Single Member Llc Tax Extension Form

Single Member Llc Tax Extension Form - Once formed, the irs does not recognize llcs for taxation. Filing your tax extension just became easier! The filing fee is $7. When are my estimate payments. An extension of time to file is not an extension of time to pay the llc tax or fee. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. If your llc has not quite reached three months in. Web tax extensions for single member llc's. Web employment tax and certain excise taxes. Please remind your smllc clients.

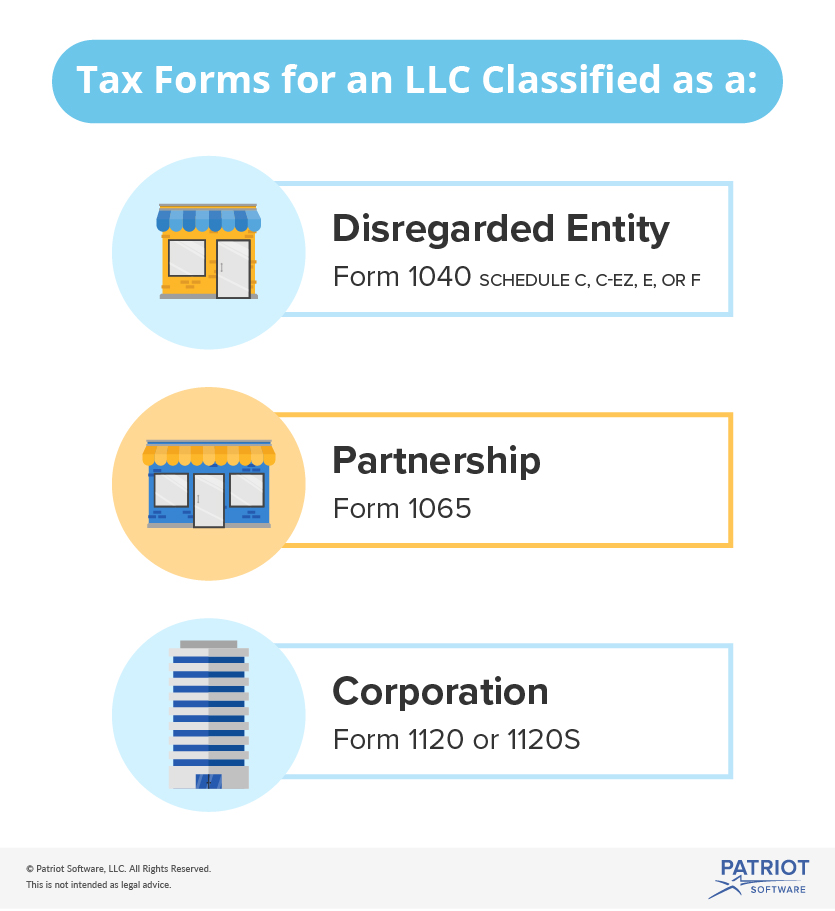

The member of a single member llc's is not required to file a separate business tax return for their llc. Web up to $40 cash back in the united states, the owner of a single member llc is required to file a tax return, reporting the income and expenses of the llc on their personal tax return. Ad file your taxes like a pro. Exempt organizations forms and payments. Web if your llc has one owner, you’re a single member limited liability company (smllc). An extension of time to file is not an extension of time to pay the llc tax or fee. Web california grants an automatic extension of time to file a return. Web up to 25% cash back you may register online by postal mail. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to file certain business. If your llc has not quite reached three months in.

Profits and losses from their. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. Filing your tax extension just became easier! Corporation tax return and payments. The filing fee is $7. A few types of businesses generally cannot be llcs, such as banks and. If your llc has not quite reached three months in. Web up to 25% cash back you may register online by postal mail. When are my estimate payments. Reach out to learn how we can help you!

