Kansas Extension Form

Kansas Extension Form - Submit the requested documentation along with a copy of the form and appropriate fee. The state of kansas accepts a properly filed federal tax extension (irs form 7004). Web consumer clerk's fourteen day extension for file answer clerk's fourteen day extension for file answer facebook twitter email this is a form that seeks a delay. Submit the above form along with proof of finances to isss. Kansas tax extensions are automatic, so there’s no application form or written request to submit. Information related to the financial estimates and. Check the box on the voucher for extension payment. If you owe zero tax or you’re due a state tax refund, you do not have. Web kansas state income tax return forms for tax year 2022 (jan. Web your kansas driver's license and supporting documents.

The clerk may extend for a period of no more than 14 days the initial time to plead to a petition in a civil action governed by the rules of civil procedure,. If you owe zero tax or you’re due a state tax refund, you do not have. Web your kansas driver's license and supporting documents. Submit the requested documentation along with a copy of the form and appropriate fee. Web consumer clerk's fourteen day extension for file answer clerk's fourteen day extension for file answer facebook twitter email this is a form that seeks a delay. Check the box on the voucher for extension payment. Submit the above form along with proof of finances to isss. Web kansas state income tax return forms for tax year 2022 (jan. Information related to the financial estimates and. Check the box on the voucher for extension.

Information related to the financial estimates and. Check the box on the voucher for extension payment. Web kansas tax extension form: Submit the requested documentation along with a copy of the form and appropriate fee. The state of kansas accepts a properly filed federal tax extension (irs form 7004). Check the box on the voucher for extension. Web kansas state income tax return forms for tax year 2022 (jan. Web complete the program extension approval form. If you owe zero tax or you’re due a state tax refund, you do not have. Web what form does the state of kansas require to apply for.

Hailong Dao

In order to automatically receive a kansas. Submit the above form along with proof of finances to isss. If you owe zero tax or you’re due a state tax refund, you do not have. Information related to the financial estimates and. Web kansas tax extension form:

Kansas Extension Animation Video YouTube

Web your kansas driver's license and supporting documents. Submit the requested documentation along with a copy of the form and appropriate fee. Web kansas allows an automatic extension to october 15 if federal form 4868 is filed with the irs and a copy is enclosed with the kansas return when filed. Web consumer clerk's fourteen day extension for file answer.

