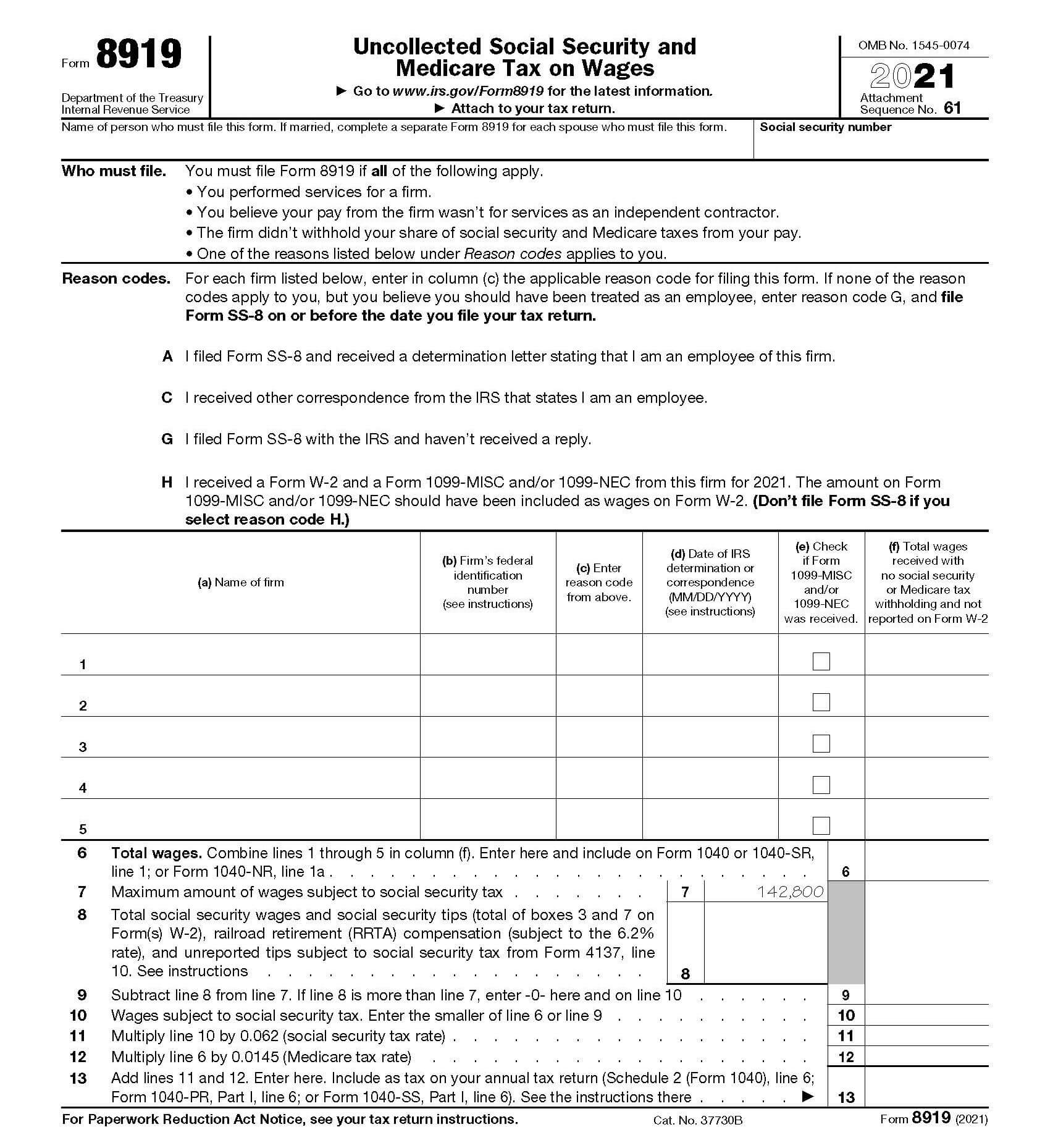

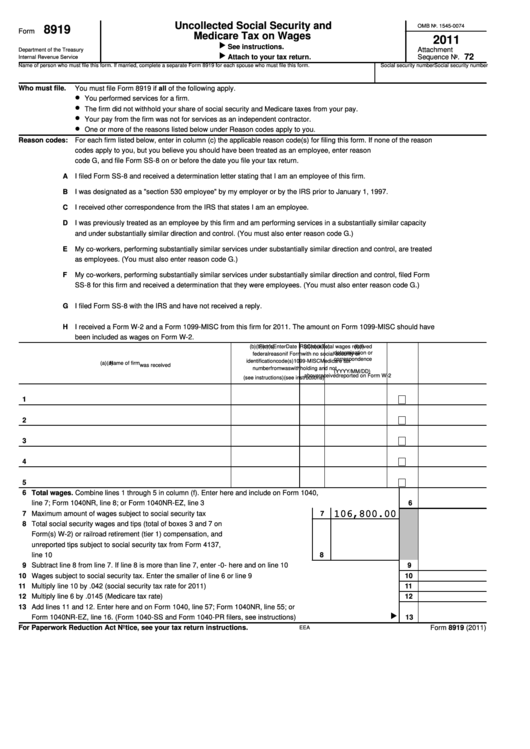

Form 8919 Instructions 2022

Form 8919 Instructions 2022 - You performed services for a firm. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. The employees who were mistakenly labeled as independent contractors must follow the procedures below. Web new form 8911 lines 4a through 5c. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web for more details, see the 2022 form 5695 (residential energy credits) instructions. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web form 8819 is used to elect the u.s.

Web for more details, see the 2022 form 5695 (residential energy credits) instructions. They must report the amount on irs form 8919. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest. Web form 8819 is used to elect the u.s. Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: The employees who were mistakenly labeled as independent contractors must follow the procedures below. Web new form 8911 lines 4a through 5c.

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web irs form 8919 instructions. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: The taxpayer performed services for an individual or a firm. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8819 is used to elect the u.s. Lines 4 and 5 were divided to break out amounts subject to the lower credit rate that applies to certain refueling property placed in service. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. You performed services for a firm.

Fill Free fillable F8919 2018 Form 8919 PDF form

Lines 4 and 5 were divided to break out amounts subject to the lower credit rate that applies to certain refueling property placed in service. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web 1 best answer anthonyc level 7 this information.

