Maryland Form Pv 2023

Maryland Form Pv 2023 - Web forms are available for downloading in the resident individuals income tax forms section below. Web online payment application options. This form is for income earned in tax year 2022, with tax returns due in april. If mailing form pv with form 502 or 505, place form pv with attached check/money order on top of tax form 502 or form 505. Log in to the editor using your credentials or click create free. Sign it in a few clicks. • if mailing form pv with form 502 or 505, place form pv with attached check/money order on top of tax form 502 or form 505. You can use this calculator to compute the amount of tax due, but. Resident individuals income tax forms electronic filing signature and payment. Web we last updated maryland form pvw in february 2023 from the maryland comptroller of maryland.

You can use this calculator to compute the amount of tax due, but. • if mailing form pv with form 502 or 505, place form pv with attached check/money order on top of tax form 502 or form 505. Web once signed into law by governor moore, maryland will become the 23 rd u.s. Web follow these quick steps to modify the pdf maryland pv form online for free: This form is for income earned in tax year 2022, with tax. This is an online version of the pvw worksheet. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. Sign it in a few clicks. Web maryland state department of assessments and taxation declaration of estimated franchise tax for telephone, electric, and gas. Sign up and log in to your account.

Log in to the editor using your credentials or click create free. View history of payments filed via this system. Web your 2023 declaration and full payment of the estimated tax are due on or before january 15, 2024. This form is for income earned in tax year 2022, with tax. Web we last updated maryland form pvw in february 2023 from the maryland comptroller of maryland. This is an online version of the pvw worksheet. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax. Web follow these quick steps to modify the pdf maryland pv form online for free: Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. Resident individuals income tax forms electronic filing signature and payment.

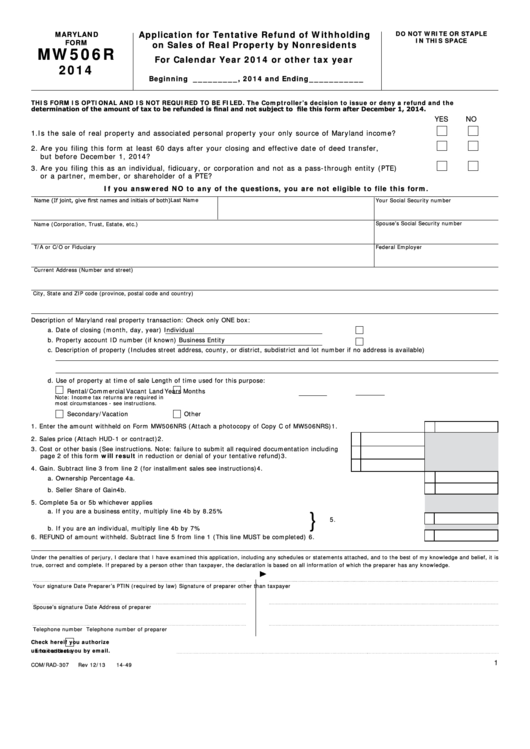

Fillable Maryland Form Mw506r Application For Tentative Refund Of

Web • attach check or money order to form pv. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax. Web we last updated maryland form pvw in february 2023 from the maryland comptroller of.

