Proshares K-1 Form

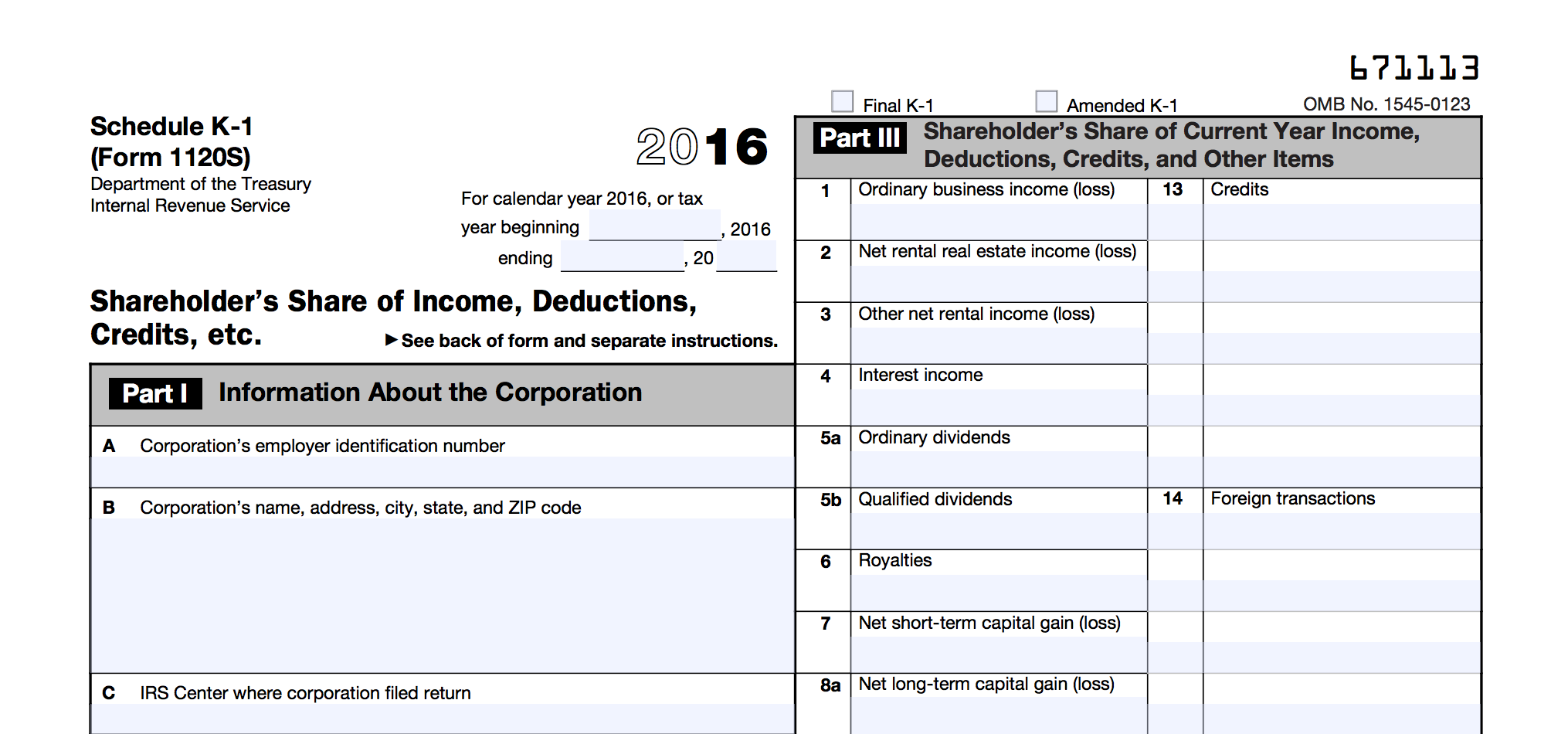

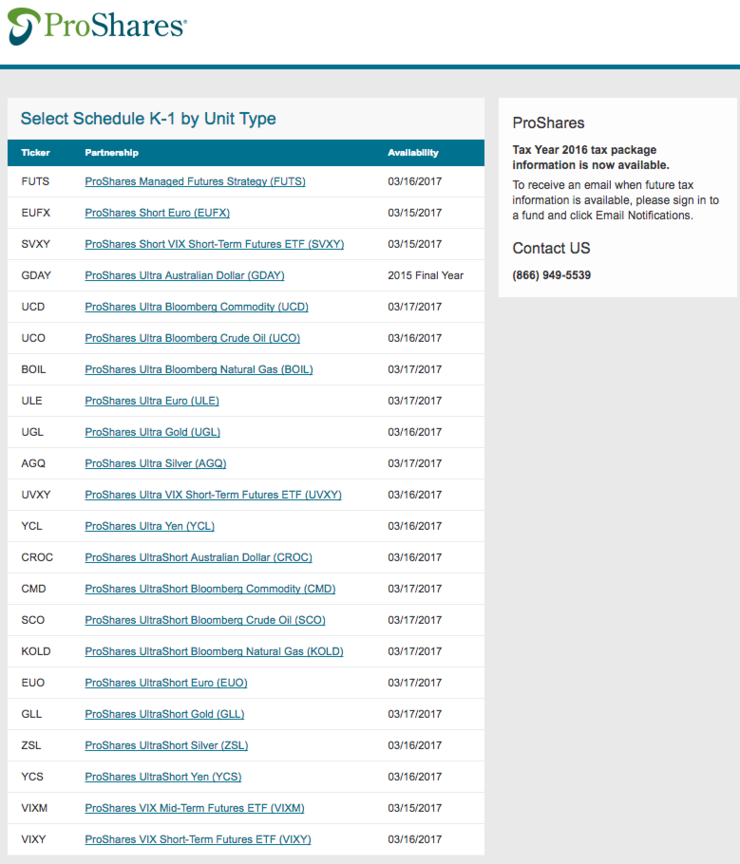

Proshares K-1 Form - Web 10/31/2021 form 8937 proshares morningstar alternatives solution etf (alts) 01/31/2021 tax supplements ici primary 01/25/2021 tax supplements ici. See back of form and. Department of the treasury internal revenue service. General information and account verification is required. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Certain derivative instruments will subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund. Forms are listed in reverse order of the date of. If you are still working, you may extend your session for another 20. You will be logged out due to inactivity. Note that several funds went.

Forms are listed in reverse order of the date of. How many shares you’ve held and the. You will be logged out due to inactivity. Department of the treasury internal revenue service. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Note that several funds went. Web proshares ultra bloomberg crude oil (uco) tax package support. Web proshares now offers one of the largest lineups of etfs, with more than $70 billion in assets. General information and account verification is required. Beneficiary’s share of income, deductions, credits, etc.

Web proshares now offers one of the largest lineups of etfs, with more than $70 billion in assets. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Certain derivative instruments will subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund. How many shares you’ve held and the. Web proshares ultra bloomberg crude oil (uco) tax package support. Ending / / partner’s share of income,. The company is the leader in strategies such as dividend growth, interest rate. Department of the treasury internal revenue service. If you are still working, you may extend your session for another 20. Proshares short bitcoin strategy etf (biti)was launched during this period.

