Delaware Form 200-C Instructions 2022

Delaware Form 200-C Instructions 2022 - Your employer erroneously withheld delaware income taxes, and c. Some information on this website is provided in pdf. Delaware department of insurance bureau of captive & financial products 1351 west north. Form 200ci delaware composite return instructions. Get ready for tax season deadlines by completing any required tax forms today. Total income tax liability you expect to owe 2. Form 209 claim for refund of deceased taxpayer. Resident individual income tax return general instructions. Form 200es req request for change. Web make check payable and mail to:

Tax refund inquiry check the status of your delaware personal income tax refund online. Form 200ci delaware composite return instructions. Your employer has not and will not file a claim for refund of such erroneous withholdings. Some information on this website is provided in pdf. Delaware division of revenue, p.o. Be sure to verify that the form you are downloading is for the. Electronic filing is fast, convenient, accurate and. Web extension form must be filed by 1. Electronic filing is fast, convenient,. Web delaware has a state income tax that ranges between 2.2% and 6.6%.

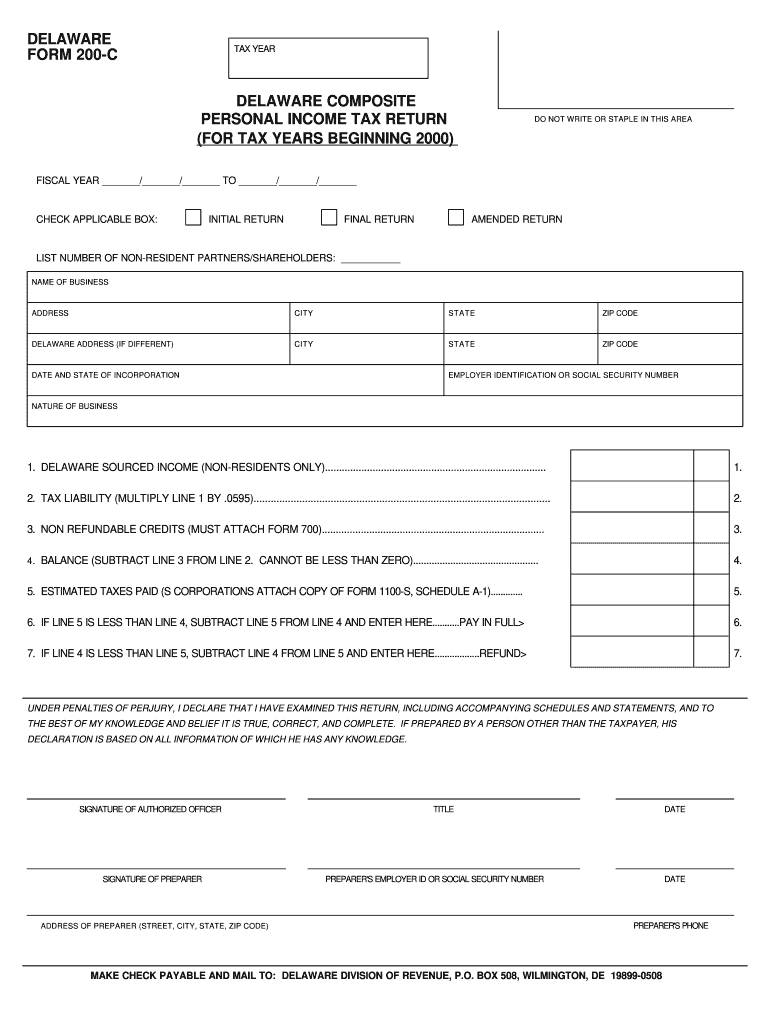

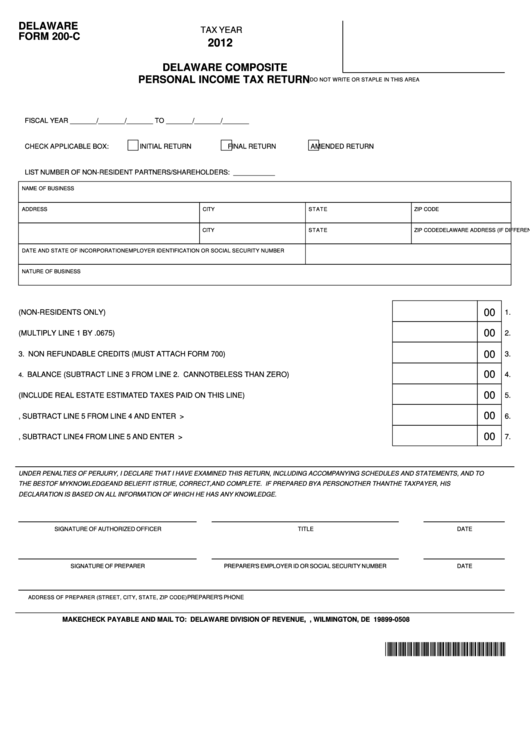

Your employer erroneously withheld delaware income taxes, and c. Form 209 claim for refund of deceased taxpayer. Web form 200c delaware composite return. Delaware department of insurance bureau of captive & financial products 1351 west north. Resident individual income tax return general instructions. Be sure to verify that the form you are downloading is for the. Complete, edit or print tax forms instantly. Web we last updated delaware form 200c in april 2021 from the delaware division of revenue. Total income tax liability you expect to owe 2. The delaware division of revenue will accept a composite return of.

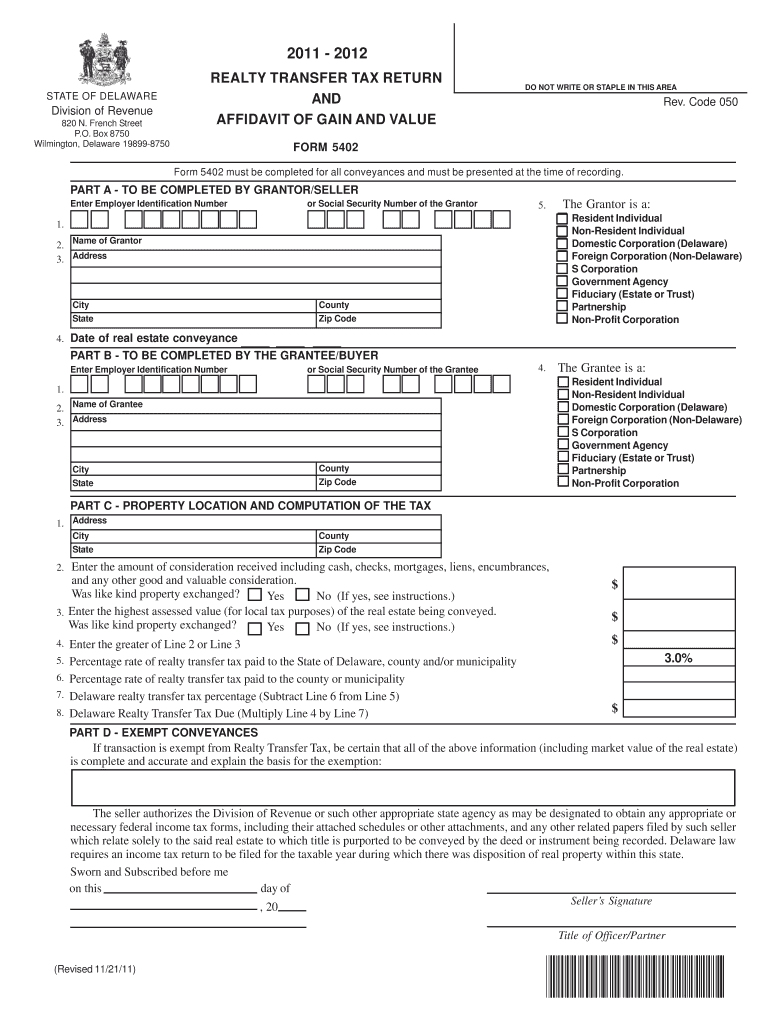

Delaware Form 5402 Instructions Fill Online, Printable, Fillable

Form 200ci delaware composite return instructions. Get ready for tax season deadlines by completing any required tax forms today. Be sure to verify that the form you are downloading is for the. Web extension form must be filed by 1. Web delaware has a state income tax that ranges between 2.2% and 6.6%.

