Form 945 For 2021

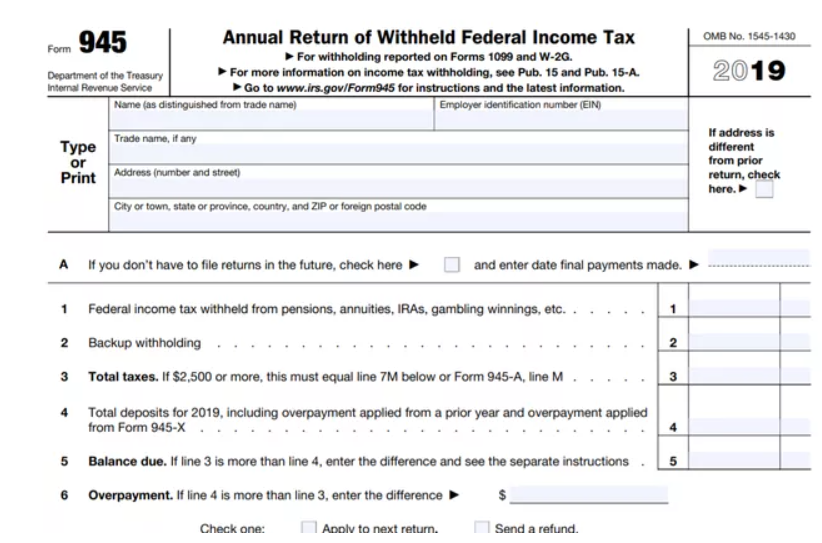

Form 945 For 2021 - Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest version of form 945, fully updated for tax year 2022. Upload, modify or create forms. Web form 945 instructions for 2022. Web when is irs form 945 due? The form 945 must be filed by jan. Complete, edit or print tax forms instantly. Web these instructions give you some background information about form 945. 4 by the internal revenue service. The finalized version of form 945 was released by the irs.

4 by the internal revenue service. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. Complete, edit or print tax forms instantly. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web when is irs form 945 due? Web the finalized 2020 form 945, annual return of withheld federal income tax, and accompanying instructions were released nov. Web form 945 instructions for 2022. Web these instructions give you some background information about form 945. Business entities may not need to file form 945 with the irs every. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient.

Complete, edit or print tax forms instantly. Web we last updated the annual return of withheld federal income tax in december 2022, so this is the latest version of form 945, fully updated for tax year 2022. Web these instructions give you some background information about form 945. Business entities may not need to file form 945 with the irs every. The finalized version of form 945 was released by the irs. Try it for free now! Web “form 945,” and “2021” on your check or money order. Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. The form 945 must be filed by jan. 4 by the internal revenue service.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. If the taxpayer has already made all. Web form 945 instructions for 2022. Ad access irs tax forms. The form 945 must be filed by jan.

