Download 941 Form 2020

Download 941 Form 2020 - Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Enter the irs form 941 2020 in the editor. April, may, june read the separate instructions before completing this form. This worksheet does not have to be attached. Web department of the treasury — internal revenue service 950117 omb no. July 2020) employer’s quarterly federal tax return 950120 omb no. Web how to complete a fillable 941 form 2020? Type or print within the boxes. Instead, employers in the u.s.

Type or print within the boxes. Employer s quarterly federal tax return keywords: Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. This worksheet does not have to be attached. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Department use only (mm/dd/yy) amended return. Web employer's quarterly federal tax return for 2021. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Instructions for form 941 (2021) pdf. Instead, employers in the u.s.

This worksheet does not have to be attached. Web how to complete a fillable 941 form 2020? Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. However, it is a great tool for completing form 941 for. January, february, march name (not your trade name) 2: Instructions for form 941 (2021) pdf. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. July 2020) employer’s quarterly federal tax return 950120 omb no. Employer’s return of income taxes withheld.

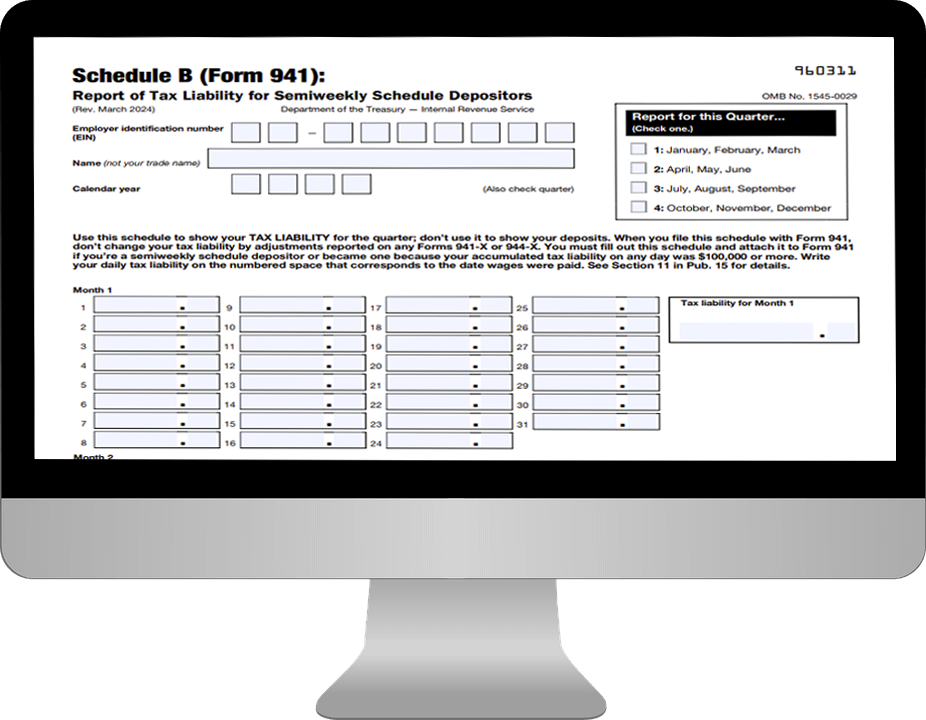

Form Fillable Schedule Printable Forms Free Online

Web form 941 worksheet for 2022. Employer’s return of income taxes withheld. Instead, employers in the u.s. Employer s quarterly federal tax return keywords: Department use only (mm/dd/yy) amended return.