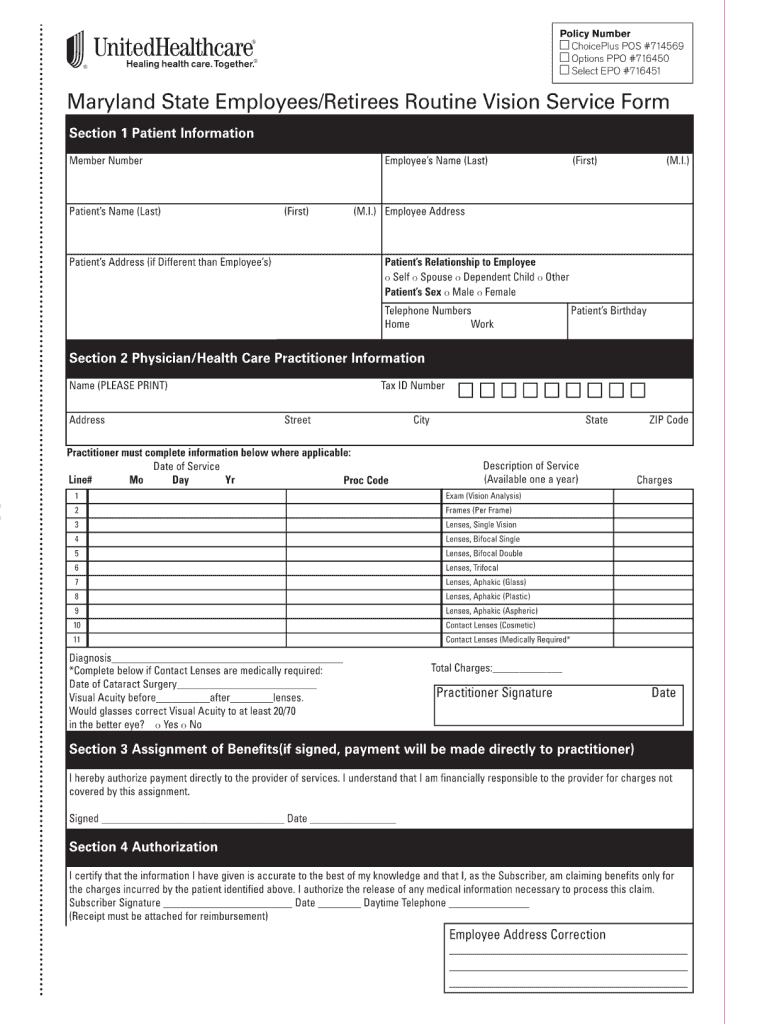

United healthcare state of maryland vision form Fill out & sign online

Web online payment application options. This is an online version of the pvw worksheet. View history of payments filed via this system. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax. Show sources >.

