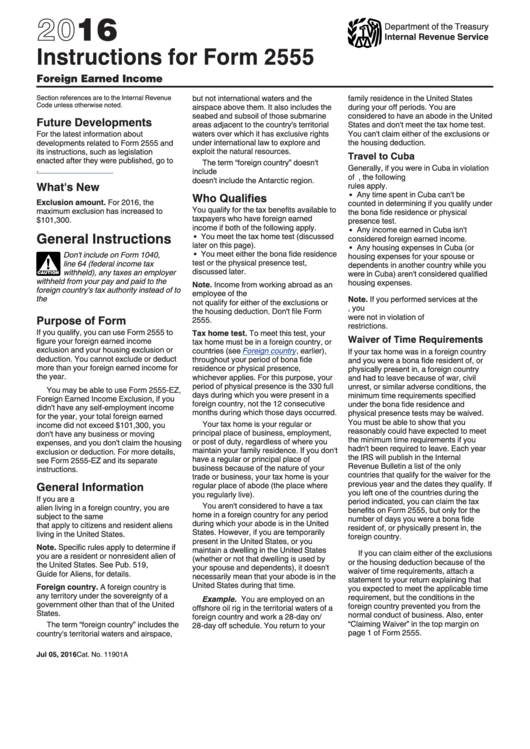

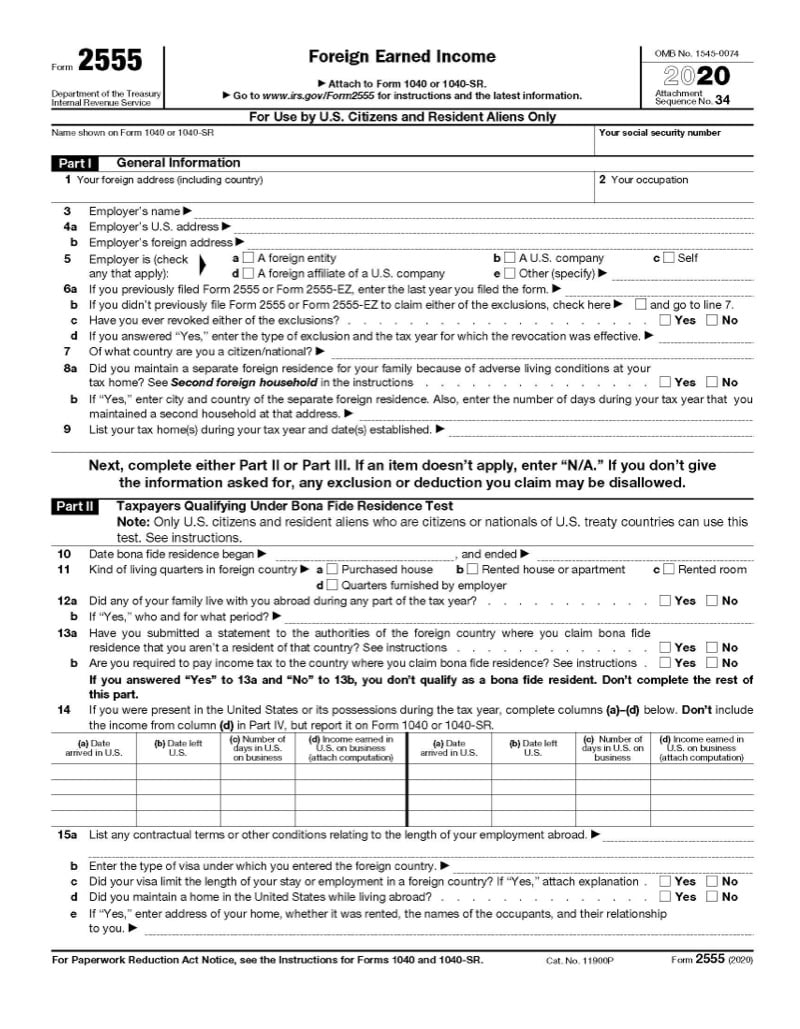

What Is Form 2555 - To report your foreign income on form 2555 in turbotax follow these steps: Irs form 2555 is intended for the reporting of foreign earned income to the internal revenue service (irs). Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. 34 for use by u.s. Citizens and resident aliens only. Web the irs form 2555 is the foreign earned income exclusion form. What if i already paid tax on the income overseas? Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year.

Web what is form 2555? Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the. Web the irs form 2555 is the foreign earned income exclusion form. What if i already paid tax on the income overseas? Most countries implement some sort of tax on income earned within their borders. The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Irs form 2555 is intended for the reporting of foreign earned income to the internal revenue service (irs). The form is used primarily by expats who meet the irs foreign earned income exclusion.

