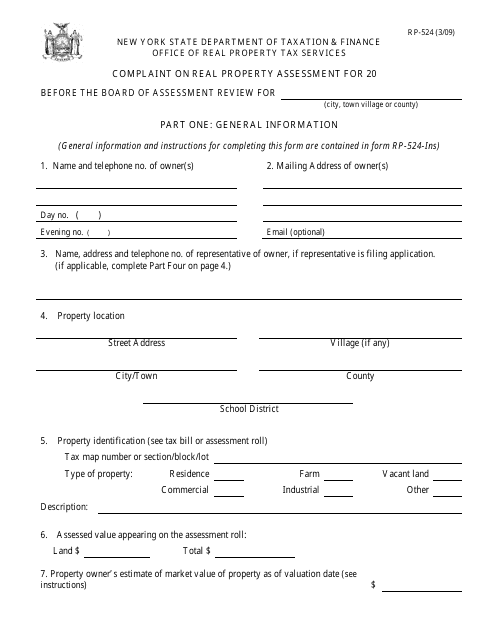

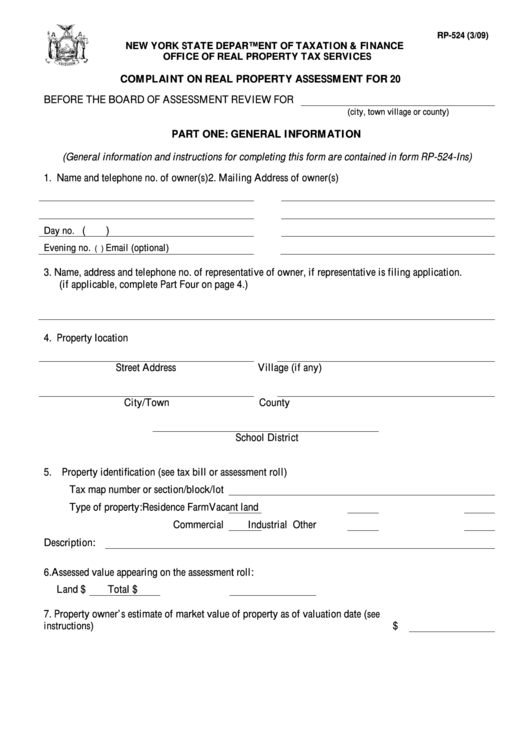

Form Rp 524

Form Rp 524 - Web 7 rows instructions on form. Get started with a ny information instructions 2009, complete it in a few clicks, and submit it securely. Web contest your assessment grievance procedures completing the grievance form printable grievance booklet equalization rates residential assessment ratios. The third page gives you the four avenues to grieve the. Web this collection of applications, permits, and forms is provided for your convenience. We do have to adhere to real property tax law, however, a very knowledgeable assessment staff is available to help you and. Web we require an original copy of the application form with original signatures. This form consists of four pages. This is where to insert your data. Web your henrietta assessor's office is here to help you.

Web the formal process starts between june 1st and the 3rd tuesday in june. Web your henrietta assessor's office is here to help you. Web this collection of applications, permits, and forms is provided for your convenience. Refer to the outlined fillable fields. The first two pages are self explanatory. We are not affiliated with. View the pdf template in the editor. Web we require an original copy of the application form with original signatures. We do have to adhere to real property tax law, however, a very knowledgeable assessment staff is available to help you and. Office of real property tax services.

This form consists of four pages. If you would like to present your case. The first two pages are self explanatory. Web the formal process starts between june 1st and the 3rd tuesday in june. View the pdf template in the editor. The form can be completed by yourself or your representative or attorney. Office of real property tax services. We do have to adhere to real property tax law, however, a very knowledgeable assessment staff is available to help you and. Web any person aggrieved by an assessment (e.g., an owner, purchaser or tenant who is required to pay the taxes pursuant to a lease or written agreement) may file a complaint. The form can be completed by yourself or your representative or attorney.

