Irs Form 568

Irs Form 568 - Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. The llc is doing business in california. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. You still have to file form 568 if the llc is registered in california. Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 3522 with the franchise tax board of california. Web visit affordable care credit page for more information about filing a tax return with form 8962. Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. The llc isn't actively doing business in california, or; If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income.

Web visit affordable care credit page for more information about filing a tax return with form 8962. Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 3522 with the franchise tax board of california. If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. The llc is organized in california. The llc is doing business in california. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. Web the generated ca form 568 will only have half of the reported values. A name control is established by the irs when the taxpayer requests an employer identification number (ein). Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california.

Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 3522 with the franchise tax board of california. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. But then turbo tax will generate only one ca 568 form with a business income of $500. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc. Web application for irs individual taxpayer identification number. If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. The llc is organized in another state or foreign country, but registered with the california sos. You still have to file form 568 if the llc is registered in california. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35.

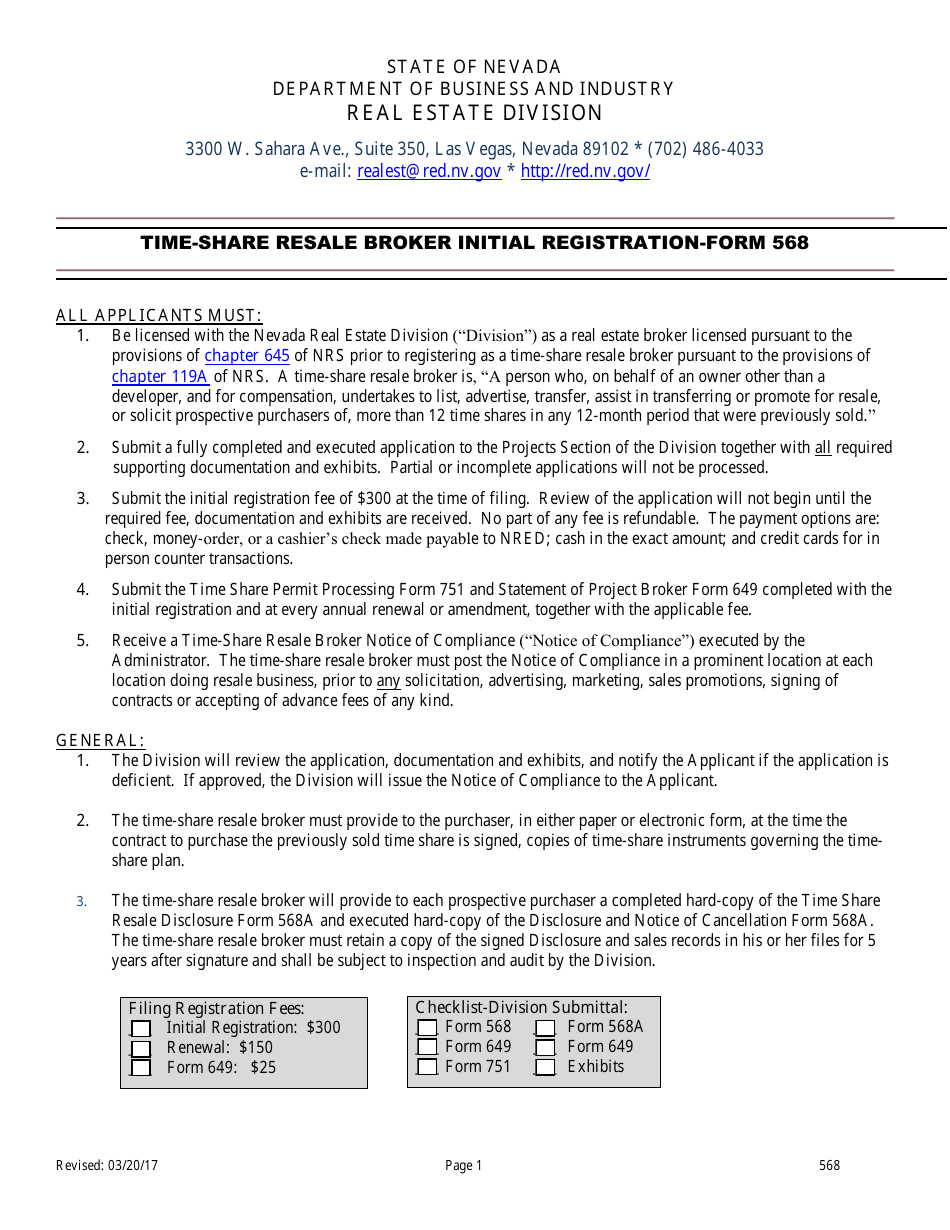

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

The llc doesn't have a california source of income; Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. In general, for taxable years beginning.

Instructions For Form 568 Limited Liability Company Return Of

Web visit affordable care credit page for more information about filing a tax return with form 8962. But then turbo tax will generate only one ca 568 form with a business income of $500. The llc doesn't have a california source of income; Web the generated ca form 568 will only have half of the reported values. Web application for.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. You still have to file form 568 if the llc is registered in california. Web visit affordable care credit page for more information about filing a tax return with form 8962. In general, for taxable years beginning.

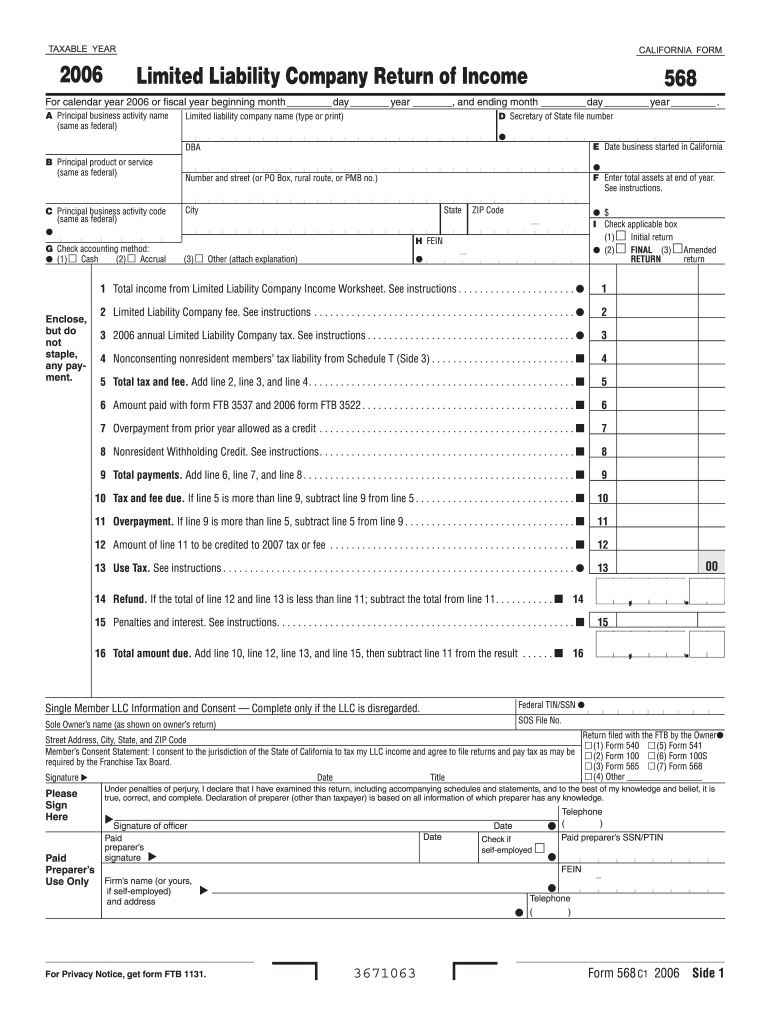

2006 Form CA FTB 568 Fill Online, Printable, Fillable, Blank PDFfiller

Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. The llc doesn't have a california source of income; I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest).