The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Web the irs form 2555 is the foreign earned income exclusion form. Citizens and resident aliens only. Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web what is the foreign earned income exclusion (form 2555)? Most countries implement some sort of tax on income earned within their borders. Go to www.irs.gov/form2555 for instructions and the latest information. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

2013 Form IRS 2555 Fill Online, Printable, Fillable, Blank PDFfiller

Go to www.irs.gov/form2555 for instructions and the latest information. Web what is the foreign earned income exclusion (form 2555)? Web what is form 2555? Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). Web the irs form 2555 is the foreign earned income exclusion form.

Form 2555EZ Foreign Earned Exclusion (2014) Free Download

34 for use by u.s. Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). To report your foreign income on form 2555 in turbotax follow these steps: If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. If you.

IRS Form 2555 Download Fillable PDF or Fill Online Foreign Earned

Citizens and resident aliens only. Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions.

Form 2555 Ez Fill Out and Sign Printable PDF Template signNow

34 for use by u.s. What if i already paid tax on the income overseas? Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web what is form 2555? You may also qualify to exclude certain foreign housing amounts.

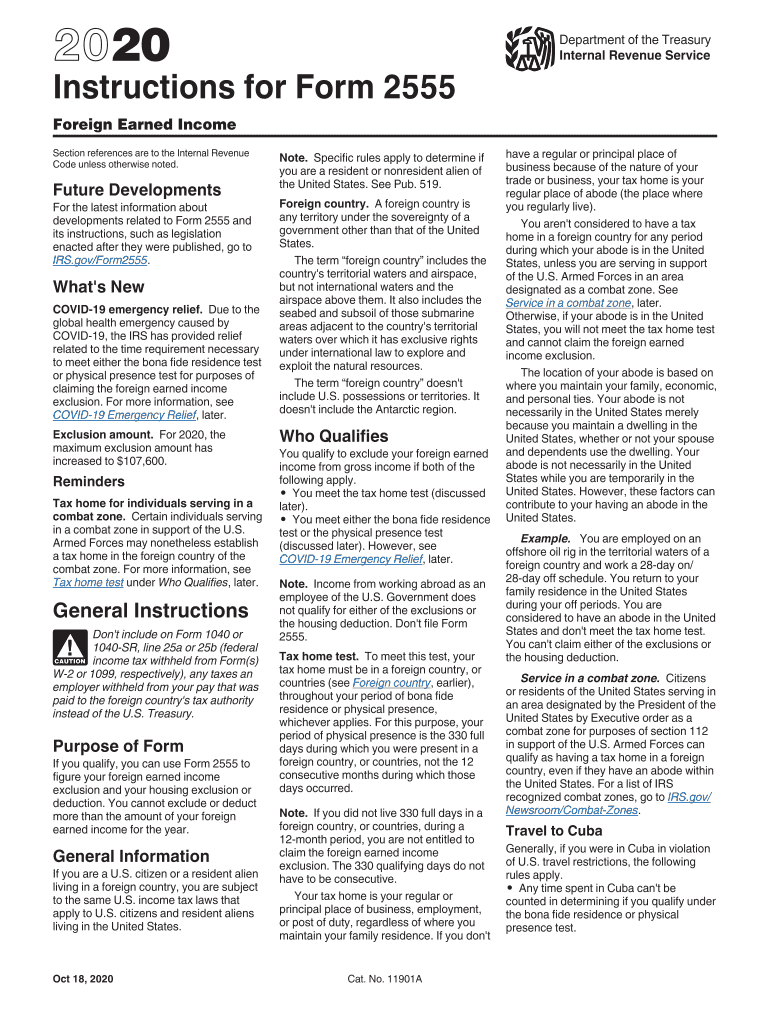

Instructions For Form 2555 2016 printable pdf download

Web what is form 2555? Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Common questions we receive include: Irs form 2555 is intended.

Form 2555 Claiming Foreign Earned Exclusion Jackson Hewitt

Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Sign in to your account if it is not open Web what is form 2555? The main purpose of tax form 2555 is.

Form 2555 Edit, Fill, Sign Online Handypdf

Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or.