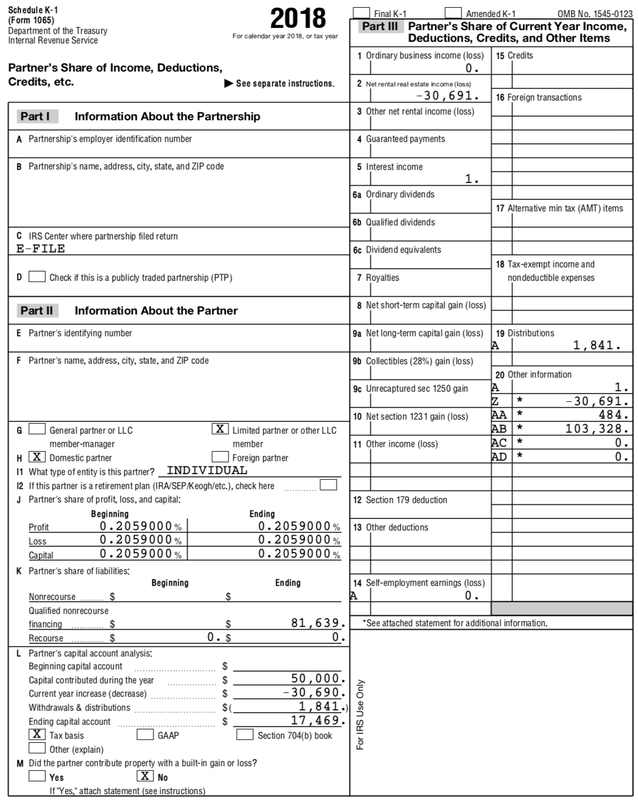

How To Create A K1 For An Llc Paul Johnson's Templates

Department of the treasury internal revenue service. Web form other market segments and funds with a similar investment objecti ve and/or strategies. How many shares you’ve held and the. Web 10/31/2021 form 8937 proshares morningstar alternatives solution etf (alts) 01/31/2021 tax supplements ici primary 01/25/2021 tax supplements ici. See back of form and.

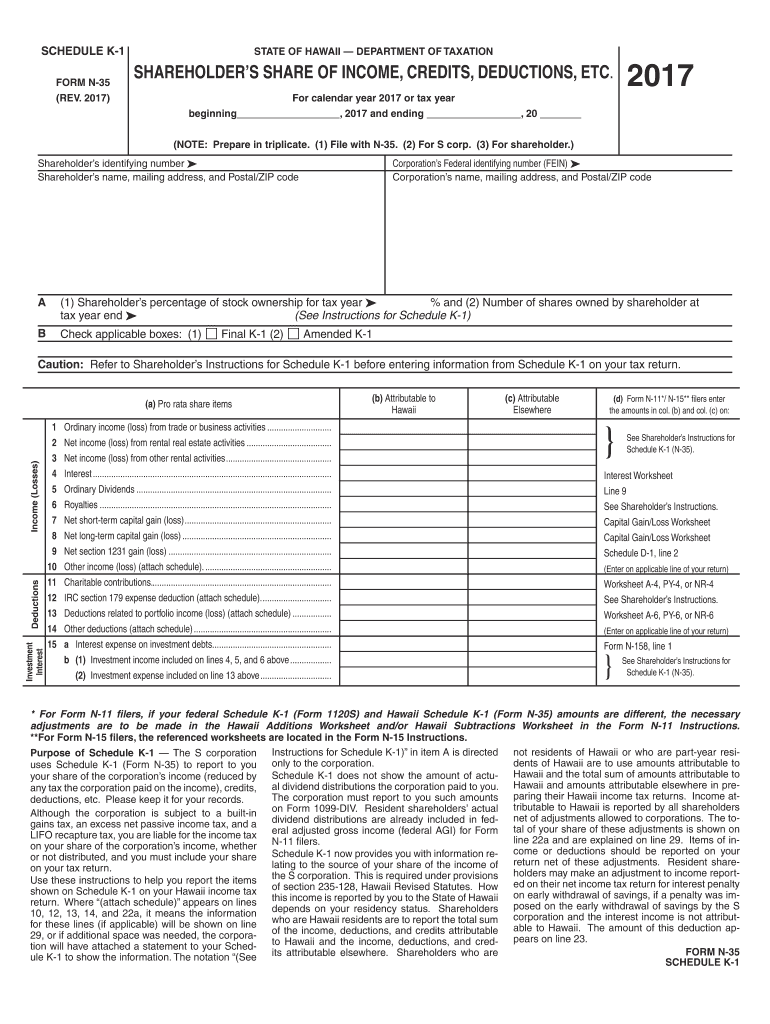

HI Schedule K1 Form N35 2017 Fill out Tax Template Online US

Proshares trust ii is a commodity pool as defined in the commodity exchange act and the applicable regulations of the cftc. Department of the treasury internal revenue service. Certain derivative instruments will subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund. If you are still working, you may extend your session.

