How To Form An Llc From A Sole Proprietorship

How To Form An Llc From A Sole Proprietorship - Web a sole proprietorship is an informal, unincorporated business structure. Web a limited liability company (llc) is a business structure allowed by state statute. Easy and affordable to create. It is hybrid in nature, meaning it offers the ease of a sole proprietorship and limited liability and tax flexibility. Sole proprietorship each business structure has its advantages and disadvantages. Ad we can help you decide what business type is best for you. Web to turn your llc into a sole proprietorship, all you really need to do is dissolve your llc. When you’re operating a sole. It is a legal entity created for running a business. Free 1st year register agent.

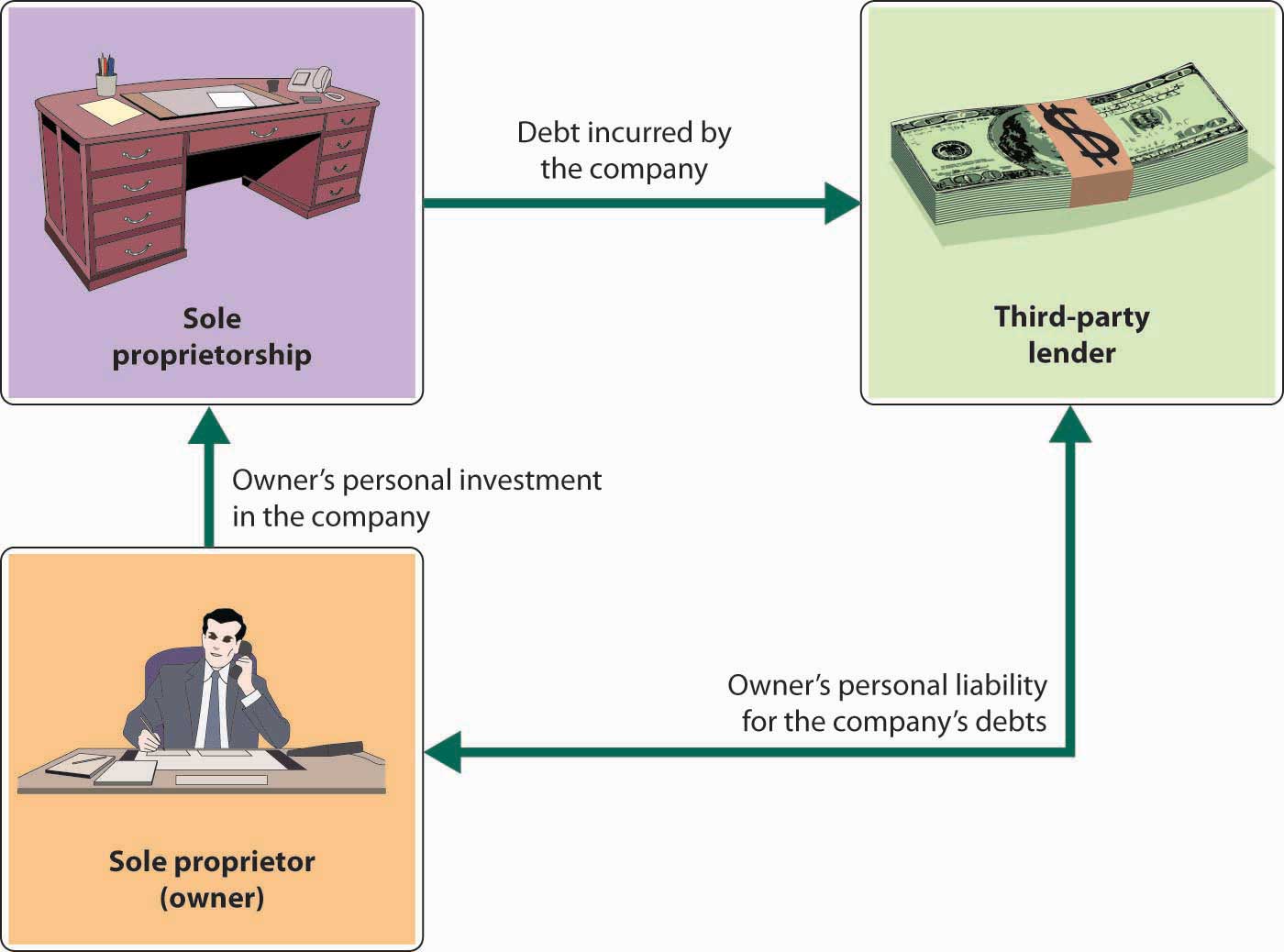

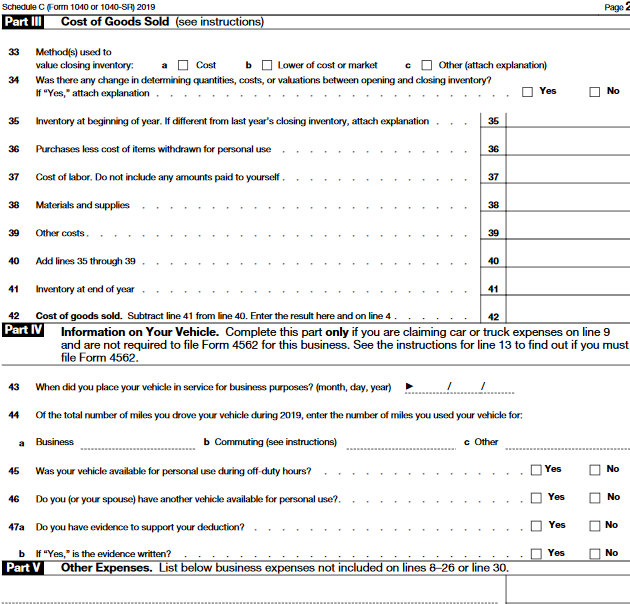

Yet it lacks liability protection. As a sole proprietor, you are personally liable for the business's debts and legal issues. Switching from a sole proprietorship to an llc is the next step in growing your business and protecting your. Start today for $0 + state fees. Web if the owner is an individual, the activities of the llc will generally be reflected on: Web file your articles of organization. Web forms for sole proprietorship. Web there are a few reasons to open up an llc instead of operating as a sole proprietorship: Ad quickly & easily form your new business, in any state, for as little as $0 + state fees. Get exactly what you want at the best price.

Web to turn your llc into a sole proprietorship, all you really need to do is dissolve your llc. It is hybrid in nature, meaning it offers the ease of a sole proprietorship and limited liability and tax flexibility. Web unless it plans on hiring employees, sole proprietorships with dba don't have a separate ein; As a sole proprietor, you are personally liable for the business's debts and legal issues. If you are the sole owner of the llc, then you must pay all the taxes on. Ad quickly & easily form your new business, in any state, for as little as $0 + state fees. Web 9 rows sole proprietorships. Find out what they are. Web there are a few reasons to open up an llc instead of operating as a sole proprietorship: Sole proprietorship each business structure has its advantages and disadvantages.

4.2 Sole Proprietorship Exploring Business

Web 9 rows sole proprietorships. Web no matter how little you know about starting your own business, you can build one from scratch by following a few simple strategies. Ad our easy online form can be completed in just 10 minutes or less. Switching from a sole proprietorship to an llc is the next step in growing your business and.

LLC vs S Corp vs C Corp vs Partnership vs Sole Prop Mazuma USA

Web to turn your llc into a sole proprietorship, all you really need to do is dissolve your llc. It is a legal entity created for running a business. Ad quickly & easily form your new business, in any state, for as little as $0 + state fees. Ad our easy online form can be completed in just 10 minutes.

Sole Proprietorship vs SCorp Tax Spreadsheet for Publisher

Web how to change from a sole proprietorship to llc. Web 9 rows sole proprietorships. You want to expand the company to more than one owner in the. Web llc stands for limited liability company. Ad we can help you decide what business type is best for you.

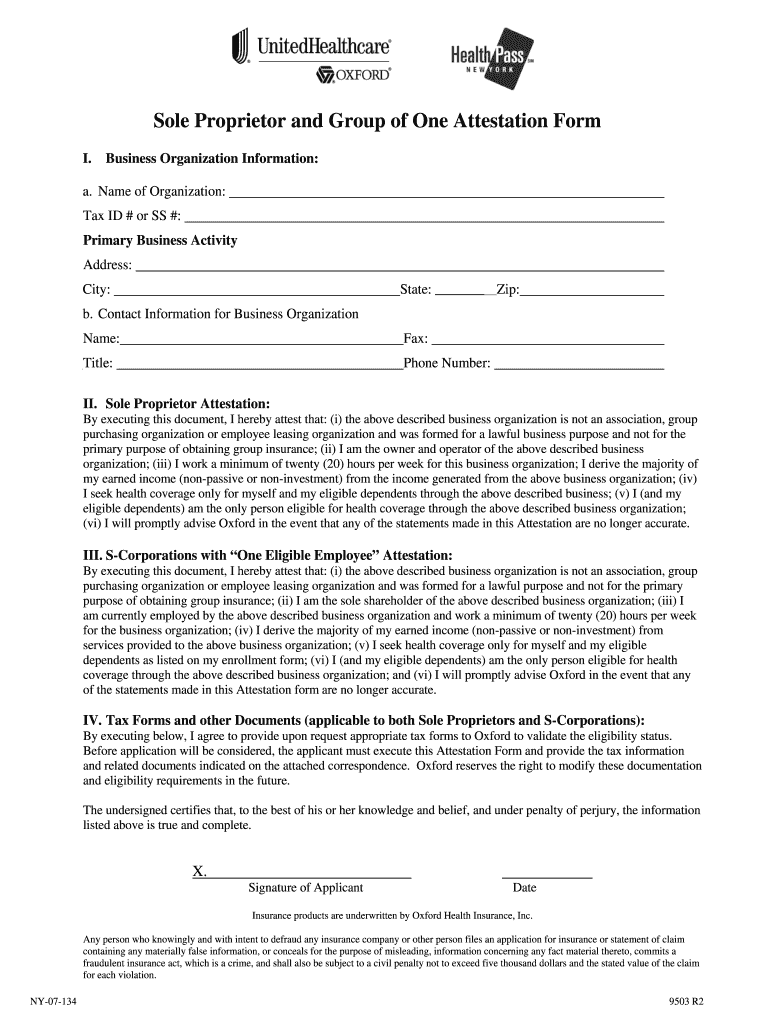

What Paperwork Is Needed For Sole Proprietorship Armando Friend's

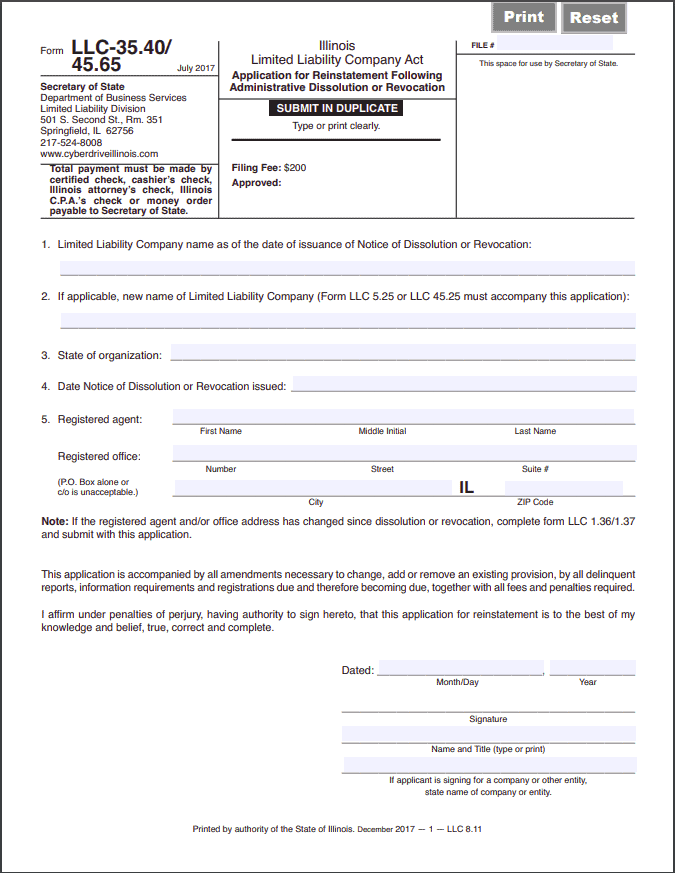

An llc requires filing articles of. Find out what they are. Pick the state where you want to organize the llc. Get exactly what you want at the best price. Ad quickly & easily form your new business, in any state, for as little as $0 + state fees.

Comparison of Business Entities

Web there are a few reasons to open up an llc instead of operating as a sole proprietorship: Ad we can help you decide what business type is best for you. File your form through this portal and include credit or debit card information to. You want to expand the company to more than one owner in the. Easy and.

Sole Proprietorship vs LLC Advantages and Disadvantages SpendMeNot

If you do that, and continue selling whatever you’re selling, you’re automatically a sole. Web business formation starting a business llc vs. Web to turn your llc into a sole proprietorship, all you really need to do is dissolve your llc. Web llc stands for limited liability company. Sole proprietorship each business structure has its advantages and disadvantages.

Sole Proprietorship Affidavit Format Fill Out and Sign Printable PDF

Web if the owner is an individual, the activities of the llc will generally be reflected on: Being your own boss, having complete. Web to turn your llc into a sole proprietorship, all you really need to do is dissolve your llc. Find out what they are. File your form through this portal and include credit or debit card information.

Form Sole Proprietorship Illinois Armando Friend's Template

Being your own boss, having complete. Web business formation starting a business llc vs. Web a limited liability company (llc) is a business structure allowed by state statute. Because an llc is formed in accordance with the rules and requirements of a particular state law, the first. If you do that, and continue selling whatever you’re selling, you’re automatically a.

Sole Proprietorship vs. LLC How Do They Compare in 2019? TheStreet

Web how to change from a sole proprietorship to llc. Web business formation starting a business llc vs. Ad our easy online form can be completed in just 10 minutes or less. It is a legal entity created for running a business. Because an llc is formed in accordance with the rules and requirements of a particular state law, the.

Difference Between Sole Proprietorship and LLC Difference Between

Web there are a few reasons to open up an llc instead of operating as a sole proprietorship: Pick the state where you want to organize the llc. Web unless you file form 8832, the irs will treat your llc as a partnership for income tax purposes. If you are the sole owner of the llc, then you must pay.

An Llc Requires Filing Articles Of.

Find out what they are. You want to expand the company to more than one owner in the. When you’re operating a sole. Being your own boss, having complete.

Web A Sole Proprietorship Is Undoubtedly The Easiest To Set Up, As It Doesn’t Require Any Paperwork.

If you are the sole owner of the llc, then you must pay all the taxes on. Web is a sole proprietorship right for you? Web a sole proprietorship is an informal, unincorporated business structure. Each state may use different regulations, you should check with your state if you.

As A Sole Proprietor, You Are Personally Liable For The Business's Debts And Legal Issues.

Web how to change from a sole proprietorship to llc. Web simple and inexpensive formation full control over the way the business is managed (i.e., no irs requirements) straightforward tax structure the disadvantages of. Web to turn your llc into a sole proprietorship, all you really need to do is dissolve your llc. Sole proprietorship each business structure has its advantages and disadvantages.

Ad We Can Help You Decide What Business Type Is Best For You.

Web file your articles of organization. Yet it lacks liability protection. Easy and affordable to create. If you want to start your own business but don’t necessarily want to form a limited liability company (llc) or.