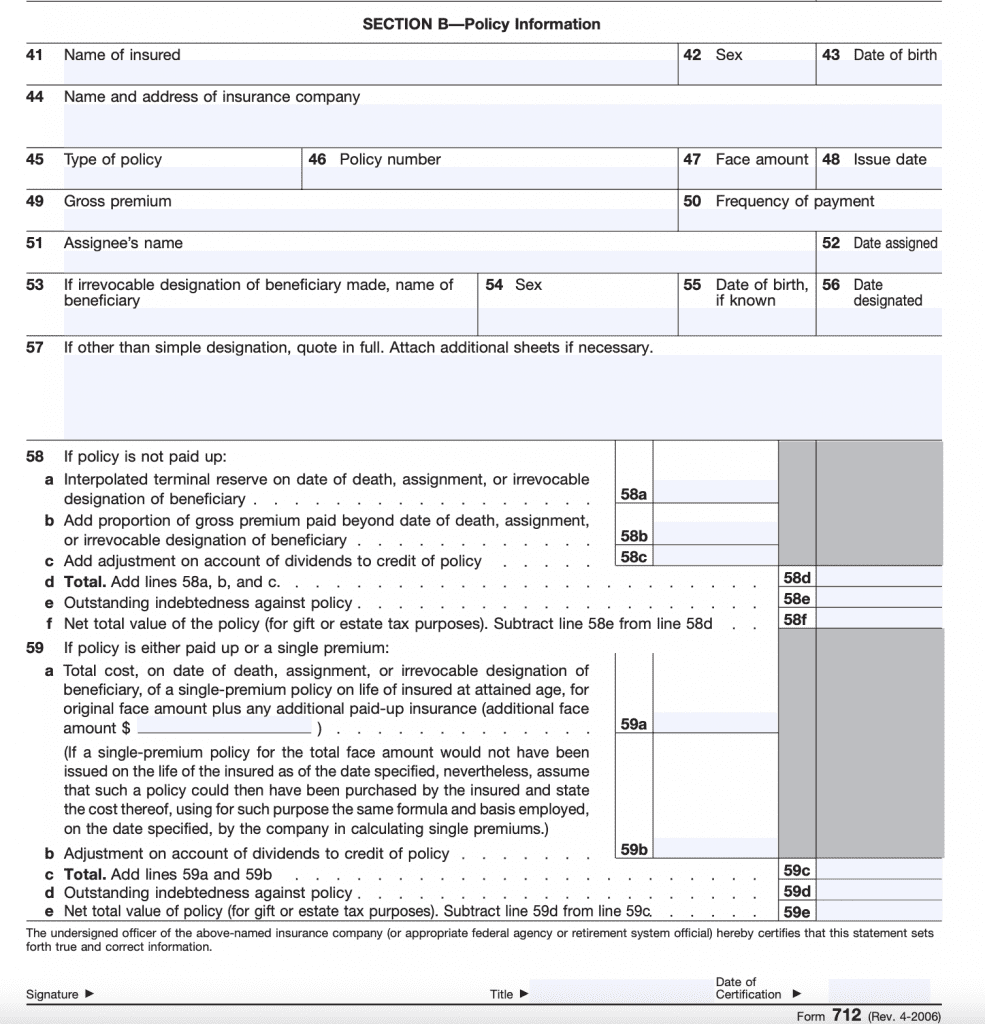

Requesting Form 712 From Insurance Company

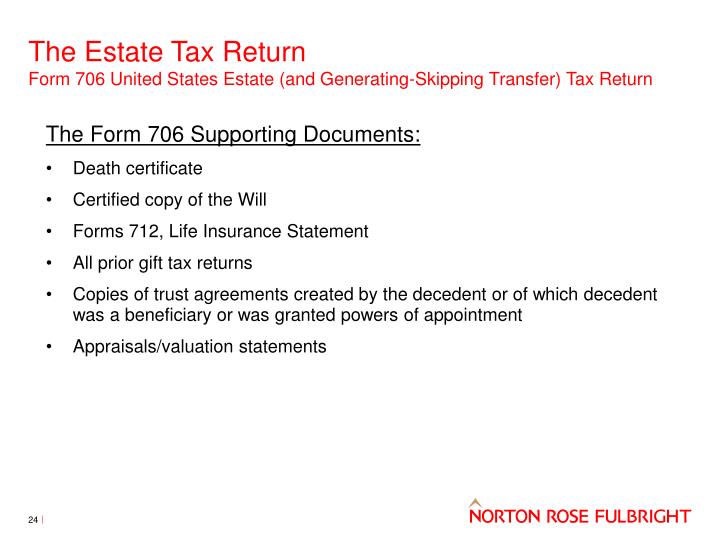

Requesting Form 712 From Insurance Company - The time needed to complete and file this form will vary depending on individual circumstances. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. Web ask the life insurance company what a form 712 is. File a separate form 712 for each policy. The life insurance company, upon request, should provide a copy of this tax form to the executor. You should also ask the company, in writing, to pay the proceeds to you. There are 2 parts to this tax form:

There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. The time needed to complete and file this form will vary depending on individual circumstances. Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran What information does irs form 712 contain? Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw File a separate form 712 for each policy. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web on behalf of the insurance company that issued the policy, by an officer of the company having access to the records of the company. The life insurance company, upon request, should provide a copy of this tax form to the executor. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general.

