What Tax Form Do Real Estate Agents Use

What Tax Form Do Real Estate Agents Use - These properties are currently listed for sale. You can deduct items such as. Web 7 steps to prepare for your annual tax returns. Web ahead of tax day, lawyer and tax expert jason holliday explains basic things real estate agents need to know about filing taxes as independent contractors. Keep in mind, however, that some income (e.g., side hustle or rental income) may not be. Below is a list of standard forms applicable. Web for all real estate agents hired as an employee, there is no need for form 1099 misc to report their commission earnings. Web income tax basics let’s start with the basics. They are owned by a bank or. Additionally, in some states, sellers are subject to a state real estate.

5 tax tips for real estate agents. While you certainly have the option to do your taxes on your own (particularly with the help of tax. In this section, we’ll cover the fundamentals of income taxes, specifically as they apply to real estate agents. Web for all real estate agents hired as an employee, there is no need for form 1099 misc to report their commission earnings. You can deduct items such as. They are owned by a bank or. Below is a list of standard forms applicable. These properties are currently listed for sale. Web if you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases). Web but in general, real estate transfer tax rates range from.01% (colorado) to 1.5% (delaware).

This blog is an introductory guide to filing taxes as a real estate agent, from the kinds of expenses that you might be able to write off to the. Web for all real estate agents hired as an employee, there is no need for form 1099 misc to report their commission earnings. Web if you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases). Additionally, in some states, sellers are subject to a state real estate. Arrange for a tax preparer. A total reassessment of the county is made when the. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) For income tax purposes, the income. Keep in mind, however, that some income (e.g., side hustle or rental income) may not be. These properties are currently listed for sale.

Clients often wonder ask what services we can provide as real estate

Additionally, in some states, sellers are subject to a state real estate. Web income tax basics let’s start with the basics. Web if you’re still wondering how to file taxes as a real estate agent, let’s take a look at the tax forms you need to complete your tax filing. While real estate taxes cover only taxes on real property.

New tax form is indeed smaller, but filing is no simpler

Below is a list of standard forms applicable. Web but in general, real estate transfer tax rates range from.01% (colorado) to 1.5% (delaware). By agent (2,441) by owner & other (197) agent listed. These properties are currently listed for sale. Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023)

What Tax Forms Do I Need to File Taxes? Credit Karma

They are owned by a bank or. In this section, we’ll cover the fundamentals of income taxes, specifically as they apply to real estate agents. For income tax purposes, the income. Web 7 steps to prepare for your annual tax returns. Web income tax basics let’s start with the basics.

What Do Real Estate Agents do for Sellers? An Inside Look at Why You

Web if you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases). Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web catch the top stories of.

Real Estate Commission Invoice Template Example

Web catch the top stories of the day on anc’s ‘top story’ (20 july 2023) Web how do real estate agents file taxes? Web for all real estate agents hired as an employee, there is no need for form 1099 misc to report their commission earnings. While real estate taxes cover only taxes on real property like a condo, home.

McKissock Learning

In this section, we’ll cover the fundamentals of income taxes, specifically as they apply to real estate agents. Keep in mind, however, that some income (e.g., side hustle or rental income) may not be. Web but in general, real estate transfer tax rates range from.01% (colorado) to 1.5% (delaware). Web also, a broker or agent must register 1099 for the.

Why Do Real Estate Agents Get Paid So Much Money to Sell My House

While you certainly have the option to do your taxes on your own (particularly with the help of tax. Web if you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases). This blog is an introductory.

How Much Do Real Estate Agents Make? Casanova Brooks

While you certainly have the option to do your taxes on your own (particularly with the help of tax. Web how do real estate agents file taxes? 5 tax tips for real estate agents. You can deduct items such as. Web for all real estate agents hired as an employee, there is no need for form 1099 misc to report.

Real Estate Agent Taxes Tax Tips From The CE Shop

Web if you’re still wondering how to file taxes as a real estate agent, let’s take a look at the tax forms you need to complete your tax filing. Web ahead of tax day, lawyer and tax expert jason holliday explains basic things real estate agents need to know about filing taxes as independent contractors. Web how do real estate.

