Pa Lst Exemption Form

Pa Lst Exemption Form - Web local services tax exemption application. Do not file this form with your earned. Web no, the local services tax (lst) exemption certificate form is an optional form. • this application for exemption from the local services tax must be signed. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their jurisdictions of less than $12,000 or $15,600 in areas. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting documents, must be completed and presented to your employer. This form may be used in conjunction with your sales tax/wholesaler license to. Earned income tax paper forms. Lookup psd codes and tax rates use the.

This form may be used in conjunction with your sales tax/wholesaler license to. Web local services tax paper forms. Earned income tax paper forms. What is the purpose of this form? • this application for exemption from the local services tax must be signed. This form should be completed if you expect to receive. Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers income. Lookup psd codes and tax rates use the. Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their jurisdictions of less than $12,000 or $15,600 in areas. Web no, the local services tax (lst) exemption certificate form is an optional form.

This form should be completed if you expect to receive. What is the purpose of this form? Web local services tax paper forms. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting documents, must be completed and presented to your employer. Web no, the local services tax (lst) exemption certificate form is an optional form. Local services tax paper forms. Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their jurisdictions of less than $12,000 or $15,600 in areas. Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers income. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Web local services tax for the municipality or school district in which you are primarily employed.

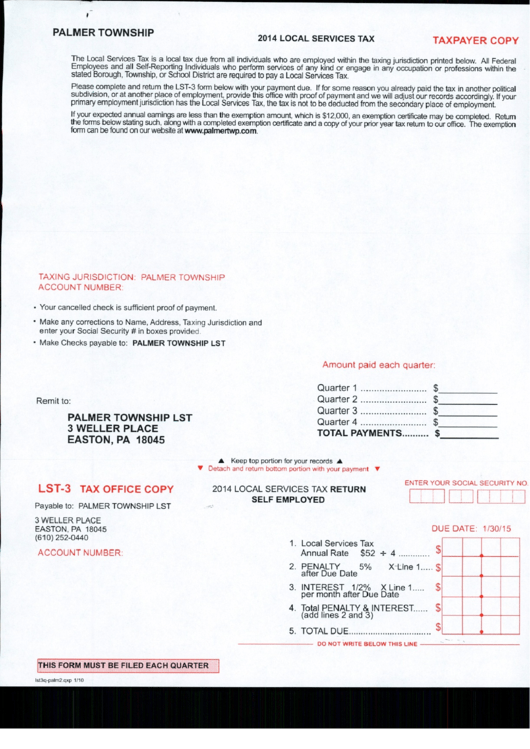

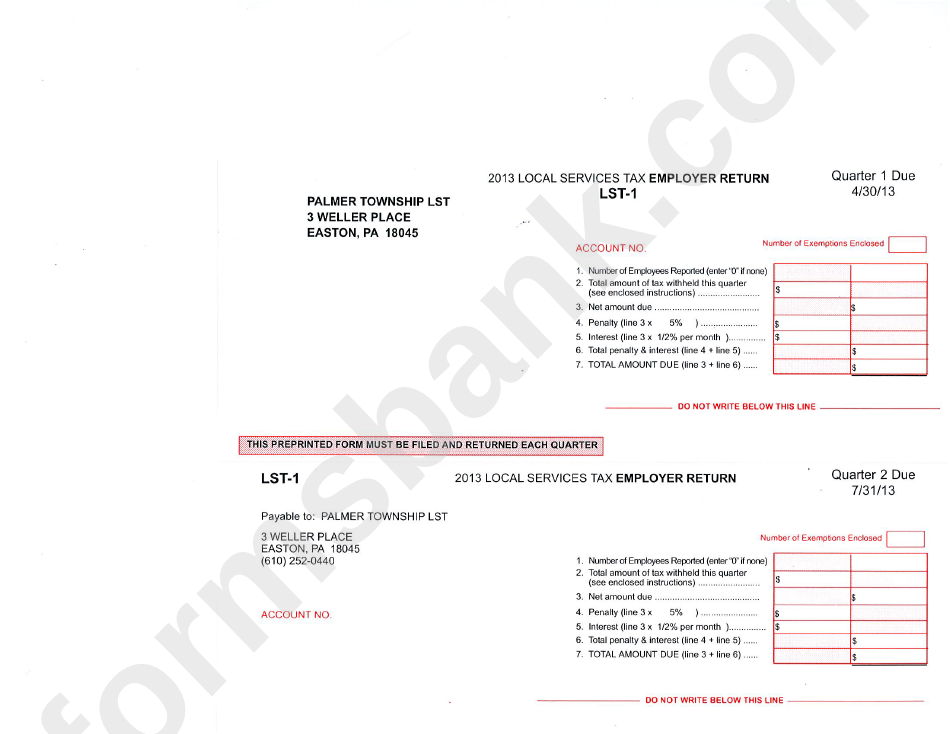

Form Lst3 Local Services Tax Return Self Employed Palmer Township

Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the. Lookup psd codes and tax rates use the. Local services tax paper forms. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting documents, must be completed and presented to.

20202022 Form PA DoR REV1220 AS Fill Online, Printable, Fillable

Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers income. Web 1125 berkshire blvd, suite 115, wyomissing, pa 19610. Sample lst spreadsheet for employer online filing. Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded.

Pa Exemption Certificate Fill and Sign Printable Template Online US

Web no, the local services tax (lst) exemption certificate form is an optional form. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: What is the purpose of this form? Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals.

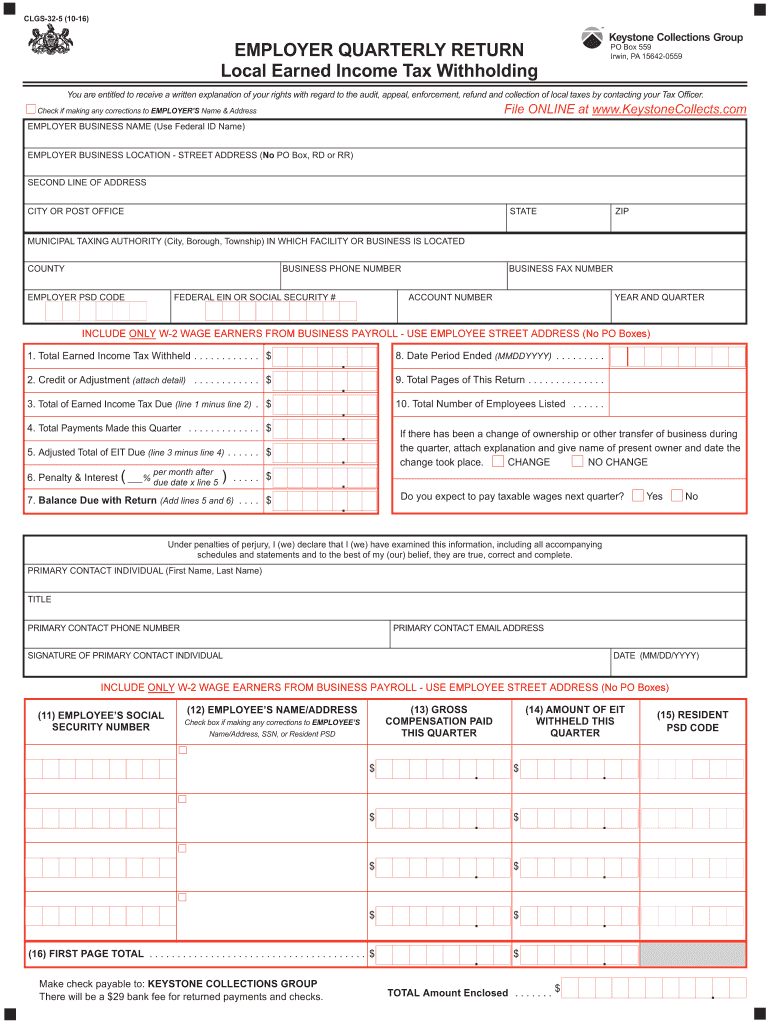

PA DCED CLGS325 2016 Fill out Tax Template Online US Legal Forms

Sample lst spreadsheet for employer online filing. This form may be used in conjunction with your sales tax/wholesaler license to. Web 1125 berkshire blvd, suite 115, wyomissing, pa 19610. Web local services tax exemption application. Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers.