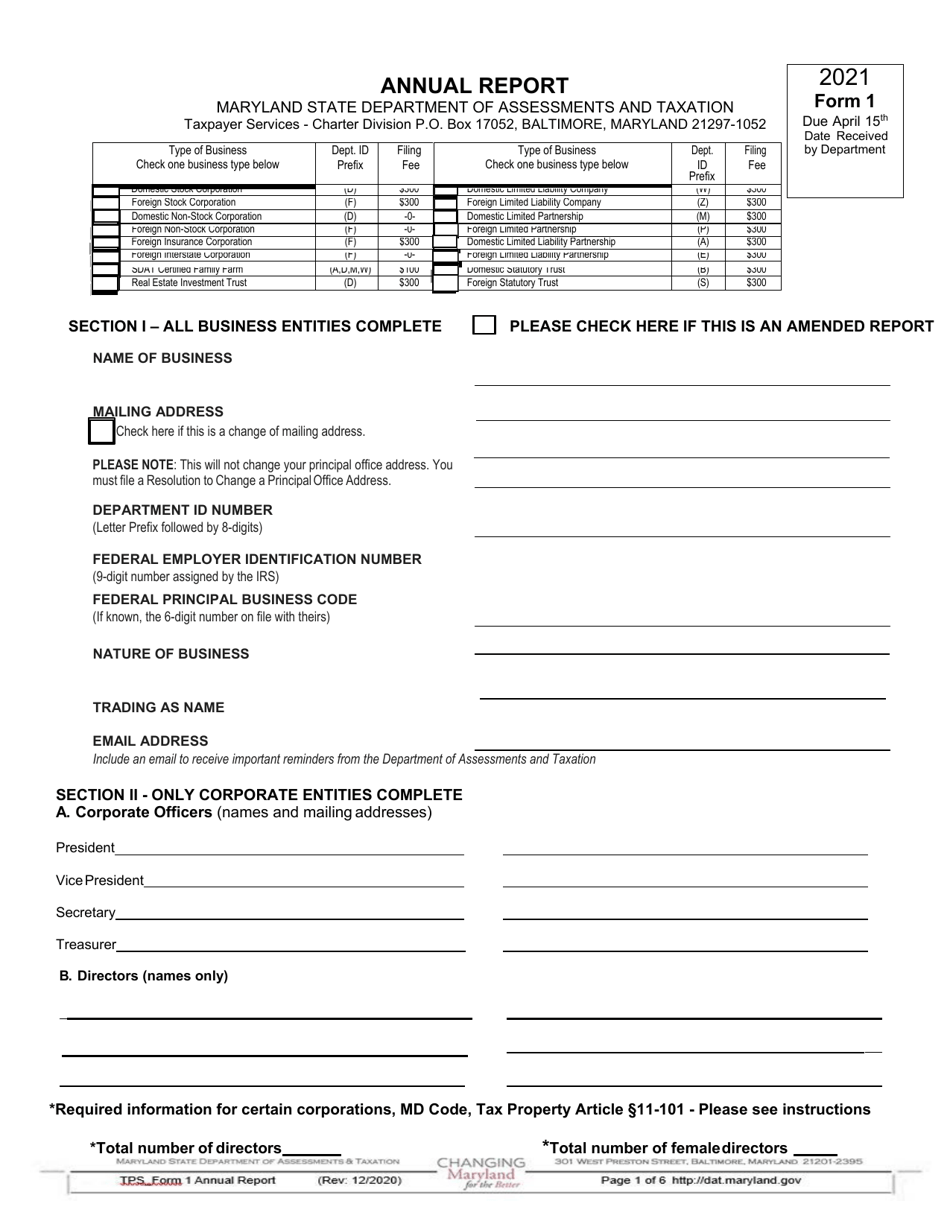

Form 1 Download Fillable PDF or Fill Online Annual Report 2021

Web we last updated maryland form pvw in february 2023 from the maryland comptroller of maryland. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax. Show sources > form pv worksheet is a maryland.

Fill Free fillable forms Comptroller of Maryland

If mailing form pv with form 502 or 505, place form pv with attached check/money order on top of tax form 502 or form 505. If you are sending a form. Description of the documents for the maryland renewable energy portfolio standard. Web • attach check or money order to form pv. Log in to the editor using your credentials.

2021 Form MD Comptroller 500D Fill Online, Printable, Fillable, Blank

This is an online version of the pvw worksheet. Show sources > form pv worksheet is a maryland individual income. Web once signed into law by governor moore, maryland will become the 23 rd u.s. You do not have to file the declaration if you file your complete tax return. Web online payment application options.

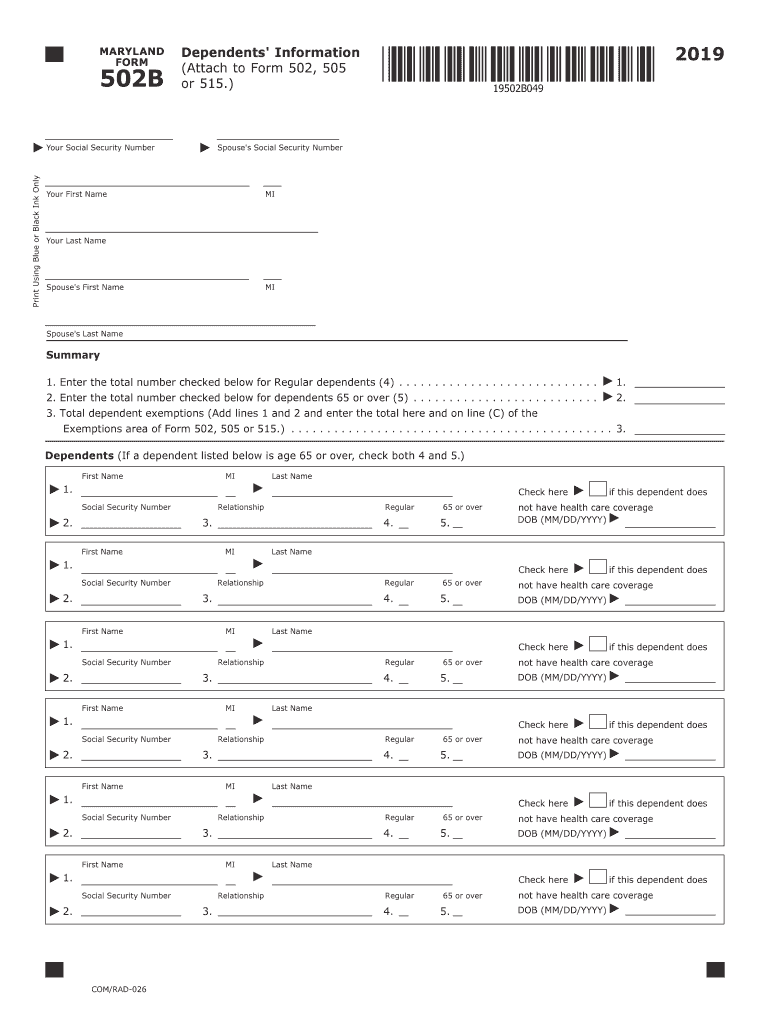

502B Fill Out and Sign Printable PDF Template signNow

If you are sending a form. Web we last updated maryland form pv worksheet from the comptroller of maryland in february 2023. This form is for income earned in tax year 2022, with tax returns due in april. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. If mailing form.

