Standard Form 592 T

Standard Form 592 T - No payment, distribution or withholding occurred. Find a suitable template on the internet. Web edit standard form 592 t. Do not use form 592 if any of the following apply: Web follow the simple instructions below: Web click the links below to see the form instructions. No payment, distribution or withholding occurred. Do not use form 592 if any of the following apply: Read all the field labels carefully. • section 9—minor changes made to aid users in.

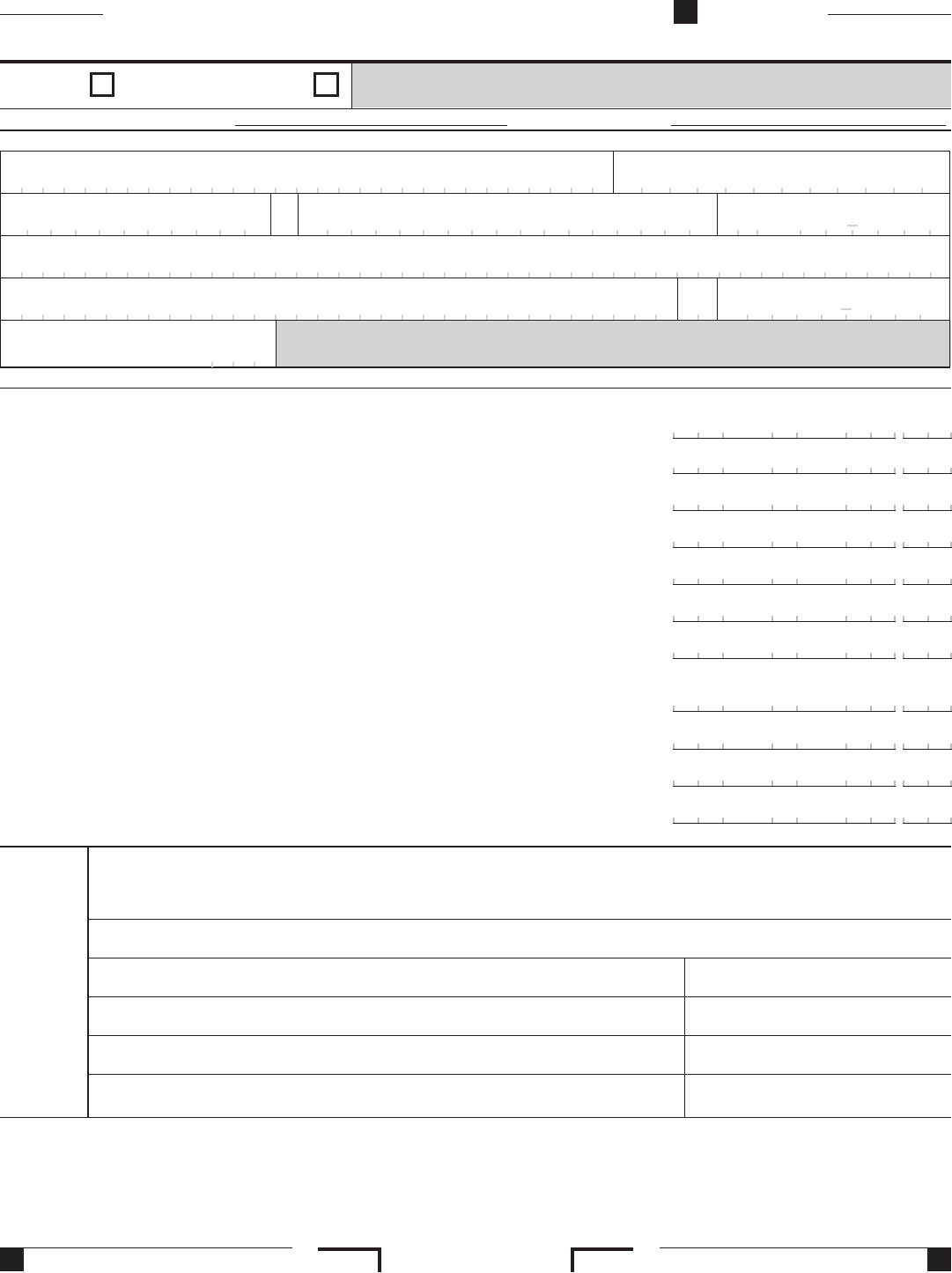

• section 9—minor changes made to aid users in. Web o o o 0 o 00 o o o o 2 o o o a to cd o a to o o cd o 0 o a o o cd o o o. Do not use form 592 if any of the following apply: Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web up to $40 cash back fill standard form 592 t, edit online. Web are you thinking about getting standard form 592 t to fill? Web video instructions and help with