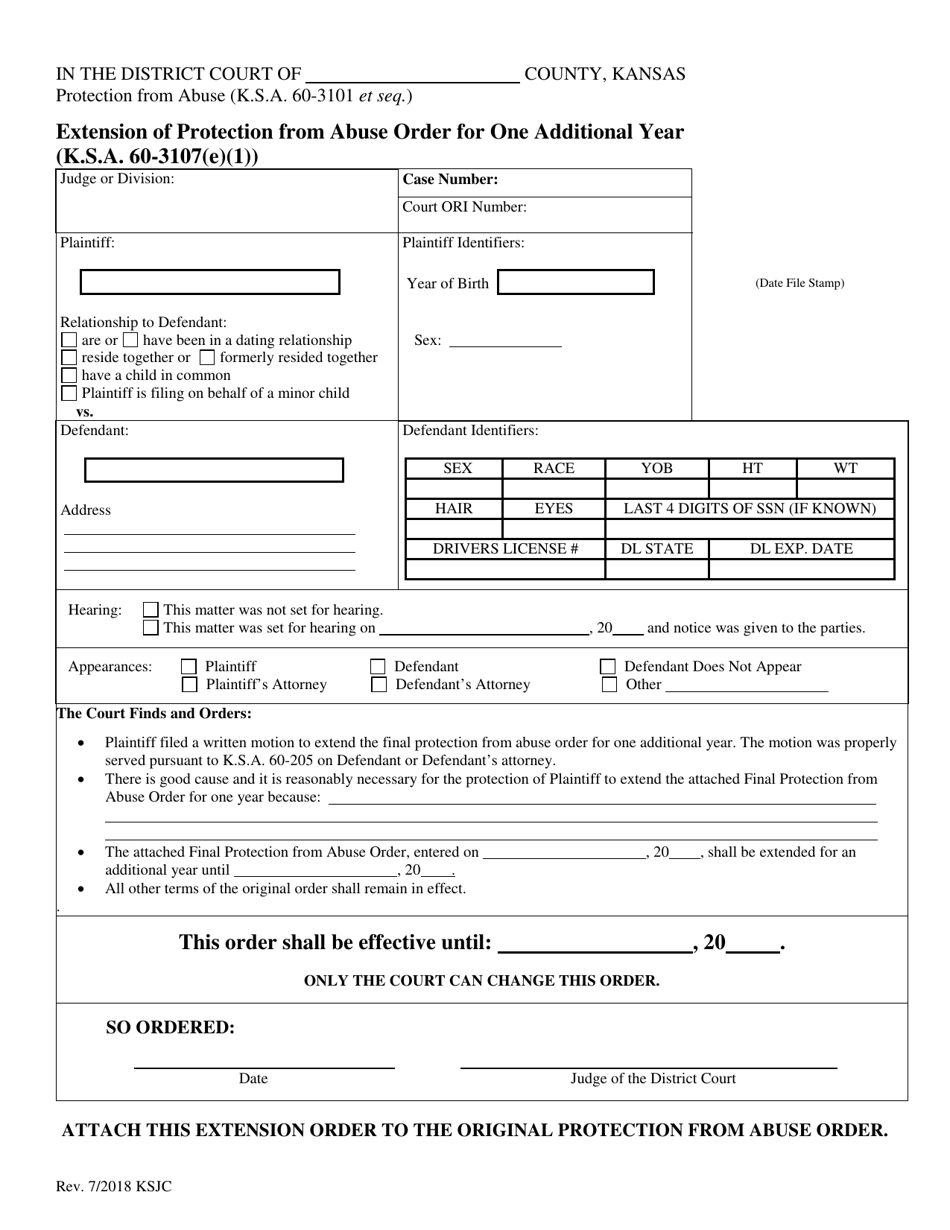

Kansas Extension of Protection From Abuse Order for Two Additional

Web complete the program extension approval form. When a due date falls on a saturday, sunday or legal. Check the box on the voucher for extension payment. Web kansas tax extension form: In order to automatically receive a kansas.

Kansas Notice of Extension to File Lien Download Printable PDF

Web complete the program extension approval form. If you owe zero tax or you’re due a state tax refund, you do not have. The state of kansas accepts a properly filed federal tax extension (irs form 7004). Submit the requested documentation along with a copy of the form and appropriate fee. Web kansas allows an automatic extension to october 15.

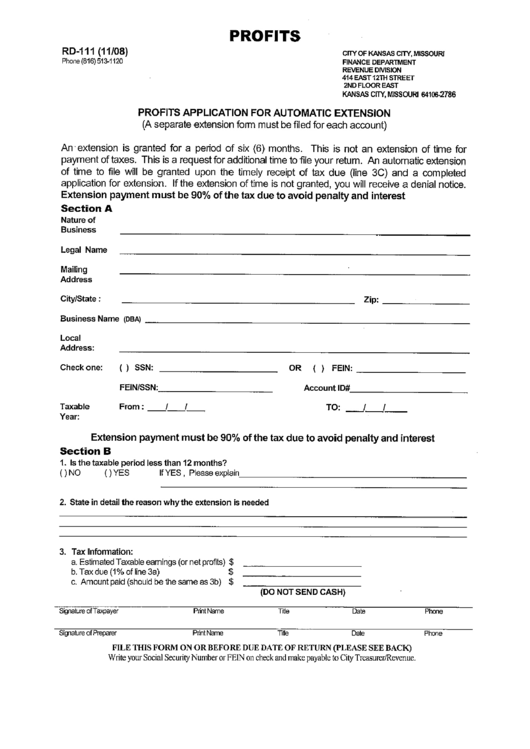

Form Rd111 Prifits Application For Automatic Extension City Of

If you owe zero tax or you’re due a state tax refund, you do not have. Information related to the financial estimates and. Submit the requested documentation along with a copy of the form and appropriate fee. Check the box on the voucher for extension payment. The state of kansas accepts a properly filed federal tax extension (irs form 7004).

Kansas Extension Service Administrative Handbook

The state of kansas accepts a properly filed federal tax extension (irs form 7004). Check the box on the voucher for extension payment. Web what form does the state of kansas require to apply for. Web your kansas driver's license and supporting documents. Submit the above form along with proof of finances to isss.

Kansas Extension of Protection From Abuse Order for the Additional Year

Web complete the program extension approval form. Web consumer clerk's fourteen day extension for file answer clerk's fourteen day extension for file answer facebook twitter email this is a form that seeks a delay. If you owe zero tax or you’re due a state tax refund, you do not have. The clerk may extend for a period of no more.

University of Kansas architecture school extension features glass skin

Information related to the financial estimates and. The clerk may extend for a period of no more than 14 days the initial time to plead to a petition in a civil action governed by the rules of civil procedure,. If you owe zero tax or you’re due a state tax refund, you do not have. Submit the requested documentation along.

Kansas extension animation video

If you owe zero tax or you’re due a state tax refund, you do not have. Submit the above form along with proof of finances to isss. The state of kansas accepts a properly filed federal tax extension (irs form 7004). The clerk may extend for a period of no more than 14 days the initial time to plead to.