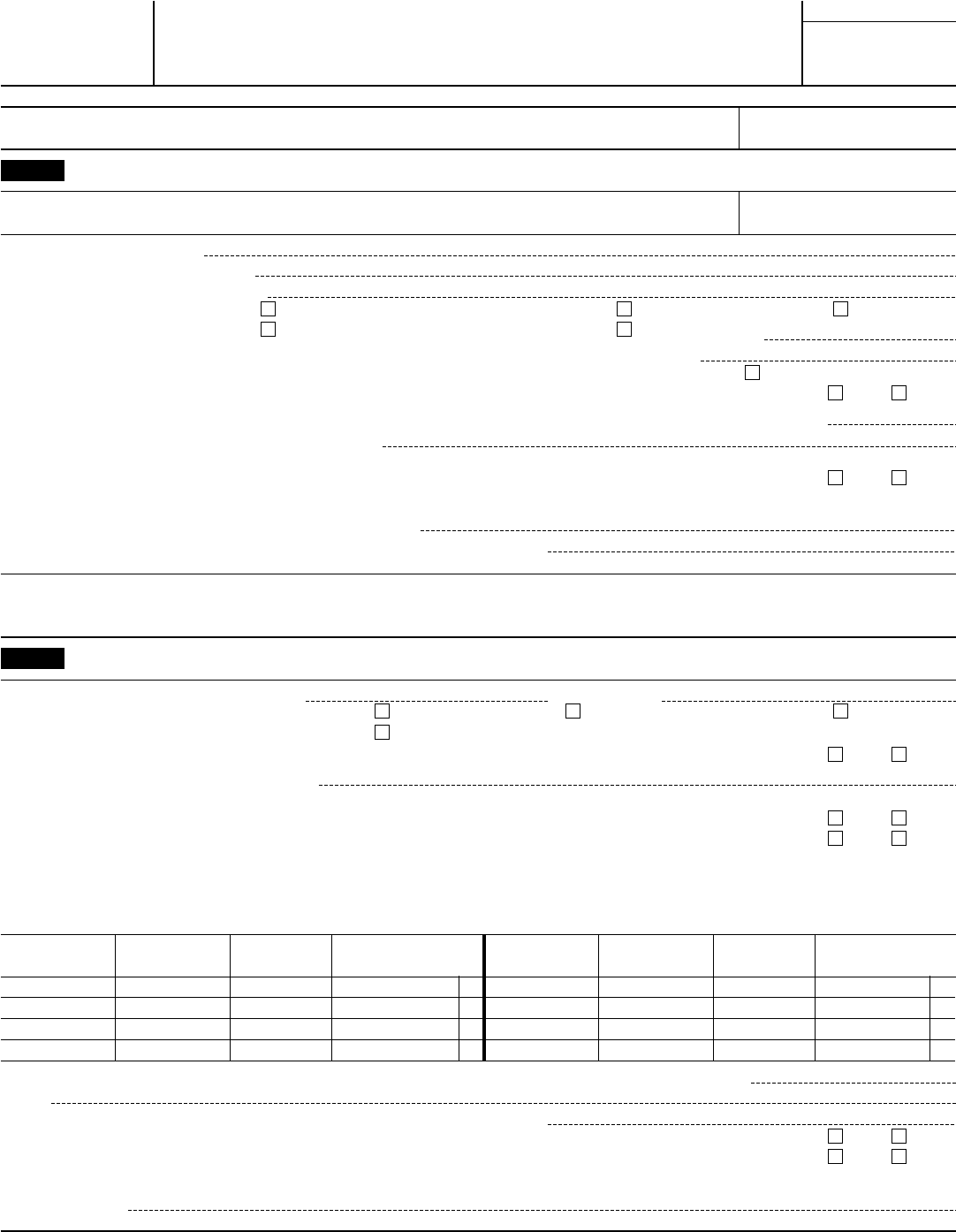

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. To report your foreign income on form 2555 in turbotax follow these steps: Go to www.irs.gov/form2555 for instructions and the latest information. If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter.

Instructions For Form 2555 printable pdf download

If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web the irs form 2555 is the foreign earned income exclusion form. Most countries implement some sort of tax on income earned within.