filling out and completing standard form 592 t. Web follow the simple instructions below: Please provide your email address and it will be emailed to. Effortlessly add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your.

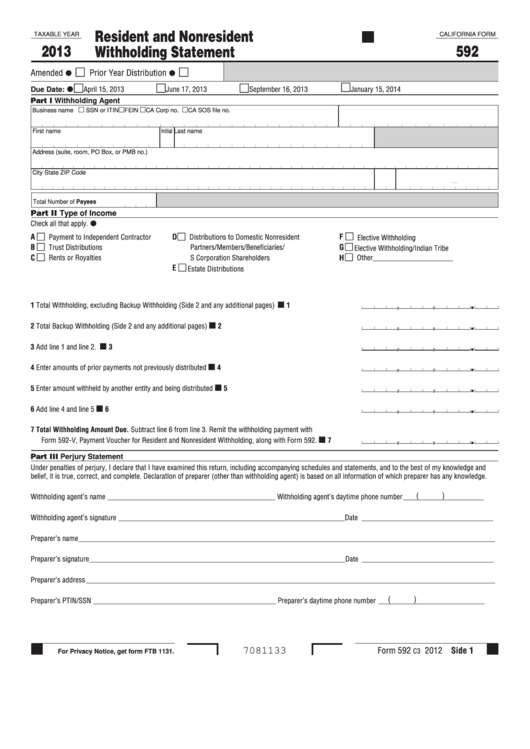

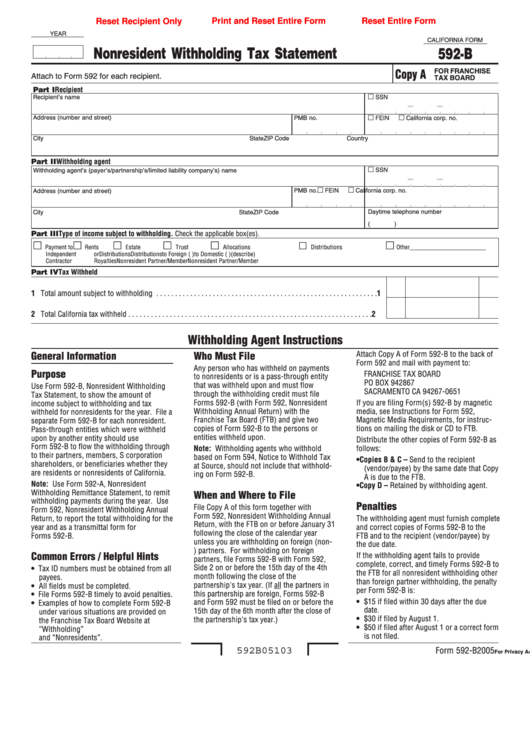

Items of income that are subject to withholding are payments to independent contractors, recipients of. Web are you thinking about getting standard form 592 t to fill? Web how to create an esignature for the standard form 592 t. Web form 592 is also used to report withholding payments for a resident payee. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Web 2021 instructions for form 592 | ftb.ca.gov. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Please provide your email address and it will be emailed to. Find a suitable template on the internet. Form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income.

