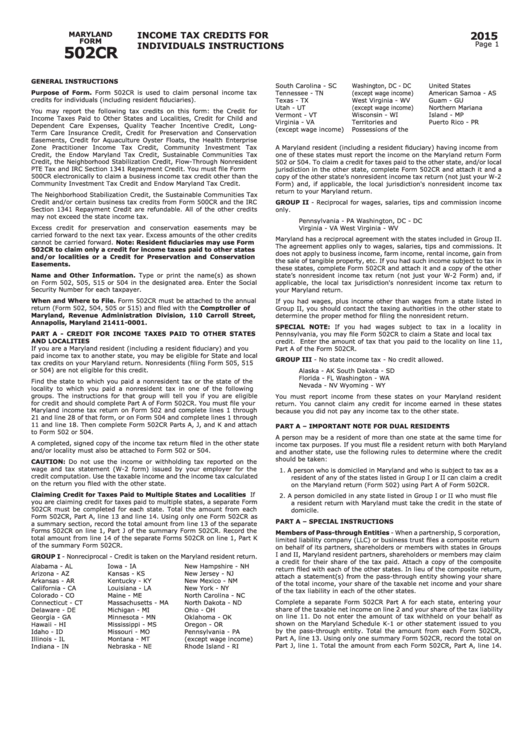

Maryland Form 502Cr

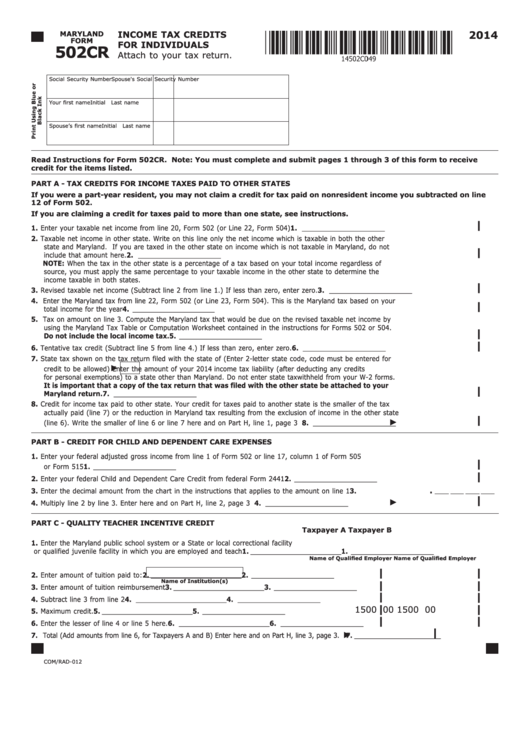

Maryland Form 502Cr - This form is for income earned in tax year 2022, with tax returns due in april. This form is for income earned in tax year 2022, with tax returns due in april. Web the return of the other state or on the maryland return (line 29 of form 502). Enter the social security number for each taxpayer. Web 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Maryland form 502cr is an income tax return designed specifically for full capita maryland taxpayers. Web there is no jump to for maryland form 502cr because the form is used for multiple credits. Most of these credits are on the screen take a look at maryland. You must complete and submit pages 1 through 3 of this form to receive credit for the. You can download or print current or past.

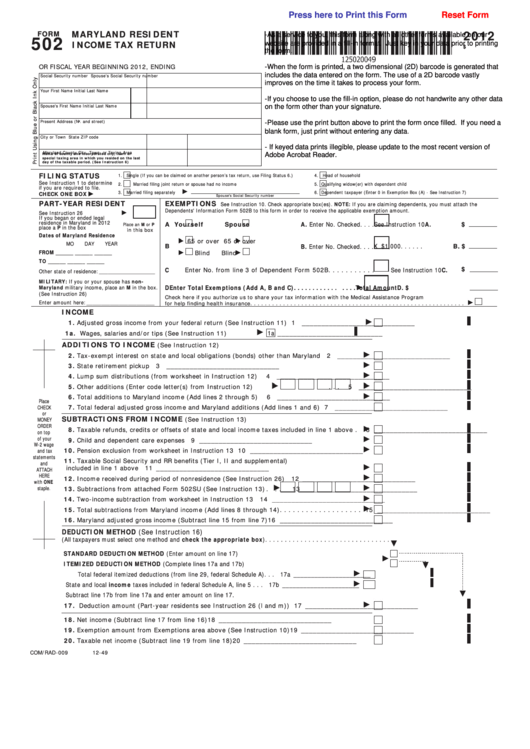

Web the return of the other state or on the maryland return (line 29 of form 502). Enter your taxable net income from line 20, form 502 (or line 10, form 504). Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web the form 502: Web read instructions for form 502cr. Web on form 502, form 505 or form 515 in the designated area. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Enter the social security number for each taxpayer. It is issued by the. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022.

