California Homestead Exemption 2021 Form

California Homestead Exemption 2021 Form - Or the median sale price for a single family. Web declared homestead exemption to declare a homestead, you can file your completed homestead declaration with the county recorder in the county where the property is. Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the. Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the. Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property. Currently, partial equity in a home in california is exempt from being used to pay a judgment lien on the. Now, the exemption amount varies. Web one of the most important protections is the homestead exemption. While the rules for homestead exemptions vary by state, here in california, we recently had. Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home.

31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,. While the rules for homestead exemptions vary by state, here in california, we recently had. In california's system 2, homeowners can exempt up to $31,950 of home. Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home. Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with. Web until 2021, the amount of the homestead exemption (protection) varied from $75,000 to $175,000 depending on circumstances. 1, 2021 $300,000 to $600,000 up to dec. Web evaluate if you qualify for a homestead exemption. Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property. Web as of january 1st, 2021, california homeowners qualify for a net equity homestead protection of:

Web up to 25% cash back in california's system 1, homeowners can exempt up to $600,000 of equity in a house. 31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,. Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home. Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Web as of january 1, 2021, the homestead exemption for california homeowners has increased from $75,000, $100,000, or $175,000 to the greater of. While the rules for homestead exemptions vary by state, here in california, we recently had. Determine if you are filing as an individual or as spouses. & more fillable forms, register and subscribe now! Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the. Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with.

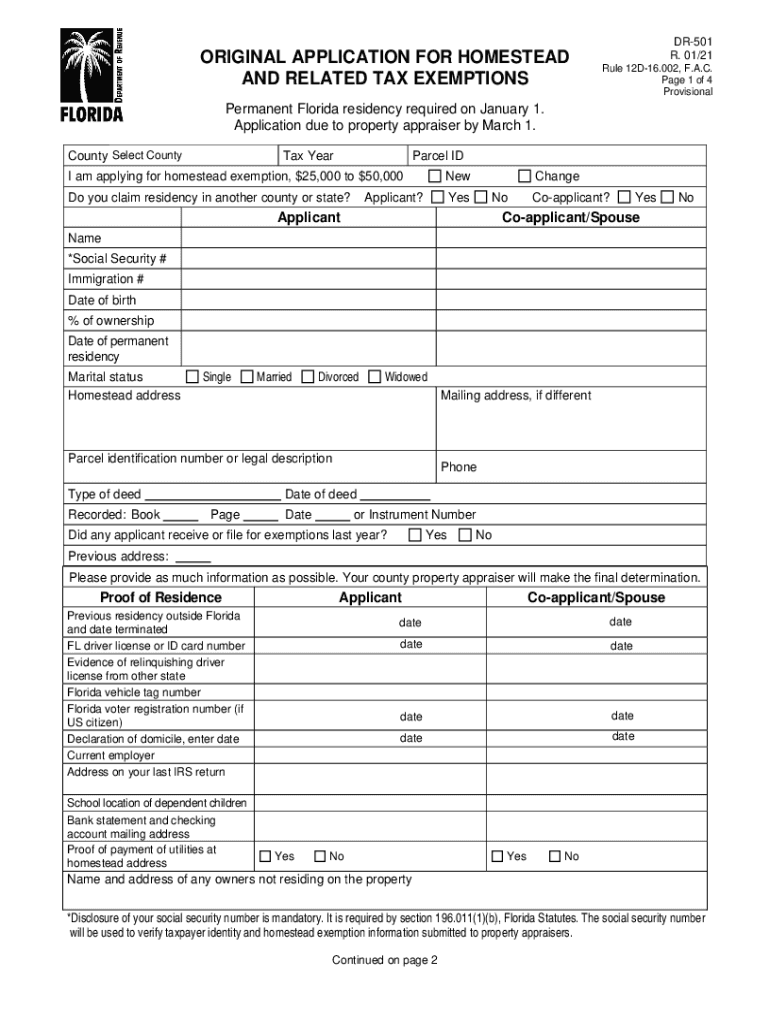

Dr 501 Fill Fill Out and Sign Printable PDF Template signNow

1, 2021 $300,000 to $600,000 up to dec. Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the. A person filing for the first time on a property may file anytime. A positive change for debtors a very.

