Virginia State Tax Extension Form

Virginia State Tax Extension Form - A franchise tax is a tax assessed on business entities based on gross. Web more time to file and pay. Web virginia state taxes at a glance: Virginia corporation tax returns are due by the 15 th day of the 4 th month after the end of the tax year. Your average tax rate is. Web to make a virginia extension payment, use form 760ip (automatic extension payment voucher for individuals). Web find forms & instructions by category. Web virginia state income tax forms virginia taxes pages return extension payment, address deadlines refund forms bracket, rates amendment tax calculator instructions virginia. Www.individual.tax.virginia.gov virginia tax extension tip: Web irs form 7004 $39.95 now only $34.95 file your tax extension now!

A franchise tax is a tax assessed on business entities based on gross. Www.individual.tax.virginia.gov virginia tax extension tip: Web in general, you’re a resident of virginia for income tax purposes if you were physically present there, lived there or had a place there (a “place of abode”) for more. Web virginia state taxes at a glance: Your average tax rate is. Web a franchise tax extension form is used to request an extension on filing the franchise taxes for an entity. Web find forms & instructions by category. If you file a tax. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! Corporation and pass through entity tax.

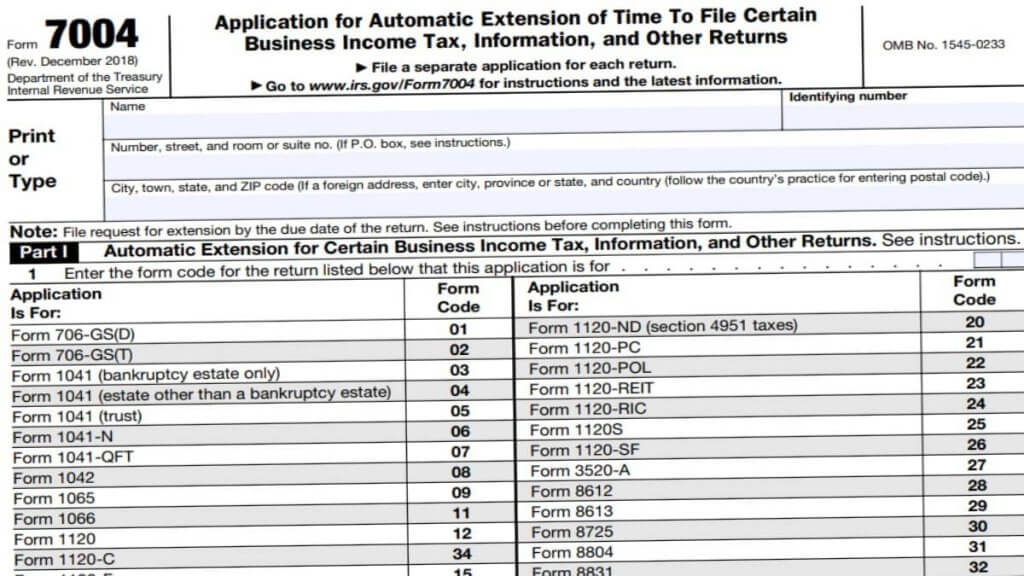

Does virginia support tax extension for business tax returns? Web a franchise tax extension form is used to request an extension on filing the franchise taxes for an entity. Web find forms & instructions by category. Web virginia state income tax forms virginia taxes pages return extension payment, address deadlines refund forms bracket, rates amendment tax calculator instructions virginia. Your average tax rate is. No paper application or online application for extension is required. A franchise tax is a tax assessed on business entities based on gross. If you make $70,000 a year living in virginia you will be taxed $11,623. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! Virginia corporation tax returns are due by the 15 th day of the 4 th month after the end of the tax year.

