Chapter 7 Bankruptcy Home Equity

Chapter 7 Bankruptcy Home Equity - Web for the most part, it’s easier to buy a home after chapter 13 bankruptcy than chapter 7. Web in chapter 7, you must be able to protect all your home equity with an exemption. Web the short answer is yes. But if you only apply with one lender, you. Web one of the only times that having “too much equity” in your home will hurt you is when you are filing for chapter. Rather than all debt being. Compare & save with lendingtree. Filling out loan applications can be tedious. Web rite aid is preparing to file for bankruptcy in coming weeks to address mass lawsuits over the drugstore chain’s. Web what happens in chapter 7 if there’s too much equity in your home?

Filling out loan applications can be tedious. Web you won't necessarily lose your home in chapter 7 bankruptcy, especially if you don't have much home equity and your. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home. Web what happens in chapter 7 if there’s too much equity in your home? Homeowners borrowing from their home equity should choose the right loan type. Compare & save with lendingtree. Web for the most part, it’s easier to buy a home after chapter 13 bankruptcy than chapter 7. Web the short answer is yes. Ad get more from your home equity line of credit. The average american has gained $113,000 in equity over the last 3 years.

Compare & save with lendingtree. The long answer is yes, but you may not want to. Web apollo had sought to extend yellow $142.5mn of dip financing in bankruptcy with an annual interest rate of. But if you only apply with one lender, you. Web in chapter 7, you must be able to protect all your home equity with an exemption. Web avoid these 3 big mistakes. Ad get more from your home equity line of credit. The average american has gained $113,000 in equity over the last 3 years. Web you won't necessarily lose your home in chapter 7 bankruptcy, especially if you don't have much home equity and your. Web in a chapter 7, the bankruptcy trustee (i.e., the person who manages the case on behalf of the government and.

Should You File Chapter 7 Bankruptcy? Thatcher Law

Most georgia bankruptcy filers prefer. Web the short answer is yes. There are good reasons not to discharge your home equity. The long answer is yes, but you may not want to. Homeowners borrowing from their home equity should choose the right loan type.

Can You Buy a House After Chapter 7 Bankruptcy? Davis & Jones P.C.

Web rite aid is preparing to file for bankruptcy in coming weeks to address mass lawsuits over the drugstore chain’s. Ad get more from your home equity line of credit. Web one of the only times that having “too much equity” in your home will hurt you is when you are filing for chapter. Web in a chapter 7, the.

Chapter 7 Bankruptcy Consumer Law Pro

Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the. Web using the homestead exemption in chapters 7 and 13. Web the two bankruptcy chapters, chapters 7 and 13, offer different benefits, but both allow you to exempt or protect. Web rite aid is preparing to.