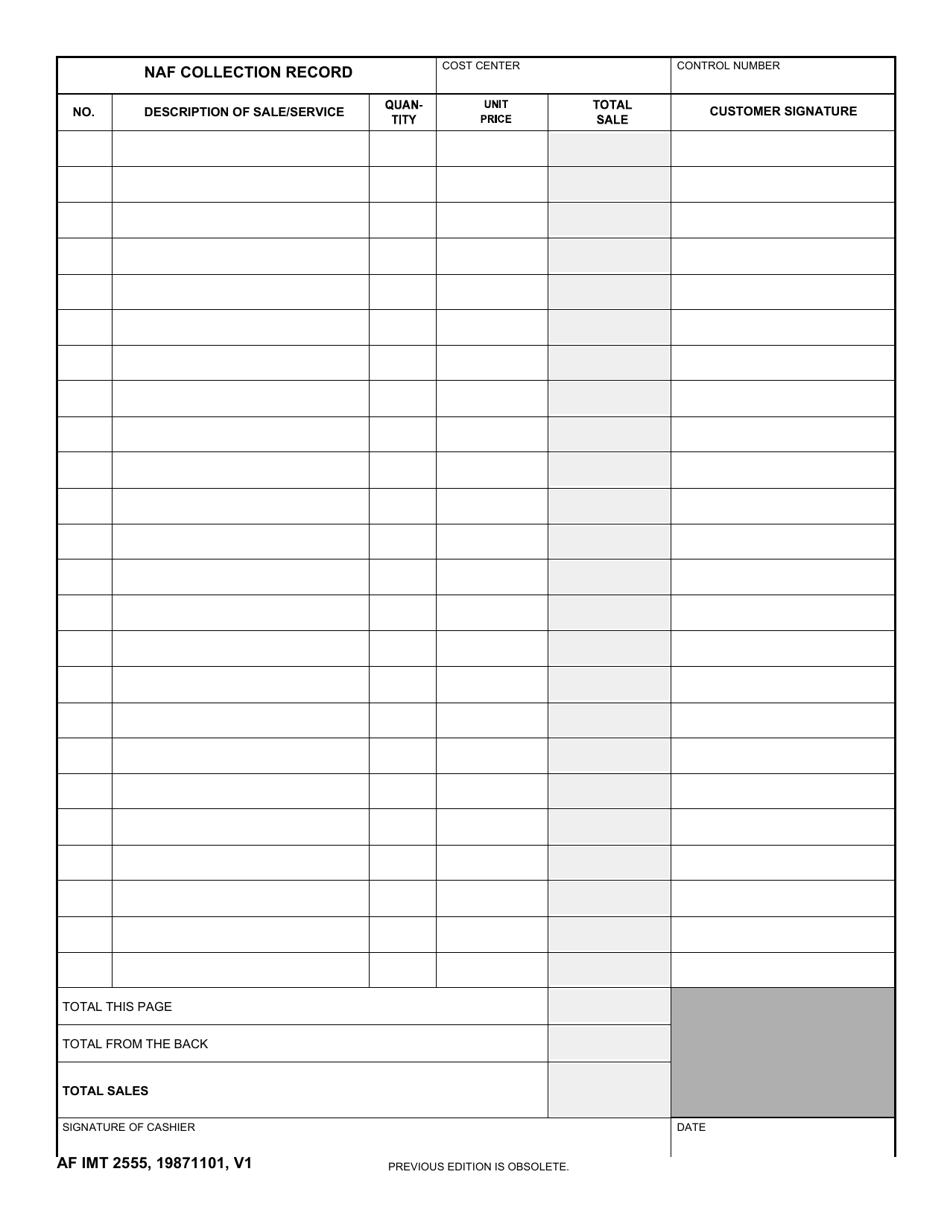

AF IMT Form 2555 Download Fillable PDF or Fill Online NAF Collection

The main purpose of tax form 2555 is to help taxpayers determine their exclusions relating to foreign earned income and housing in order to properly file federal income taxes. Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). Web form 2555 shows how you qualify for the bona fide residence test or physical.

Sign In To Your Account If It Is Not Open

Tax if i live overseas? Web what is form 2555? Web you will use form 2555 foreign income to claim the foreign earned income exclusion (feie). If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction.

To Report Your Foreign Income On Form 2555 In Turbotax Follow These Steps:

What if i already paid tax on the income overseas? Web the irs form 2555 is the foreign earned income exclusion form. Web form 2555 is the form you file to claim the foreign earned income exclusion, which allows you to exclude up to $112,000 of foreign earned income for the 2022/2023 tax year. Go to www.irs.gov/form2555 for instructions and the latest information.

Most Countries Implement Some Sort Of Tax On Income Earned Within Their Borders.

You may also qualify to exclude certain foreign housing amounts. The form is used primarily by expats who meet the irs foreign earned income exclusion. Common questions we receive include: If you claim the exclusion(s) and/or deduction under the bona fide residence test, be sure to enter the.

The Main Purpose Of Tax Form 2555 Is To Help Taxpayers Determine Their Exclusions Relating To Foreign Earned Income And Housing In Order To Properly File Federal Income Taxes.

Citizens and resident aliens only. Web form 2555 shows how you qualify for the bona fide residence test or physical presence test, how much of your foreign earned income is excluded, and how to figure the amount of your allowable foreign housing exclusion or deduction. If you are living and working abroad, you may be entitled to exclude up to $112,000 (2022) of your foreign income from your return. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file.