This will allow the executor to complete the estate tax return. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. File a separate form 712 for each policy. The time needed to complete and file this form will vary depending on individual circumstances. There are 2 parts to this tax form: Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran The life insurance company, upon request, should provide a copy of this tax form to the executor. Web on behalf of the insurance company that issued the policy, by an officer of the company having access to the records of the company. What information does irs form 712 contain?

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

File a separate form 712 for each policy. If there were multiple policies in effect, the executor must. Report on line 13 the annual premium, not the What information does irs form 712 contain? Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file.

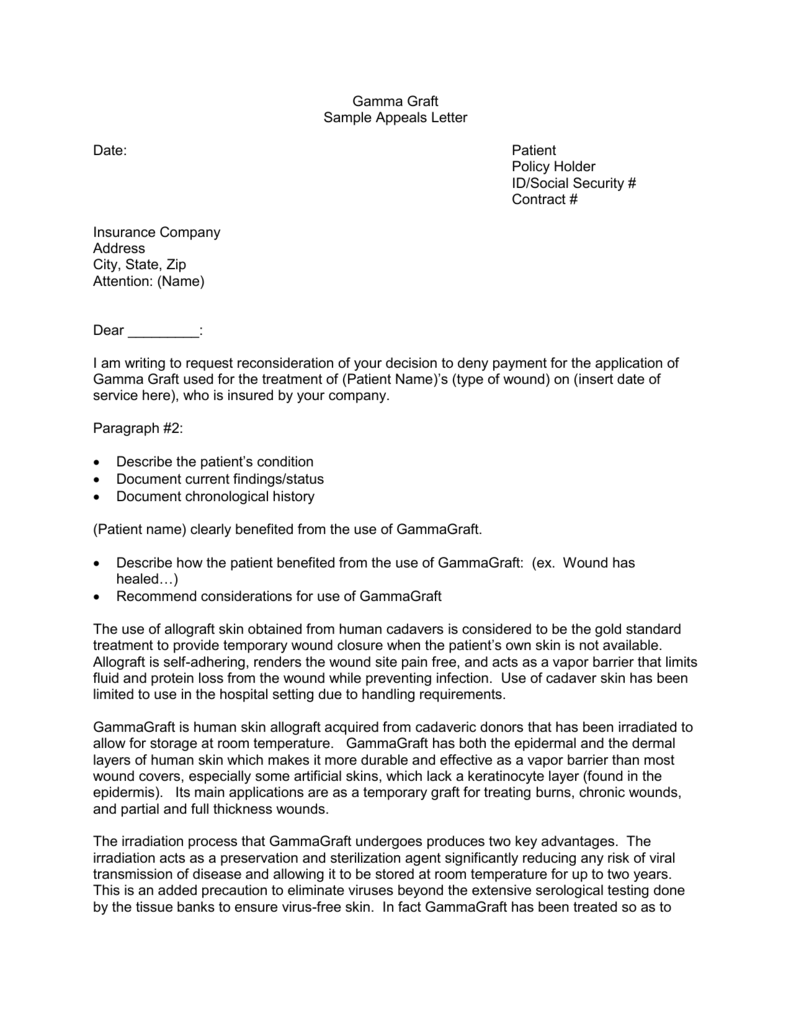

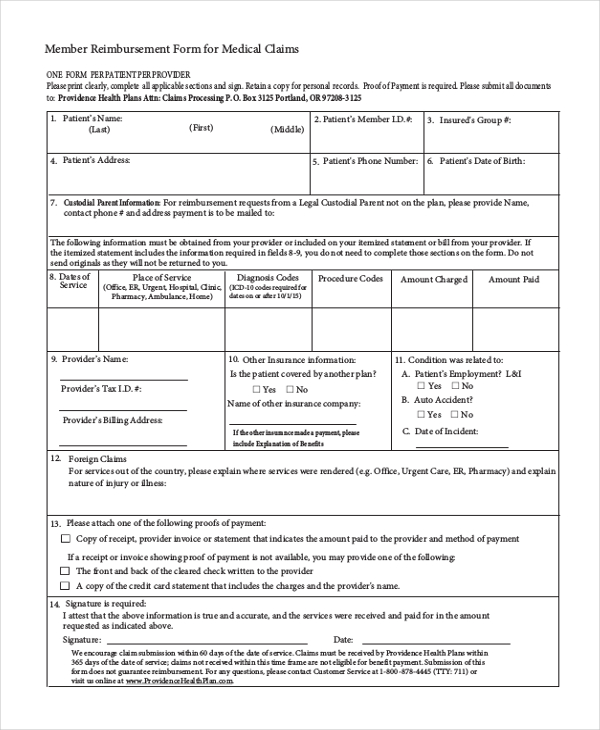

Sample Letter To Insurance Company Requesting Reimbursement For Your

File a separate form 712 for each policy. The life insurance company, upon request, should provide a copy of this tax form to the executor. Web form 712 plays a key role in establishing the value of a life insurance policy when filing gift tax and estate tax returns. Web life insurance company. Web the irs federal form 712 reports.

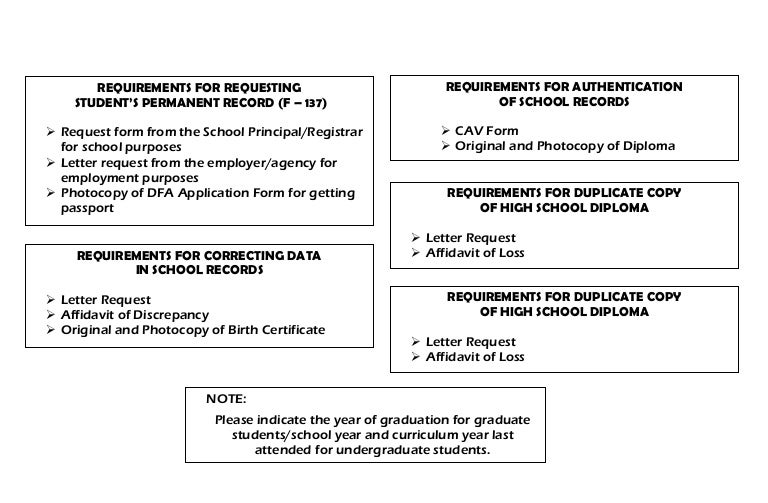

Requirements for requesting form 137

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. The life insurance company, upon request, should provide a copy of this tax form to the executor. There are 2 parts to this tax form: Web the irs federal form 712 reports the value of a life insurance policy's proceeds after.