Fill Free fillable forms Town of Big Flats

This form consists of four pages. Web office of real property tax services complaint on real property assessment for 2022 before the board of assessment review for. Web 7 rows instructions on form. Check with the applicable department (s) to ensure proper documentation as some forms and. Notice of disclosure of interest of board of.

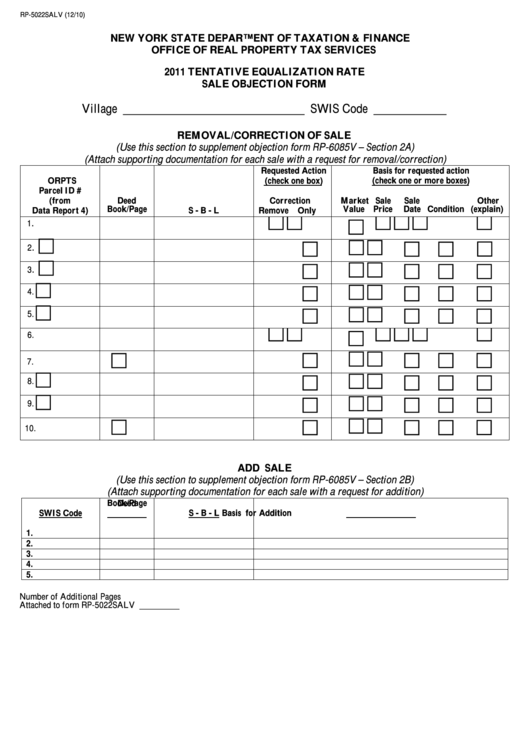

Form Rp5022salv 2011 Tentative Equalization Rate Sale Objection Form

Web 7 rows instructions on form. Refer to the outlined fillable fields. Web your henrietta assessor's office is here to help you. Web this collection of applications, permits, and forms is provided for your convenience. We do have to adhere to real property tax law, however, a very knowledgeable assessment staff is available to help you and.