This is an income tax credit for individuals. Web form 502cr is used to claim the conservation easement tax credit. Web initial spouse's last name read instructions for form 502cr. 2020 tax return resident income maryland (comptroller of maryland) form is 4 pages long and contains: This form is for income earned in tax year 2022, with tax returns due in april. You must complete and submit pages 1 through 3 of this form to receive credit for the items listed. Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. Web we last updated maryland form 502cr in january 2023 from the maryland comptroller of maryland. The form is estimated to. You must complete and submit pages 1 through 4 of this form to receive credit for the items listed.

Fill Free fillable forms Comptroller of Maryland

It is issued by the. Taxable net income in other state. This form is for income earned in tax year 2022, with tax returns due in april. Web the form 502: Web a maryland resident having income from one of these states must report the income on the maryland return form 502.

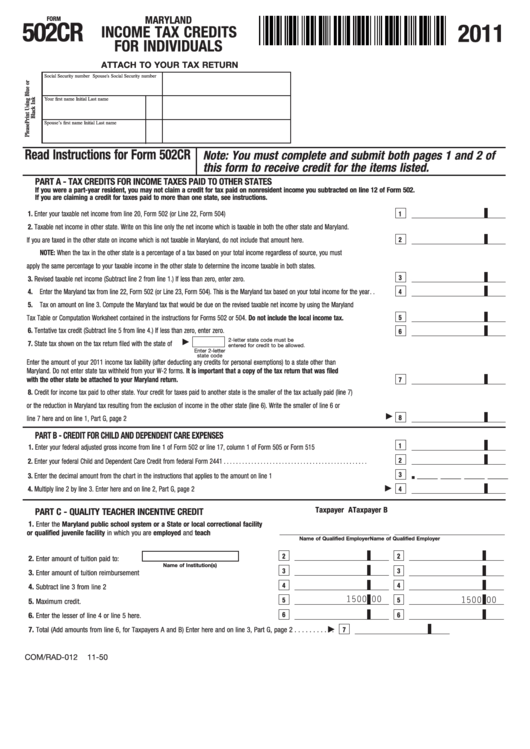

Fillable Form 502cr Maryland Tax Credits For Individuals

Web read instructions for form 502cr. Most of these credits are on the screen take a look at maryland. Web the return of the other state or on the maryland return (line 29 of form 502). Web what is a maryland 502cr form? Form 502cr must be attached to.

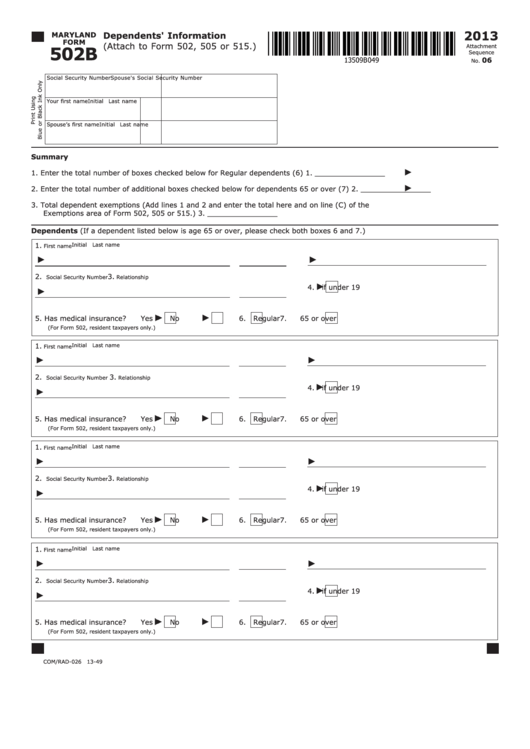

Fillable Maryland Form 502b Dependents' Information 2013 printable

For individuals form 502cr must be attached to your maryland tax return. Web 2023 individual income tax forms 2023 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web we last updated.