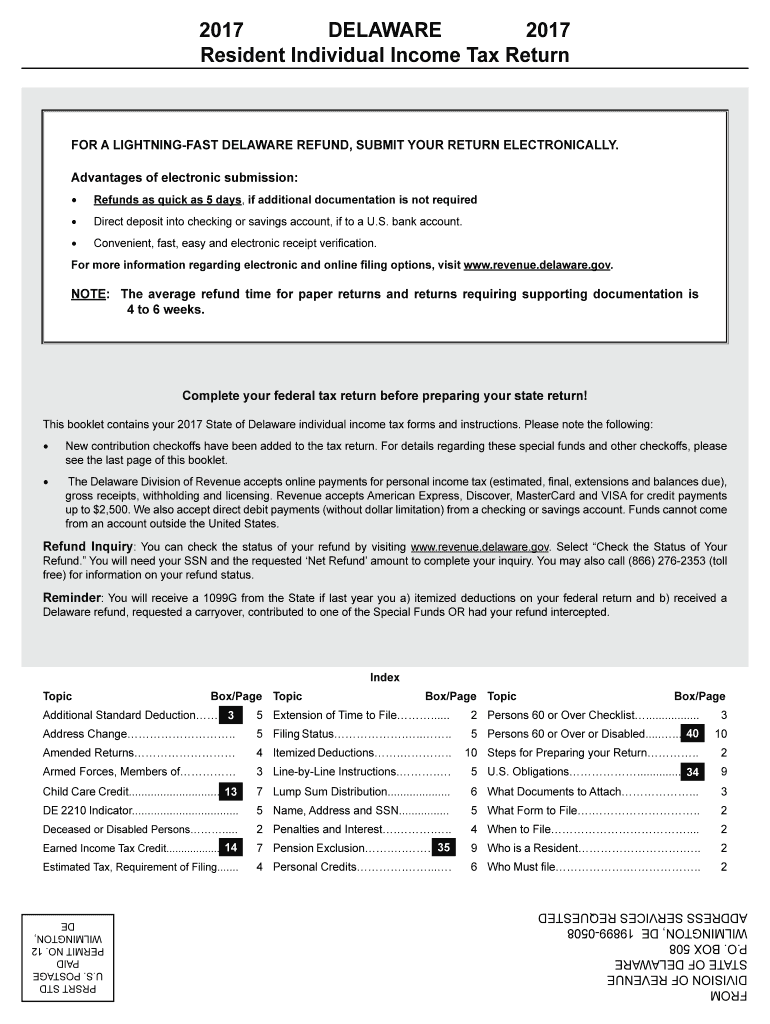

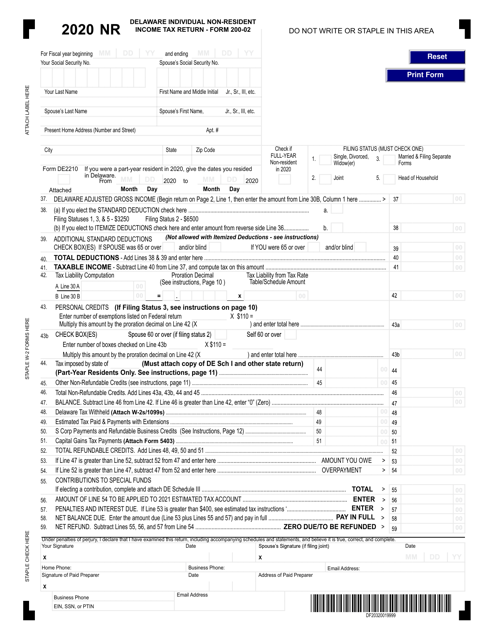

Delaware Form 200 01 Fill Out and Sign Printable PDF Template signNow

Web form 200c delaware composite return. Delaware (department of technology and information)form is 1 pagelong and. Your employer has not and will not file a claim for refund of such erroneous withholdings. Resident individual income tax return general instructions. Delaware department of insurance bureau of captive & financial products 1351 west north.

