Form 8959 Additional Medicare Tax

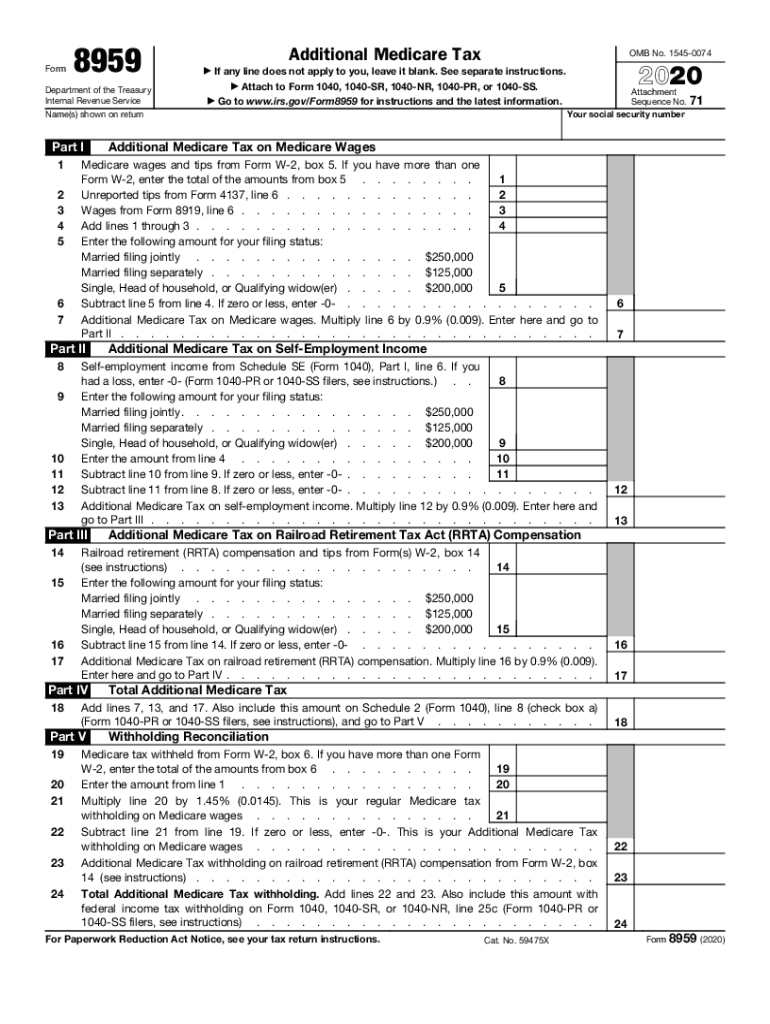

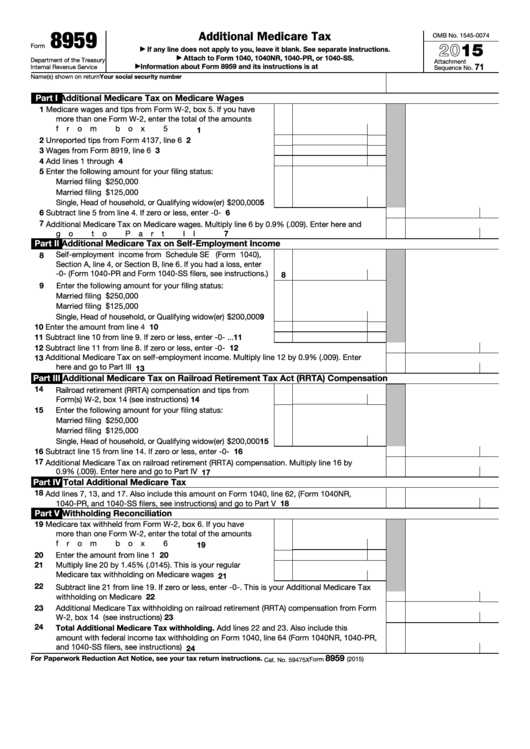

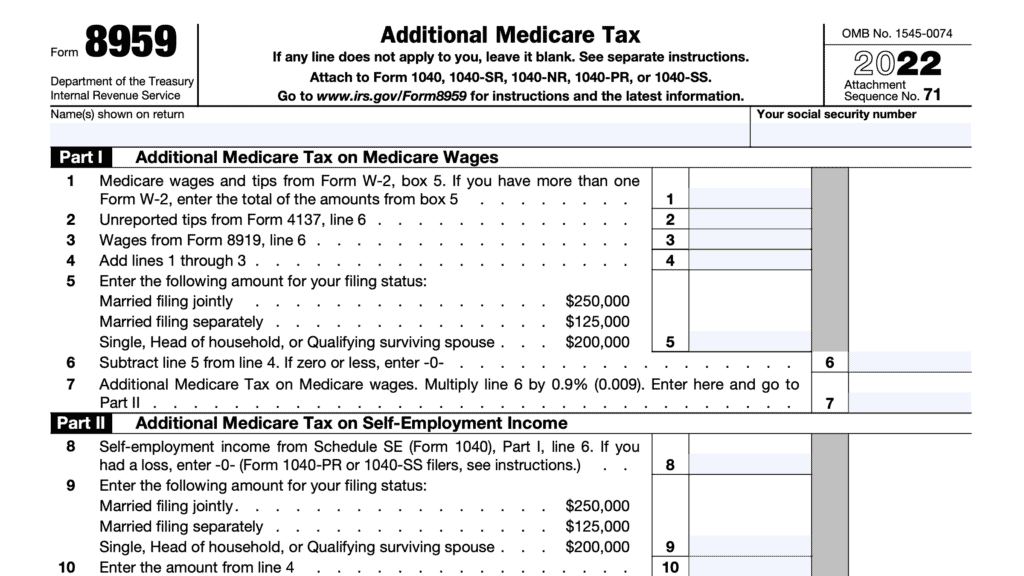

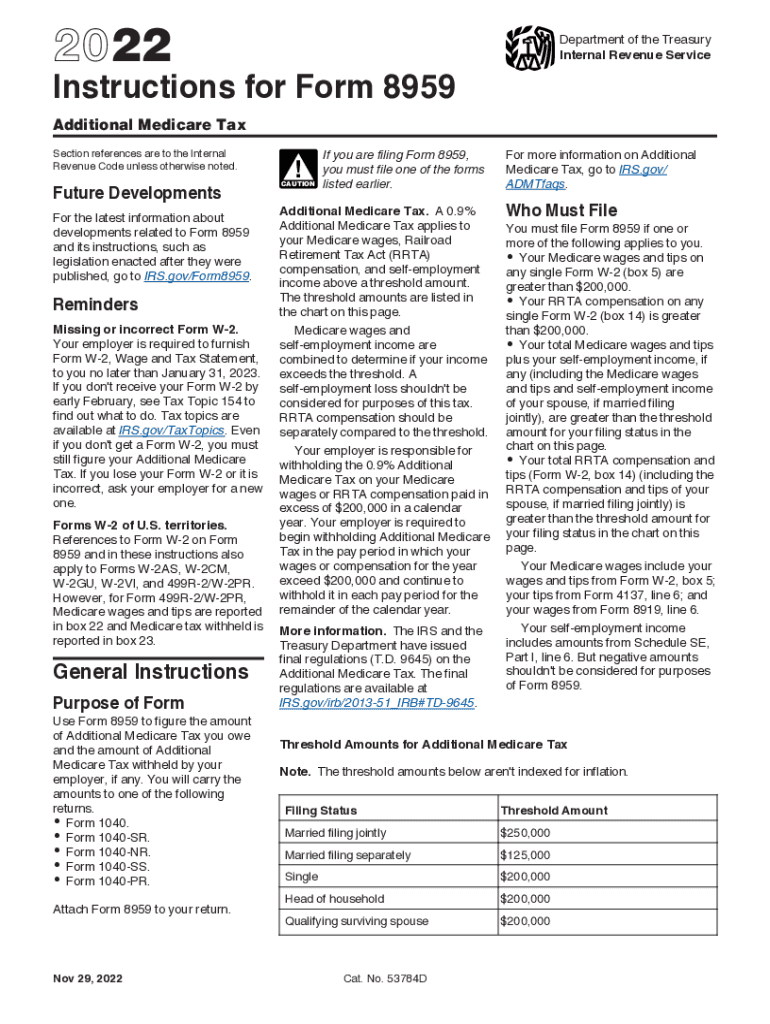

Form 8959 Additional Medicare Tax - This is wrong and i don't want to upgrade. Web what do you think? Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else. Individuals will also report additional medicare tax withheld by. Part i additional medicare tax on medicare wages. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. I got to the end of the flow in turbotax free, but i'm being told i have to upgrade due to form 8959 which only deluxe can handle. Additional medicare tax on medicare wages in part i, taxpayers will calculate the total additional tax on medicare wages. This is a new tax added by the creation of.

