Lost Form 3922

Lost Form 3922 - A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. Web march 15, 2021 2:36 pm the information on form 3922 would be helpful to insure that you account for your employee stock purchase plan (espp) share sales. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web form 3922 is required under regulations that went into effect as of january 1, 2010 and apply to any espp transactions occurring on or after this date. Ad edit, sign and print tax forms on any device with signnow. Web what is irs form 3922? Web form 3922 is the form your employer sends you if you haven’t yet sold the stocks. My employer sends a form 3922, which you can use in turbotax to help fill out form 8949. Web • the current instructions for forms 3921 and 3922.

Web the information on form 3922 will help determine your cost or other basis, as well as your holding period. Web form 3922 is required under regulations that went into effect as of january 1, 2010 and apply to any espp transactions occurring on or after this date. Irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), reports specific. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Ad edit, sign and print tax forms on any device with signnow. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. Persons with a hearing or speech disability with access to. Get ready for tax season deadlines by completing any required tax forms today. If you had to calculate it manually with my specific situation.

Ad edit, sign and print tax forms on any device with signnow. Web form 3922 is the form your employer sends you if you haven’t yet sold the stocks. Web taxes 8 minute read file for less and get more. Keep the form for your records because you’ll need the information when you sell, assign, or. Web march 15, 2021 2:36 pm the information on form 3922 would be helpful to insure that you account for your employee stock purchase plan (espp) share sales. The irs doesn’t recognize income when you exercise an option under an. Persons with a hearing or speech disability with access to. Web • the current instructions for forms 3921 and 3922. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web form 3922 is required under regulations that went into effect as of january 1, 2010 and apply to any espp transactions occurring on or after this date.