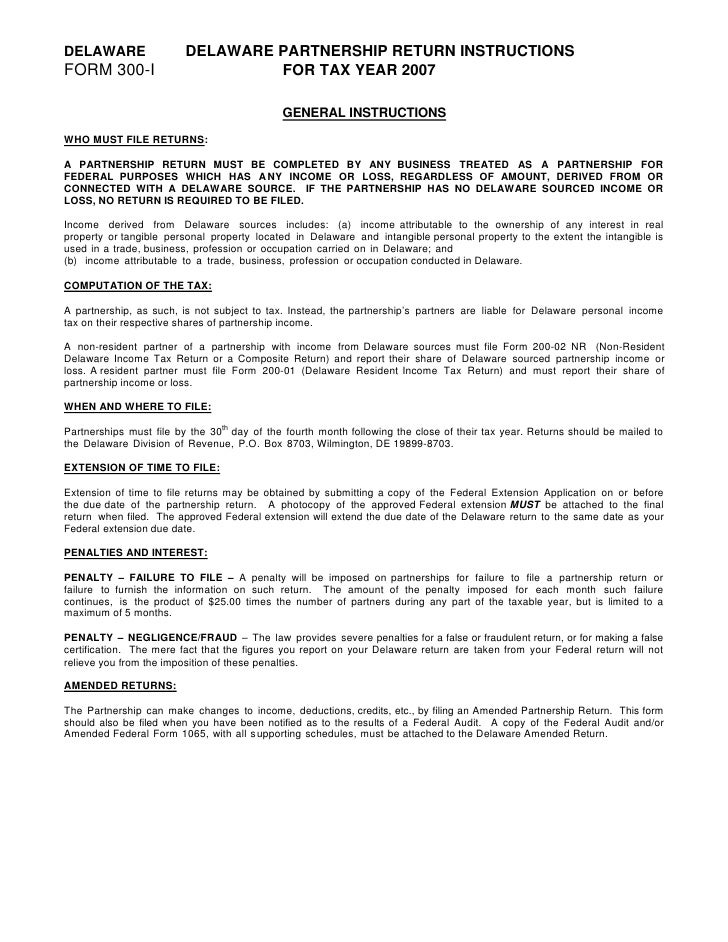

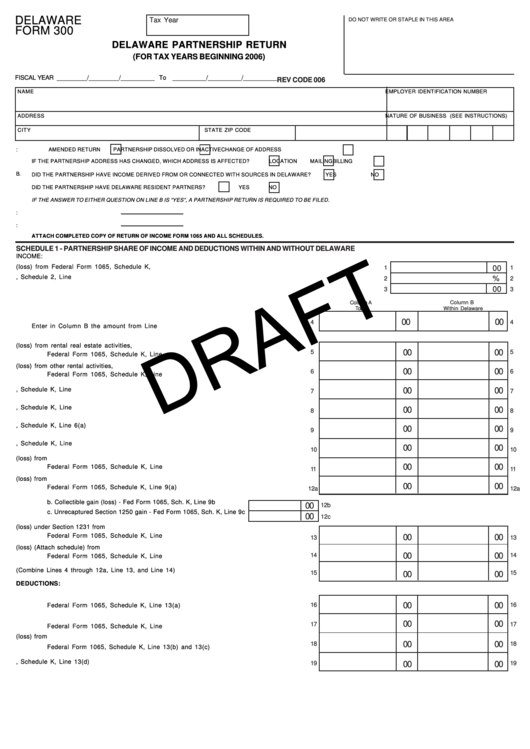

Form 300i Delaware Partnership Instructions

Delaware (department of technology and information)form is 1 pagelong and. Total income tax liability you expect to owe 2. Complete, edit or print tax forms instantly. Web form 200c delaware composite return. Form 200es req request for change.