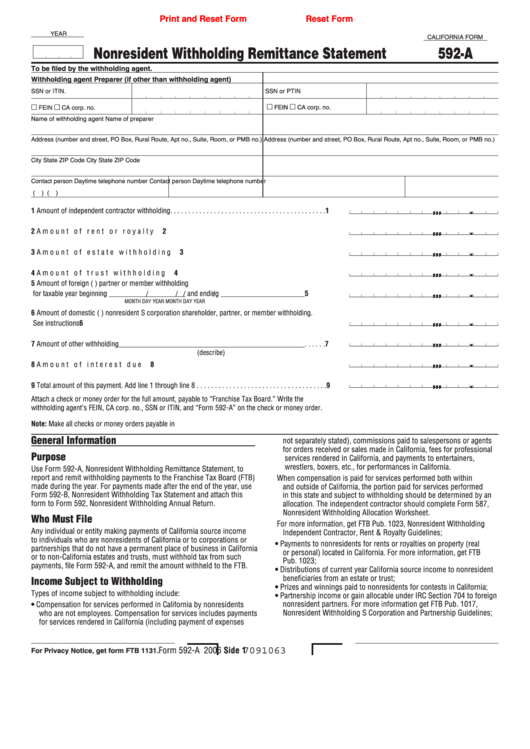

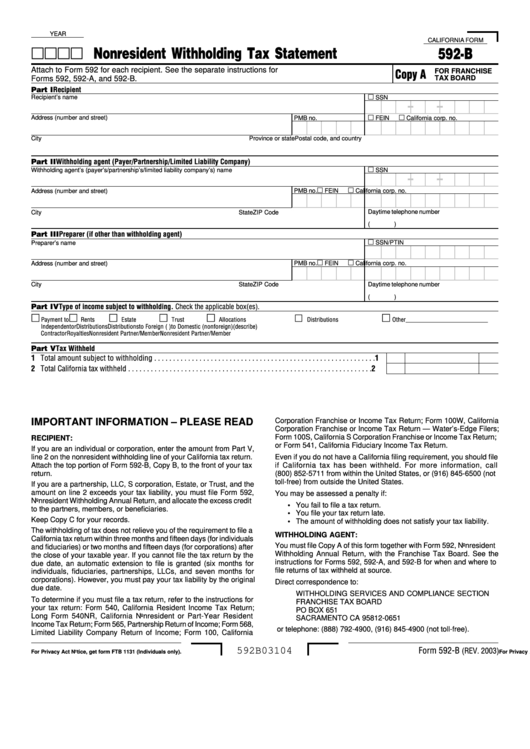

Fillable Form 592A Nonresident Withholding Remittance Statement

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web o o o 0 o 00 o o o o 2 o o o a to cd o a to o o cd o 0 o a o o cd o o o. Web edit standard form 592 t. 2023 ca form 592, resident and nonresident.

Standard Form 592 T Fill Online, Printable, Fillable, Blank pdfFiller

Find a suitable template on the internet. Web follow the simple instructions below: Web form 592 is also used to report withholding payments for a resident payee. Web form 592 is also used to report withholding payments for a resident payee. Web 2021 instructions for form 592 | ftb.ca.gov.