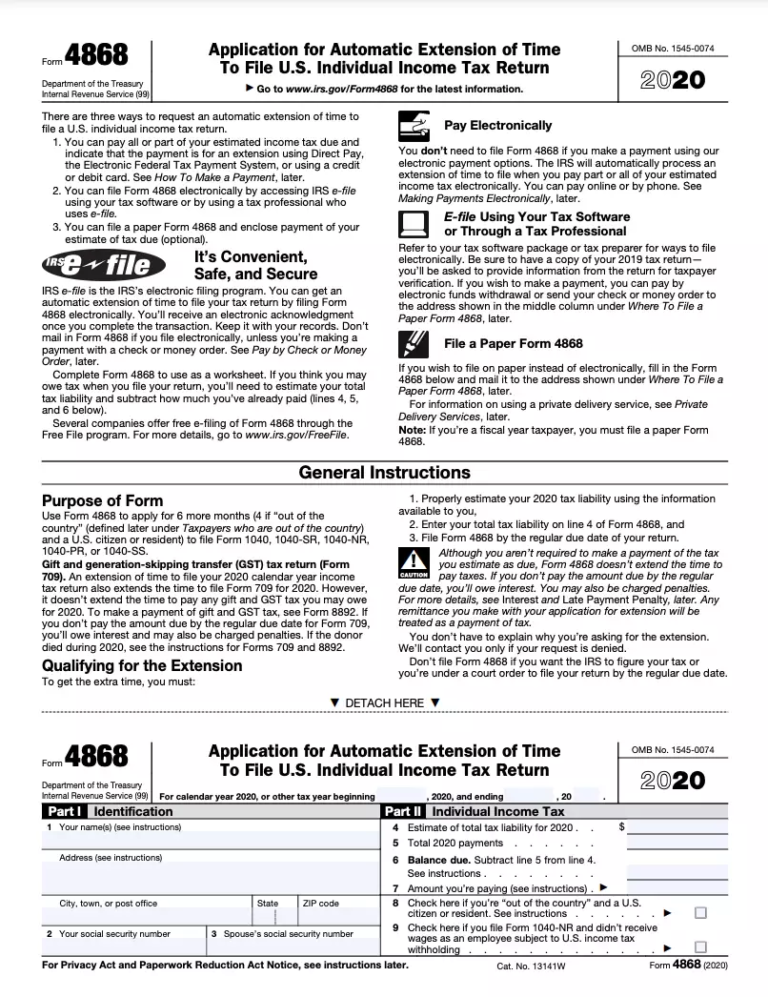

Top10 US Tax Forms in 2022 Explained PDF.co

Web you can make a virginia extension payment with form 760ip, or pay electronically using vatax online services: If you won’t be able to file by the original may 1 deadline, don’t worry. Web a franchise tax extension form is used to request an extension on filing the franchise taxes for an entity. What form does the state of virginia.

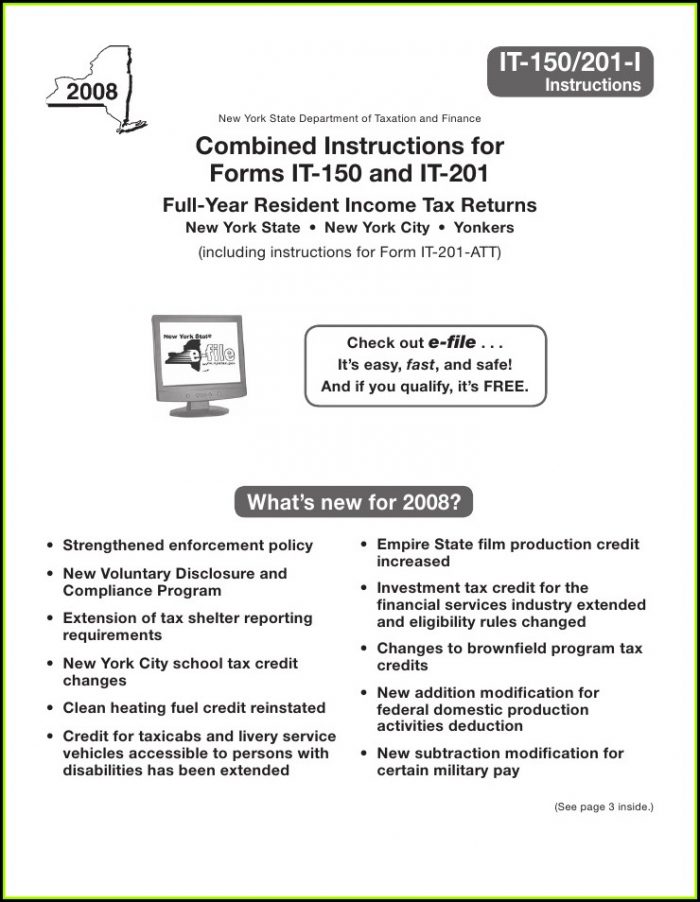

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Web you can make a virginia extension payment with form 760ip, or pay electronically using vatax online services: Web a franchise tax extension form is used to request an extension on filing the franchise taxes for an entity. Web virginia state taxes at a glance: No paper application or online application for extension is required. Web to make a virginia.