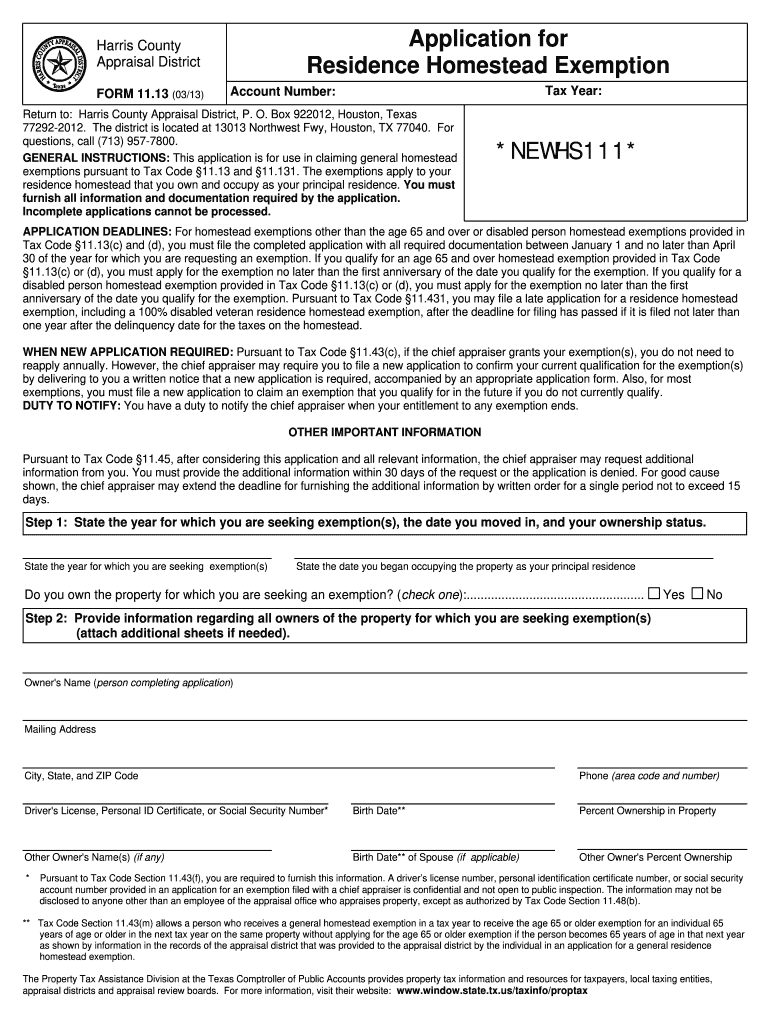

Nc Property Tax Homestead Exemption PRFRTY

Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property. & more fillable forms, register and subscribe now! Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home. Web declared.

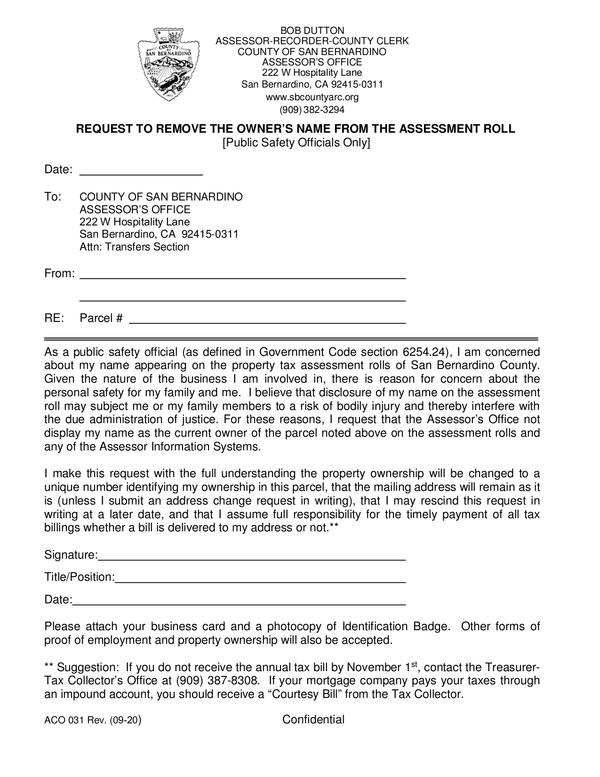

California Homestead Exemption Form San Bernardino County

A positive change for debtors a very significant law change for. Web up to $40 cash back caldocs. In california's system 2, homeowners can exempt up to $31,950 of home. Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with. Web declared homestead exemption to declare.

