Irs Audit Reconsideration Form 12661

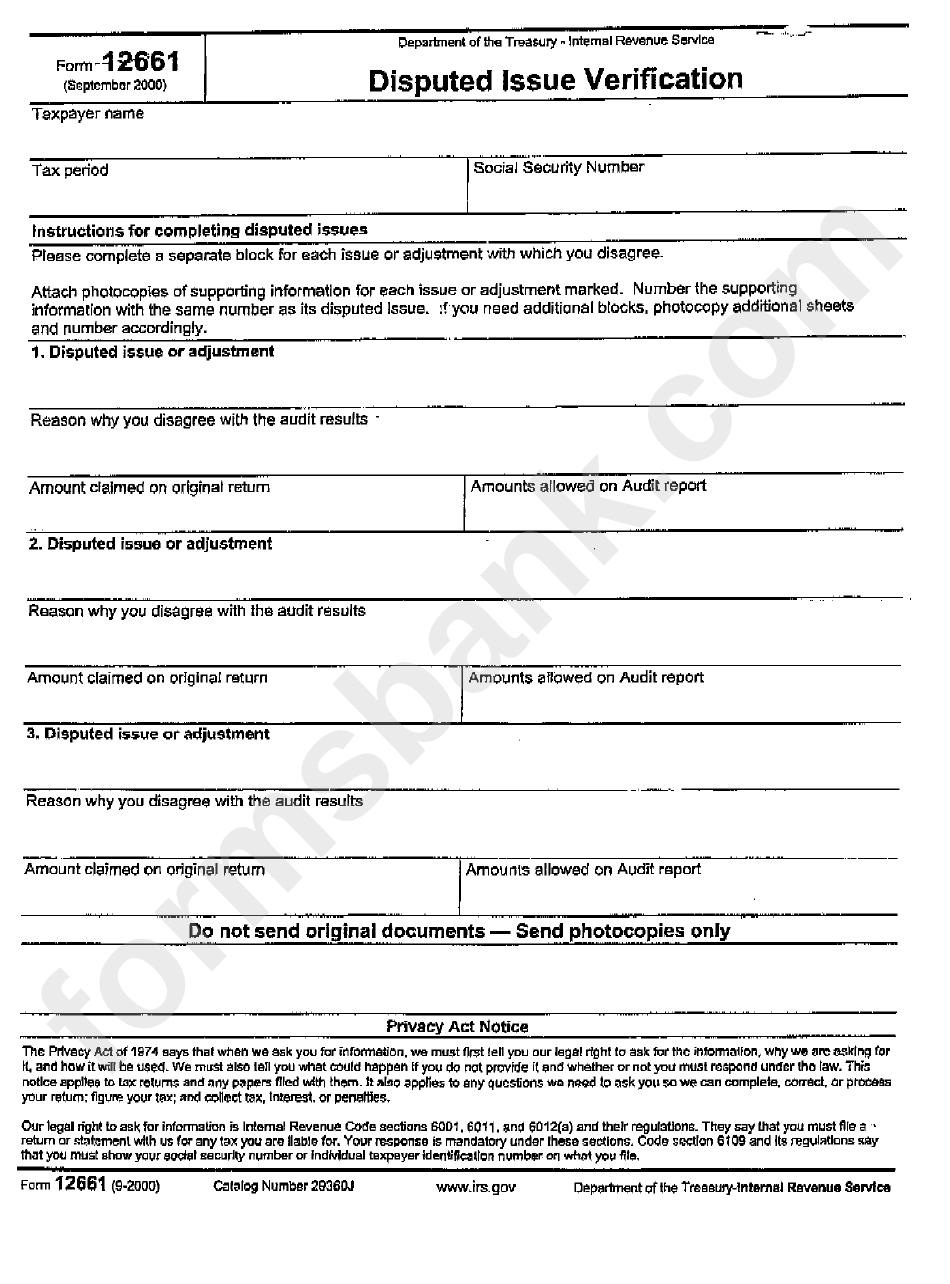

Irs Audit Reconsideration Form 12661 - How to request irs audit reconsideration review audit report and gather documents. Web request an audit reconsideration: Web an audit reconsideration is a process the irs offers to help you if you disagree with the results of an audit of your tax return, or if you disagree with a tax return the irs. Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Web you may request an audit reconsideration when you disagree with the tax the irs says you owe and any of the three situations below apply: Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit. Web the audit reconsideration process: Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited.

Web request an audit reconsideration: Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. Web send letter 3338c with pub 3598, and form 12661 to the taxpayer and advise them to follow procedures in the publication on how to file an audit. You can also write an irs audit reconsideration letter. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree with upon receiving. Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report) to your request. Get your online template and fill it in using progressive. To request an audit reconsideration, you must complete and submit form 12661 to the irs. Web responding with irs form 12661. Web the audit reconsideration process:

The irs will review the taxpayer’s claim. Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit. Get your online template and fill it in using progressive. Form 12661 must be submitted within 30 days of the. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. Web advise the taxpayer to fully explain the reason for disagreement with the audit adjustment on form 12661. If available, attach a copy of your examination report, form 4549, along with the. Web you may request an audit reconsideration when you disagree with the tax the irs says you owe and any of the three situations below apply:

irs audit reconsideration form 12661 Fill Online, Printable, Fillable

In any of the four situations below, you can request an audit reconsideration. Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. To request an audit reconsideration, you must complete and submit form 12661 to the irs. Web form 12661 is the official irs.

IRS Publication 936 2010 Fill and Sign Printable Template Online US

How to request irs audit reconsideration review audit report and gather documents. Web responding with irs form 12661. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Web other documents to include are form 12661, disputed issue verification, which explains the issues you are.

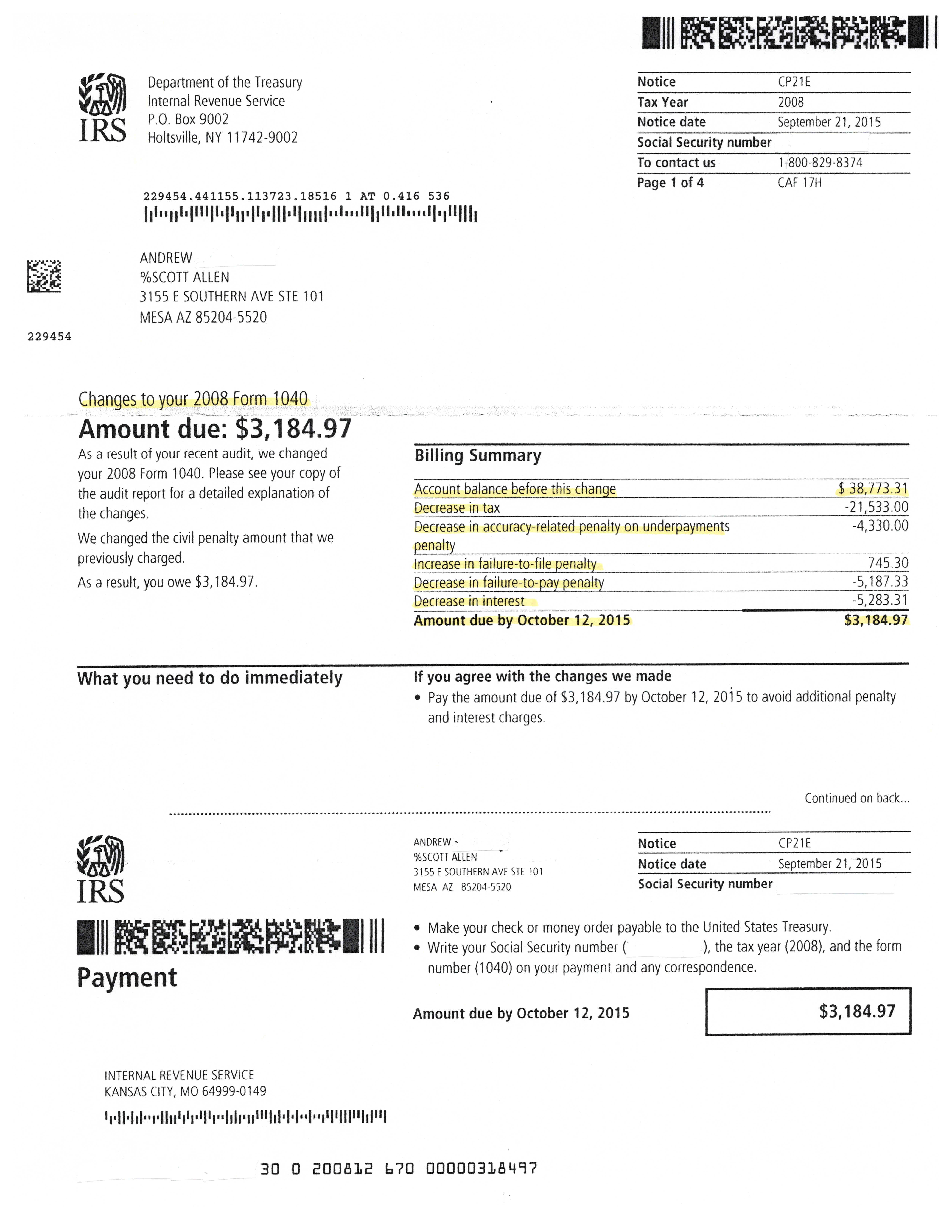

IRS Audit Penalties Everything to Know About IRS Audit Tax Penalties

Web request an audit reconsideration: Get your online template and fill it in using progressive. Web send letter 3338c with pub 3598, and form 12661 to the taxpayer and advise them to follow procedures in the publication on how to file an audit. Web you may request an audit reconsideration when you disagree with the tax the irs says you.

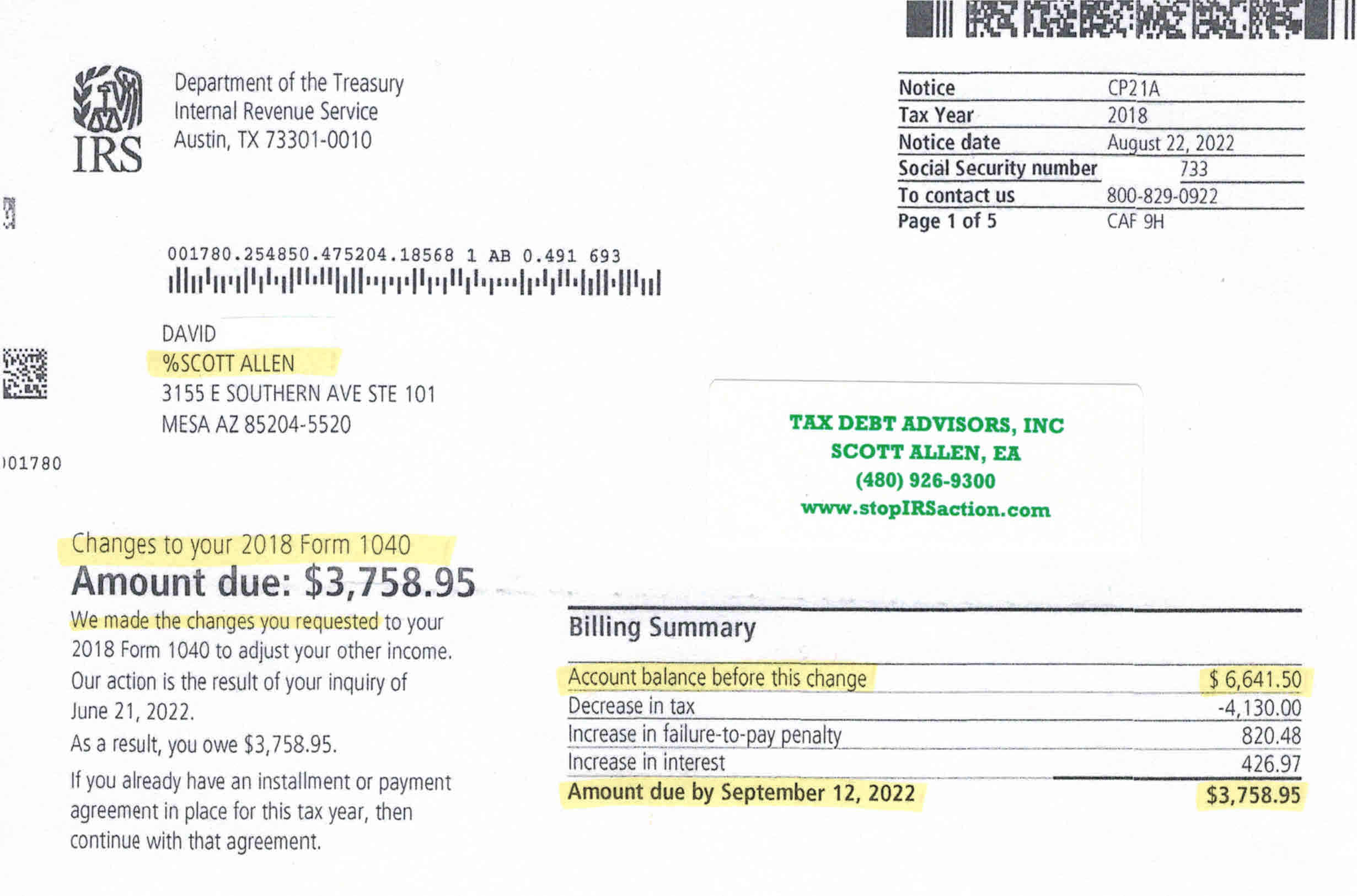

Successful IRS Audit Reconsideration in Phoenix Arizona Tax Debt

Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. Form 12661 must be submitted within 30 days of the. • form 12661 is now obsolete and no longer relevant. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web send letter 3338c with.

See? 45+ List Of Irs Audit Reconsideration Sample Letter Your Friends

• form 12661 is now obsolete and no longer relevant. Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report) to your request. The request for reconsideration can help you resolve. To request an audit reconsideration, you must complete and submit form 12661 to the irs..

David’s IRS Audit reconsideration in Scottsdale Arizona Tax Debt Advisors

Web audit reconsideration section 1. Web responding with irs form 12661. Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web advise the taxpayer to fully explain the reason for disagreement with the audit.

IRS Appeals Page 2 Tax Debt Advisors

Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit. Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Web.

IRS Form W2G IRS Form for Gambling Winnings

Web an audit reconsideration is a process the irs offers to help you if you disagree with the results of an audit of your tax return, or if you disagree with a tax return the irs. Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report).

Form 12661 Disputed Issue Verification 2000 printable pdf download

Get your online template and fill it in using progressive. In any of the four situations below, you can request an audit reconsideration. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web form 12661 is the official irs audit letter for reconsideration that gives taxpayers the opportunity to explain which decisions they disagree.

IRS Audit Letter 4364C Sample 1

Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments. You can also write an irs audit reconsideration letter. Web o copy of audit report (form 4549) o reconsideration request is sent to the campus shown on audit report. The request for reconsideration can help you resolve. Web form 12661.

• Form 12661 Is Now Obsolete And No Longer Relevant.

Web other documents to include are form 12661, disputed issue verification, which explains the issues you are outlining, and form 4549, which is your original. Web you can file for an audit reconsideration under certain circumstances authorized by the internal revenue code 6020 (b). Web request an audit reconsideration: Web responding with irs form 12661.

The Request For Reconsideration Can Help You Resolve.

Web o copy of audit report (form 4549) o reconsideration request is sent to the campus shown on audit report. Web audit reconsideration section 1. Web form 12661 is a form that taxpayers can use to request an audit reconsideration for a return or claim that has already been audited. Introduction 4.13.1 introduction manual transmittal december 16, 2015 purpose (1) this transmits revised 4.13.1 audit.

How To Request Irs Audit Reconsideration Review Audit Report And Gather Documents.

If available, attach a copy of your examination report, form 4549, along with the. Web an audit reconsideration is a process the irs offers to help you if you disagree with the results of an audit of your tax return, or if you disagree with a tax return the irs. In any of the four situations below, you can request an audit reconsideration. Web form 12661 is the irs form for you to explain why you disagree with the audit’s changes and adjustments.

A Process That Reopens Your Irs Audit.

Web in that case, you can request a reconsideration by attaching irs form 12661 (disputed issue verification) and irs form 4549 (your audit report) to your request. Web form 12661, disputed issue verification, is recommended to explain the issues you disagree with. Web the audit reconsideration process: Form 12661 must be submitted within 30 days of the.