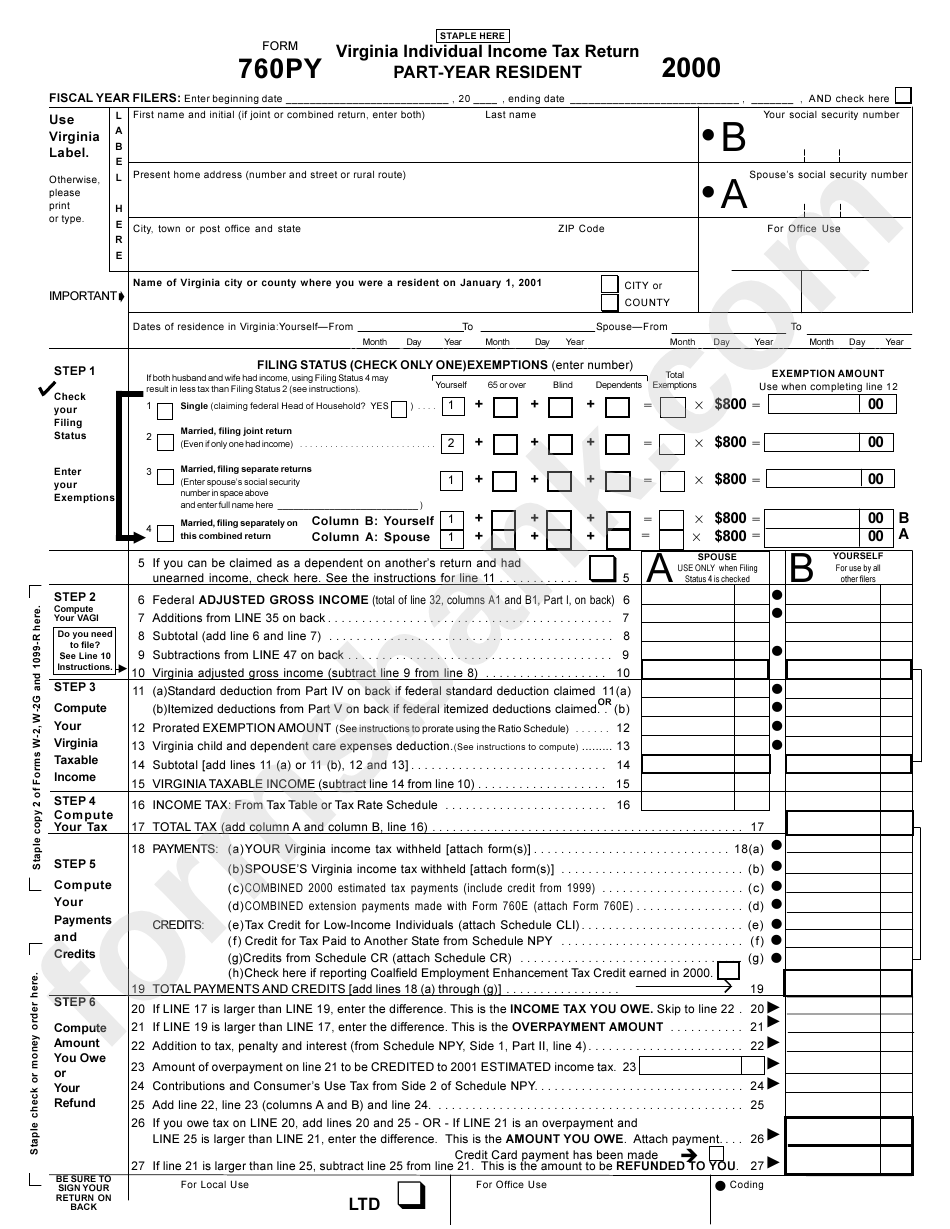

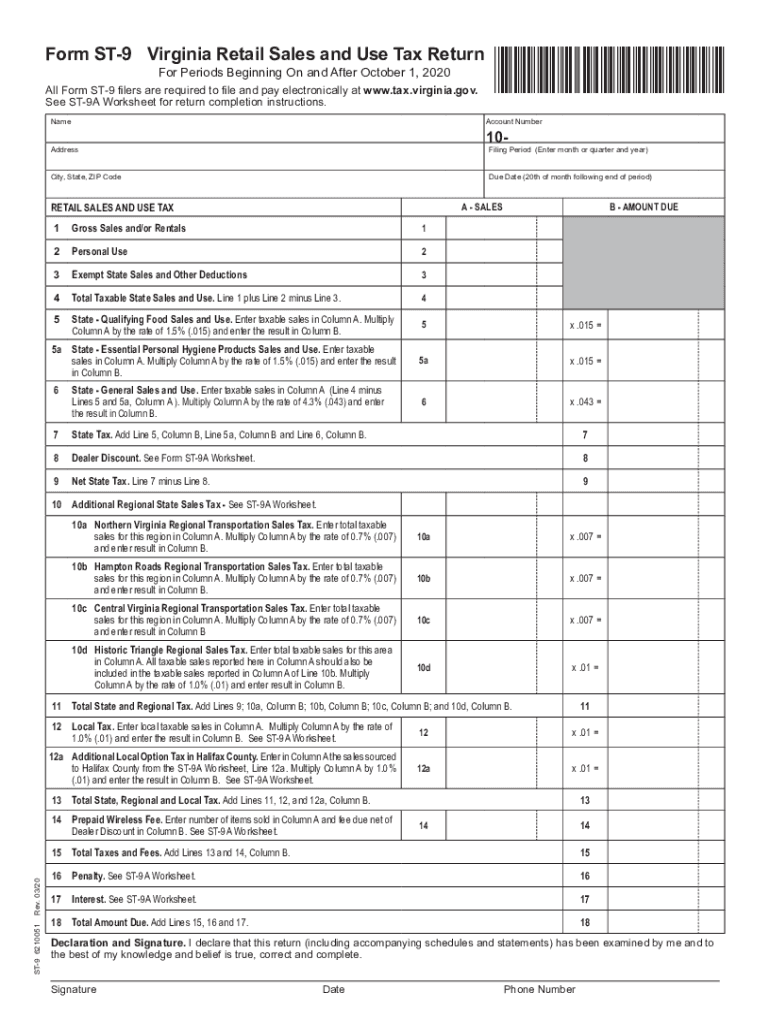

Free Printable Virginia State Tax Forms Printable Form 2022

Web more time to file and pay. Virginia corporation tax returns are due by the 15 th day of the 4 th month after the end of the tax year. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! Web a franchise tax extension form is used to request an extension on filing the franchise taxes.

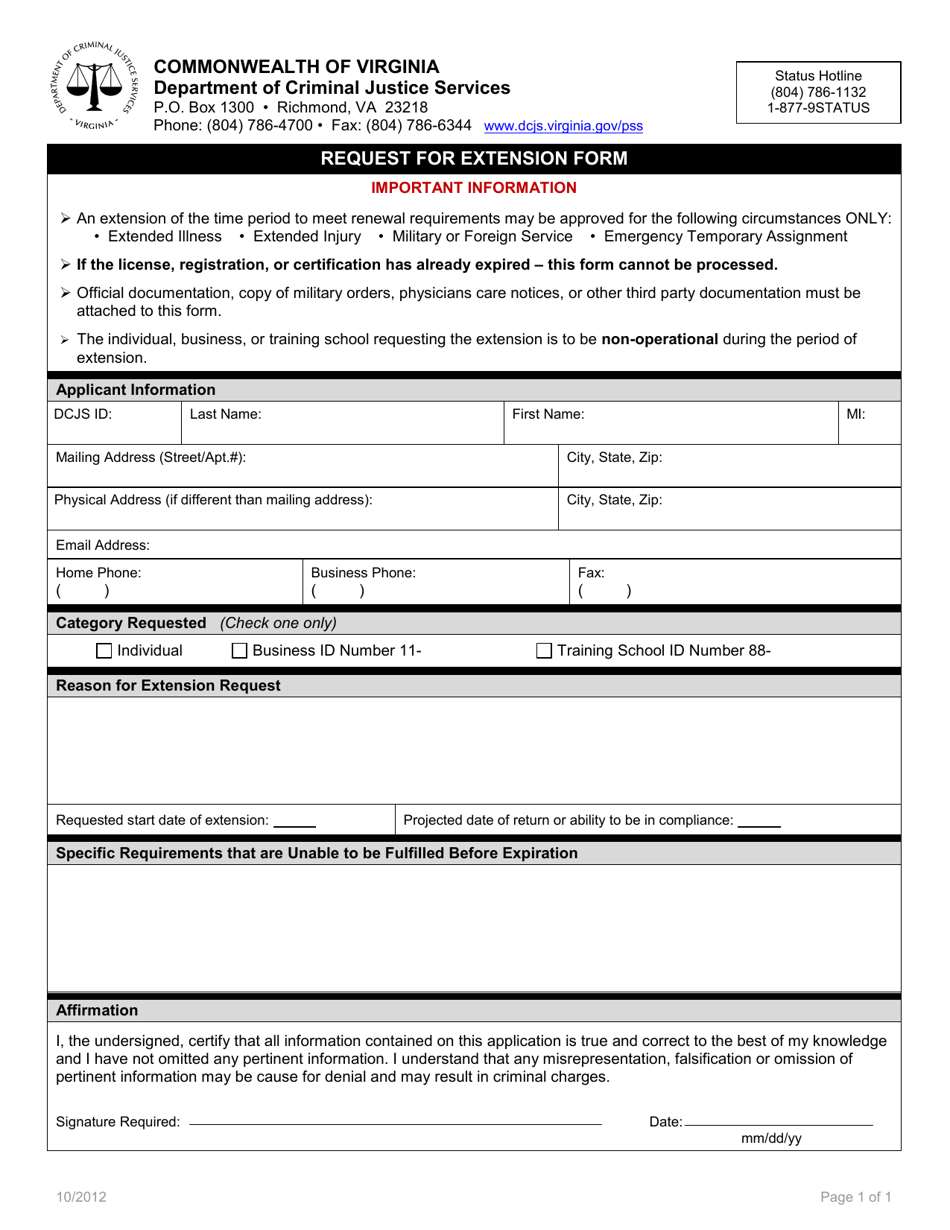

Virginia Request for Extension Form Download Fillable PDF Templateroller

Web the 2022 virginia state income tax return for tax year 2022 (jan. Web in general, you’re a resident of virginia for income tax purposes if you were physically present there, lived there or had a place there (a “place of abode”) for more. Web you can make a virginia extension payment with form 760ip, or pay electronically using vatax.