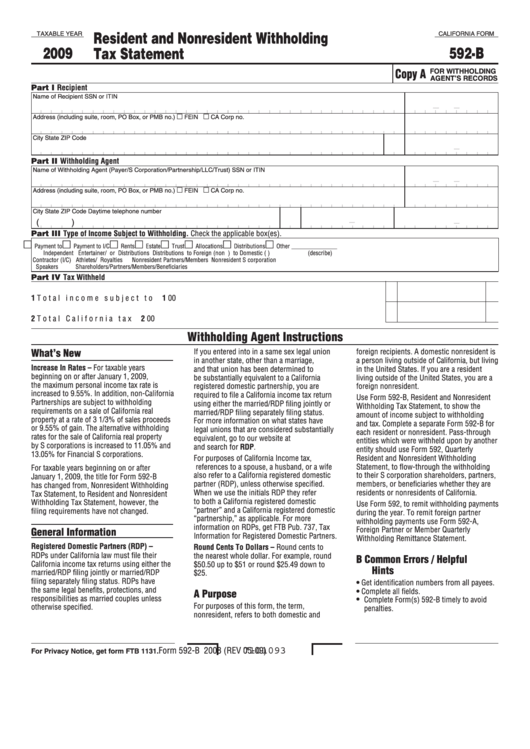

Fillable California Form 592B Resident And Nonresident Withholding

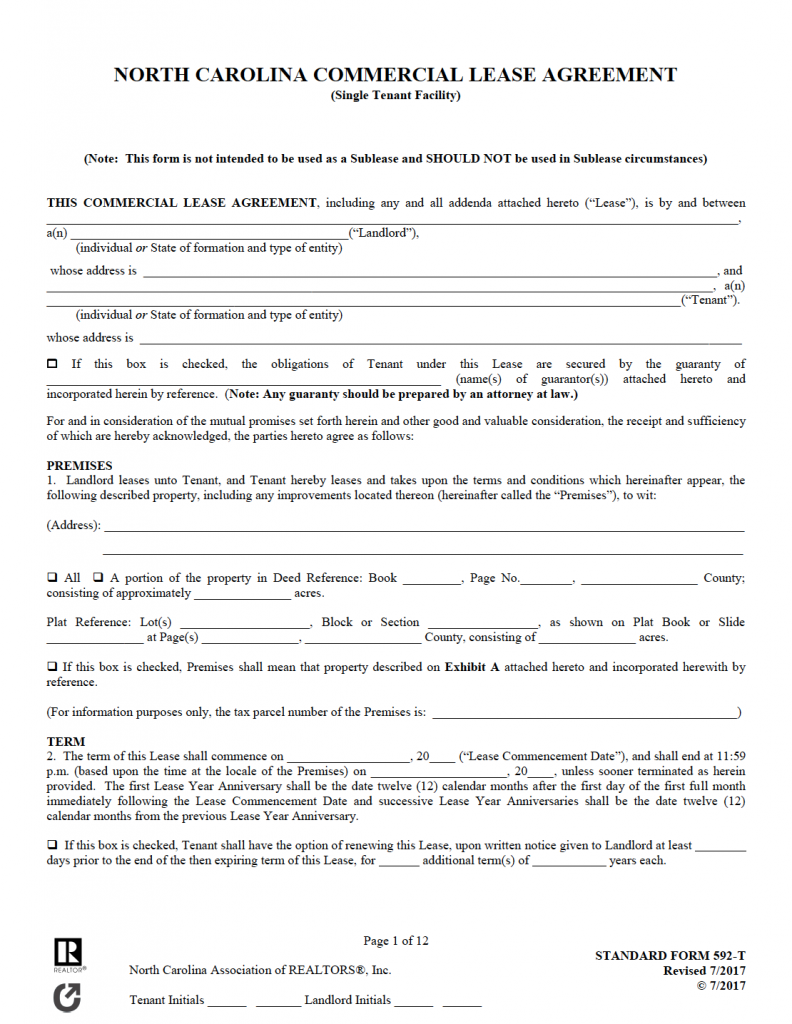

Find a suitable template on the internet. If this box is checked, tenant shall have the option of renewing this lease, upon written notice given to landlord at least. Web file form 592 to report withholding on domestic nonresident individuals. Web up to $40 cash back 2022 instructions for form 592 | ftb.ca.gov form 592 includes a schedule of payees.

44 California Ftb 592 Forms And Templates free to download in PDF

If this box is checked, tenant shall have the option of renewing this lease, upon written notice given to landlord at least. Web form 592 is also used to report withholding payments for a resident payee. Find a suitable template on the internet. No payment, distribution or withholding occurred. 2023 ca form 592, resident and nonresident withholding statement.