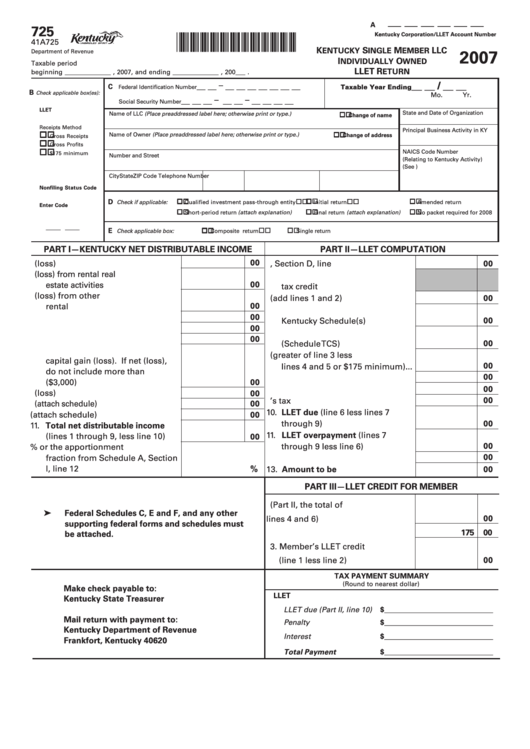

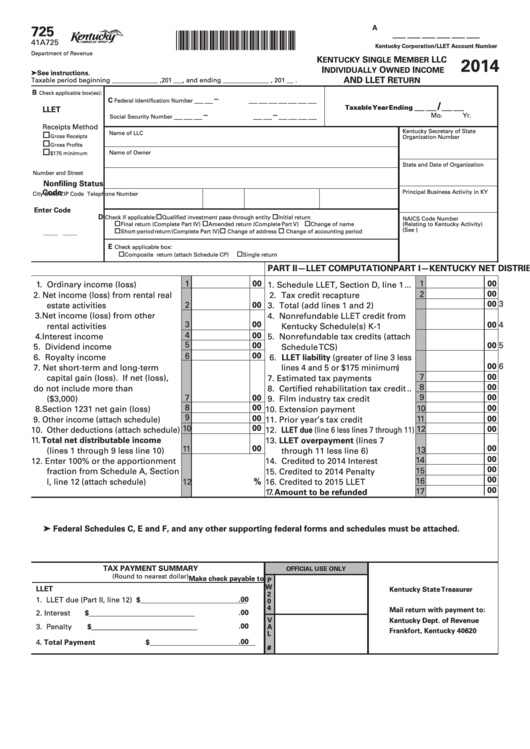

Fillable Form 725 Kentucky Single Member Llc Individually Owned Llet

The registration is good for five years. Web single member llcs (smllcs) disregarded for tax purposes will be granted an automatic six month extension, with the exception of an smllc owned by a partnership or an llc. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time.

Form 725 Kentucky Single Member Llc Individually Owned And

The filing fee is $7. The registration is good for five years. Filing your tax extension just became easier! Llc and partnership tax return and payments. Web employment tax and certain excise taxes.

W9 Tips and Common Errors CENTIPEDE Care Solutions a HEOPS Company

Web if your llc has one owner, you’re a single member limited liability company (smllc). An extension of time to file is not an extension of time to pay the llc tax or fee. The filing fee is $7. Web select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension.

SingleMember LLC Tax Considerations Seaton CPA, LLC

Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and elects to be. Web if your llc has one owner, you’re a single member limited liability company (smllc). If you are married, you and your spouse are considered one owner and can.

Single Member LLC What Tax Return to File? Nina's Soap

Web up to 25% cash back you may register online by postal mail. The member of a single member llc's is not required to file a separate business tax return for their llc. Reach out to learn how we can help you! Web up to $40 cash back in the united states, the owner of a single member llc is.

Tax Forms for an LLC Federal Forms LLCs Should Know About

The filing fee is $7. The member of a single member llc's is not required to file a separate business tax return for their llc. Web up to $40 cash back in the united states, the owner of a single member llc is required to file a tax return, reporting the income and expenses of the llc on their personal.