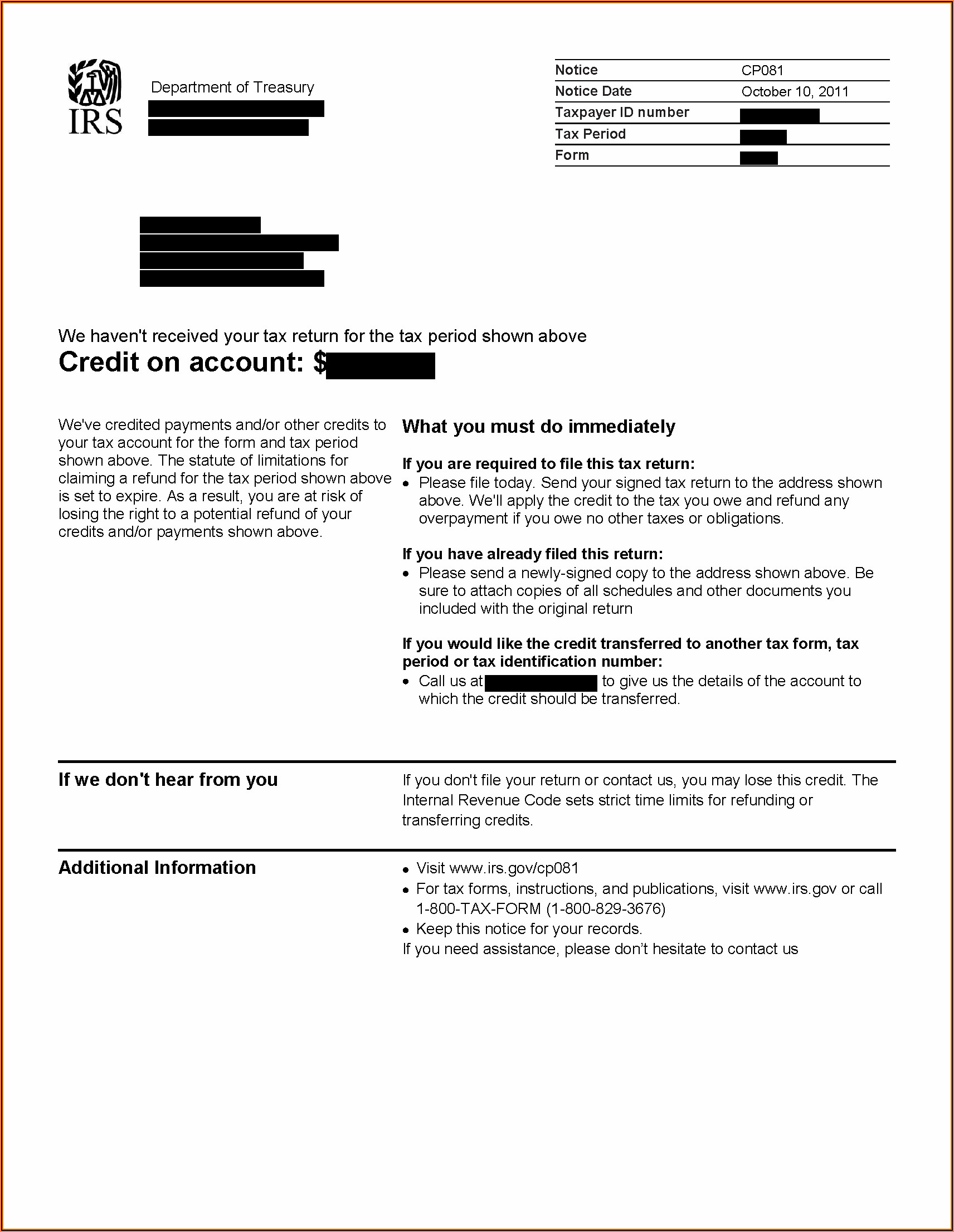

Us Gov Irs Tax Forms Extension Form Resume Examples l6YNxJo23z

Web irs form 7004 $39.95 now only $34.95 file your tax extension now! If you file a tax. Virginia corporation tax returns are due by the 15 th day of the 4 th month after the end of the tax year. Web the 2022 virginia state income tax return for tax year 2022 (jan. Corporation and pass through entity tax.

Business Tax Extension 7004 Form 2021

Web find forms & instructions by category. Web virginia state income tax forms virginia taxes pages return extension payment, address deadlines refund forms bracket, rates amendment tax calculator instructions virginia. Your average tax rate is. Web virginia state taxes at a glance: If you file a tax.

Virginia State Tax Forms 2021 Printable Printable Form 2022

Web you can make a virginia extension payment with form 760ip, or pay electronically using vatax online services: How do i pay my. Web in general, you’re a resident of virginia for income tax purposes if you were physically present there, lived there or had a place there (a “place of abode”) for more. Web find forms & instructions by.

Virginia Tax Exemption Form

For calendar year filers, the filing date is automatically extended to november 1. Corporation and pass through entity tax. Web to make a virginia extension payment, use form 760ip (automatic extension payment voucher for individuals). If you file a tax. How do i pay my.