Most taxpayers won’t complete all parts, but we’ll go through each part in detail. You can find these thresholds in the instructions for form 8959. I got to the end of the flow in turbotax free, but i'm being told i have to upgrade due to form 8959 which only deluxe can handle. Web turbotax says i have additional medicare tax (form 8959) and need to upgrade. Individuals will also report additional medicare tax withheld by. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. How do i complete irs form 8959? This is wrong and i don't want to upgrade. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else.

Web turbotax says i have additional medicare tax (form 8959) and need to upgrade. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. How do i complete irs form 8959? This is a new tax added by the creation of. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else. For instructions and the latest information. You can find these thresholds in the instructions for form 8959. Web how much is subject to additional medicare tax.

Form 8959 Additional Medicare Tax (2014) Free Download

How do i complete irs form 8959? Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web how much is subject to additional medicare tax. Additional medicare tax on medicare wages in part i, taxpayers will calculate the total additional tax on medicare wages. Web turbotax says i have additional.

Form 8959 Fill Out and Sign Printable PDF Template signNow

Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. This is a new tax added by the creation of. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Web turbotax says i have.

What Is the Form 8959 Additional Medicare Tax for Earners

Individuals will also report additional medicare tax withheld by. This is wrong and i don't want to upgrade. I got to the end of the flow in turbotax free, but i'm being told i have to upgrade due to form 8959 which only deluxe can handle. Web what do you think? Web turbotax says i have additional medicare tax (form.

How to Complete IRS Form 8959 Additional Medicare Tax YouTube

For instructions and the latest information. Medicare wages and tips from. This is wrong and i don't want to upgrade. Individuals will also report additional medicare tax withheld by. Web what do you think?

Fillable Form 8959 Additional Medicare Tax 2015 printable pdf download

Medicare wages and tips from. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. Carl must file form 8959. Most taxpayers won’t complete all parts, but we’ll go through each part in detail. How can i finish the filing.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Part i additional medicare tax on medicare wages. Additional medicare tax on medicare wages in part i, taxpayers will calculate the total additional tax on medicare wages. Most taxpayers won’t complete all parts, but we’ll go through each part in detail. How do i complete irs form 8959? Individuals will also report additional medicare tax withheld by.

IRS Form 8960 Instructions Guide to Net Investment Tax

Medicare wages and tips from. Individuals will also report additional medicare tax withheld by. I got to the end of the flow in turbotax free, but i'm being told i have to upgrade due to form 8959 which only deluxe can handle. Web how much is subject to additional medicare tax. Web turbotax says i have additional medicare tax (form.

2022 Form IRS 8959 Instructions Fill Online, Printable, Fillable

This is a new tax added by the creation of. Carl must file form 8959. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and.

Form 8959 additional medicare tax Australian instructions Stepby

Part i additional medicare tax on medicare wages. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file. Most taxpayers won’t.

Download Instructions for IRS Form 8959 Additional Medicare Tax PDF

Individuals will also report additional medicare tax withheld by. For instructions and the latest information. Web how much is subject to additional medicare tax. Carl must file form 8959. How can i finish the filing without upgrading?

How Can I Finish The Filing Without Upgrading?

Web what do you think? Web turbotax says i have additional medicare tax (form 8959) and need to upgrade. You can find these thresholds in the instructions for form 8959. This is a new tax added by the creation of.

Carl Must File Form 8959.

That threshold is $250,000 for jointly filing couples, $125,000 for married couples filing separately, and $200,000 for everybody else. Most taxpayers won’t complete all parts, but we’ll go through each part in detail. For instructions and the latest information. Web beginning with the 2013 tax year, you have to file form 8959 if the medicare wages or rrta reported exceed $200,000 for single filers or $250,000 for joint filers.

This Is Wrong And I Don't Want To Upgrade.

Part i additional medicare tax on medicare wages. How do i complete irs form 8959? Additional medicare tax on medicare wages in part i, taxpayers will calculate the total additional tax on medicare wages. I got to the end of the flow in turbotax free, but i'm being told i have to upgrade due to form 8959 which only deluxe can handle.

Medicare Wages And Tips From.

Web how much is subject to additional medicare tax. Use this form to figure the amount of additional medicare tax you owe and the amount of additional medicare tax withheld by your employer, if any. It is an additional.9% on top of the.0145 that your employer already. Web information about form 8959, additional medicare tax, including recent updates, related forms and instructions on how to file.