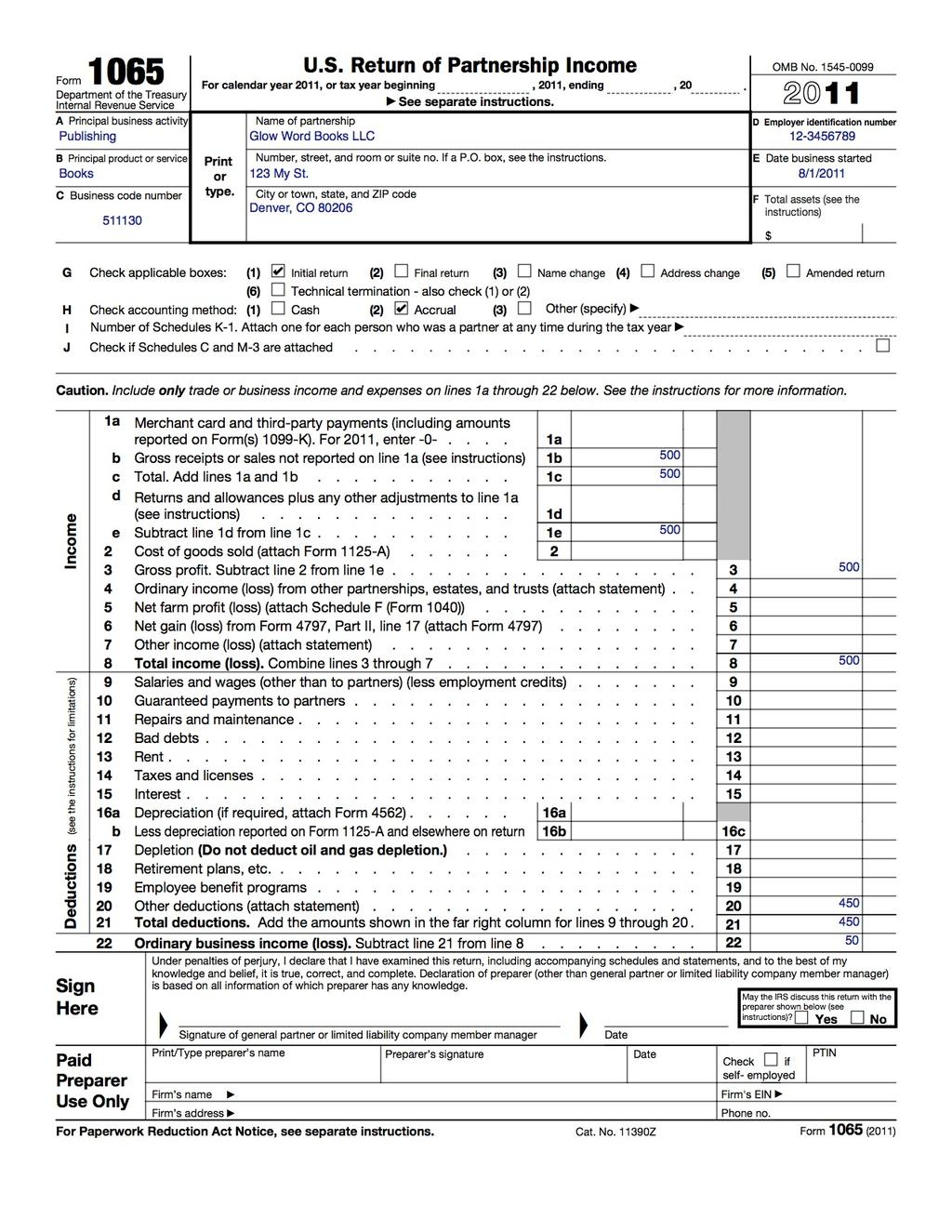

Llc Capital Account Spreadsheet Within How To Fill Out An Llc 1065 Irs

Exempt organizations forms and payments. When are my estimate payments. Web employment tax and certain excise taxes. Once formed, the irs does not recognize llcs for taxation. Web tax extensions for single member llc's.