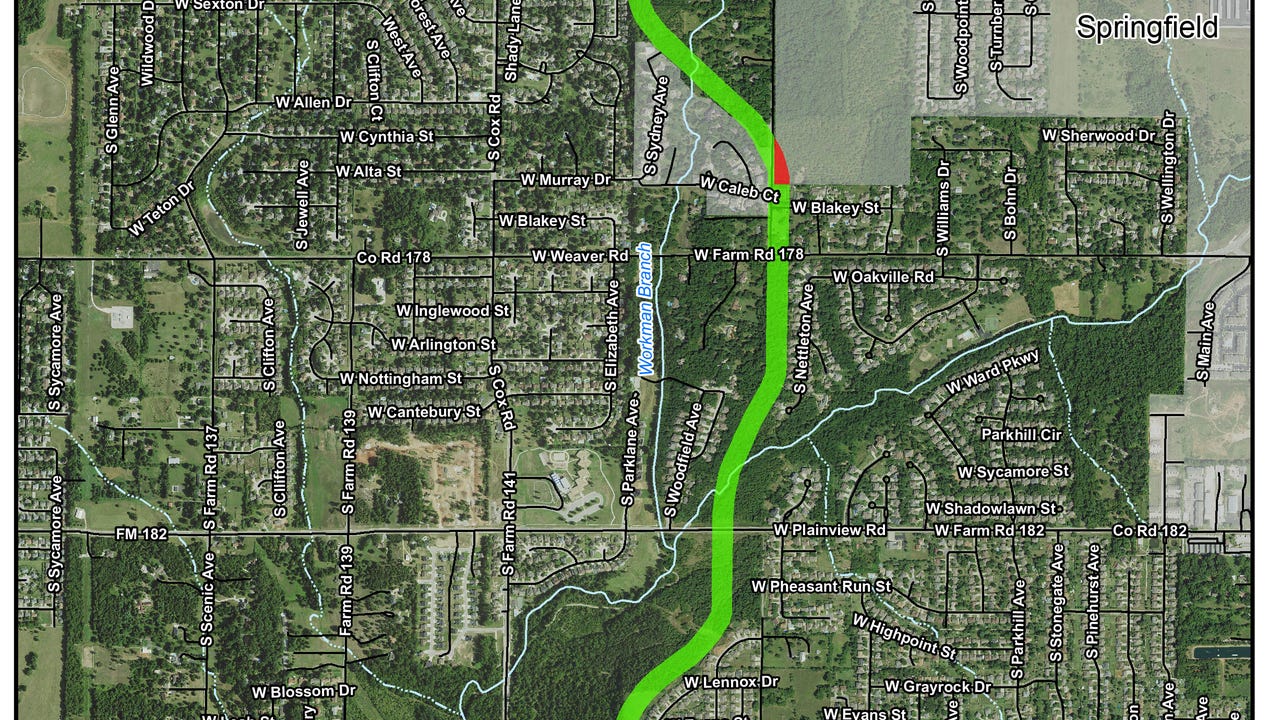

Kansas Expressway extension in Springfield could begin as soon as next fall

Web kansas tax extension form: Submit the above form along with proof of finances to isss. Web kansas state income tax return forms for tax year 2022 (jan. Web what form does the state of kansas require to apply for. If you owe zero tax or you’re due a state tax refund, you do not have.

Web Your Kansas Driver's License And Supporting Documents.

Web kansas state income tax return forms for tax year 2022 (jan. Check the box on the voucher for extension payment. Kansas tax extensions are automatic, so there’s no application form or written request to submit. Web kansas allows an automatic extension to october 15 if federal form 4868 is filed with the irs and a copy is enclosed with the kansas return when filed.

The State Of Kansas Accepts A Properly Filed Federal Tax Extension (Irs Form 7004).

Web kansas tax extension form: Submit the above form along with proof of finances to isss. When a due date falls on a saturday, sunday or legal. In order to automatically receive a kansas.

Web What Form Does The State Of Kansas Require To Apply For.

Information related to the financial estimates and. Web today, governor laura kelly announced that kansas 2020 individual income tax, fiduciary income tax, and homestead or property tax relief refund claim filings are. Web kansas tax extension form: Web complete the program extension approval form.

The Clerk May Extend For A Period Of No More Than 14 Days The Initial Time To Plead To A Petition In A Civil Action Governed By The Rules Of Civil Procedure,.

Web consumer clerk's fourteen day extension for file answer clerk's fourteen day extension for file answer facebook twitter email this is a form that seeks a delay. If you owe zero tax or you’re due a state tax refund, you do not have. Submit the requested documentation along with a copy of the form and appropriate fee. Check the box on the voucher for extension.

/cloudfront-us-east-1.images.arcpublishing.com/gray/R254B3C5FFHXNOPKSATPLFVQLM.jpg)