Llc Form 568

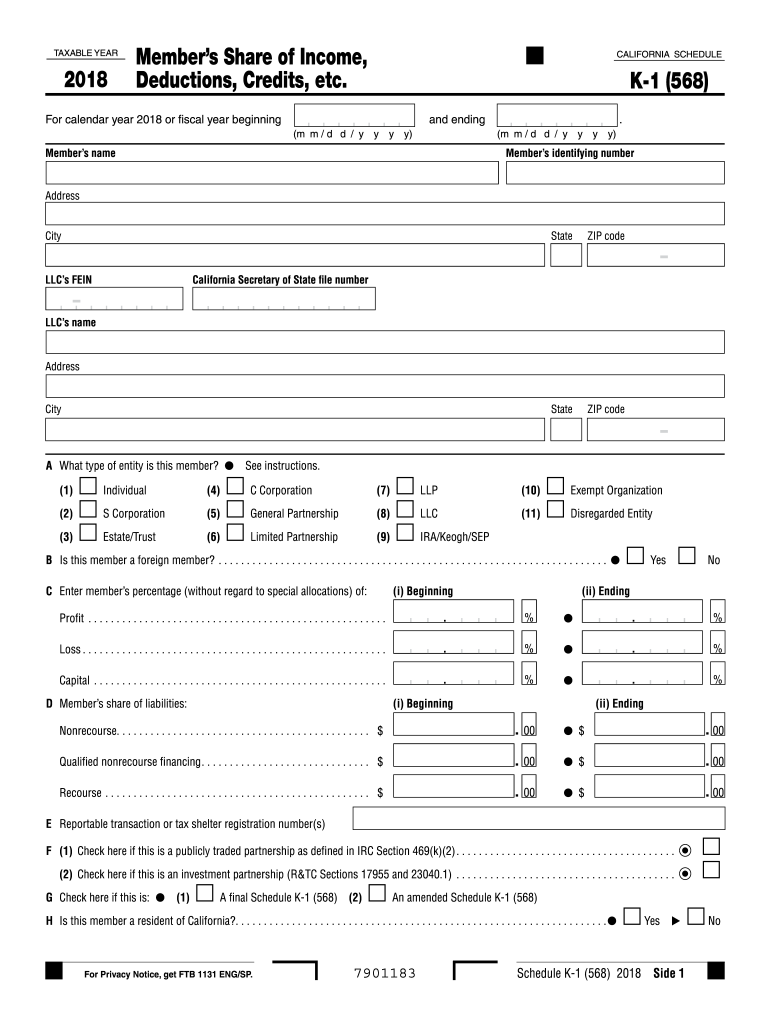

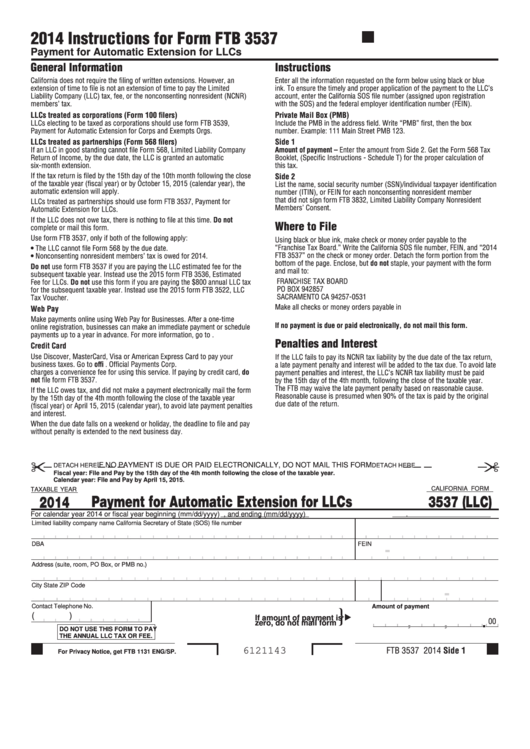

Llc Form 568 - (m m / d d / y y y y) (m m / d d / y y y. Web a limited liability company is formed by filing articles of organization with the corporations division. Line 1—total income from schedule iw. Sets forth the information that must be provided in the. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web 2018 limited liability company return of income. For calendar year 2018 or fiscal year beginning and ending. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Start a business let's talk the limited. Per the ca ftb limited liability company.

Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Web the llc input screens are located in the limited liability folder. Llcs may be classified for tax purposes as a partnership, a. Per the ca ftb limited liability company. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web 2018 limited liability company return of income. Web file limited liability company return of income (form 568) by the original return due date. (m m / d d / y y y y) (m m / d d / y y y.

Web form 568 california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. Web the llc input screens are located in the limited liability folder. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web 2018 limited liability company return of income. Web 2017 limited liability company return of income. Ca and unique secretary of state (sos) account number. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. Sets forth the information that must be provided in the. Web ca form 568 instructions for llc paperwork before filing ca form 568, be sure to find out what you need to know for the llc paperwork. To create an llc unit, enter a state use code 3 form 568:

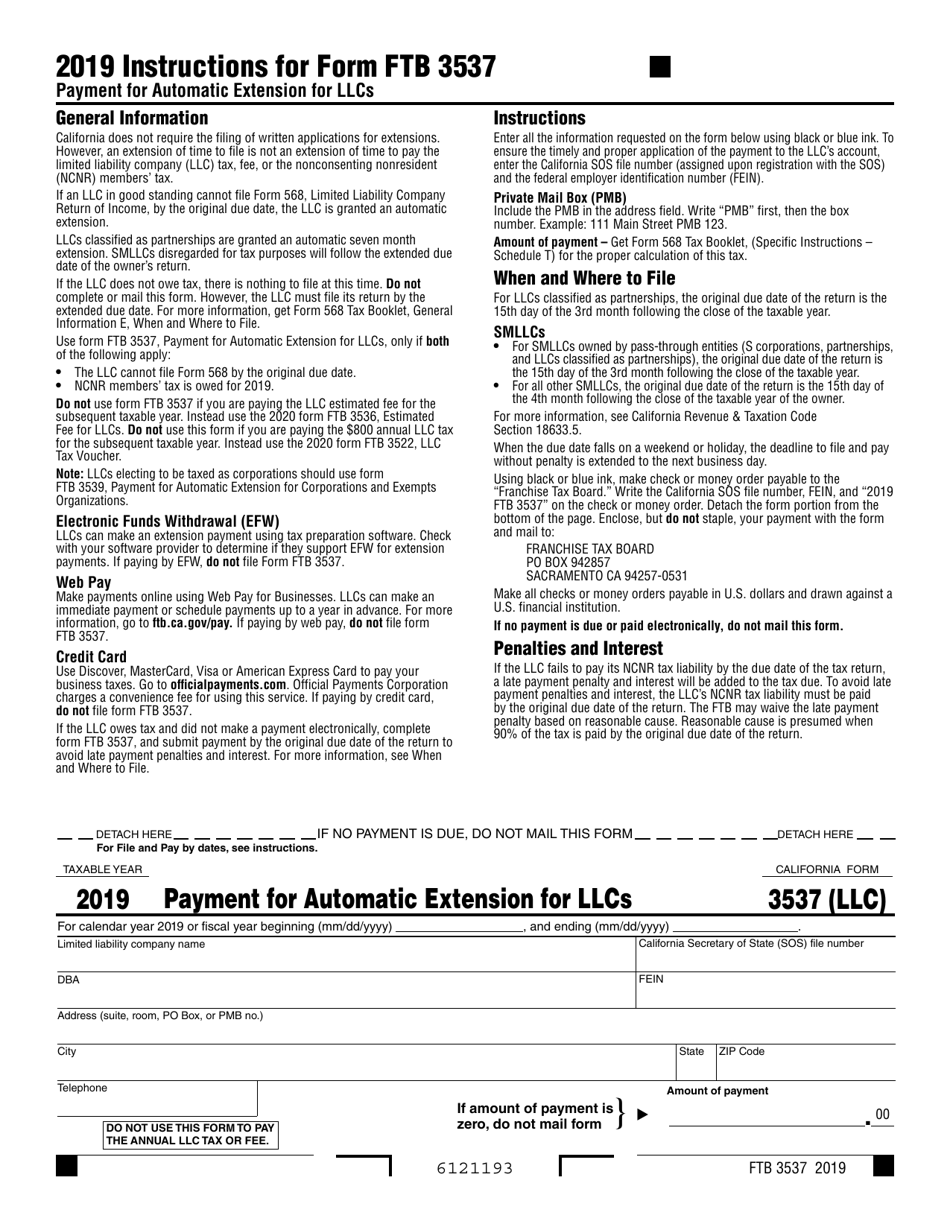

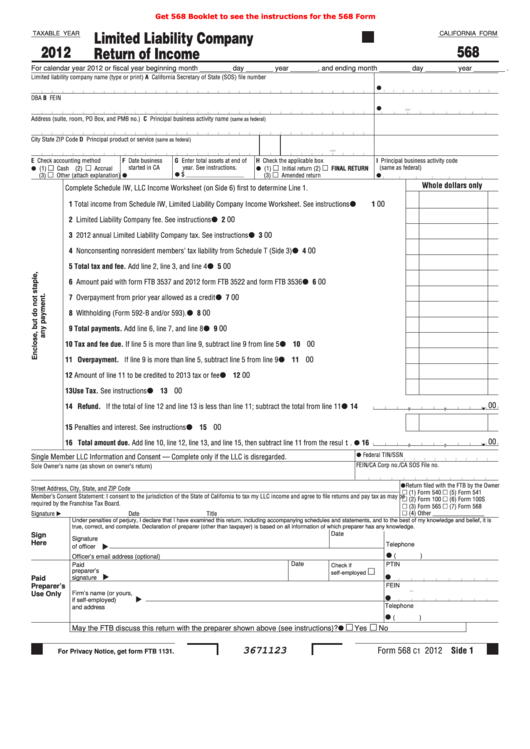

Form FTB3537 Download Fillable PDF or Fill Online Payment for Automatic

California llc (568) california llc (568) extension. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Line 1—total income from schedule iw. For calendar year 2017 or fiscal year beginning and ending. (m m / d d / y y.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

For calendar year 2018 or fiscal year beginning and ending. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income and use. Web 2017 limited liability company return of income. (m m / d d / y y y y) (m m /.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web a limited liability company is formed by filing articles of organization with the corporations division. California llc (568) california llc (568) extension. Only llcs classified as partnerships file form 568. Web form 568 california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. Web.