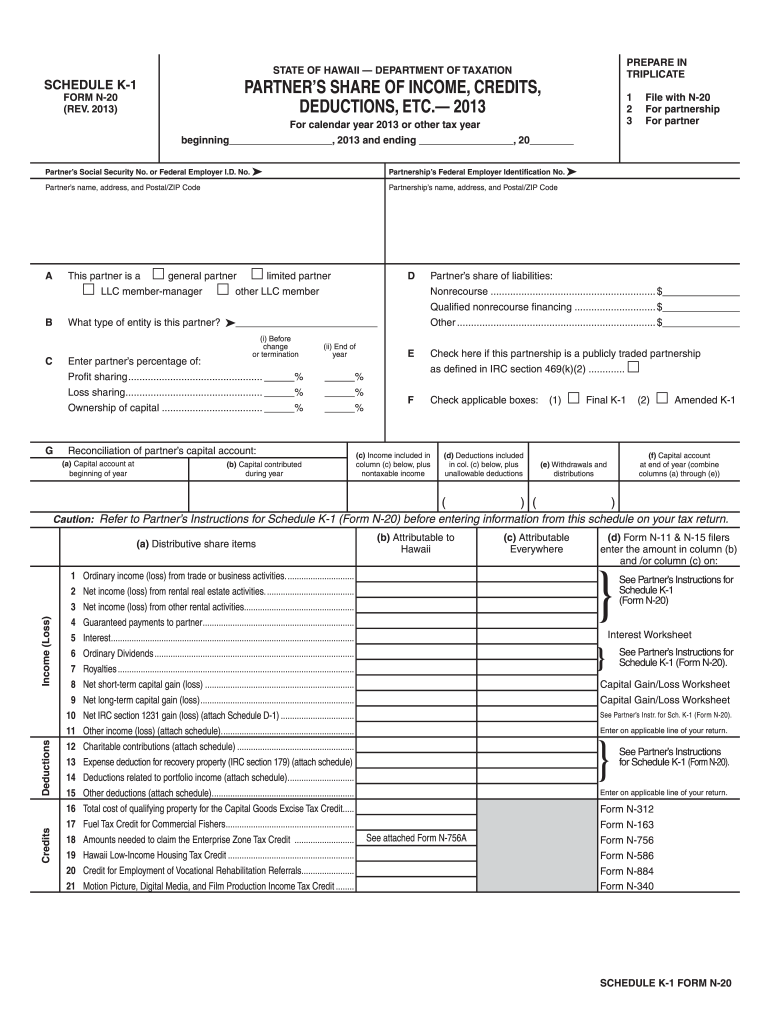

Schedule K 1, Form N 20, Rev , Partner's Share Hawaii Gov Fill Out

If you are still working, you may extend your session for another 20. Department of the treasury internal revenue service. For calendar year 2022, or tax year beginning / / 2022. Certain derivative instruments will subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund. Note that several funds went.

ProShares DeSantis Breindel

See back of form and. Note that several funds went. Forms are listed in reverse order of the date of. Department of the treasury internal revenue service. How many shares you’ve held and the.

ProShares DeSantis Breindel

Ending / / partner’s share of income,. Web proshares ultra bloomberg crude oil (uco) tax package support. Department of the treasury internal revenue service. Web proshares now offers one of the largest lineups of etfs, with more than $70 billion in assets. For calendar year 2022, or tax year beginning / / 2022.