Fill Free fillable forms Comptroller of Maryland

Web we last updated the retirement income form in january 2023, so this is the latest version of form 502r, fully updated for tax year 2022. You must complete and submit pages 1 through 3 of this form to receive credit for the. Most of these credits are on the screen take a look at maryland. Form 502cr must be.

Fillable Form 502 Maryland Resident Tax Return, Form 502b

You must complete and submit pages 1 through 3 of this form to receive credit for the. When and where to file. Web we last updated maryland form 502r in january 2023 from the maryland comptroller of maryland. Web form 2013 attachment sequence no. Web initial spouse's last name read instructions for form 502cr.

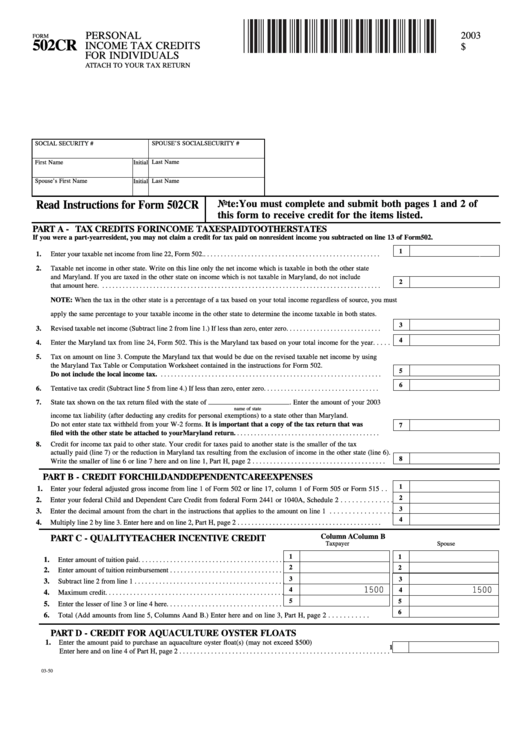

Fillable Form 502cr Personal Tax Credits For Individuals

Web form 2013 attachment sequence no. Web what is maryland form 502cr? Taxable net income in other state. This form is for income earned in tax year 2022, with tax returns due in april. Web initial spouse's last name read instructions for form 502cr.

Fill Free fillable forms Comptroller of Maryland

Maryland form 502cr is an income tax return designed specifically for full capita maryland taxpayers. Write on this line only the net. Taxable net income in other state. This form is for income earned in tax year 2022, with tax returns due in april. Web there is no jump to for maryland form 502cr because the form is used for.

Instructions For Maryland Form 502cr Tax Credits For

You can download or print current or past. The form is estimated to. This form is for income earned in tax year 2022, with tax returns due in april. Maryland form 502cr is an income tax return designed specifically for full capita maryland taxpayers. Web on form 502, form 505 or form 515 in the designated area.