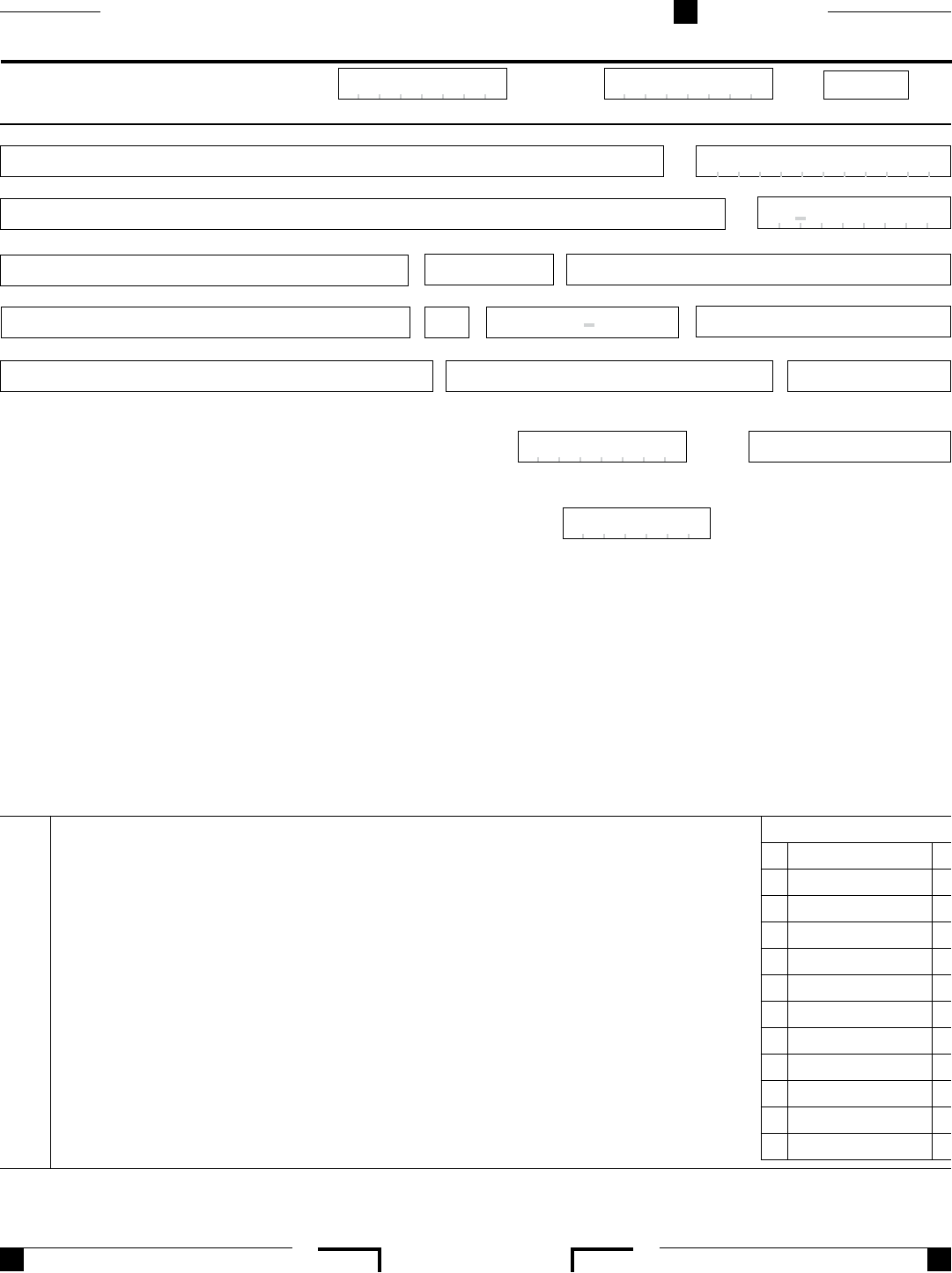

Fillable Form 3536 (Llc) Estimated Fee For Llcs 2015 printable pdf

For calendar year 2017 or fiscal year beginning and ending. Only llcs classified as partnerships file form 568. Web ca llc form 568 efile for tax year 2021 hi, for last year 2020's taxes, turbo tax home & business was not able to efile ca llc form 568. Web ca form 568 instructions for llc paperwork before filing ca form.

GridWise Research

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web ca llc form 568 efile for tax year 2021 hi, for last year 2020's taxes, turbo tax home & business was not able to efile ca llc form 568. Web if you have an llc, here’s how to fill in the california.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web form 568 california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. Ca and unique secretary of state (sos) account number. Web a limited liability company is formed by filing articles of organization with the corporations division. File form 1065 at the applicable irs.