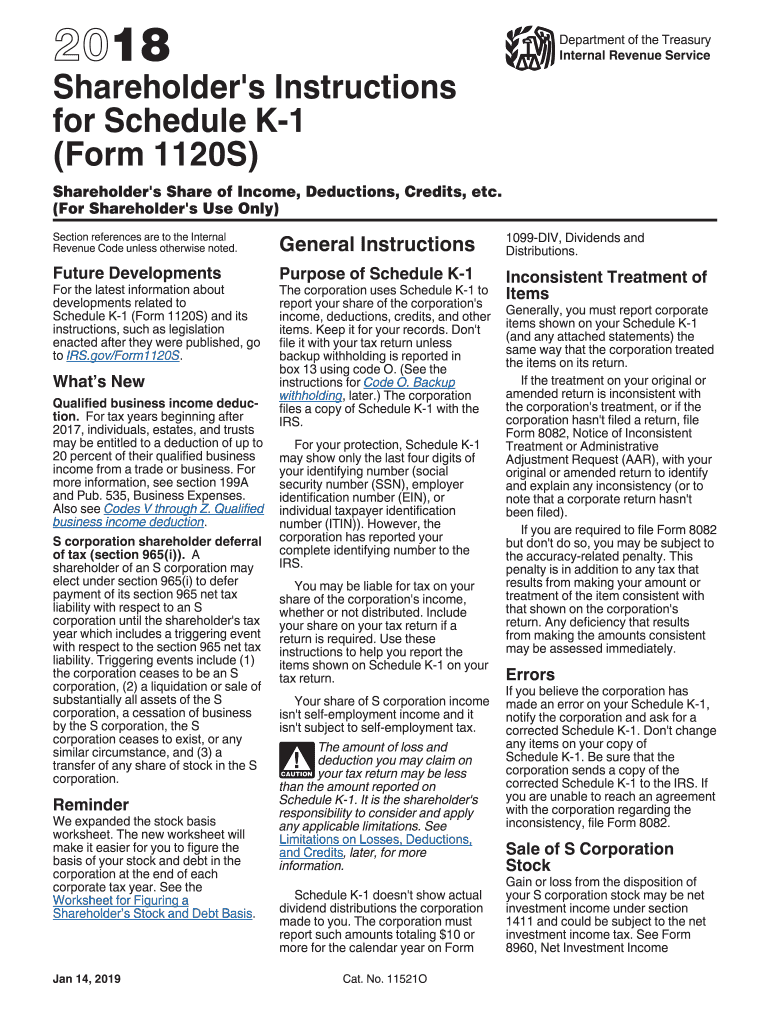

2018 Form IRS Instruction 1120S Schedule K1 Fill Online, Printable

You will be logged out due to inactivity. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether or not distributed. Web proshares ultra bloomberg crude oil (uco) tax package support. Web proshares now offers one of the largest lineups of etfs, with more than $70.

Silver Hair Color Styles Proshares Ultra Silver

If you are still working, you may extend your session for another 20. Web proshares now offers one of the largest lineups of etfs, with more than $70 billion in assets. Web form other market segments and funds with a similar investment objecti ve and/or strategies. The company is the leader in strategies such as dividend growth, interest rate. Forms.