What Tax Forms Do I Need To File For A Sole Proprietorship Charles

Web up to 25% cash back you may register online by postal mail. Ad sovos combines tax automation with a human touch. Web employment tax and certain excise taxes. Reach out to learn how we can help you! Web california grants an automatic extension of time to file a return.

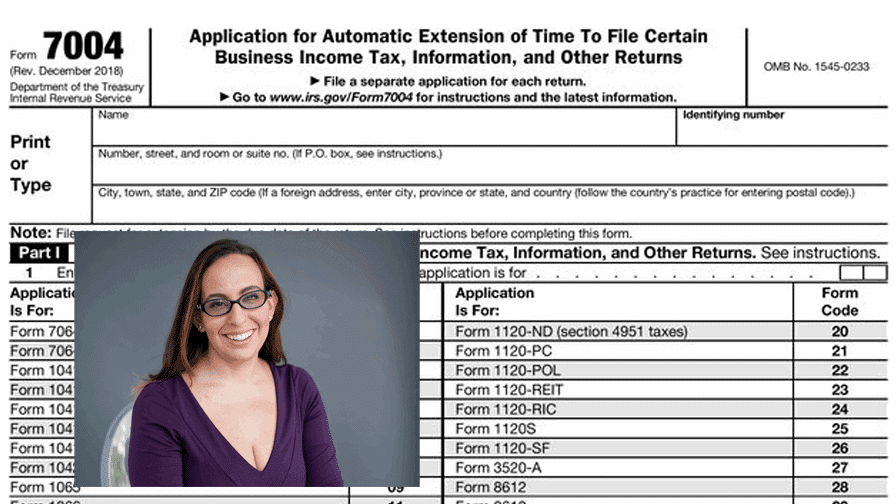

How to file an LLC Tax extension Form 7004 Bette Hochberger, CPA, CGMA

A few types of businesses generally cannot be llcs, such as banks and. Web employment tax and certain excise taxes. Ad sovos combines tax automation with a human touch. Web tax extensions for single member llc's. Once formed, the irs does not recognize llcs for taxation.

How and Where to File Taxes for LLC in 2019 • Benzinga

Ad sovos combines tax automation with a human touch. Web usually, an llc's tax return is due on the 15th day of the fourth month following the close of its fiscal year. Web for income tax purposes, an llc with only one member is treated as an entity disregarded as separate from its owner, unless it files form 8832 and.

Ad Sovos Combines Tax Automation With A Human Touch.

Web california grants an automatic extension of time to file a return. The member of a single member llc's is not required to file a separate business tax return for their llc. A few types of businesses generally cannot be llcs, such as banks and. Web if your llc has one owner, you’re a single member limited liability company (smllc).

Web Up To $40 Cash Back In The United States, The Owner Of A Single Member Llc Is Required To File A Tax Return, Reporting The Income And Expenses Of The Llc On Their Personal Tax Return.

Llc and partnership tax return and payments. If you are married, you and your spouse are considered one owner and can elect to be treated. Reach out to learn how we can help you! If your llc has not quite reached three months in.

Web Single Member Llcs (Smllcs) Disregarded For Tax Purposes Will Be Granted An Automatic Six Month Extension, With The Exception Of An Smllc Owned By A Partnership Or An Llc.

The filing fee is $7. Ad file your taxes like a pro. When are my estimate payments. Web employment tax and certain excise taxes.

Web For Income Tax Purposes, An Llc With Only One Member Is Treated As An Entity Disregarded As Separate From Its Owner, Unless It Files Form 8832 And Elects To Be.

Exempt organizations forms and payments. An extension of time to file is not an extension of time to pay the llc tax or fee. Profits and losses from their. Web up to 25% cash back you may register online by postal mail.