Life Insurance Plans Chapter 9 Lesson 5

Life Insurance Plans Chapter 9 Lesson 5 - Web true a good homeowner's insurance policy will include guaranteed replacement cost. Web true term life insurance is more expensive because it funds a savings plan. Those choices dictate the third variable. Use get form or simply click on the template preview to open it in the editor. Persuade an audience to get life insurance by explaining the. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? Article 8, requirements for replacement of life insurance and annuity policies; T/f false the purpose of insurance is to transfer risk so that an accident or injury does not devastate you financially. Web teach your students about protecting their assets with insurance. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1.

Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. In order for an insurance contract to be valid, insurable interest must be. T/f false the purpose of insurance is to transfer. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Long term care insurance(60years old) 6. Web teach your students about protecting their assets with insurance. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance… At the death of the policyholder, the insurance company pays the death benefit to the beneficiaries. Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance.

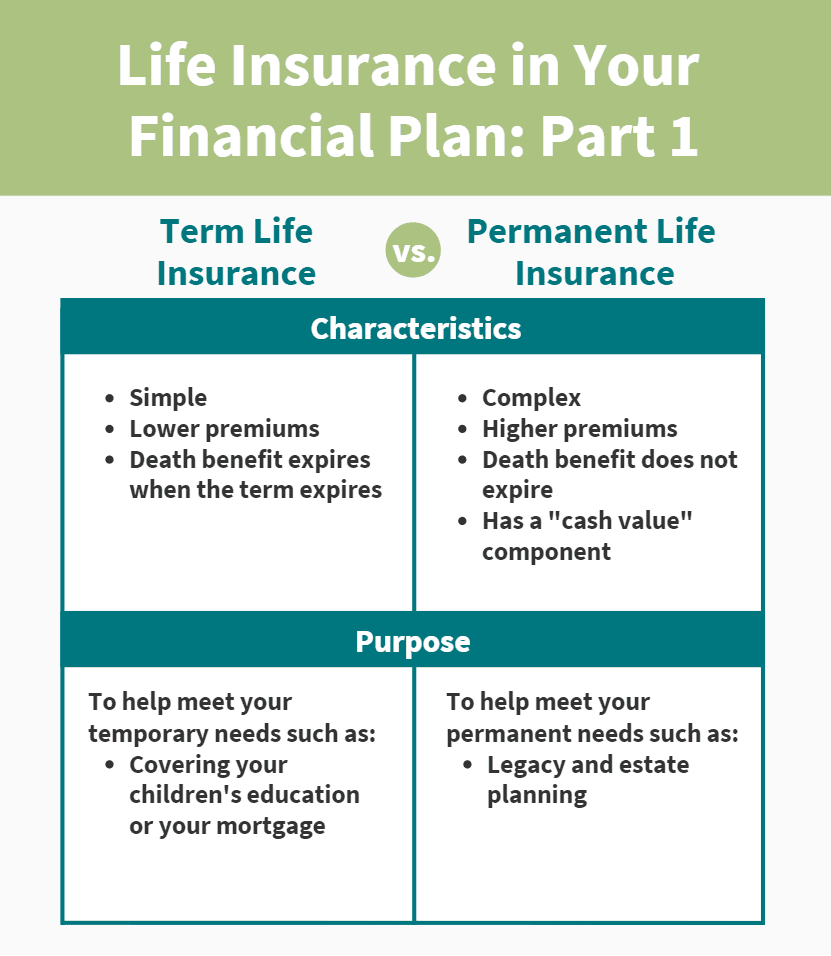

Whole life insurance (or cash value) life insurance that lasts for the life. Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance. Click the card to flip 👆. Web study with quizlet and memorize flashcards containing terms like you should buy life insurance policy that's _____ times your annual salary, what's the payment you make each time you visit the doctor?, hdhp insurance. Use get form or simply click on the template preview to open it in the editor. Web true term life insurance is more expensive because it funds a savings plan. Web life insurance for a specified amount of time; Free insurance lesson plans, activities and more for grades 9. Face amount, premium, and type of plan; Long term care insurance(60years old) 6.

Life Insurance 101 Everything You Need to Know [Infographic

Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance. Use the cross or check marks in the. Long term care insurance(60years old) 6. Provides a monetary (financial) payment to a specified beneficiary in the event that the insured person dies. Web name life insurance plans chapter 9, lesson 5 joe is 30 years.