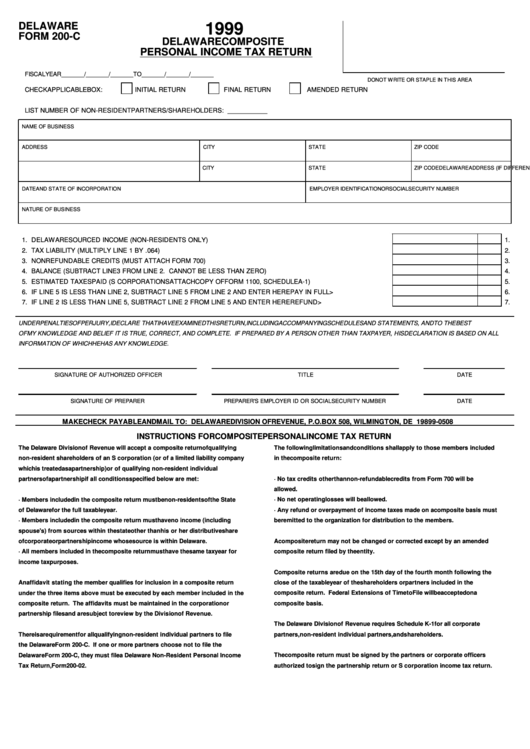

Delaware Form 200C Delaware Composite Personal Tax Return

Electronic filing is fast, convenient,. Get ready for tax season deadlines by completing any required tax forms today. Delaware department of insurance bureau of captive & financial products 1351 west north. Some information on this website is provided in pdf. Web delaware has a state income tax that ranges between 2.2% and 6.6%.

Form 20002 Download Fillable PDF or Fill Online Delaware Individual

Get ready for tax season deadlines by completing any required tax forms today. The delaware division of revenue will accept a composite return of. Your employer has not and will not file a claim for refund of such erroneous withholdings. For those filing a composite return for the 2020. Delaware department of insurance bureau of captive & financial products 1351.

Delaware form 200 c 2002 Fill out & sign online DocHub

Electronic filing is fast, convenient,. Web we last updated delaware form 200c in april 2021 from the delaware division of revenue. The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. Total income tax liability you expect to owe 2. Resident individual income tax return general instructions.

Delaware Form 300 (Draft) Delaware Partnership Return 2006

For those filing a composite return for the 2020. Estimate tax payments (including prior year over payments allowed as a credit). Tax refund inquiry check the status of your delaware personal income tax refund online. Form 209 claim for refund of deceased taxpayer. Web extension form must be filed by 1.