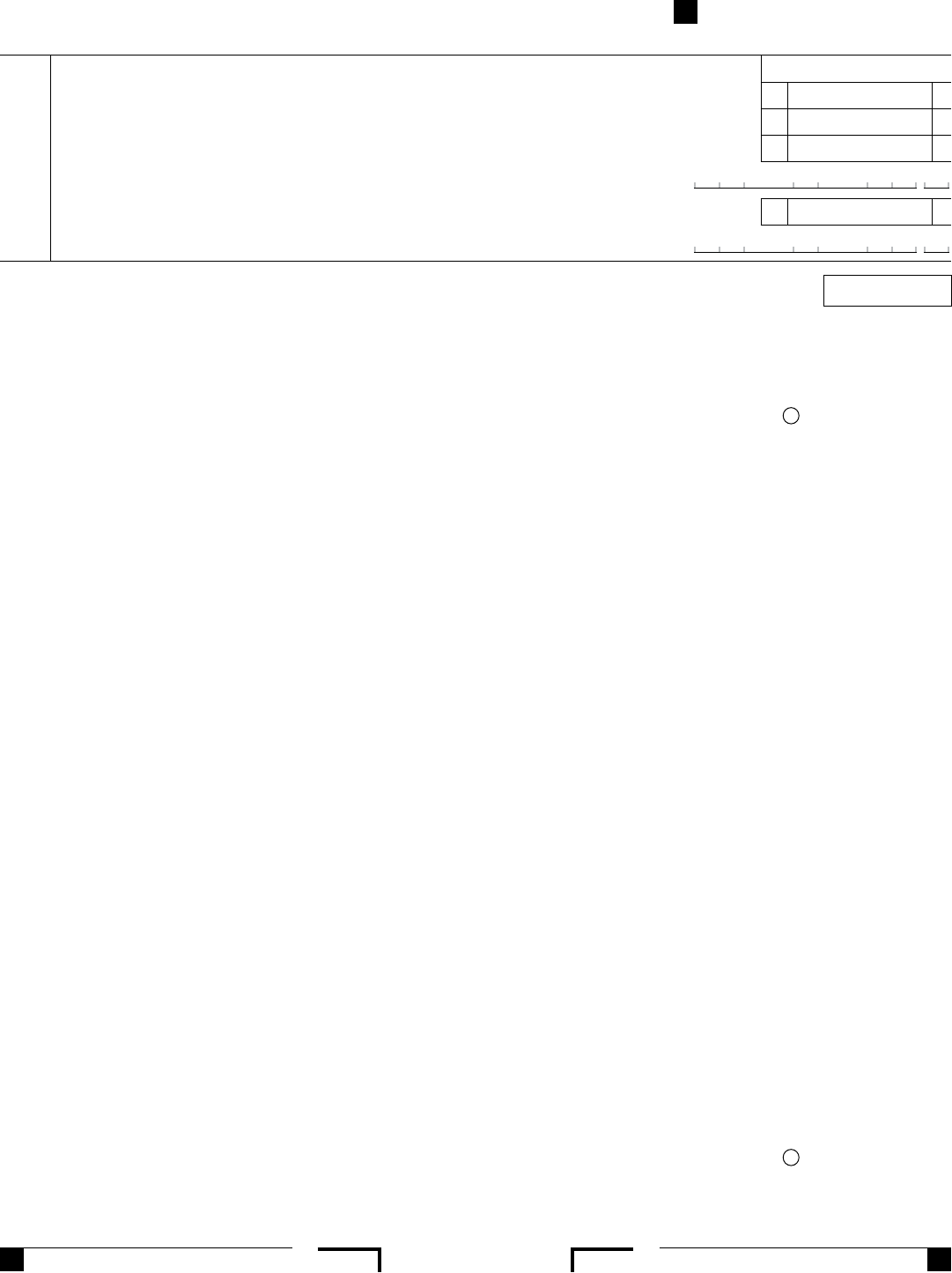

California Schedule K 1 568 Form Fill Out and Sign Printable PDF

If your llc files on an extension, refer to payment for automatic extension for. Web while a single member llc does not file california form 565, they must file california form 568 which provides details about the llc. Web if you have an llc, here’s how to fill in the california form 568: Start a business let's talk the limited..

Contractor's Estimate Sheet Single

Llcs may be classified for tax purposes as a partnership, a. Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party. To create an llc unit, enter a state use code 3 form 568: Only llcs classified as partnerships file form 568. Web ca.

Fillable California Form 568 Limited Liability Company Return Of

To create an llc unit, enter a state use code 3 form 568: File form 1065 at the applicable irs address listed below. If your llc files on an extension, refer to payment for automatic extension for. Start a business let's talk the limited. Per the ca ftb limited liability company.

Form 3537 California Payment For Automatic Extension For Llcs 2014

(m m / d d / y y y y) (m m / d d / y y y. California llc (568) california llc (568) extension. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Click.

California Llc (568) California Llc (568) Extension.

Web form 568 california — limited liability company return of income download this form print this form it appears you don't have a pdf plugin for this browser. You and your clients should be aware that a disregarded smllc is required to: Llcs may be classified for tax purposes as a partnership, a. Only llcs classified as partnerships file form 568.

Ca And Unique Secretary Of State (Sos) Account Number.

Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. (m m / d d / y y y y) (m m / d d / y y y. Web file limited liability company return of income (form 568) by the original return due date. Line 1—total income from schedule iw.

Web If You Have An Llc, Here’s How To Fill In The California Form 568:

Click the file menu, and select go to state/city. Web federal form 5227, split interest trust alabama. File form 1065 at the applicable irs address listed below. Web a limited liability company is formed by filing articles of organization with the corporations division.

Web Since The Limited Liability Company Is Doing Business In Both Nevada And California, It Must File A California Form 568, Limited Liability Company Return Of Income And Use.

Web ca llc form 568 efile for tax year 2021 hi, for last year 2020's taxes, turbo tax home & business was not able to efile ca llc form 568. For calendar year 2018 or fiscal year beginning and ending. To create an llc unit, enter a state use code 3 form 568: Web if there is more than one responsible party, the entity may list whichever party the entity wants the irs to recognize as the responsible party.