Foundations In Personal Finance Chapter 9 Answer Key Pdf Fill Online

Face amount, premium, and type of plan; At the death of the policyholder, the insurance company pays the death benefit to the beneficiaries. Web terms in this set (15) life insurance. If an insurance plan is completed by one applicant but signed by another. In order for an insurance contract to be valid, insurable interest must be.

canonprintermx410 25 Images What Is A Private Insurance Company

T/f false the purpose of insurance is to transfer. Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance. ____ life is a policy in which the policyowner chooses two of three variables: Face amount, premium, and type of plan; T/f false the purpose of insurance is to transfer risk so that an accident.

Does Whole Life Insurance Work as Part of a Retirement Strategy

Long term care insurance(60years old) 6. Method used to determine an adequate amount of life insurance based on the survivors' needs and the amount of. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? Use get form or simply click on the template preview to open.

Life Insurance in Your Financial Plan Part 1 Aspen Wealth Management

Who does not need life insurance. Joe makes $48,000 per year and has $200 budgeted per month to spend on life. Use get form or simply click on the template preview to open it in the editor. T/f false the purpose of insurance is to transfer risk so that an accident or injury does not devastate you financially. Web true.

Taxsaving life insurance plans you need to consider this yearAegon

Web life insurance for a specified amount of time; Long term care insurance(60years old) 6. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. T/f false the.

Need and Benefits of Buying Life Insurance Plan by Alankit Insurance

____ life is a policy in which the policyowner chooses two of three variables: Chapter 5, general regulation of life insurers; Start completing the fillable fields and carefully type in required information. Web name life insurance plans chapter 9, lesson 5 joe is 30 years old, married, and his wife is expecting their first baby. Persuade an audience to get.

Essential Tips to Get Started with Life Insurance Plans

Web study with quizlet and memorize flashcards containing terms like you should buy life insurance policy that's _____ times your annual salary, what's the payment you make each time you visit the doctor?, hdhp insurance. Persuade an audience to get life insurance by explaining the. Joe makes $48,000 per year and has $200 budgeted per month to spend on life..

Types of Life Insurance Plans

Web describes the type of coverage in an insurance agreement. Web strengthen your preparations for the life & health insurance exam by taking advantage of the resources in this online course. Web terms in this set (15) life insurance. Start completing the fillable fields and carefully type in required information. Web true term life insurance is more expensive because it.

[Updated 2023] Top 25 Insurance PowerPoint Templates Agents and

Whole life insurance (or cash value) life insurance that lasts for the life. Of the three types of insurance in the “lessons on insurance and credit” teaching kit, life insurance is the most difficult for students to comprehend. T/f true term life insurance is for a specified period, is more expensive, and has no savings plan. T/f false the purpose.

Whole Life Insurance (Or Cash Value) Life Insurance That Lasts For The Life.

Click the card to flip 👆. In order for an insurance contract to be valid, insurable interest must be. Web describes the type of coverage in an insurance agreement. Understand and explain the purpose of life insurance.

Web Terms In This Set (15) Life Insurance.

Web codes division 2, classes of insurance; Web name life insurance plans chapter 9, lesson 5 joe is 30 years old, married, and his wife is expecting their first baby. Web teach your students about protecting their assets with insurance. T/f true term life insurance is for a specified period, is more expensive, and has no savings plan.

Joe Makes $48,000 Per Year And Has $200 Budgeted Per Month To Spend On Life Insurance.

Joe makes $48,000 per year and has $200 budgeted per month to spend on life. Chapter 5, general regulation of life insurers; Paperwork filed with an insurance company in order to get them to cover a loss for someone they insure. Amount you pay monthly, quarterly, semiannually or annually to purchase different types of insurance…

Differentiate Between The Different Forms Of Life Insurance.

Face amount, premium, and type of plan; Of the three types of insurance in the “lessons on insurance and credit” teaching kit, life insurance is the most difficult for students to comprehend. ____ life is a policy in which the policyowner chooses two of three variables: Provides a monetary (financial) payment to a specified beneficiary in the event that the insured person dies.

![[Updated 2023] Top 25 Insurance PowerPoint Templates Agents and](https://www.slideteam.net/wp/wp-content/uploads/2020/01/Life-Insurance-Policies-And-Plan.png)