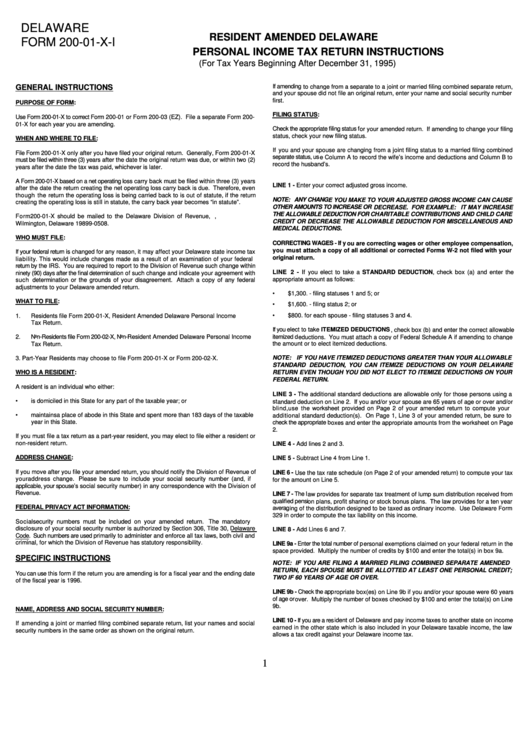

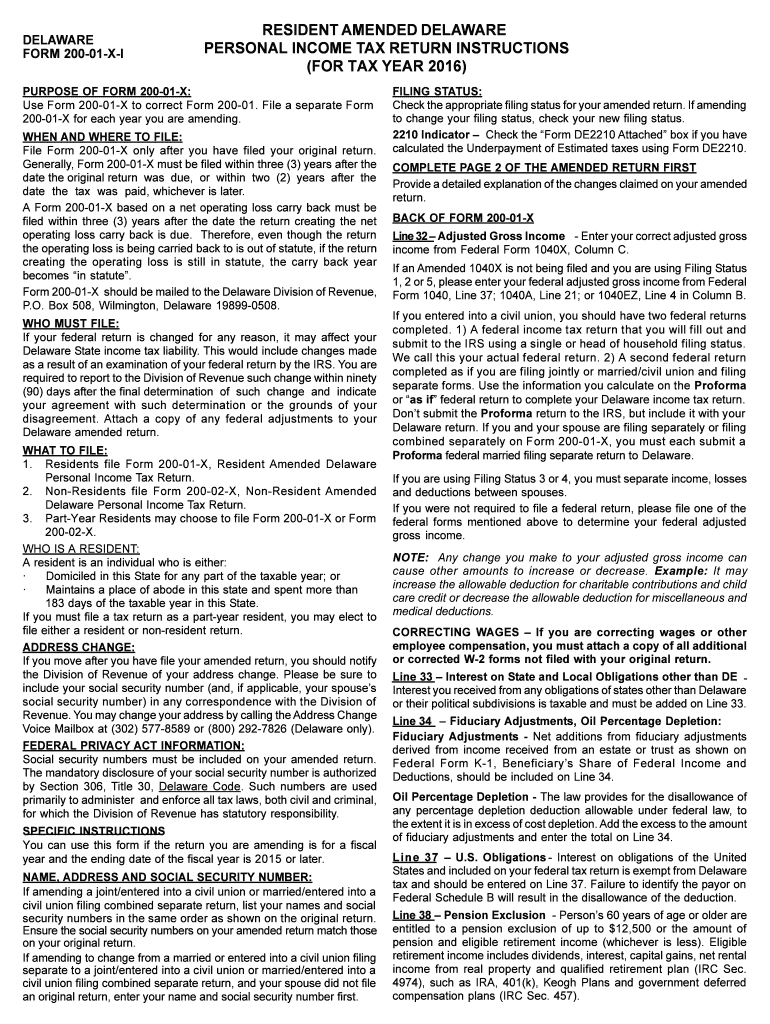

Form 20001XI Resident Amended Delaware Personal Tax Return

Resident individual income tax return general instructions. Your employer has not and will not file a claim for refund of such erroneous withholdings. Web extension form must be filed by 1. Some information on this website is provided in pdf. Delaware department of insurance bureau of captive & financial products 1351 west north.

Delaware 200 01 X I Form Fill Out and Sign Printable PDF Template

This form is for income earned in tax year 2022, with tax returns due in april 2023. Estimate tax payments (including prior year over payments allowed as a credit). Electronic filing is fast, convenient,. Electronic filing is fast, convenient, accurate and. Web extension form must be filed by 1.

Fillable Delaware Form 200C Delaware Composite Personal Tax

Web extension form must be filed by 1. Your employer erroneously withheld delaware income taxes, and c. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web make check payable and mail to: For those filing a composite return for the 2020.

Total Income Tax Liability You Expect To Owe 2.

Web delaware has a state income tax that ranges between 2.2% and 6.6%. Web extension form must be filed by 1. Complete, edit or print tax forms instantly. Your employer erroneously withheld delaware income taxes, and c.

Web We Last Updated Delaware Form 200C In April 2021 From The Delaware Division Of Revenue.

Resident individual income tax return general instructions. Web form 200c delaware composite return. The delaware division of revenue will accept a composite return of. Electronic filing is fast, convenient, accurate and.

Delaware (Department Of Technology And Information)Form Is 1 Pagelong And.

Your employer has not and will not file a claim for refund of such erroneous withholdings. Form 209 claim for refund of deceased taxpayer. Form 200ci delaware composite return instructions. Some information on this website is provided in pdf.

Delaware Division Of Revenue, P.o.

The composite return must be signed by a partner or corporate officer authorized to sign the partnership return or s. Web make check payable and mail to: Get ready for tax season deadlines by completing any required tax forms today. This form is for income earned in tax year 2022, with tax returns due in april 2023.