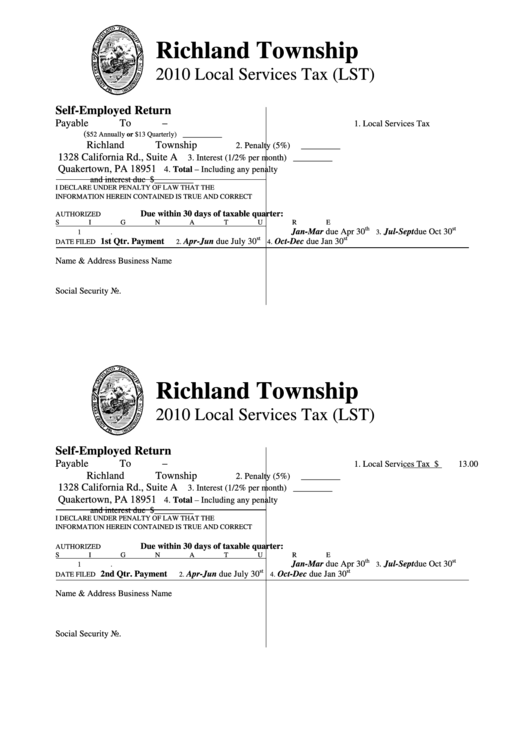

Local Services Tax (Lst) Form Richland Township 2010 printable pdf

Web local services tax for the municipality or school district in which you are primarily employed. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn.

PA Form 541 Franklin County 2019 Fill out Tax Template Online US

Web local services tax exemption application. Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the. Sample lst spreadsheet for employer online filing. Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers.

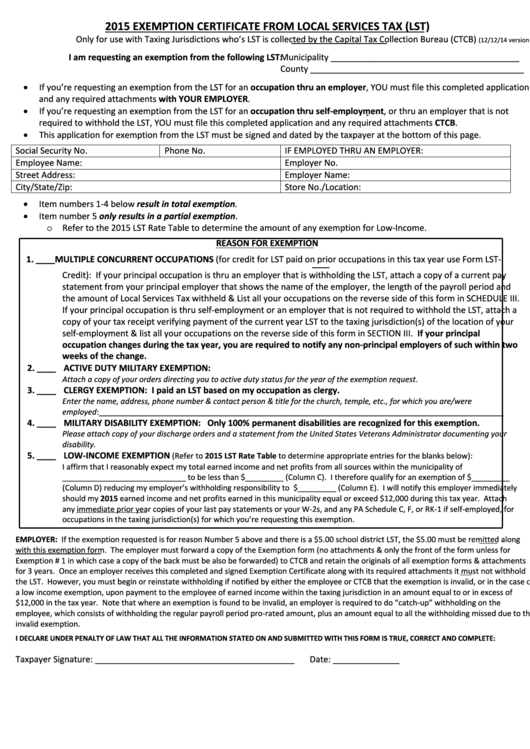

Exemption Certificate From Local Services Tax (Lst) Pennsylvania

Web 1125 berkshire blvd, suite 115, wyomissing, pa 19610. Web local services tax exemption application. Earned income tax paper forms. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Lookup psd codes and tax rates use the.

Form Lst1 Local Services Tax Employer Return Palmer Township Lst

Do not file this form with your earned. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Local services tax (lst) forms / returns. Web local services tax exemption application. Web 1125 berkshire blvd, suite 115, wyomissing, pa 19610.

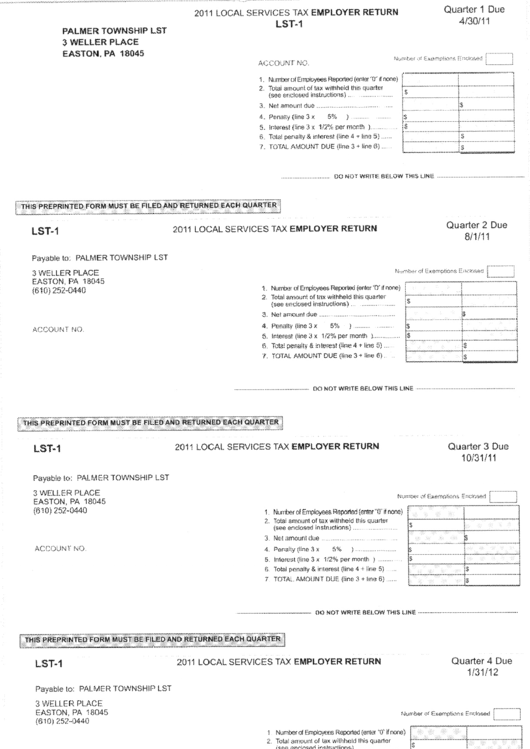

Form Lst1 Local Services Tax Employer Return 2011 printable pdf

Local services tax (lst) forms / returns. File completed application with keystone collections group, po box 559, irwin, pa 15642. Local services tax instructions and form booklet. Web 1125 berkshire blvd, suite 115, wyomissing, pa 19610. Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the.