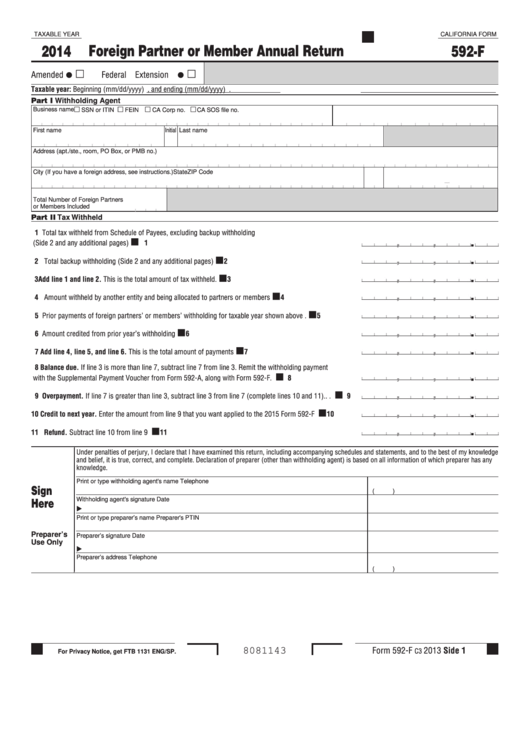

2017 Form 592F Foreign Partner Or Member Annual Return Edit, Fill

Web click the links below to see the form instructions. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Items of income that are subject to withholding are payments to independent contractors, recipients of. • section 9—minor changes made to aid users in. Web 2021 instructions for form 592 | ftb.ca.gov.

Form 592B Nonresident Withholding Tax Statement printable pdf download

With our platform filling in standard form 592 t will take. Web 2021 instructions for form 592 | ftb.ca.gov. No payment, distribution or withholding occurred. Web up to $40 cash back 2022 instructions for form 592 | ftb.ca.gov form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the. Web follow the.

Fillable California Form 592F Foreign Partner Or Member Annual

Form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income. Read all the field labels carefully. Web click the links below to see the form instructions. Web 2021 instructions for form 592 | ftb.ca.gov. Items of income that are subject to withholding are payments to independent contractors, recipients.

Form 592 Download Fillable PDF or Fill Online Statement Under Section

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Web how to create an esignature for the standard form 592 t. 2023 ca form 592, resident and nonresident withholding statement. Effortlessly add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your. Business name ssn or itin.

Fillable Form 592B Nonresident Withholding Tax Statement 2005

Web follow the simple instructions below: Web 2021 instructions for form 592 | ftb.ca.gov. Web are you thinking about getting standard form 592 t to fill? Effortlessly add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your. Web o o o 0 o 00 o o o o 2 o.

Free North Carolina Rental Lease Agreement Templates PDF WORD

Form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income. Web up to $40 cash back 2022 instructions for form 592 | ftb.ca.gov form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the. Web video instructions and help with.

Web Form 592 Is Also Used To Report Withholding Payments For A Resident Payee.

With our platform filling in standard form 592 t will take. Web form 592 is also used to report withholding payments for a resident payee. Web o o o 0 o 00 o o o o 2 o o o a to cd o a to o o cd o 0 o a o o cd o o o. Do not use form 592 if any of the following apply:

2023 Ca Form 592, Resident And Nonresident Withholding Statement.

Web are you thinking about getting standard form 592 t to fill? Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Web file form 592 to report withholding on domestic nonresident individuals. No payment, distribution or withholding occurred.

Find A Suitable Template On The Internet.

If this box is checked, tenant shall have the option of renewing this lease, upon written notice given to landlord at least. Web click the links below to see the form instructions. • section 9—minor changes made to aid users in. Web edit standard form 592 t.

Form 592 Includes A Schedule Of Payees Section, On Side 2, That Requires The Withholding Agent To Identify The Payees, The Income.

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Please provide your email address and it will be emailed to. Do not use form 592 if any of the following apply: Effortlessly add and underline text, insert images, checkmarks, and symbols, drop new fillable areas, and rearrange or remove pages from your.