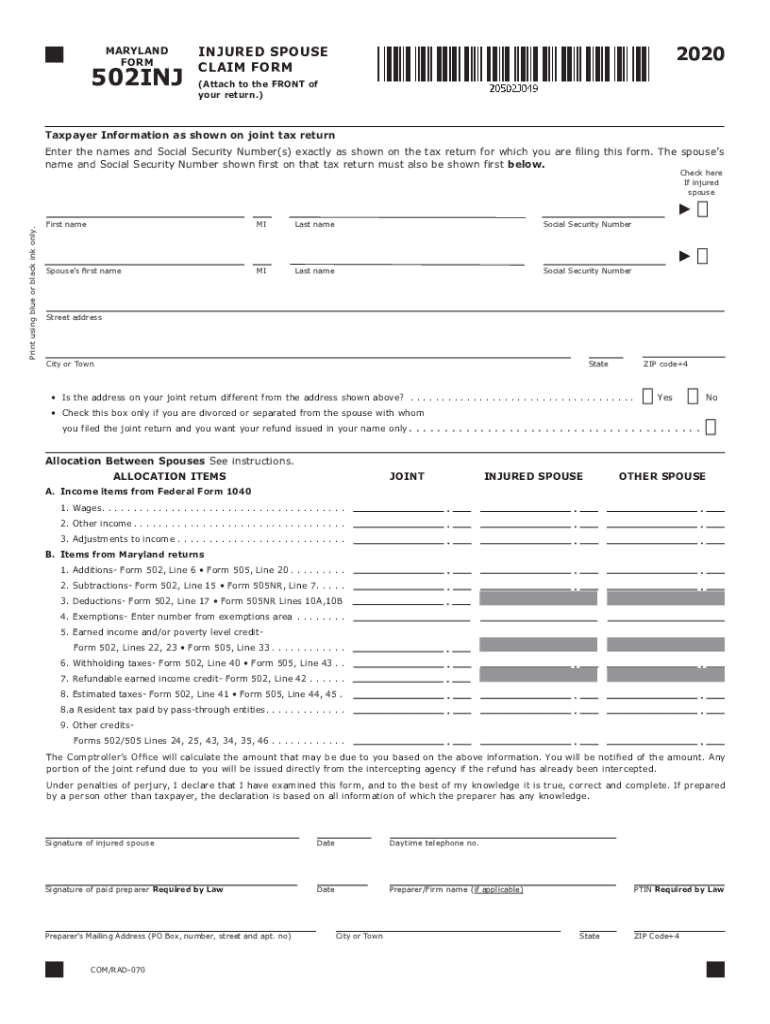

maryland injured spouse form Fill out & sign online DocHub

Web online payment application options. If you are sending a form. Web • attach check or money order to form pv. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. This form is for income earned in tax year 2022, with tax.

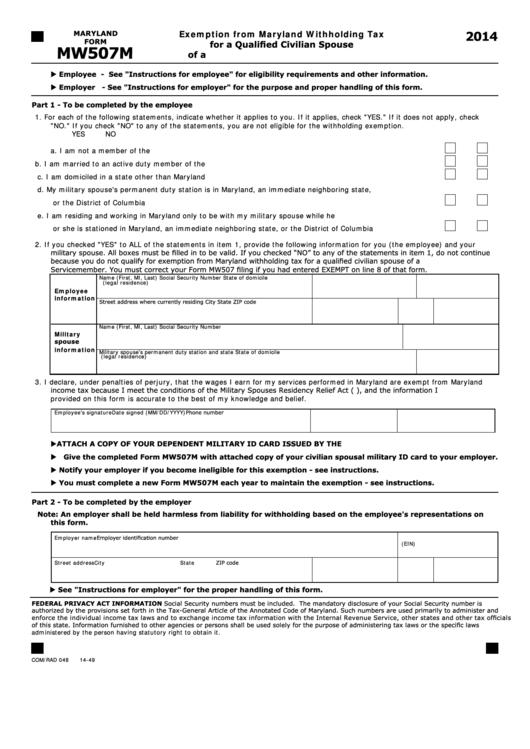

Fillable Maryland Form Mw507m Exemption From Maryland Withholding Tax

Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. This form is for income earned in tax year 2022, with tax. Web your 2023 declaration and full payment of the estimated tax are due on or before january 15, 2024. Description of the documents for the maryland renewable energy portfolio.