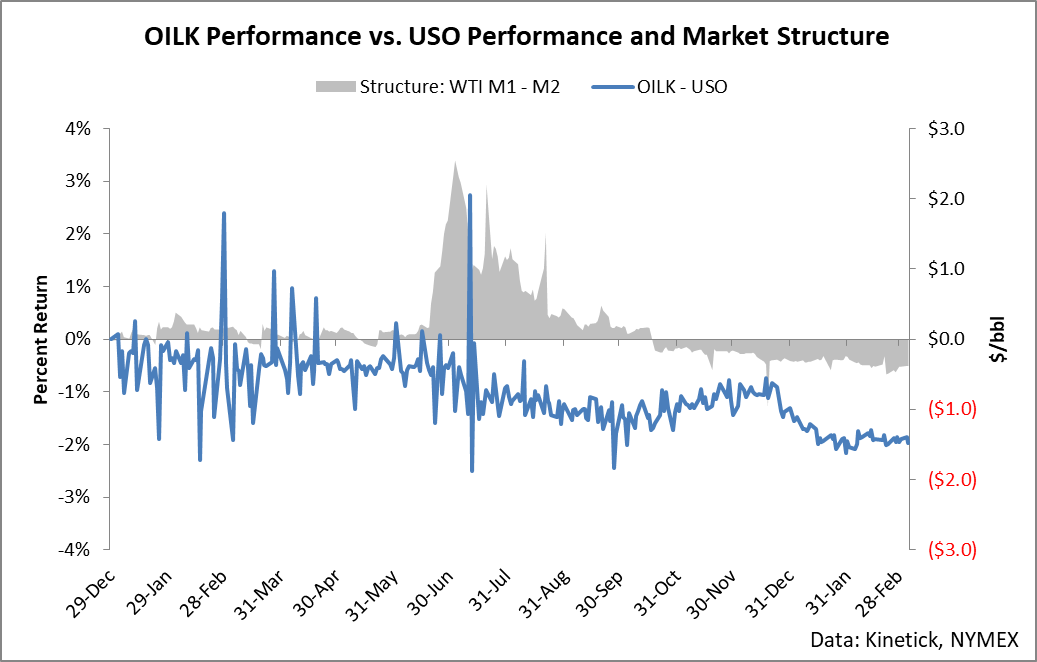

Proshares K 1 Free Crude Oil Strategy Etf buzzonedesign

Proshares short bitcoin strategy etf (biti)was launched during this period. Ending / / partner’s share of income,. Web 10/31/2021 form 8937 proshares morningstar alternatives solution etf (alts) 01/31/2021 tax supplements ici primary 01/25/2021 tax supplements ici. Web although the partnership generally isn't subject to income tax, you may be liable for tax on your share of the partnership income, whether.

What Is a Schedule K1 Form? ZipBooks

Web proshares ultra bloomberg crude oil (uco) tax package support. Web form other market segments and funds with a similar investment objecti ve and/or strategies. You will be logged out due to inactivity. How many shares you’ve held and the. Web proshares now offers one of the largest lineups of etfs, with more than $70 billion in assets.

ProShares 에서 K1 Tax form 을 이슈하는 종목들 네이버 블로그

Note that several funds went. Web 10/31/2021 form 8937 proshares morningstar alternatives solution etf (alts) 01/31/2021 tax supplements ici primary 01/25/2021 tax supplements ici. Web form other market segments and funds with a similar investment objecti ve and/or strategies. Proshares trust ii is a commodity pool as defined in the commodity exchange act and the applicable regulations of the cftc..

You Will Be Logged Out Due To Inactivity.

Web 10/31/2021 form 8937 proshares morningstar alternatives solution etf (alts) 01/31/2021 tax supplements ici primary 01/25/2021 tax supplements ici. See back of form and. Certain derivative instruments will subject the fund to counterparty risk and credit risk, which could result in significant losses for the fund. Proshares trust ii is a commodity pool as defined in the commodity exchange act and the applicable regulations of the cftc.

Beneficiary’s Share Of Income, Deductions, Credits, Etc.

Department of the treasury internal revenue service. Department of the treasury internal revenue service. Forms are listed in reverse order of the date of. Web proshares ultra bloomberg crude oil (uco) tax package support.

Ending / / Partner’s Share Of Income,.

How many shares you’ve held and the. Web proshares now offers one of the largest lineups of etfs, with more than $70 billion in assets. The company is the leader in strategies such as dividend growth, interest rate. Proshares short bitcoin strategy etf (biti)was launched during this period.

Web Although The Partnership Generally Isn't Subject To Income Tax, You May Be Liable For Tax On Your Share Of The Partnership Income, Whether Or Not Distributed.

Note that several funds went. If you are still working, you may extend your session for another 20. General information and account verification is required. For calendar year 2022, or tax year beginning / / 2022.