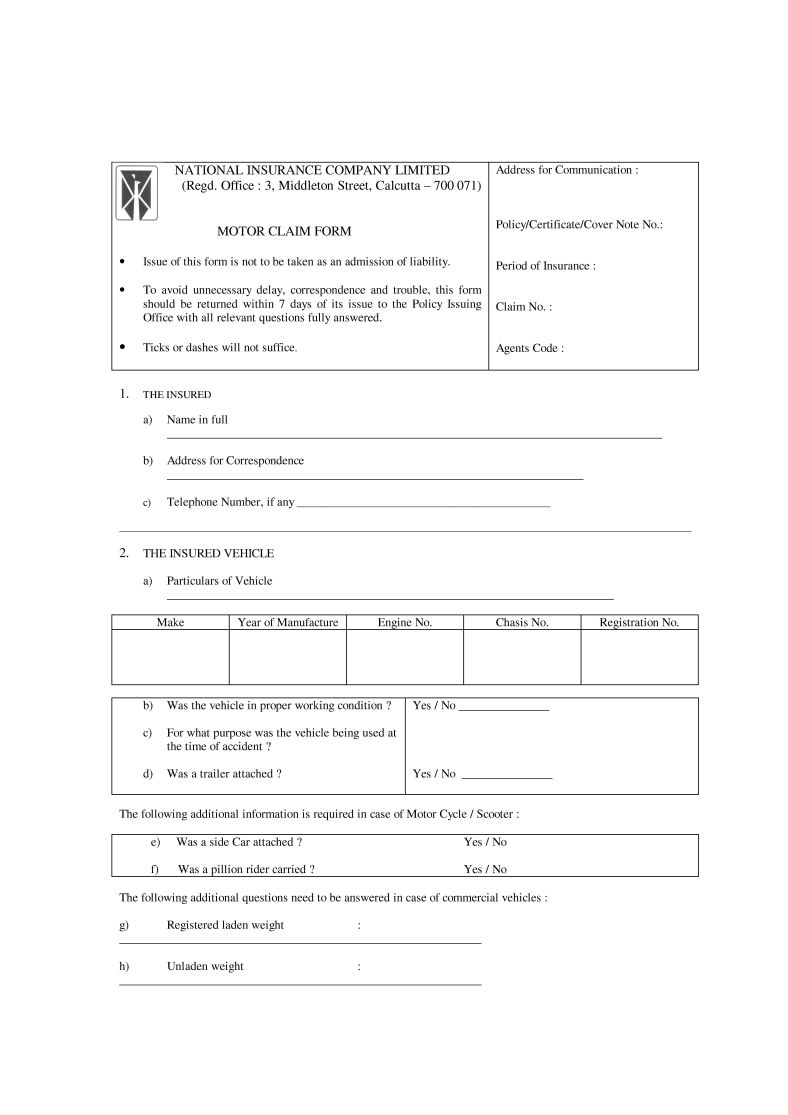

Claim Form National Insurance Company Download 2021 2022 Student Forum

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21. There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate..

IRS Form 712 A Guide to the Life Insurance Statement

File a separate form 712 for each policy. If there were multiple policies in effect, the executor must. Web life insurance company. Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21.

Sample Letter To Insurance Company Requesting Reimbursement For Your

This will allow the executor to complete the estate tax return. If there were multiple policies in effect, the executor must. Web on behalf of the insurance company that issued the policy, by an officer of the company having access to the records of the company. The time needed to complete and file this form will vary depending on individual.

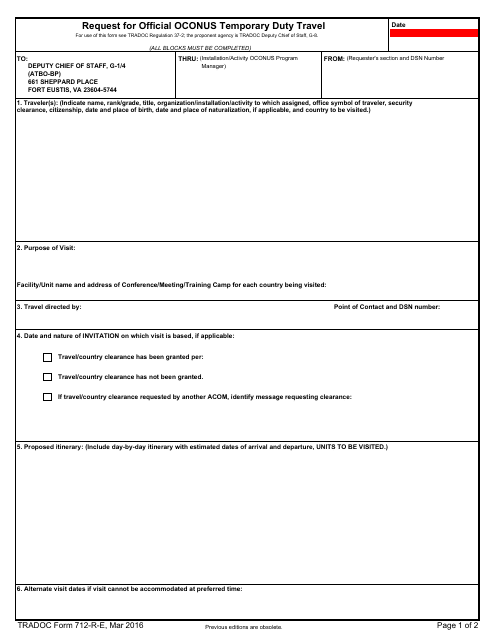

TRADOC Form 712RE Download Fillable PDF or Fill Online Request for

Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw What information does irs form 712 contain? American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. Understanding irs form 712 when valuing life insurance on gift tax &.

Insurance Policy Form 712

What information does irs form 712 contain? This will allow the executor to complete the estate tax return. The time needed to complete and file this form will vary depending on individual circumstances. Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Understanding irs form 712 when valuing life insurance.

Mumbai News Network Latest News Today's Insurance Alertss 712

This will allow the executor to complete the estate tax return. Report on line 13 the annual premium, not the You should also ask the company, in writing, to pay the proceeds to you. File a separate form 712 for each policy. What information does irs form 712 contain?

Life Insurance Form 712 Realtors Can Save Up to 58 on Life Insurance