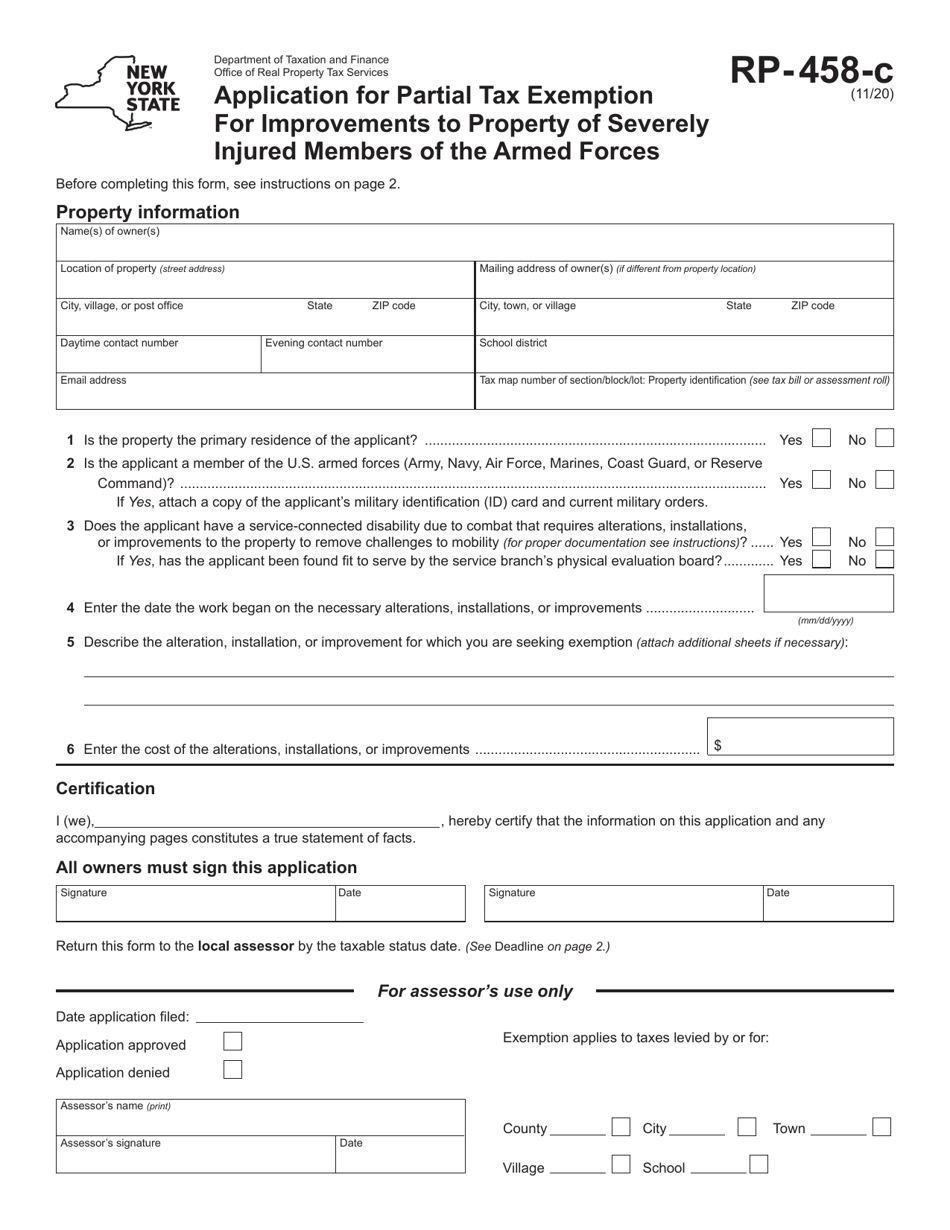

Form RP458C Download Fillable PDF or Fill Online Application for

Web this collection of applications, permits, and forms is provided for your convenience. Web office of real property tax services complaint on real property assessment for 2022 before the board of assessment review for. Web we require an original copy of the application form with original signatures. Web contest your assessment grievance procedures completing the grievance form printable grievance booklet.

Form RP524 Download Printable PDF, Complaint on Real Property

View the pdf template in the editor. Get started with a ny information instructions 2009, complete it in a few clicks, and submit it securely. The form can be completed by yourself or your representative or attorney. We are not affiliated with. Web this collection of applications, permits, and forms is provided for your convenience.

Fillable Form Rp524 Complaint On Real Property Assessment For 20

Web any person aggrieved by an assessment (e.g., an owner, purchaser or tenant who is required to pay the taxes pursuant to a lease or written agreement) may file a complaint. Web office of real property tax services complaint on real property assessment for 2022 before the board of assessment review for. Web your henrietta assessor's office is here to.

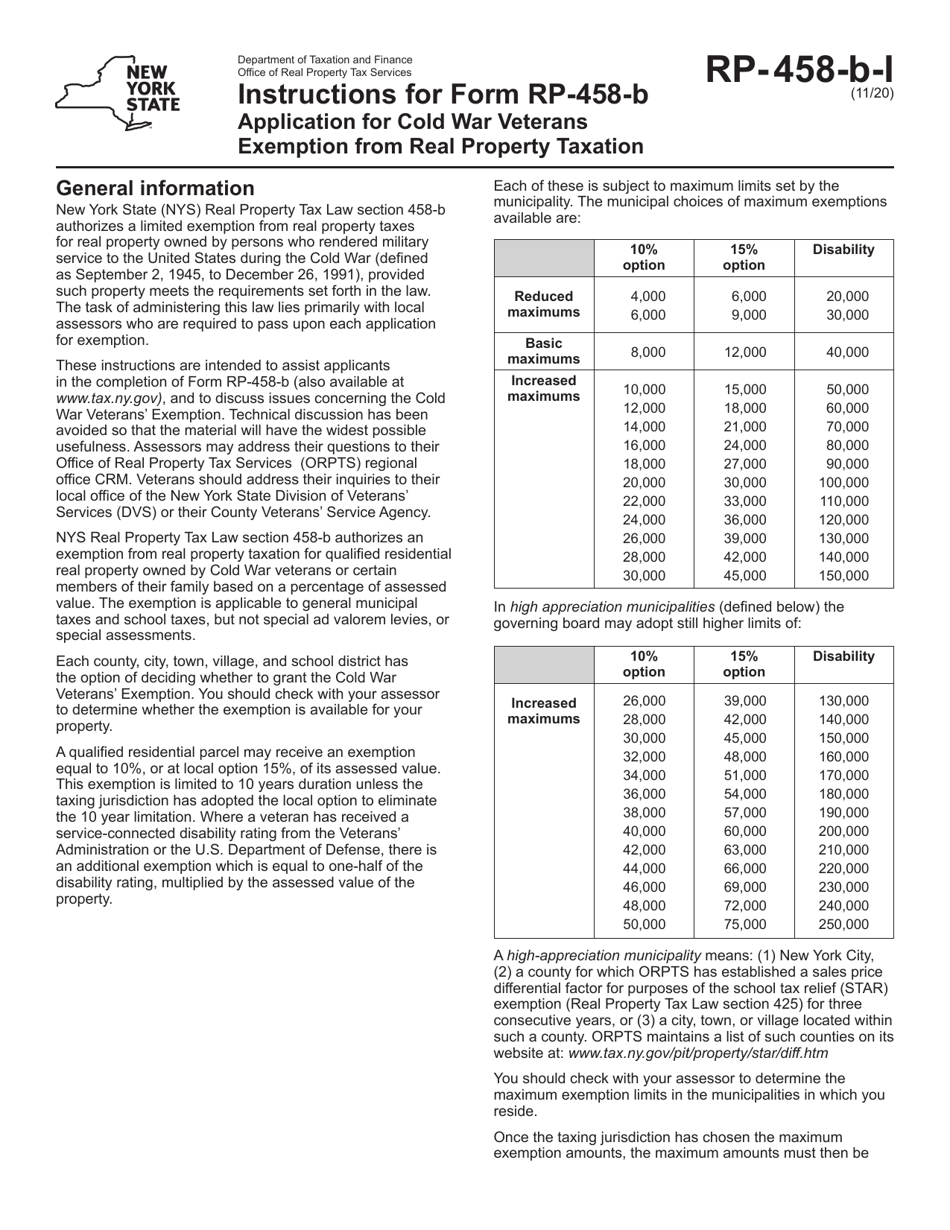

Download Instructions for Form RP458B Application for Cold War

We do have to adhere to real property tax law, however, a very knowledgeable assessment staff is available to help you and. Web this collection of applications, permits, and forms is provided for your convenience. Web contest your assessment grievance procedures completing the grievance form printable grievance booklet equalization rates residential assessment ratios. Web 7 rows instructions on form. Refer.

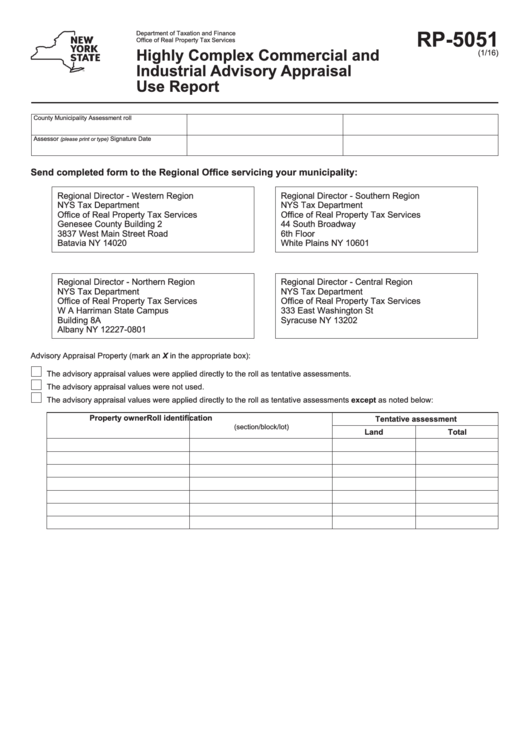

Fillable Form Rp5051 Highly Complex Commercial And Industrial

If we receive a faxed copy, the original must be. Web office of real property tax services complaint on real property assessment for 2022 before the board of assessment review for. Office of real property tax services. Web 7 rows instructions on form. If you would like to present your case.

Fill Free fillable forms Town of Bedford

Refer to the outlined fillable fields. Office of real property tax services. Notice of disclosure of interest of board of. The first two pages are self explanatory. The form can be completed by yourself or your representative or attorney.

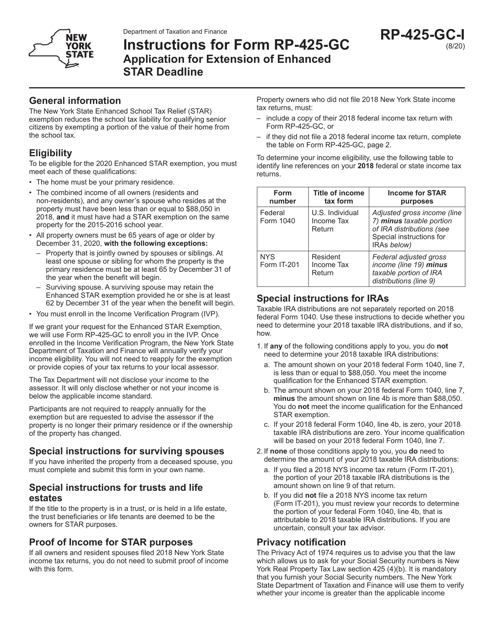

Download Instructions for Form RP425GC Application for Extension of

Office of real property tax services. The first two pages are self explanatory. Get started with a ny information instructions 2009, complete it in a few clicks, and submit it securely. We are not affiliated with. Web contest your assessment grievance procedures completing the grievance form printable grievance booklet equalization rates residential assessment ratios.

Fill Free fillable Form On Real Property

This form consists of four pages. This is where to insert your data. The third page gives you the four avenues to grieve the. Web contest your assessment grievance procedures completing the grievance form printable grievance booklet equalization rates residential assessment ratios. The form can be completed by yourself or your representative or attorney.

This Form Consists Of Four Pages.

If we receive a faxed copy, the original must be. Web office of real property tax services complaint on real property assessment for 2022 before the board of assessment review for. The third page gives you the four avenues to grieve the. Check with the applicable department (s) to ensure proper documentation as some forms and.

Refer To The Outlined Fillable Fields.

Notice of disclosure of interest of board of. The form can be completed by yourself or your representative or attorney. Web your henrietta assessor's office is here to help you. The first two pages are self explanatory.

If You Would Like To Present Your Case.

Web 7 rows instructions on form. Web contest your assessment grievance procedures completing the grievance form printable grievance booklet equalization rates residential assessment ratios. Office of real property tax services. Web any person aggrieved by an assessment (e.g., an owner, purchaser or tenant who is required to pay the taxes pursuant to a lease or written agreement) may file a complaint.

This Is Where To Insert Your Data.

Web this collection of applications, permits, and forms is provided for your convenience. The form can be completed by yourself or your representative or attorney. Get started with a ny information instructions 2009, complete it in a few clicks, and submit it securely. We do have to adhere to real property tax law, however, a very knowledgeable assessment staff is available to help you and.