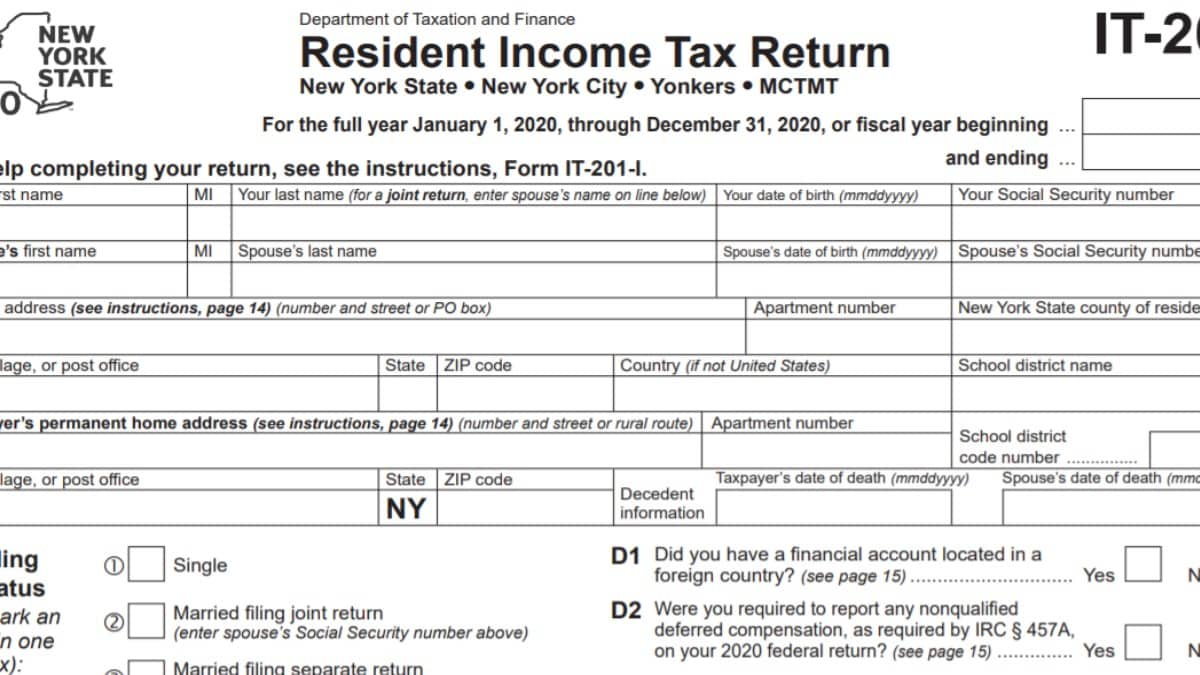

I9 Form 2022 Instructions

They must report the amount on irs form 8919. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. You performed.

2020 Form IRS 8880 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 8819 is used to elect the u.s. The taxpayer performed services for an individual or a firm. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web 1 best answer anthonyc level 7 this information is entered in a different area.

When to Use IRS Form 8919

Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web form 8819 is used to elect the u.s. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web for.

IT201 Instructions 2022 2023 State Taxes TaxUni

Lines 4 and 5 were divided to break out amounts subject to the lower credit rate that applies to certain refueling property placed in service. The employees who were mistakenly labeled as independent contractors must follow the procedures below. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web irs form.

Top Form 8919 Templates free to download in PDF format

Web for more details, see the 2022 form 5695 (residential energy credits) instructions. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. They must report the amount on irs form 8919. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8819 is used to elect the u.s. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web information about form 8919, uncollected social security and medicare tax on.

1040x2.pdf Irs Tax Forms Social Security (United States)

The taxpayer performed services for an individual or a firm. Web employees will use form 8919 to determine the amount they owe in social security and medicare taxes. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web information about form 8919, uncollected social security and.

Form 8919 Uncollected Social Security and Medicare Tax on Wages (2014

Web general instructions purpose of form use form 8959 to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your. Web for more details, see the 2022 form 5695 (residential energy credits) instructions. They must report the amount on irs form 8919. Web form 8819 is used to elect the u.s..

Form 8919 2021 Fill Online, Printable, Fillable, Blank pdfFiller

Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Web new form 8911 lines 4a through 5c. Web for more details, see the 2022 form 5695 (residential energy credits) instructions. Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms,.

Web Employees Will Use Form 8919 To Determine The Amount They Owe In Social Security And Medicare Taxes.

You performed services for a firm. The taxpayer performed services for an individual or a firm. Web 1 best answer anthonyc level 7 this information is entered in a different area of the program then regular w2s. Lines 4 and 5 were divided to break out amounts subject to the lower credit rate that applies to certain refueling property placed in service.

Web General Instructions Purpose Of Form Use Form 8959 To Figure The Amount Of Additional Medicare Tax You Owe And The Amount Of Additional Medicare Tax Withheld By Your.

Web information about form 8919, uncollected social security and medicare tax on wages, including recent updates, related forms, and instructions on how to file. Web form 8819 is used to elect the u.s. Web form 8919, uncollected social security and medicare tax on wages, will need to be filed if all of the following are true: Web form 8919 department of the treasury internal revenue service uncollected social security and medicare tax on wages go to www.irs.gov/form8919 for the latest.

The Employees Who Were Mistakenly Labeled As Independent Contractors Must Follow The Procedures Below.

They must report the amount on irs form 8919. Web irs form 8919 instructions. Web in short, workers must file form 8919, uncollected social security and medicare tax on wages, if they did not have social security and medicare taxes. Web new form 8911 lines 4a through 5c.