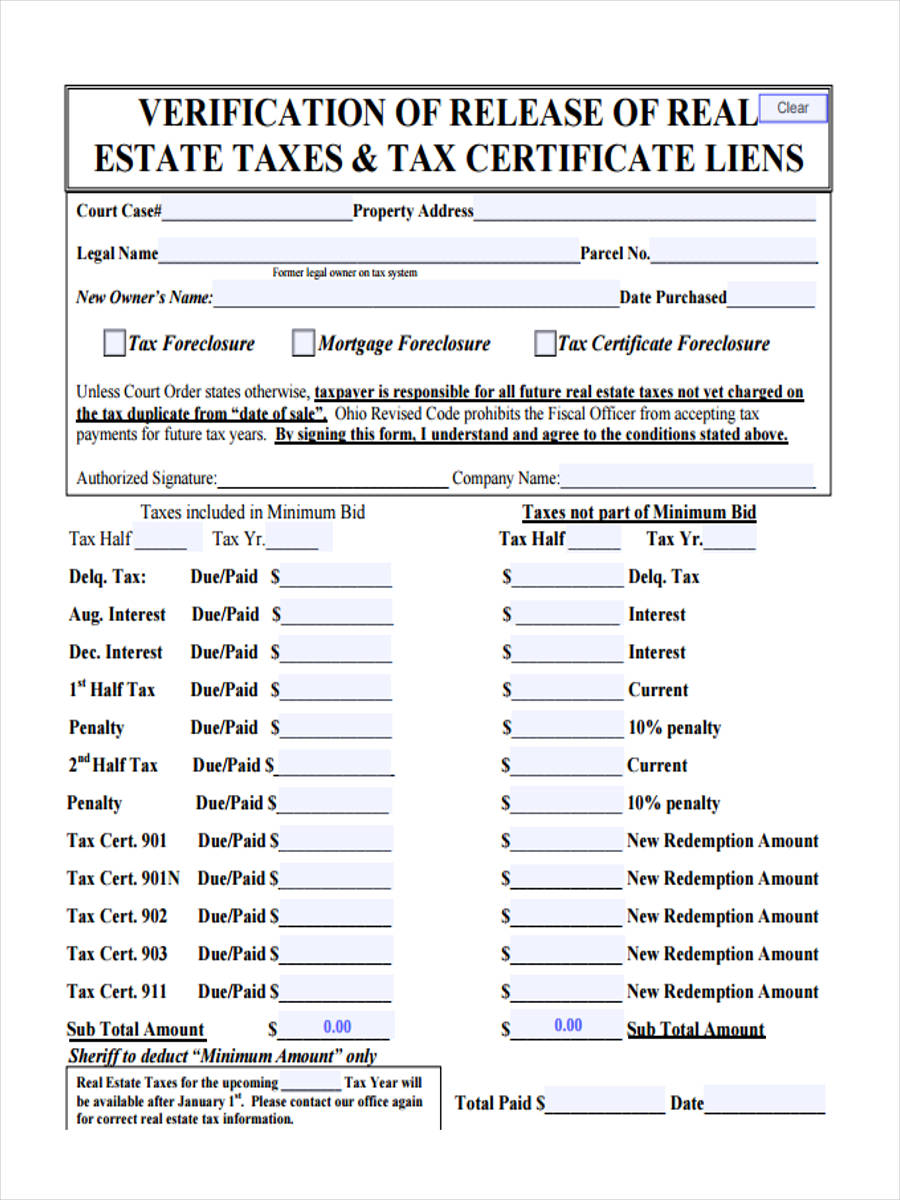

FREE 8+ Sample Tax Verification Forms in PDF

Web income tax basics let’s start with the basics. For income tax purposes, the income. These properties are currently listed for sale. Arrange for a tax preparer. In this section, we’ll cover the fundamentals of income taxes, specifically as they apply to real estate agents.

A Total Reassessment Of The County Is Made When The.

5 tax tips for real estate agents. Below is a list of standard forms applicable. Web also, a broker or agent must register 1099 for the payment of rent for office space, unless the rent is paid to a real estate agent or a company, as described below. By agent (2,441) by owner & other (197) agent listed.

Web 7 Steps To Prepare For Your Annual Tax Returns.

These properties are currently listed for sale. Web for all real estate agents hired as an employee, there is no need for form 1099 misc to report their commission earnings. Arrange for a tax preparer. Keep in mind, however, that some income (e.g., side hustle or rental income) may not be.

Web Catch The Top Stories Of The Day On Anc’s ‘Top Story’ (20 July 2023)

Web ahead of tax day, lawyer and tax expert jason holliday explains basic things real estate agents need to know about filing taxes as independent contractors. Additionally, in some states, sellers are subject to a state real estate. While real estate taxes cover only taxes on real property like a condo, home or rental property, personal property taxes include tangible and movable personal. Web but in general, real estate transfer tax rates range from.01% (colorado) to 1.5% (delaware).

They Are Owned By A Bank Or.

Web if you have a gain from the sale of your main home, you may be able to exclude up to $250,000 of the gain from your income ($500,000 on a joint return in most cases). For income tax purposes, the income. This blog is an introductory guide to filing taxes as a real estate agent, from the kinds of expenses that you might be able to write off to the. You can deduct items such as.