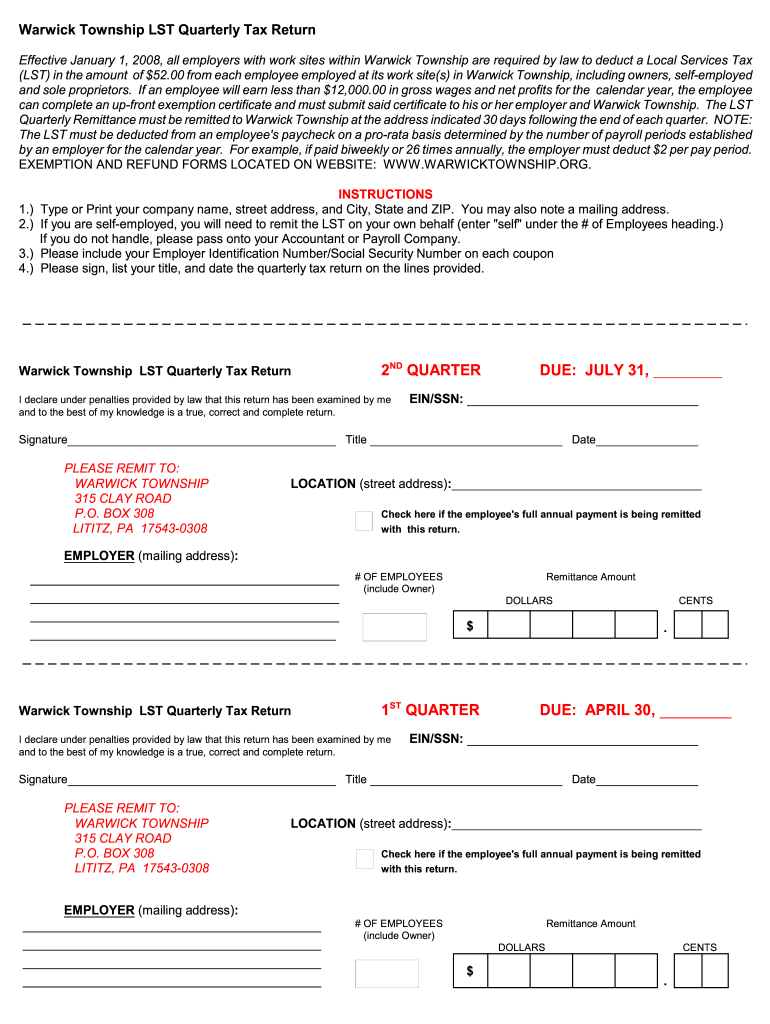

PA Warwick Township LST Quarterly Tax Return Fill out Tax Template

Web no, the local services tax (lst) exemption certificate form is an optional form. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the. Local services.

Sample Lst Spreadsheet For Employer Online Filing.

What is the purpose of this form? Web local services tax paper forms. • this application for exemption from the local services tax must be signed. Lookup psd codes and tax rates use the.

Local Services Tax Paper Forms.

Web 1125 berkshire blvd, suite 115, wyomissing, pa 19610. Earned income tax paper forms. Do not file this form with your earned. Web an exemption certificate can be obtained at the city web site www.city.pittsburgh.pa.us/finance a copy should be forwarded to pittsburgh and the.

Web No, The Local Services Tax (Lst) Exemption Certificate Form Is An Optional Form.

Web if the total lst rate enacted exceeds $10.00, the act requires that all jurisdictions exempt individuals with incomes within their jurisdictions of less than $12,000 or $15,600 in areas. Web follow the four (4) steps outlined below in order to comply with local income tax requirements as an employer in pa: Web po box 559 • irwin pa 15642 form lst22r2.1 local services tax refund application name address city/state zip tax year ssn phone multiple employers income. Local services tax instructions and form booklet.

This Form Should Be Completed If You Expect To Receive.

This form may be used in conjunction with your sales tax/wholesaler license to. File completed application with keystone collections group, po box 559, irwin, pa 15642. Web local services tax exemption application. Web a copy of this application for exemption from the local services tax (lst), and all necessary supporting documents, must be completed and presented to your employer.