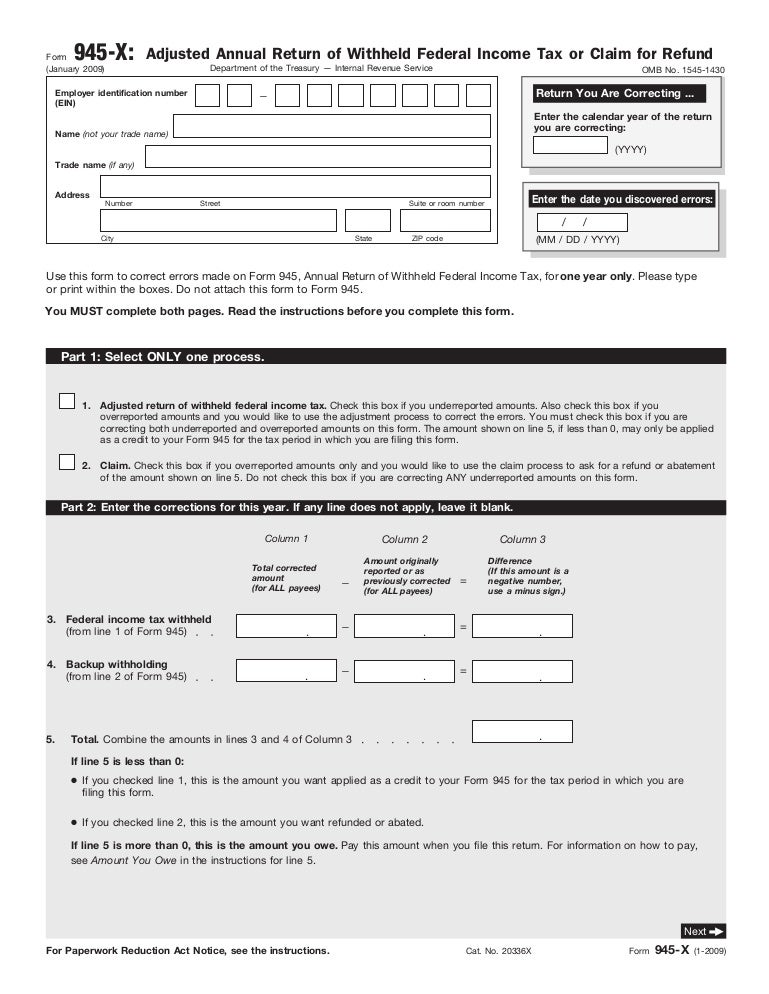

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Web use this form to report withheld federal income tax from nonpayroll payments. Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Web form 945 instructions for 2022. 4 by the internal revenue service. Web these instructions give you some background information about form 945. Try it for free now! Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes.

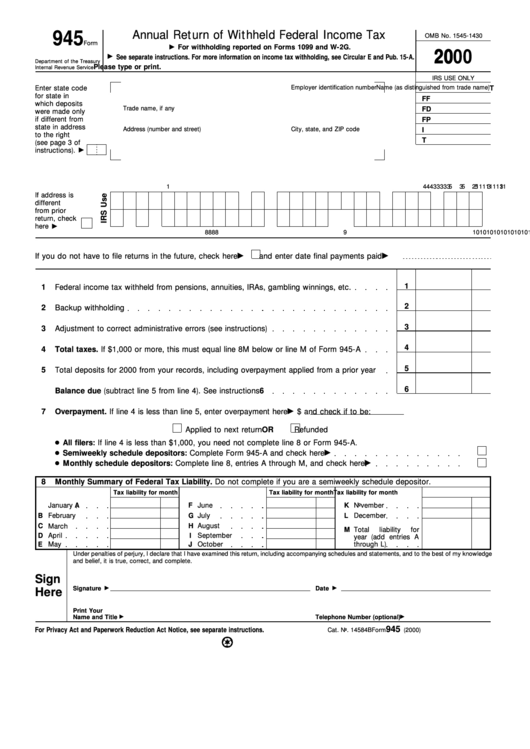

Form 945 Annual Return Of Withheld Federal Tax 2000

They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. The finalized 2021 form 945, annual return.

Form 945X Adjusted Annual Return of Withheld Federal Tax or

Business entities may not need to file form 945 with the irs every. The finalized 2021 form 945, annual return of. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Try it for free now! Web use this form to report withheld federal income tax from nonpayroll payments.

Form 945 Edit, Fill, Sign Online Handypdf

If the taxpayer has already made all. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web when is irs form 945 due? Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits.

2022 Form 945. Annual Return of Withheld Federal Tax Fill out

Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient. Web form 945 instructions for 2022. Web “form 945,” and “2021” on your check or money order. If the taxpayer has already made all. Pensions (including distributions from tax.

Form 945 Reporting Withholding for Defined Benefit Plans Saber Pension

Ad access irs tax forms. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web these instructions give you some background information about form 945. They tell you who must file form 945, how to complete it line by line, and when and where to file it. Web we last updated.