Homestead Exemption California The Ultimate Guide Talkov Law

Web up to 25% cash back in california's system 1, homeowners can exempt up to $600,000 of equity in a house. Web until 2021, the amount of the homestead exemption (protection) varied from $75,000 to $175,000 depending on circumstances. Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens.

Property Tax Homestead Exemption California PROFRTY

A person filing for the first time on a property may file anytime. Say hello to california's new homestead exemption. & more fillable forms, register and subscribe now! Web california assembly bill ab1885 increases the homestead exemption to a minimum of $300,000 and a maximum of $600,000 depending on median county home. Web all you have to do to declare.

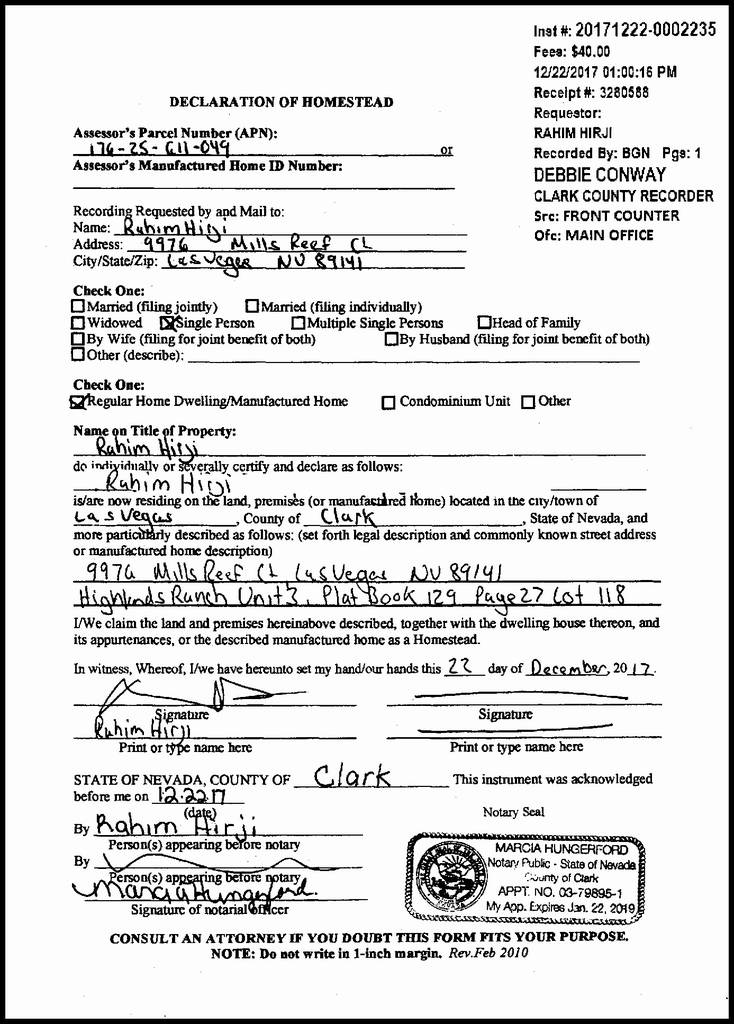

Free Printable Ez Homestead Forms Printable Forms Free Online

A person filing for the first time on a property may file anytime. In california's system 2, homeowners can exempt up to $31,950 of home. Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Web california assembly bill ab1885 increases the homestead exemption to a minimum.

Protect Your Home from a Lawsuit in California Asset Laws

Web evaluate if you qualify for a homestead exemption. Say hello to california's new homestead exemption. 1, 2021 $300,000 to $600,000 up to dec. In california's system 2, homeowners can exempt up to $31,950 of home. Web up to $40 cash back caldocs.

New California Homestead Exemption 2021 OakTree Law

A positive change for debtors a very significant law change for. & more fillable forms, register and subscribe now! Web up to 25% cash back in california's system 1, homeowners can exempt up to $600,000 of equity in a house. Web evaluate if you qualify for a homestead exemption. Web prior to january of 2021, the homestead exemptions in california.

Homestead Exemption California 2023 Form Orange County

Or the median sale price for a single family. & more fillable forms, register and subscribe now! Say hello to california's new homestead exemption. Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with. Web the homestead exemption protects homeowners from losing a portion of their.

California Homestead Exemption Form San Bernardino County

A person filing for the first time on a property may file anytime. & more fillable forms, register and subscribe now! Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Web until 2021, the amount of the homestead exemption (protection) varied from $75,000 to $175,000 depending.