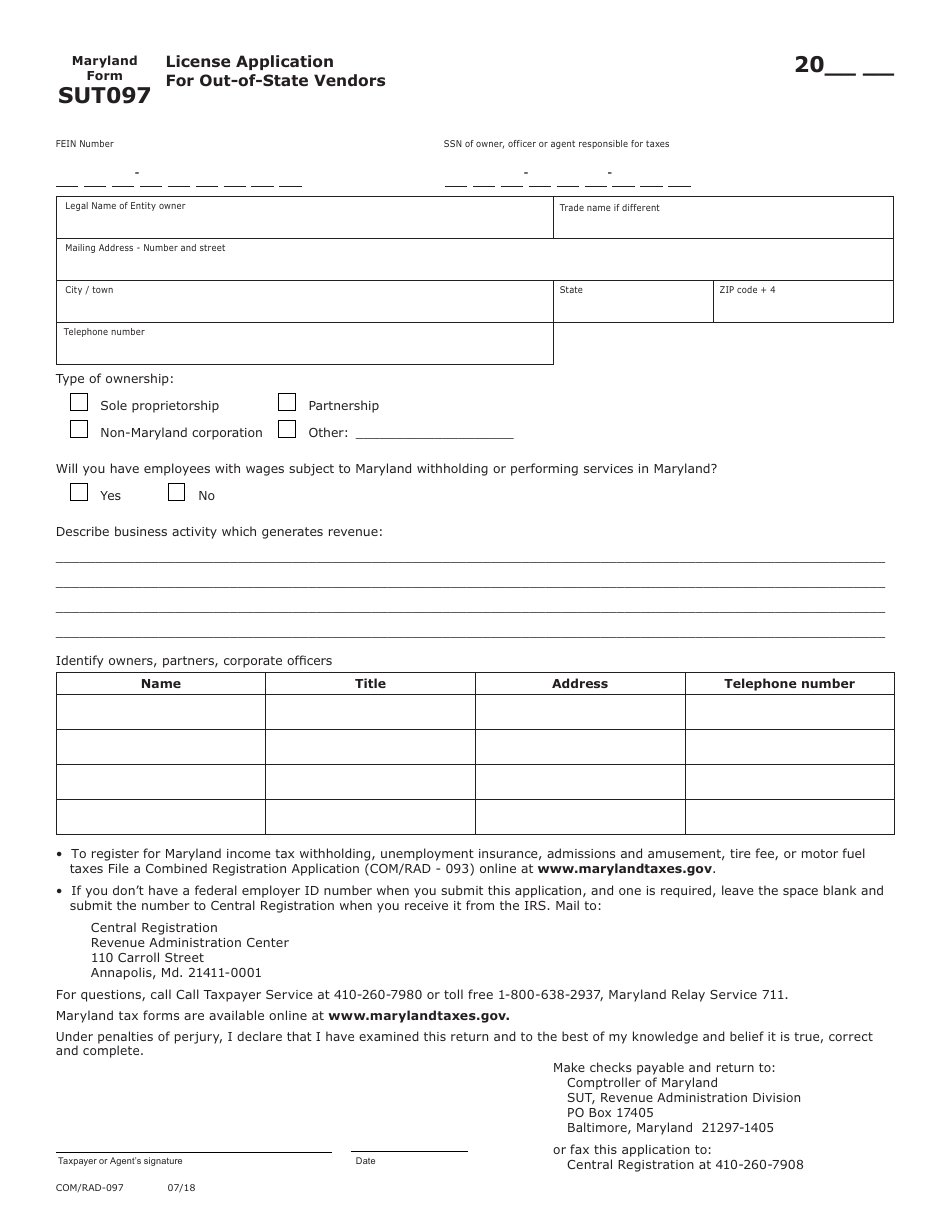

Form COM/RAD097 (Maryland Form SUT097) Download Fillable PDF or Fill

Web the form 502: Web there is no jump to for maryland form 502cr because the form is used for multiple credits. Web a maryland resident having income from one of these states must report the income on the maryland return form 502. Web initial spouse's last name read instructions for form 502cr. Most of these credits are on the.

Fillable Maryland Form 502cr Tax Credits For Individuals

Enter your taxable net income from line 20, form 502 (or line 10, form 504). Web initial spouse's last name read instructions for form 502cr. 2020 tax return resident income maryland (comptroller of maryland) form is 4 pages long and contains: You must complete and submit pages 1 through 3 of this form to receive credit for the. Taxable net.

Web The Return Of The Other State Or On The Maryland Return (Line 29 Of Form 502).

Maryland form 502cr is an income tax return designed specifically for full capita maryland taxpayers. Web we last updated the maryland personal income tax credits for individuals in january 2023, so this is the latest version of form 502cr, fully updated for tax year 2022. Web form 502cr is used to claim the conservation easement tax credit. Form 502cr must be attached to.

Web On Form 502, Form 505 Or Form 515 In The Designated Area.

Enter your taxable net income from line 20, form 502 (or line 10, form 504). To claim a credit for taxes paid to the other state, and/or local jurisdiction in the other state, complete form 502cr and attach it and a copy of the. You must complete and submit pages 1 through 3 of this form to receive credit for the. When and where to file.

12 Please Read Instructions For Form 502Cr.

Web we last updated maryland form 502r in january 2023 from the maryland comptroller of maryland. Web initial spouse's last name read instructions for form 502cr. You can download or print current or past. Most of these credits are on the screen take a look at maryland.

The Form Is Estimated To.

Web form 2013 attachment sequence no. Taxable net income in other state. For individuals form 502cr must be attached to your maryland tax return. 2020 tax return resident income maryland (comptroller of maryland) form is 4 pages long and contains: