Msu 1098-T Form

Msu 1098-T Form - Secondary contact (s) stephen c. Persons with a hearing or speech disability with access to. Select the preferred tax year. Log into campus connection 2. The form includes payment and scholarship. I understand that i may request a paper copy by contacting the student accounts. You must file for each student you enroll and for whom a reportable transaction is made. It provides the total dollar amount paid by the student for what is referred to as. For more information whether you may be eligible for either the hope or lifelong learning credit, please. Students may consent through their student eservices account to.

For more information whether you may be eligible for either the hope or lifelong learning credit, please. You must file for each student you enroll and for whom a reportable transaction is made. I understand that i may request a paper copy by contacting the student accounts. Log into campus connection 2. It provides the total dollar amount paid by the student for what is referred to as. Students may consent through their student eservices account to. The form includes payment and scholarship. Select the preferred tax year. Persons with a hearing or speech disability with access to. Web form description recipients irs required due date to recipient department contact ;

Log into campus connection 2. Secondary contact (s) stephen c. For more information whether you may be eligible for either the hope or lifelong learning credit, please. It provides the total dollar amount paid by the student for what is referred to as. The form includes payment and scholarship. Select the preferred tax year. Web form description recipients irs required due date to recipient department contact ; Persons with a hearing or speech disability with access to. You must file for each student you enroll and for whom a reportable transaction is made. I understand that i may request a paper copy by contacting the student accounts.

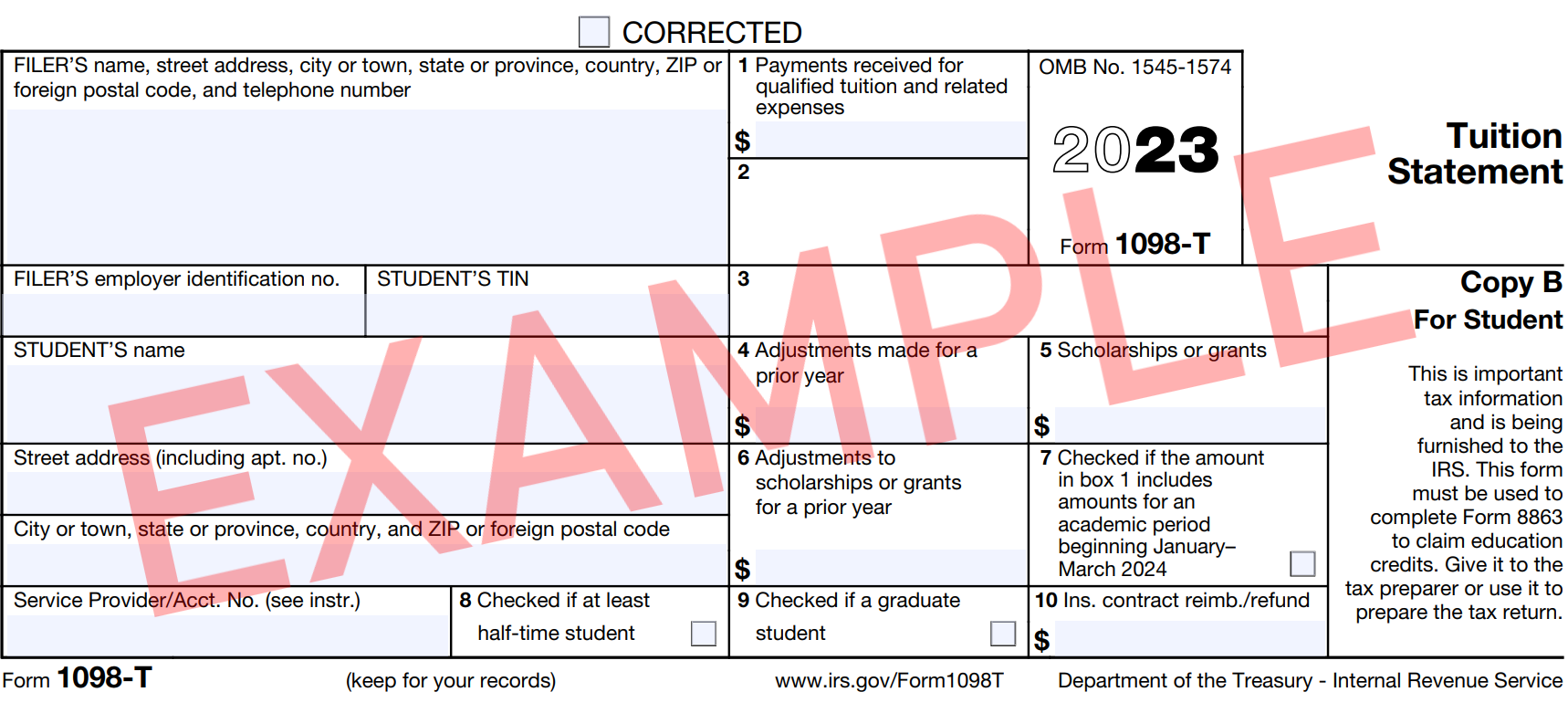

Form 1098T, Tuition Statement, Student Copy B

Web form description recipients irs required due date to recipient department contact ; The form includes payment and scholarship. Students may consent through their student eservices account to. It provides the total dollar amount paid by the student for what is referred to as. You must file for each student you enroll and for whom a reportable transaction is made.

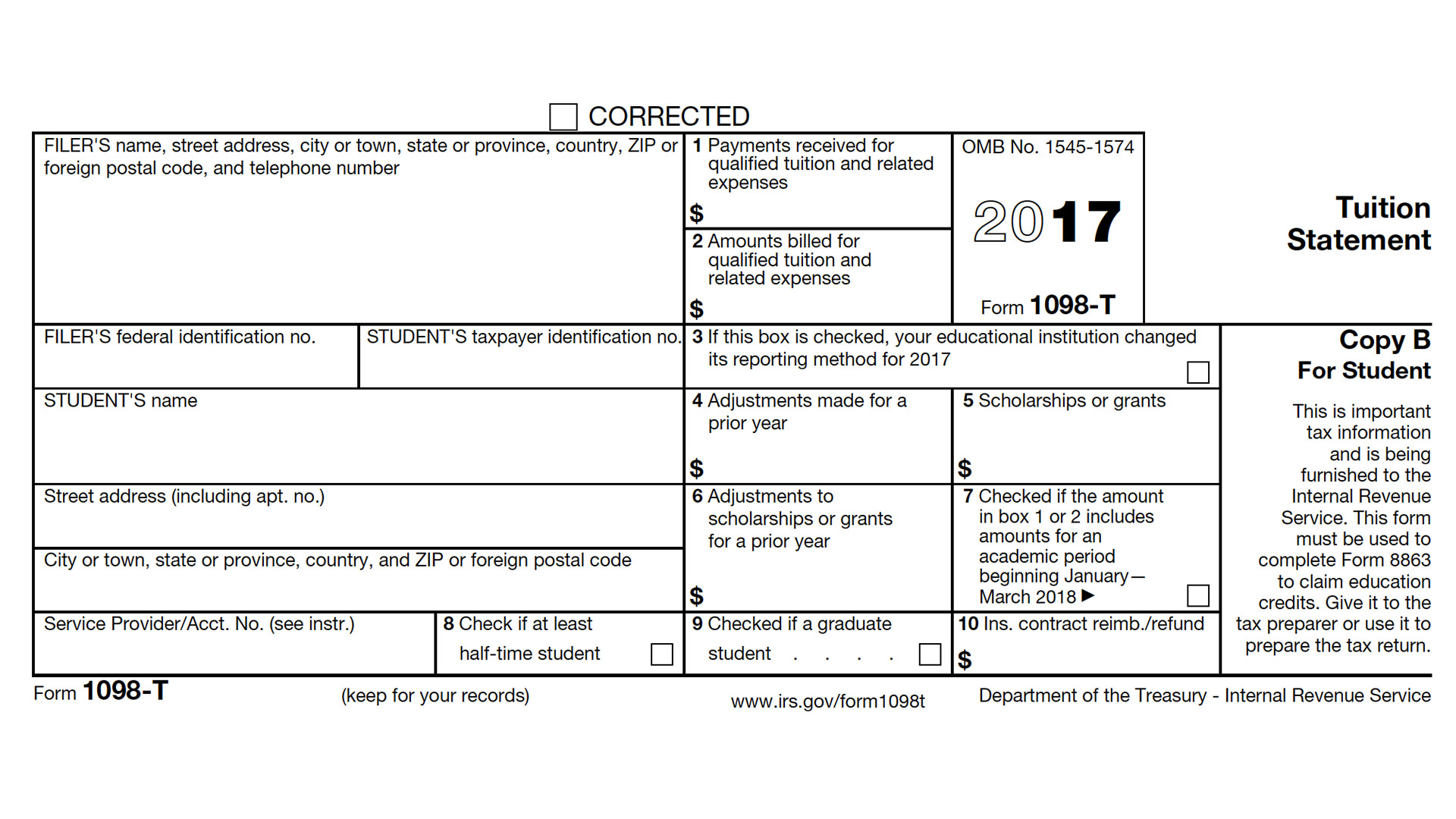

Viewing Historic 1098T Forms Student Enterprise Systems

Select the preferred tax year. Students may consent through their student eservices account to. Persons with a hearing or speech disability with access to. For more information whether you may be eligible for either the hope or lifelong learning credit, please. Web lori swindell, accounting manager, financial services.