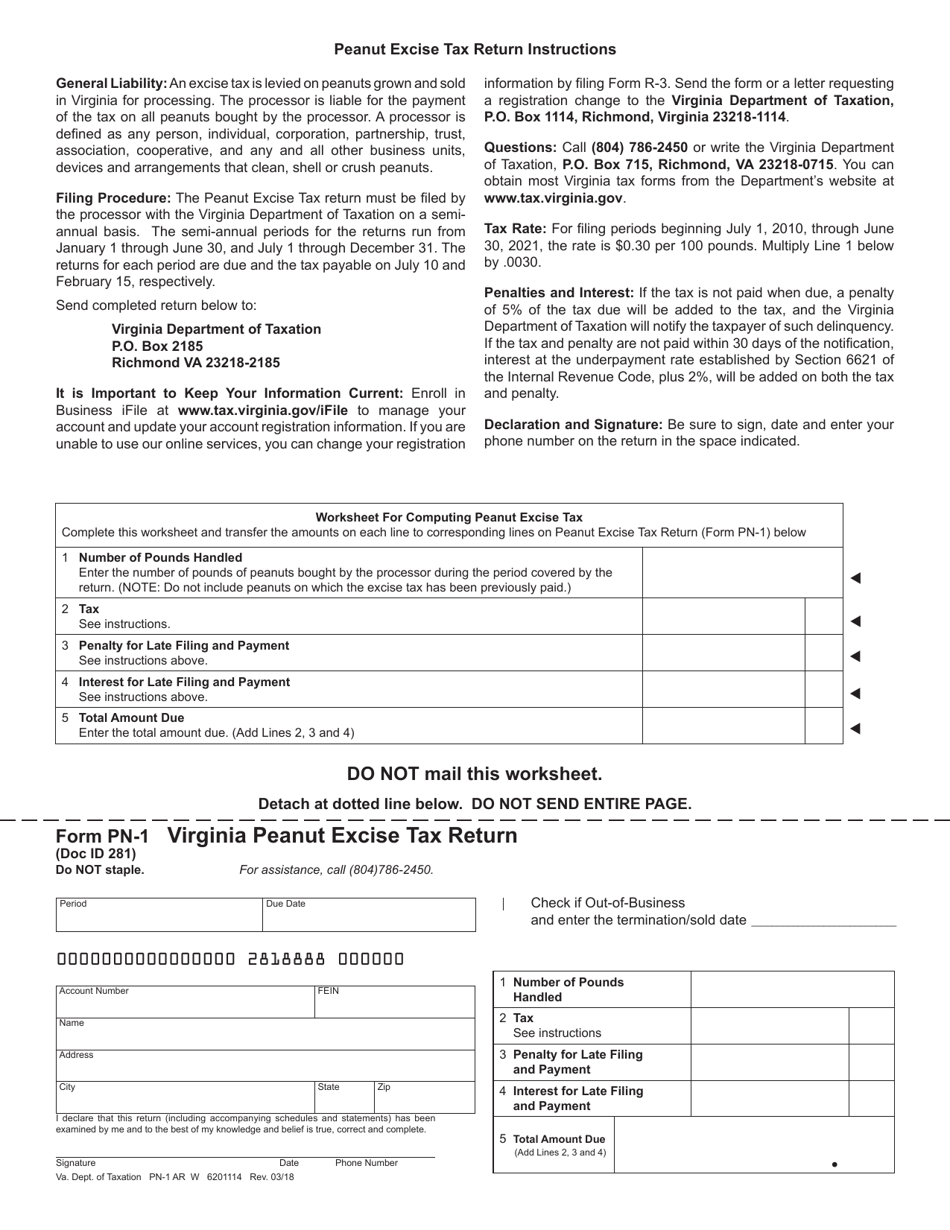

Form PN1 Download Fillable PDF or Fill Online Virginia Peanut Excise

What form does the state of virginia require to apply for an extension? Web to make a virginia extension payment, use form 760ip (automatic extension payment voucher for individuals). Web virginia state taxes at a glance: Corporation and pass through entity tax. Web find forms & instructions by category.

Mississippi Business Tax Extension

Www.individual.tax.virginia.gov virginia tax extension tip: A franchise tax is a tax assessed on business entities based on gross. State extension payments can be made by paper check or. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! Web in general, you’re a resident of virginia for income tax purposes if you were physically present there, lived.

Www.individual.tax.virginia.gov Virginia Tax Extension Tip:

Web more time to file and pay. If you make $70,000 a year living in virginia you will be taxed $11,623. Web irs form 7004 $39.95 now only $34.95 file your tax extension now! No paper application or online application for extension is required.

Corporation And Pass Through Entity Tax.

If you file a tax. Web virginia state taxes at a glance: Web in general, you’re a resident of virginia for income tax purposes if you were physically present there, lived there or had a place there (a “place of abode”) for more. A franchise tax is a tax assessed on business entities based on gross.

State Extension Payments Can Be Made By Paper Check Or.

Web find forms & instructions by category. How do i pay my. Web virginia state income tax forms virginia taxes pages return extension payment, address deadlines refund forms bracket, rates amendment tax calculator instructions virginia. Web to make a virginia extension payment, use form 760ip (automatic extension payment voucher for individuals).

Web The 2022 Virginia State Income Tax Return For Tax Year 2022 (Jan.

Virginia corporation tax returns are due by the 15 th day of the 4 th month after the end of the tax year. If you won’t be able to file by the original may 1 deadline, don’t worry. Web a franchise tax extension form is used to request an extension on filing the franchise taxes for an entity. For calendar year filers, the filing date is automatically extended to november 1.