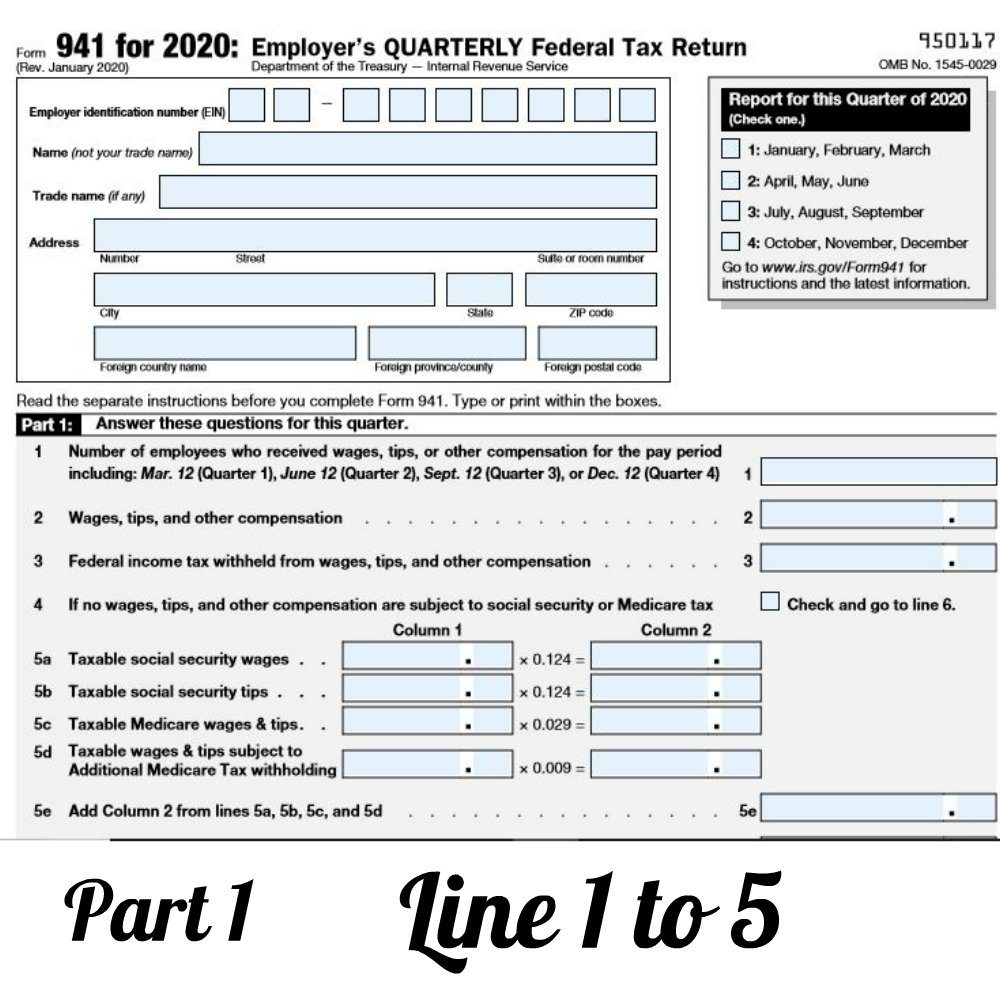

How to Fill Out 2020 Form 941 Employer’s Quarterly Federal Tax Return

Employer s quarterly federal tax return keywords: Instructions for form 941 (2021) pdf. Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. However, it is a great tool for completing form 941 for. Enter the irs form 941 2020 in the editor.

You Will Probably See These Changes on the Revised Form 941… Blog

July 2020) employer’s quarterly federal tax return 950120 omb no. Employer’s return of income taxes withheld. For additional information and to locate the refund request form visit the online credit inquiry system at. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. January, february, march name (not your trade name) 2:

The NoWorry Guide To File Form 941 During Tax Year 2020 Blog

Enter the irs form 941 2020 in the editor. Instead, employers in the u.s. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet. Web department of the treasury — internal revenue service 950117 omb no. You must complete all five pages.

Fillable Form 941 Schedule B 2020 Download Printable 941 for Free

Web department of the treasury — internal revenue service 950117 omb no. April, may, june read the separate instructions before completing this form. April, may, june trade name (if any). This worksheet does not have to be attached. To help business owners calculate the tax credits they are eligible for, the irs has created worksheet.

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

This worksheet does not have to be attached. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Enter the irs form 941 2020 in the editor. For additional information and to locate the refund request form visit the online credit inquiry system at. Instructions for form 941 (2021).

2020 Form IRS 941SS Fill Online, Printable, Fillable, Blank pdfFiller

Pick the first field and start writing the requested info. Instructions for form 941 (2021) pdf. This worksheet does not have to be attached. April, may, june trade name (if any). For additional information and to locate the refund request form visit the online credit inquiry system at.

How do I download Form 941?

Instructions for form 941 (2021) pdf. Type or print within the boxes. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. January, february, march name (not your trade name) 2: To help business owners calculate the tax credits they are eligible for, the irs has created worksheet.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

You must complete all five pages. This worksheet does not have to be attached. Instructions for form 941 (2021) pdf. Pick the first field and start writing the requested info. Department use only (mm/dd/yy) amended return.

941 Form 2021

Instructions for form 941 (2021) pdf. April, may, june trade name (if any). Enter the irs form 941 2020 in the editor. Department use only (mm/dd/yy) amended return. For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b).

Web How To Complete A Fillable 941 Form 2020?

Employer s quarterly federal tax return keywords: April, may, june read the separate instructions before completing this form. Instructions for form 941 (2021) pdf. You should simply follow the instructions:

You Must Complete All Five Pages.

For employers who withhold taxes from employee's paychecks or who must pay the employer's portion of social security or medicare tax (also known as schedule b). Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. Type or print within the boxes. This worksheet does not have to be attached.

Pick The First Field And Start Writing The Requested Info.

Form 941 is used by employers who withhold income taxes from wages or who must pay social security or medicare tax. Department use only (mm/dd/yy) amended return. July 2020) employer’s quarterly federal tax return 950120 omb no. Employer’s return of income taxes withheld.

Web Department Of The Treasury — Internal Revenue Service 950117 Omb No.

January, february, march name (not your trade name) 2: Territories will file form 941, or, if you prefer your form and instructions in spanish, you can file new form 941 (sp), declaración del impuesto federal trimestral del Web employer's quarterly federal tax return for 2021. Instead, employers in the u.s.