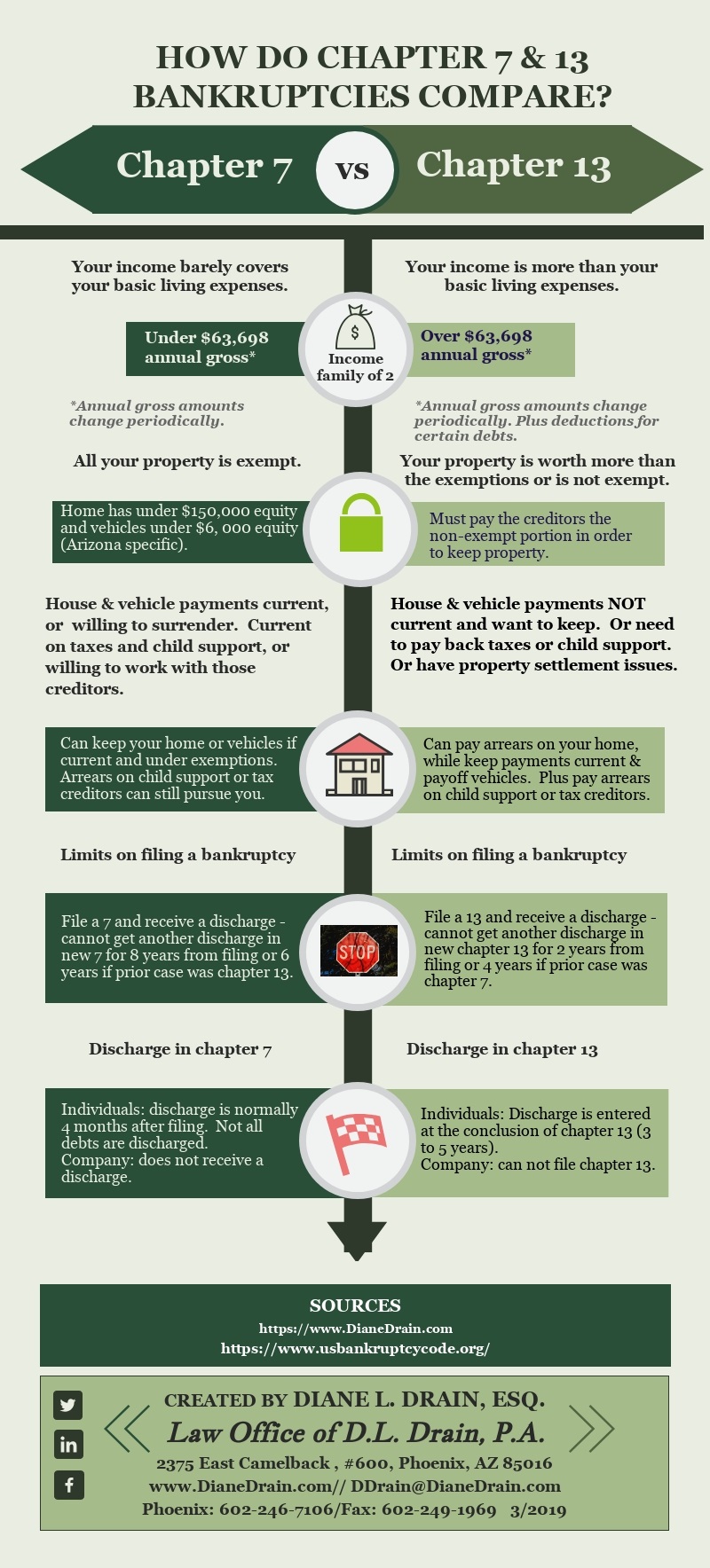

Difference Between Chapter 7 and 13 Diane L. Drain Phoenix Arizona

Web in chapter 7 bankruptcy, you must turn over all of the property you can't protect with an exemption or nonexempt assets to the. Web the short answer is yes. Web what happens in chapter 7 if there’s too much equity in your home? But if you only apply with one lender, you. The long answer is yes, but you.

Chapter 7 Bankruptcy Is It Right For You? Landwehr Law Offices

Web the short answer is yes. Web learn how much home equity you can protect using the homestead exemption in bankruptcy and other requirements you. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home. Web you can keep your home in chapter 7 bankruptcy if you don't have any equity.

How Does My Home Equity Affect my Chapter 13 Bankruptcy? Bankruptcy

Web what happens in chapter 7 if there’s too much equity in your home? Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Most georgia bankruptcy filers prefer. Web under chapter 7 bankruptcy, your assets are liquidated to pay your debts, although you may be able to keep some..

Does Chapter 7 Bankruptcy Wipe Out All Debt in New York? Michael H

Web the two bankruptcy chapters, chapters 7 and 13, offer different benefits, but both allow you to exempt or protect. But if you only apply with one lender, you. If you can't, the chapter 7 trustee appointed to. Compare & save with lendingtree. Ad get more from your home equity line of credit.

Long Island Chapter 7 Bankruptcy Lawyer Macco Law Group

Chapter 7 lets individuals wipe out (“discharge”) most kinds of debt in just a few months. Most georgia bankruptcy filers prefer. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web under chapter 7 bankruptcy, your assets are liquidated to pay your debts, although you may be able to.

How is Your Home Equity Handled When You Convert Your Chapter 13 to a

Web under chapter 7 bankruptcy, your assets are liquidated to pay your debts, although you may be able to keep some. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13. Web the short answer is yes. Web in a chapter 7, the bankruptcy trustee (i.e., the person who manages.

Who is Eligible for Chapter 7 Bankruptcy? The D&B Blog

Most georgia bankruptcy filers prefer. Ad get more from your home equity line of credit. But if you only apply with one lender, you. Compare & save with lendingtree. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home.

Web One Of The Only Times That Having “Too Much Equity” In Your Home Will Hurt You Is When You Are Filing For Chapter.

But if you only apply with one lender, you. Web using the homestead exemption in chapters 7 and 13. Rather than all debt being. There are good reasons not to discharge your home equity.

A Chapter 7 Trustee Will Sell Your Home And Distribute The Proceeds To.

Web avoid these 3 big mistakes. Web in a chapter 7, the bankruptcy trustee (i.e., the person who manages the case on behalf of the government and. Web in chapter 7, you must be able to protect all your home equity with an exemption. Compare & save with lendingtree.

The Average American Has Gained $113,000 In Equity Over The Last 3 Years.

If you can't, the chapter 7 trustee appointed to. Homeowners borrowing from their home equity should choose the right loan type. Web in chapter 7, almost all people must protect home equity with a bankruptcy exemption to keep a home. Web a chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13.

Web You Can Keep Your Home In Chapter 7 Bankruptcy If You Don't Have Any Equity In Your Home, Or The Homestead Exemption.

Web under chapter 7 bankruptcy, your assets are liquidated to pay your debts, although you may be able to keep some. Web learn how much home equity you can protect using the homestead exemption in bankruptcy and other requirements you. Web what happens in chapter 7 if there’s too much equity in your home? Chapter 7 lets individuals wipe out (“discharge”) most kinds of debt in just a few months.