Now, The Exemption Amount Varies.

Homestead documents must be in a format that the. Currently, partial equity in a home in california is exempt from being used to pay a judgment lien on the. Web as of january 1st, 2021, california homeowners qualify for a net equity homestead protection of: Web the homestead exemption protects homeowners from losing a portion of their equity due to lawsuits that result in judgment liens being attached to their property.

& More Fillable Forms, Register And Subscribe Now!

Web as of january 1, 2021, the california homestead exemption amount will be at least $300,000 if the median sale price for homes in your county were less than that during the. Web as of january 1, 2021, the homestead exemption for california homeowners has increased from $75,000, $100,000, or $175,000 to the greater of. 31, 2020 $75,000 to $175,000 california homestead exemption assembly bill 1885 on september 15, 2020,. In california's system 2, homeowners can exempt up to $31,950 of home.

Web Up To 25% Cash Back In California's System 1, Homeowners Can Exempt Up To $600,000 Of Equity In A House.

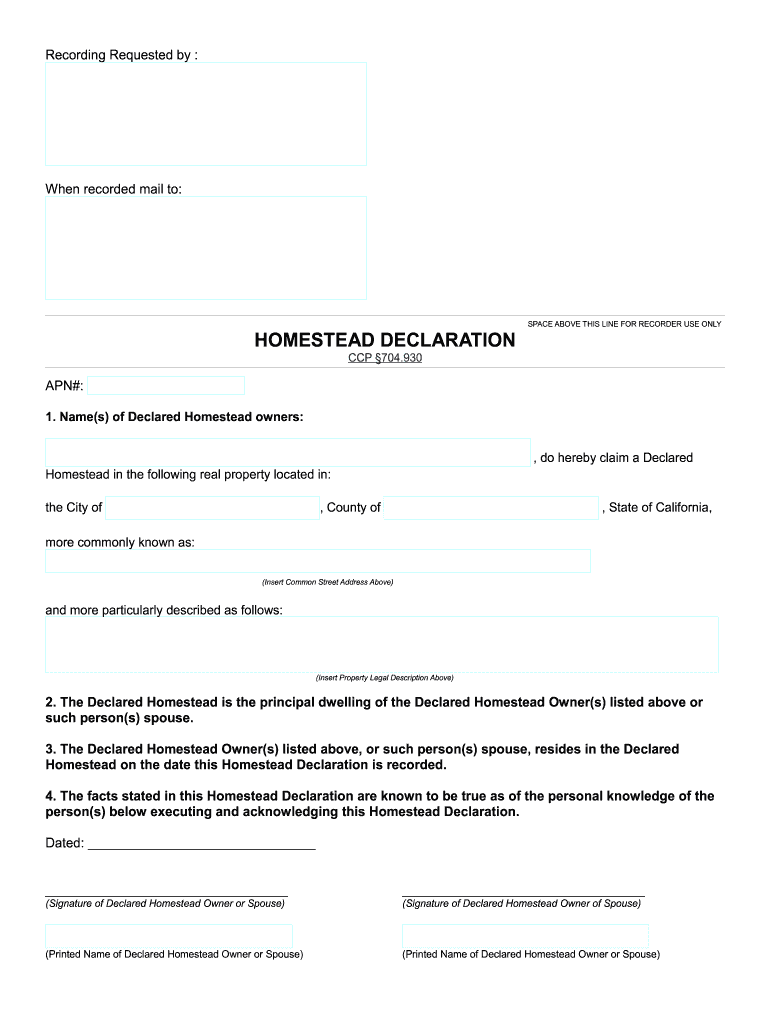

Web all you have to do to declare a dwelling as a homestead is to fill out a declaration form, available online, including from california law library websites. Determine if you are filing as an individual or as spouses. Web one of the most important protections is the homestead exemption. Web currently, the california homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk.

A Person Filing For The First Time On A Property May File Anytime.

Web declared homestead exemption to declare a homestead, you can file your completed homestead declaration with the county recorder in the county where the property is. Web up to $40 cash back caldocs. Web california homestead exemption increases in 2021 on september 15, 2020, california governor gavin newsom signed assembly bill 1885 into law, effectively increasing the. Web prior to january of 2021, the homestead exemptions in california were $75,000 for single persons, $100,000 for a “family unit” (married and/or with.