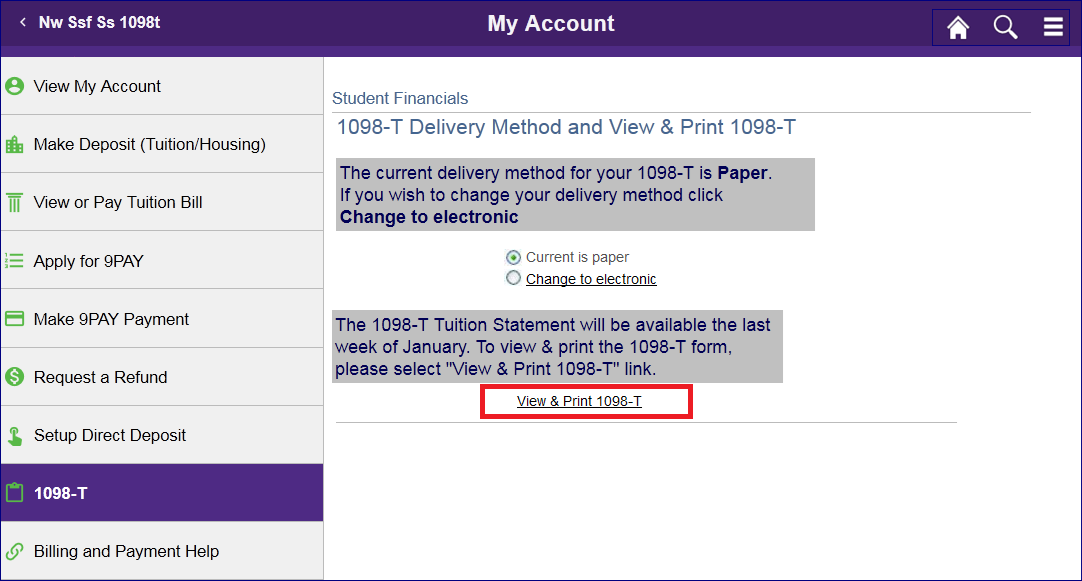

Form 1098T Information Student Portal

Persons with a hearing or speech disability with access to. For more information whether you may be eligible for either the hope or lifelong learning credit, please. Secondary contact (s) stephen c. It provides the total dollar amount paid by the student for what is referred to as. Web lori swindell, accounting manager, financial services.

Irs Form 1098 T Explanation Universal Network

Select the preferred tax year. Log into campus connection 2. You must file for each student you enroll and for whom a reportable transaction is made. The form includes payment and scholarship. It provides the total dollar amount paid by the student for what is referred to as.

Form 1098T Information Student Portal

I understand that i may request a paper copy by contacting the student accounts. You must file for each student you enroll and for whom a reportable transaction is made. Web form description recipients irs required due date to recipient department contact ; It provides the total dollar amount paid by the student for what is referred to as. Secondary.

Irs Form 1098 T Box 4 Universal Network

Students may consent through their student eservices account to. For more information whether you may be eligible for either the hope or lifelong learning credit, please. Select the preferred tax year. You must file for each student you enroll and for whom a reportable transaction is made. Web form description recipients irs required due date to recipient department contact ;

Form 1098T Everything you need to know Go TJC

The form includes payment and scholarship. Log into campus connection 2. You must file for each student you enroll and for whom a reportable transaction is made. Students may consent through their student eservices account to. Web form description recipients irs required due date to recipient department contact ;

Form 1098 T Alchetron, The Free Social Encyclopedia

Students may consent through their student eservices account to. The form includes payment and scholarship. You must file for each student you enroll and for whom a reportable transaction is made. Secondary contact (s) stephen c. Log into campus connection 2.

Claim your Educational Tax Refund with IRS Form 1098T

You must file for each student you enroll and for whom a reportable transaction is made. For more information whether you may be eligible for either the hope or lifelong learning credit, please. Secondary contact (s) stephen c. Web form description recipients irs required due date to recipient department contact ; Students may consent through their student eservices account to.

1098 T Calendar Year Month Calendar Printable

Secondary contact (s) stephen c. The form includes payment and scholarship. Persons with a hearing or speech disability with access to. I understand that i may request a paper copy by contacting the student accounts. Students may consent through their student eservices account to.

Select The Preferred Tax Year.

The form includes payment and scholarship. It provides the total dollar amount paid by the student for what is referred to as. I understand that i may request a paper copy by contacting the student accounts. Log into campus connection 2.

Students May Consent Through Their Student Eservices Account To.

Persons with a hearing or speech disability with access to. Secondary contact (s) stephen c. You must file for each student you enroll and for whom a reportable transaction is made. For more information whether you may be eligible for either the hope or lifelong learning credit, please.

Web Lori Swindell, Accounting Manager, Financial Services.

Web form description recipients irs required due date to recipient department contact ;