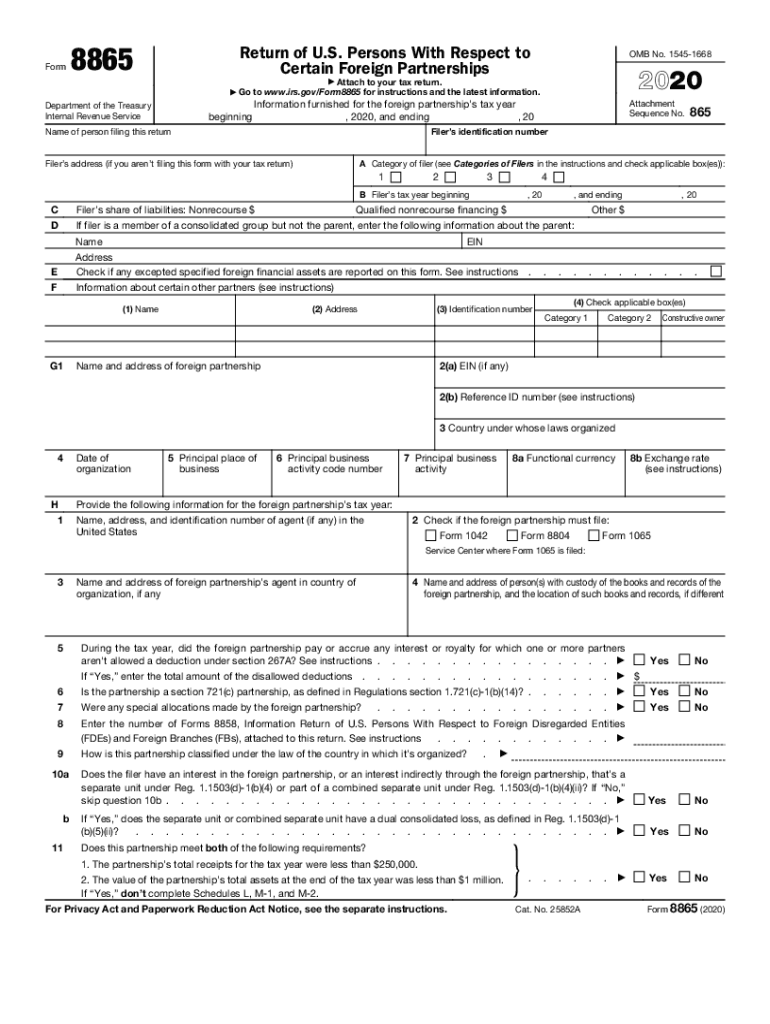

IRS 8865 2020 Fill out Tax Template Online US Legal Forms

Web these instructions give you some background information about form 945. The finalized version of form 945 was released by the irs. Ad access irs tax forms. Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. Web “form 945,” and “2021” on your check or money order.

Things an Employer Must Know About IRS Form 945 in the US!

For more information on income tax withholding, see pub. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for. 4 by the internal revenue service. The finalized 2021 form 945, annual return of. Upload, modify or create forms.

Upload, Modify Or Create Forms.

If the taxpayer has already made all. For more information on income tax withholding, see pub. Ad access irs tax forms. Web easy and secure efiling quick and accurate reporting state filing compliance supports bulk efiling usps address validation notice management efile now more salient.

Web We Last Updated The Annual Return Of Withheld Federal Income Tax In December 2022, So This Is The Latest Version Of Form 945, Fully Updated For Tax Year 2022.

Irs 945 2020 get irs 945 2020 how it works open form follow the instructions easily sign the form with your finger. Pensions (including distributions from tax. Web “form 945,” and “2021” on your check or money order. The finalized version of form 945 was released by the irs.

Web Form 945 Instructions For 2022.

Web use this form to report withheld federal income tax from nonpayroll payments. Generally, taxpayers must file irs form 945 by january 31st of the year following the tax year filed. Web these instructions give you some background information about form 945. Web form 945 pertains only to what the irs calls nonpayroll payments. this form is commonly used for payments to certain independent contractors, as well as for.

Business Entities May Not Need To File Form 945 With The Irs Every.

Web when is irs form 945 due? The form 945 must be filed by jan. Web any business filing form 945 for 2020 has until february 1, 2021, to file, or february 10 if you’ve made deposits on time in full payment of the year’s taxes. 4 by the internal revenue service.