Maryland Printable Tax Forms Printable Form 2022

Description of the documents for the maryland renewable energy portfolio standard. • if mailing form pv with form 502 or 505, place form pv with attached check/money order on top of tax form 502 or form 505. This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks. This.

Rmv Tint Waiver Fill Out and Sign Printable PDF Template signNow

Log in to the editor using your credentials or click create free. This form is for income earned in tax year 2022, with tax. Show sources > form pv worksheet is a maryland individual income. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount.

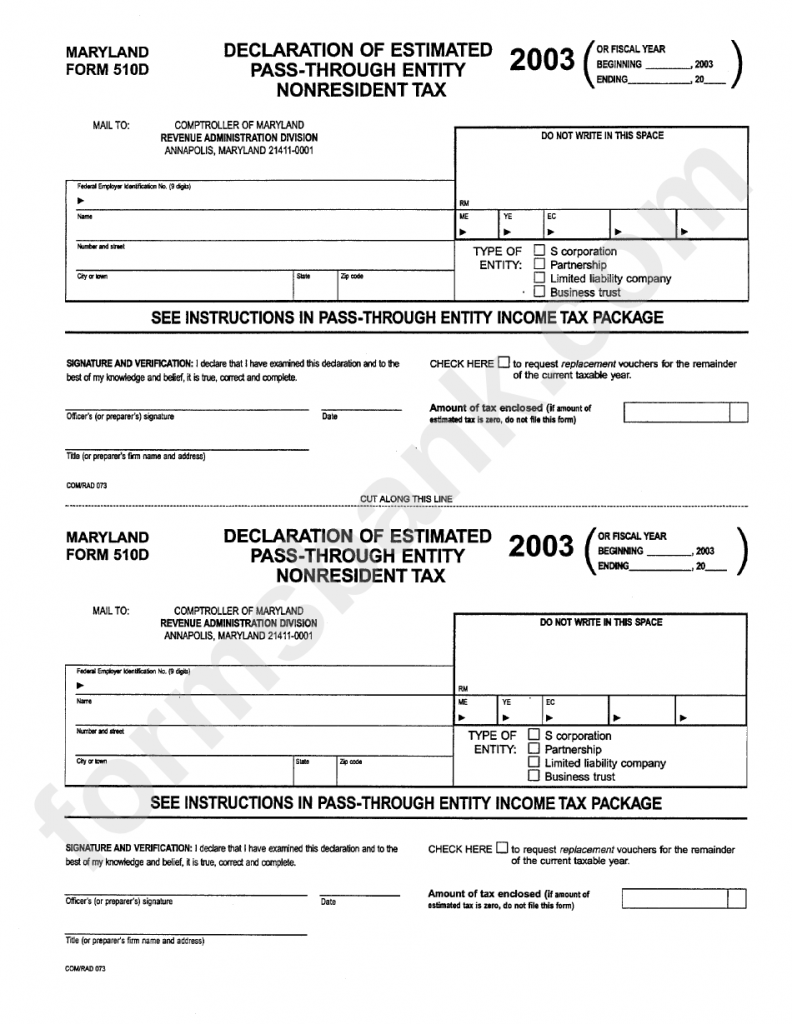

Web Maryland State Department Of Assessments And Taxation Declaration Of Estimated Franchise Tax For Telephone, Electric, And Gas.

Web once signed into law by governor moore, maryland will become the 23 rd u.s. Resident individuals income tax forms electronic filing signature and payment. Web online payment application options. Web your 2023 declaration and full payment of the estimated tax are due on or before january 15, 2024.

If You Are Sending A Form.

Description of the documents for the maryland renewable energy portfolio standard. Web follow these quick steps to modify the pdf maryland pv form online for free: View history of payments filed via this system. Web forms are available for downloading in the resident individuals income tax forms section below.

Web • Attach Check Or Money Order To Form Pv.

Web • attach check or money order to form pv. Show sources > form pv worksheet is a maryland individual income. • if mailing form pv with form 502 or 505, place form pv with attached check/money order on top of tax form 502 or form 505. Log in to the editor using your credentials or click create free.

If Mailing Form Pv With Form 502 Or 505, Place Form Pv With Attached Check/Money Order On Top Of Tax Form 502 Or Form 505.

This form is for income earned in tax year 2022, with tax returns due in april. You can use this calculator to compute the amount of tax due, but. Web the form pv is a payment voucher you will send with your check or money order for any balance due in the “total amount due” line of your forms 502 and 505, estimated tax. You do not have to file the declaration if you file your complete tax return.