There are 2 parts to this tax form: Web life insurance company. Web form 712 plays a key role in establishing the value of a life insurance policy when filing gift tax and estate tax returns. File a separate form 712 for each policy. There may be a reason for the estate to report the existence of the policy, but.

Web Ask The Life Insurance Company What A Form 712 Is.

Web life insurance company. You should also ask the company, in writing, to pay the proceeds to you. Report on line 13 the annual premium, not the What information does irs form 712 contain?

Web Form 712 Plays A Key Role In Establishing The Value Of A Life Insurance Policy When Filing Gift Tax And Estate Tax Returns.

Web the irs federal form 712 reports the value of a life insurance policy's proceeds after the insured dies for estate tax purposes. The time needed to complete and file this form will vary depending on individual circumstances. File a separate form 712 for each policy. Web form—letter to life insurance company regarding death of decedent—requesting irs form 712, secondary sources § 35:21.

There Are 2 Parts To This Tax Form:

Web information about form 712, life insurance statement, including recent updates, related forms, and instructions on how to file. Understanding irs form 712 when valuing life insurance on gift tax & estate tax returns | our insights | plante moran Form—letter to life insurance company regarding death of decedent—requesting irs form 712 | secondary sources | westlaw The life insurance company, upon request, should provide a copy of this tax form to the executor.

This Will Allow The Executor To Complete The Estate Tax Return.

There may be a reason for the estate to report the existence of the policy, but the proceeds are not part of the estate. American mayflower life insurance company federal home life insurance company first colony life insurance company genworth life and annuity insurance genworth life insurance general. Web on behalf of the insurance company that issued the policy, by an officer of the company having access to the records of the company. If there were multiple policies in effect, the executor must.