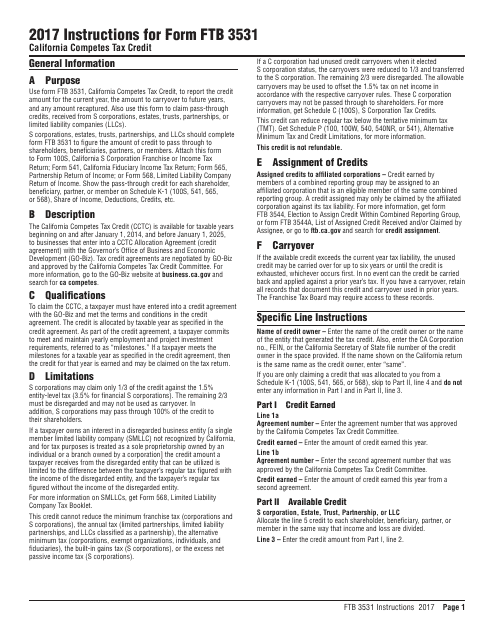

Instructions for Form Ftb 3531 California Competes Tax Credit

Web the generated ca form 568 will only have half of the reported values. Web 2022 instructions for form 568, limited liability company return of income. References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). I (1) during this taxable year, did another person.

Irs Form 2290 Printable Form Resume Examples

References in these instructions are to the internal revenue code (irc) as of january 1, 2015, and to the california revenue and taxation code (r&tc). You still have to file form 568 if the llc is registered in california. Web the generated ca form 568 will only have half of the reported values. Web form 568 accounts for the income,.

Form 568 Instructions 2022 State And Local Taxes Zrivo

The llc doesn't have a california source of income; A name control is established by the irs when the taxpayer requests an employer identification number (ein). I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds.

3.11.213 Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC

Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply: Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. The llc is organized in another state or foreign country, but registered with the california.

File IRS 2290 Form Online for 20222023 Tax Period

If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. The llc isn't actively doing business in california, or; Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. The llc is organized in california. Web visit affordable.

IRS Mileage Rate 2022 IRS TaxUni

Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins. The llc doesn't have a california source of income; If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. References in these.

But Then Turbo Tax Will Generate Only One Ca 568 Form With A Business Income Of $500.

The llc doesn't have a california source of income; Get or renew an individual taxpayer identification number (itin) for federal tax purposes if you are not eligible for a social security number. I (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc holds a controlling or majority interest that owned california real property (i.e., land, buildings), leased such property for a term of 35. Web it is important that the combination of name control and taxpayer identification number (tin) provided on an electronically filed return match irs’s record of name controls and tins.

The Llc Is Organized In Another State Or Foreign Country, But Registered With The California Sos.

You still have to file form 568 if the llc is registered in california. The llc isn't actively doing business in california, or; Llcs classified as a disregarded entity or partnership are required to file form 568 along with form 3522 with the franchise tax board of california. Web form 568 must be filed by every llc that is not taxable as a corporation if any of the following apply:

References In These Instructions Are To The Internal Revenue Code (Irc) As Of January 1, 2015, And To The California Revenue And Taxation Code (R&Tc).

If your total business income is $1000, you create two husband/wife llcs for federal taxes each with $500 income. The llc is doing business in california. The llc is organized in california. Web form 568 accounts for the income, withholding, coverages, taxes, and additional financial elements of your private limited liability company, or llc.

Web 2022 Instructions For Form 568, Limited Liability Company Return Of Income.

Web the generated ca form 568 will only have half of the reported values. In general, for taxable years beginning on or after january 1, 2015, california law conforms to the internal revenue. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. Web visit affordable care credit page for more information about filing a tax return with form 8962.