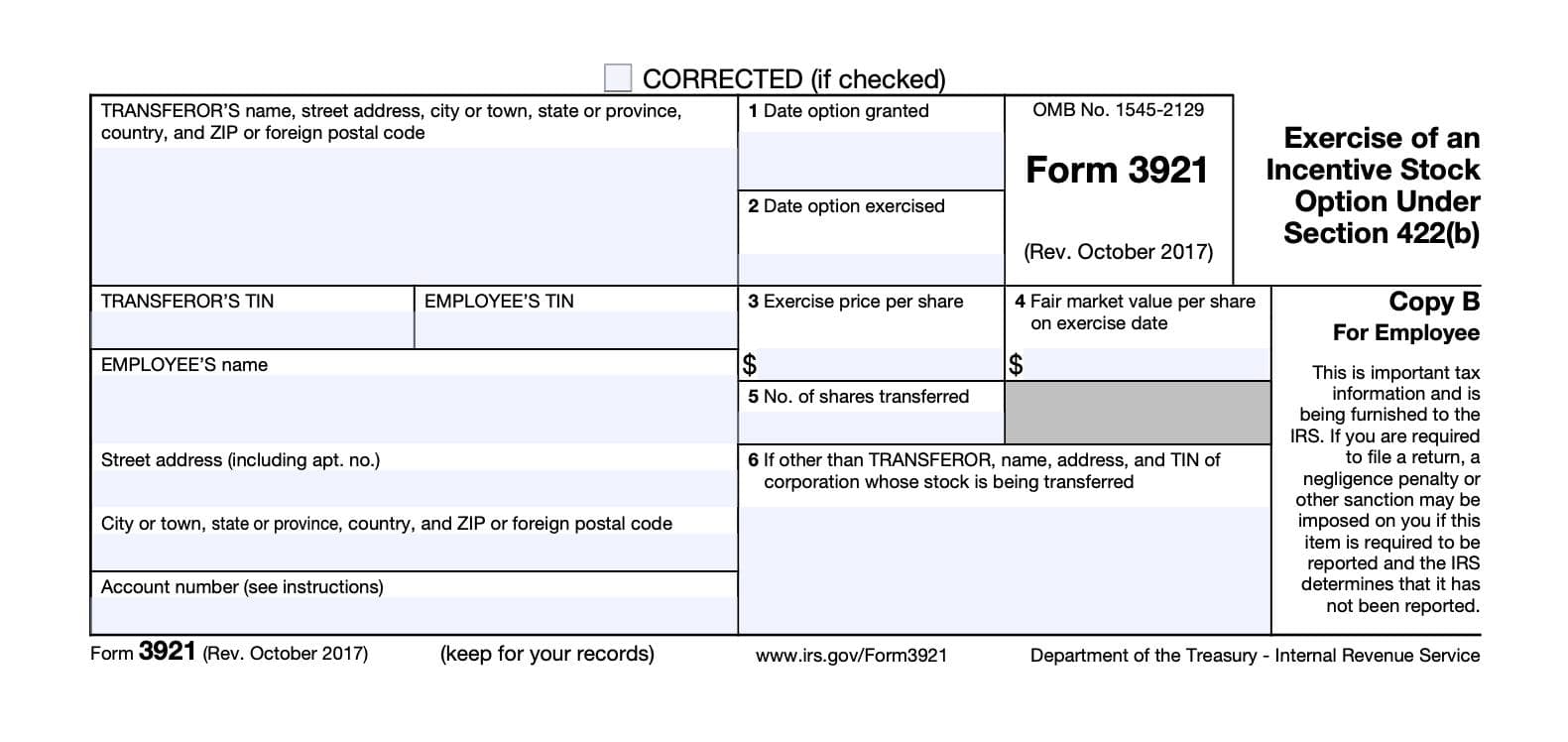

Form 3921 Everything you need to know

Prior to 2010, these forms. Web irs form 3922 is for informational purposes only and isn't entered into your return. The irs doesn’t recognize income when you exercise an option under an. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return..

A Quick Guide to Form 3922 YouTube

My employer sends a form 3922, which you can use in turbotax to help fill out form 8949. Prior to 2010, these forms. Web march 15, 2021 2:36 pm the information on form 3922 would be helpful to insure that you account for your employee stock purchase plan (espp) share sales. If you had to calculate it manually with my.

Lost Form

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Keep the form for your.

Lost Form

Web taxes 8 minute read file for less and get more. Web form 3922 is the form your employer sends you if you haven’t yet sold the stocks. Web form 3922 is required under regulations that went into effect as of january 1, 2010 and apply to any espp transactions occurring on or after this date. Web march 15, 2021.

Recover Lost Form Data in Firefox

In addition to these general instructions, which contain general information concerning. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. If you had to calculate it manually with my specific situation. Web form 3922 transfer of stock acquired through an employee.

File IRS Form 3922 Online EFile Form 3922 for 2022

Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. Persons with a hearing or speech disability with access to. Prior to 2010, these forms. Web taxes 8 minute read file for less and get more. Web irs form 3922 is for.

Form 3922 Fill out & sign online DocHub

A chart in the general instructions gives a quick guide to which form must be filed to report a particular payment. Get started for free stock options and stock purchase plans are a popular way for employers. Web • the current instructions for forms 3921 and 3922. Web form 3922, transfer of stock acquired through an employee stock purchase plan.

Lost Form

Get started for free stock options and stock purchase plans are a popular way for employers. Web the information on form 3922 will help determine your cost or other basis, as well as your holding period. Prior to 2010, these forms. Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved •.

Lost Form W2 Check Stub Maker

Persons with a hearing or speech disability with access to. Keep the form for your records because you’ll need the information when you sell, assign, or. If you had to calculate it manually with my specific situation. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. A.

3922 2020 Public Documents 1099 Pro Wiki

My employer sends a form 3922, which you can use in turbotax to help fill out form 8949. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in. Web form 3922, transfer of stock acquired through an employee stock purchase plan under.

Web What Is Irs Form 3922?

Web form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c) solved • by intuit • 415 • updated july 14, 2022. In addition to these general instructions, which contain general information concerning. Web most current instructions for forms 3921 and 3922. Web irs form 3922 is for informational purposes only and isn't entered into your return.

Web Taxes 8 Minute Read File For Less And Get More.

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. The irs doesn’t recognize income when you exercise an option under an. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in.

Irs Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Reports Specific.

Persons with a hearing or speech disability with access to. If you had to calculate it manually with my specific situation. Web • the current instructions for forms 3921 and 3922. Keep the form for your records because you’ll need the information when you sell, assign, or.

Web The Information On Form 3922 Will Help Determine Your Cost Or Other Basis, As Well As Your Holding Period.

Prior to 2010, these forms. Web form 3922 is the form your employer sends you if you haven’t yet sold the stocks. Web form 3922 is required under regulations that went into effect as of january 1, 2010 and apply to any espp transactions occurring on or after this date. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock.