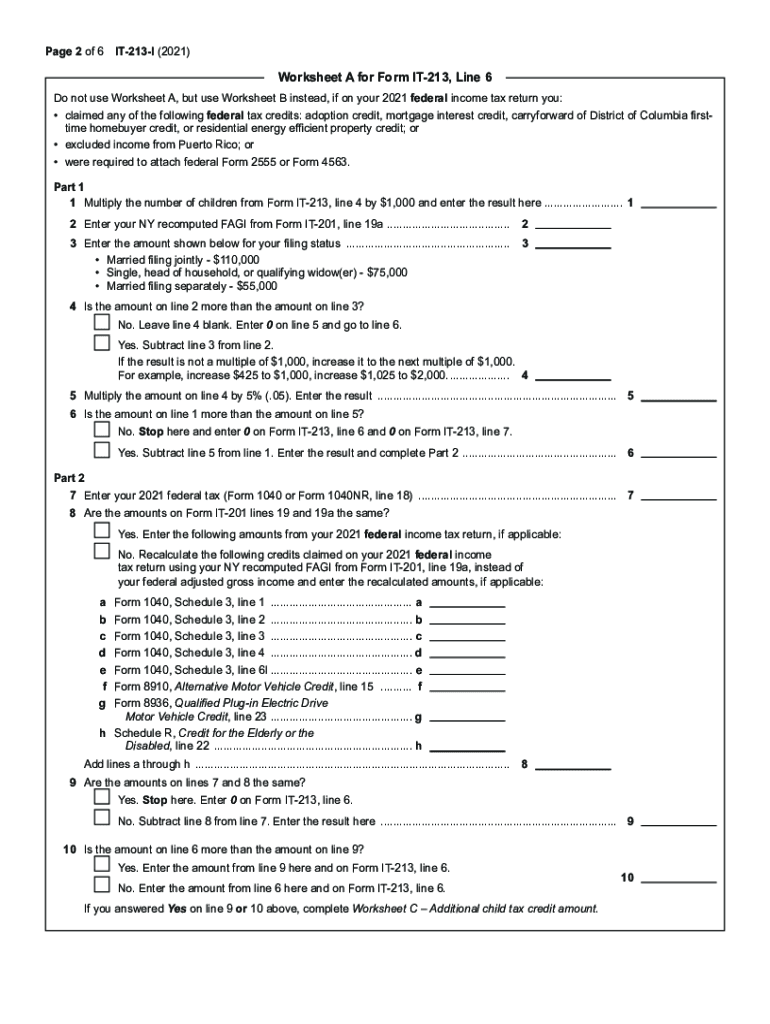

Form It-213 Instructions

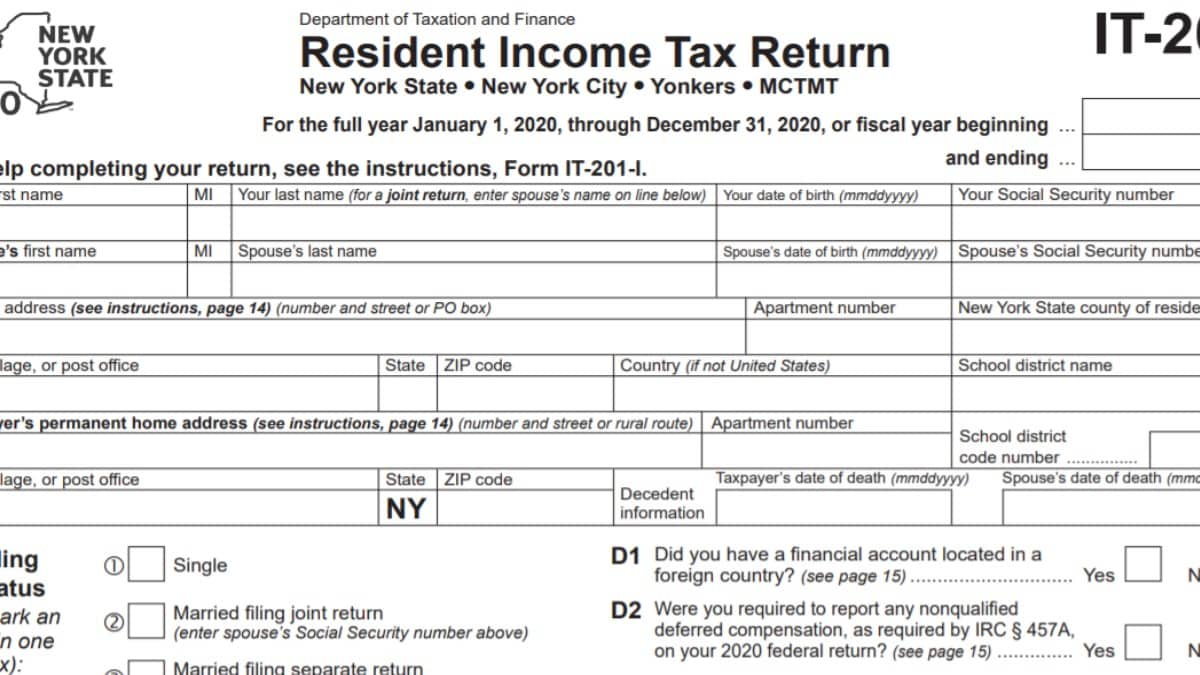

Form It-213 Instructions - Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety. Submit a copy of the certificate of eligibility and the empire zone retention certificate. Mail th e original form prio r t o the return due dat e to: Web and end date and time for the operational period to which the form applies. Dec 12, 2022 — recalculate the following credits claimed on your 2022 federal income tax. Web certificate (buy american) (rev. This can be one, two, or three addresses. Web follow the simple instructions below: Web your new york recomputed federal adjusted gross income is: Married filing a joint return $110,000 or less.

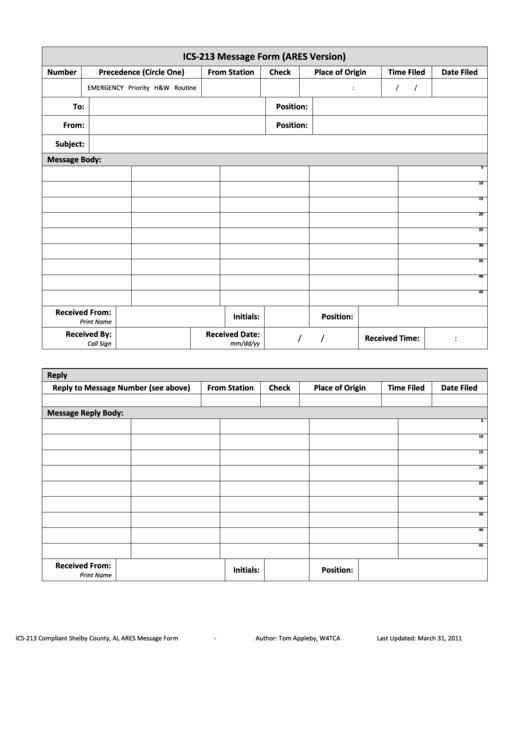

Web the repetitive loss update form is generated separately by the federal emergency management agency (fema) and provided to the community when needed. Web and end date and time for the operational period to which the form applies. Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety. The times of terrifying complex legal and tax documents are over. Georgiadepartmen o revenue processin gcenter p.o. Web 2) thi s form must b e complete d n triplicate. Web certificate (buy american) (rev. For personal income tax purposes, nys has decoupled from federal changes made to. Skip to main content an official website of the united states government. Submit a copy of the certificate of eligibility and the empire zone retention certificate.

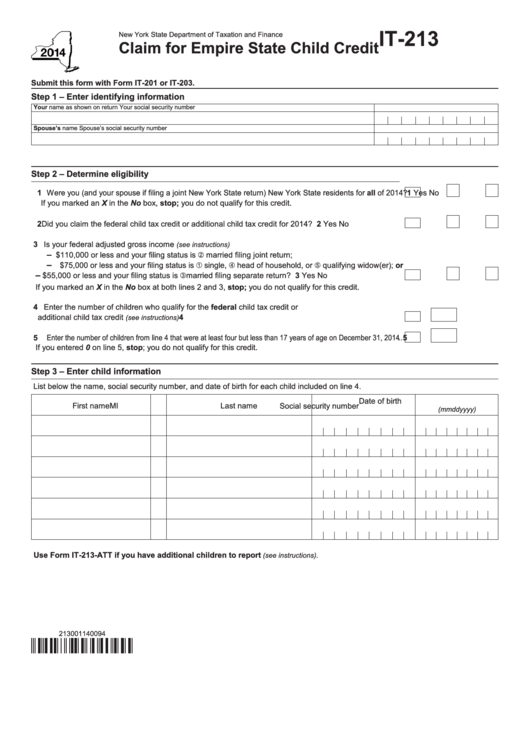

Dec 12, 2022 — recalculate the following credits claimed on your 2022 federal income tax. Affidavit of support under section 213a of the ina. The times of terrifying complex legal and tax documents are over. Electronic filing is the fastest, safest way to file—but if you must file a paper claim for empire state child credit,. Submit a copy of the certificate of eligibility and the empire zone retention certificate. For personal income tax purposes, nys has decoupled from federal changes made to. This can be one, two, or three addresses. Web certificate (buy american) (rev. Single, or head of household, or qualifying widow (er) $75,000 or less. Order (use additional forms when requesting different resource sources of supply.) qty.

Answer to "What is it? 213" The Four Ages Of Sand

Mail th e original form prio r t o the return due dat e to: Web your new york recomputed federal adjusted gross income is: This can be one, two, or three addresses. For personal income tax purposes, nys has decoupled from federal changes made to. With us legal forms the whole process of creating legal.

Ny It 213 Fill Out and Sign Printable PDF Template signNow

Web certificate (buy american) (rev. The times of terrifying complex legal and tax documents are over. With us legal forms the whole process of creating legal. For personal income tax purposes, nys has decoupled from federal changes made to. Dec 12, 2022 — recalculate the following credits claimed on your 2022 federal income tax.

Fillable Form It213 Claim For Empire State Child Credit 2014

Mail th e original form prio r t o the return due dat e to: Affidavit of support under section 213a of the ina. Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety. Order (use additional forms when requesting different resource sources of supply.) qty. The times of terrifying complex legal and tax documents are.

Ex 213 2nd form worksheet

Electronic filing is the fastest, safest way to file—but if you must file a paper claim for empire state child credit,. For personal income tax purposes, nys has decoupled from federal changes made to. Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety. Single, or head of household, or qualifying widow (er) $75,000 or less..

IT201 Instructions 2022 2023 State Taxes TaxUni

Web certificate (buy american) (rev. Skip to main content an official website of the united states government. Georgiadepartmen o revenue processin gcenter p.o. Dec 12, 2022 — recalculate the following credits claimed on your 2022 federal income tax. Married filing a joint return $110,000 or less.

Ics 213 Message Form printable pdf download

For personal income tax purposes, nys has decoupled from federal changes made to. This can be one, two, or three addresses. With us legal forms the whole process of creating legal. Web your new york recomputed federal adjusted gross income is: If you are a shareholder of an s corporation, obtain your share of the.

2000 Form USCIS I134 Fill Online, Printable, Fillable, Blank pdfFiller

Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety. For personal income tax purposes, nys has decoupled from federal changes made to. With us legal forms the whole process of creating legal. Web certificate (buy american) (rev. The times of terrifying complex legal and tax documents are over.

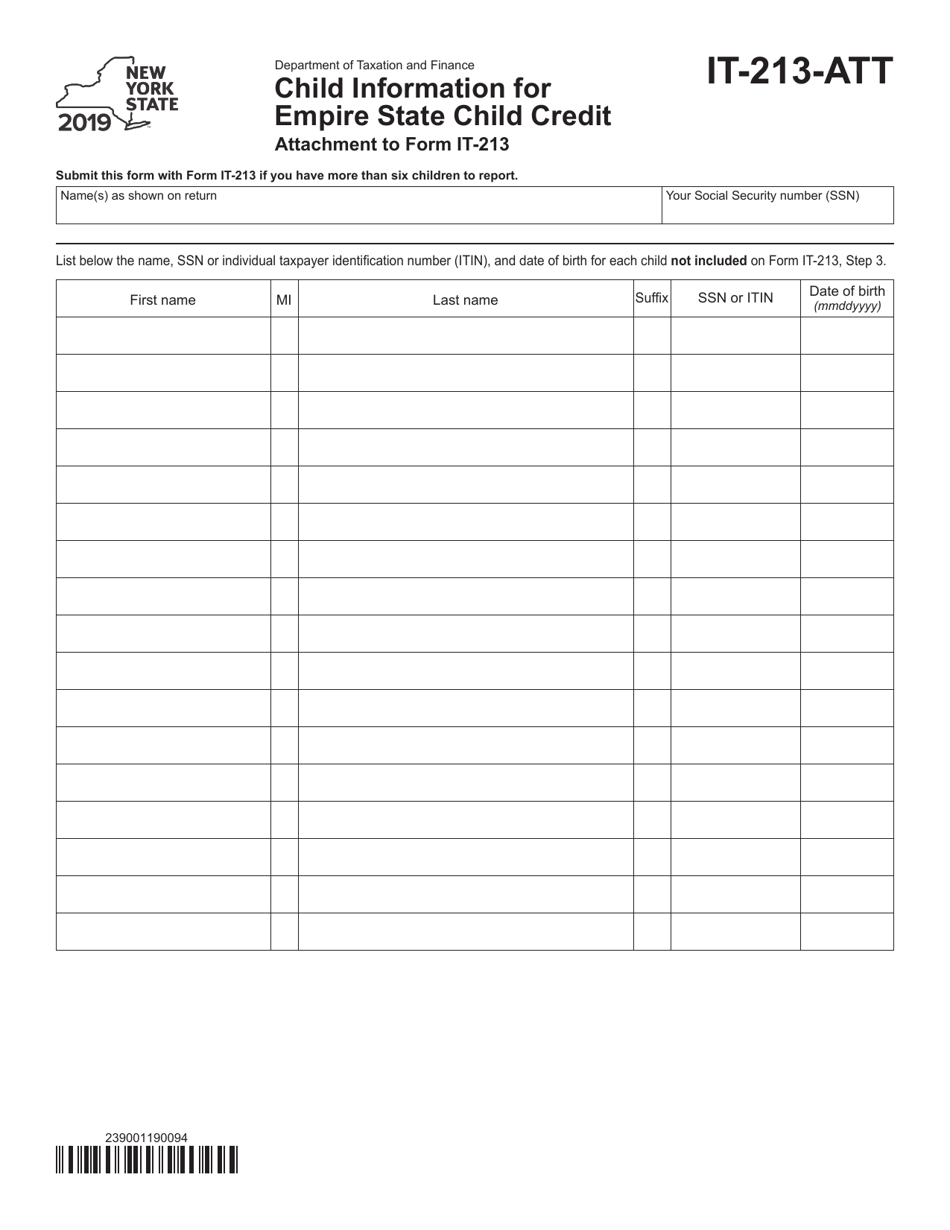

Form IT213ATT Download Fillable PDF or Fill Online Child Information

If you are a shareholder of an s corporation, obtain your share of the. Single, or head of household, or qualifying widow (er) $75,000 or less. For personal income tax purposes, nys has decoupled from federal changes made to. Mail th e original form prio r t o the return due dat e to: Dec 12, 2022 — recalculate the.

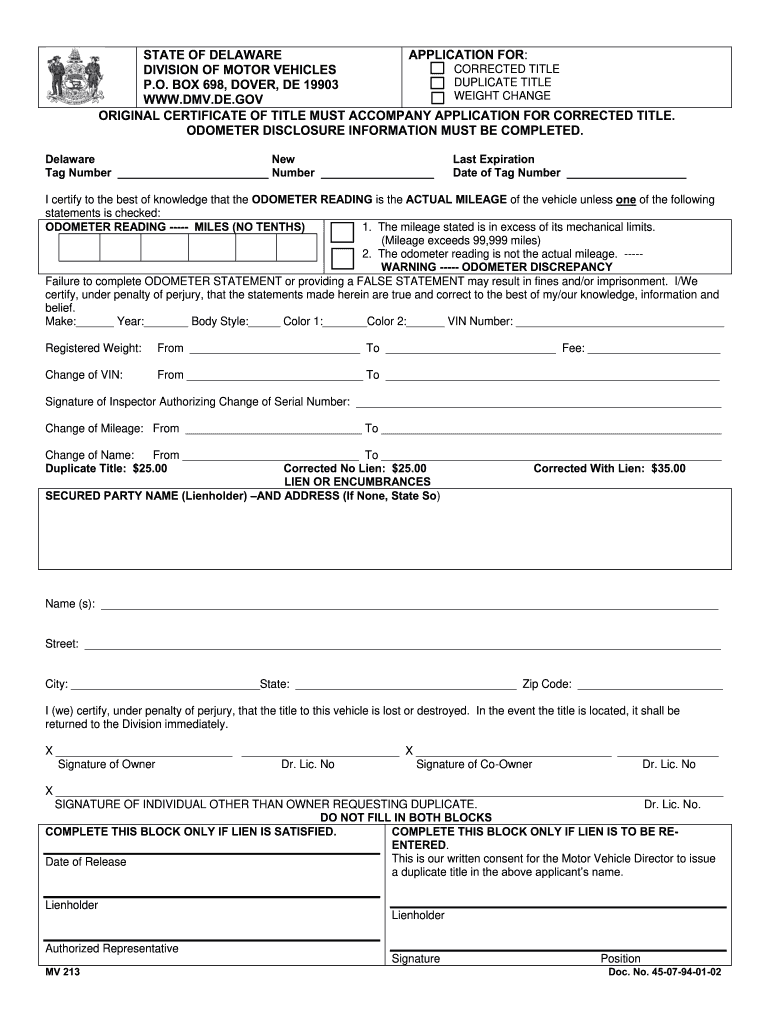

Mv213 Form Fill Out and Sign Printable PDF Template signNow

Order (use additional forms when requesting different resource sources of supply.) qty. Web your new york recomputed federal adjusted gross income is: Mail th e original form prio r t o the return due dat e to: Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety. This can be one, two, or three addresses.

20202022 Form CT PC213 Fill Online, Printable, Fillable, Blank

Skip to main content an official website of the united states government. Web follow the simple instructions below: Order (use additional forms when requesting different resource sources of supply.) qty. Web and end date and time for the operational period to which the form applies. Dec 12, 2022 — recalculate the following credits claimed on your 2022 federal income tax.

Web And End Date And Time For The Operational Period To Which The Form Applies.

Electronic filing is the fastest, safest way to file—but if you must file a paper claim for empire state child credit,. Web certificate (buy american) (rev. Submit a copy of the certificate of eligibility and the empire zone retention certificate. Order (use additional forms when requesting different resource sources of supply.) qty.

Skip To Main Content An Official Website Of The United States Government.

Web 2) thi s form must b e complete d n triplicate. Married filing a joint return $110,000 or less. If you are a shareholder of an s corporation, obtain your share of the. Enter the title of the organizational unit or resource designator (e.g., facilities unit, safety.

Affidavit Of Support Under Section 213A Of The Ina.

Web the repetitive loss update form is generated separately by the federal emergency management agency (fema) and provided to the community when needed. Georgiadepartmen o revenue processin gcenter p.o. Web your new york recomputed federal adjusted gross income is: For personal income tax purposes, nys has decoupled from federal changes made to.

Web Follow The Simple Instructions Below:

Mail th e original form prio r t o the return due dat e to: The times of terrifying complex legal and tax documents are over. This can be one, two, or three addresses. Single, or head of household, or qualifying widow (er) $75,000 or less.