Form 5471 Sch H

Form 5471 Sch H - In addition, there are several schedules that are required ancillary to the. December 2021) department of the treasury internal revenue service. Foreign tax credit form 1118 (final rev. Web follow these steps to generate and complete form 5471 in the program: The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Web form 5471 is used by certain u.s. What is it, how to file it, & when do you have. Web the irs makes significant changes to schedule h of form 5471 02 sep 2020 by anthony diosdi recently, the internal revenue service (“irs”) issued a draft of a new schedule. Web there are five (5) categories of form 5471 filers with categories one and five having subcategories. Schedule h is no longer completed separately for each applicable category of income.

Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Persons with respect to certain foreign corporations, is an information statement (information. Web changes to separate schedule h (form 5471). Web follow these steps to generate and complete form 5471 in the program: Web form 5471, officially called the information return of u.s. Schedule h is no longer completed separately for each applicable category of income. December 2021) department of the treasury internal revenue service. Web there are five (5) categories of form 5471 filers with categories one and five having subcategories. Web form 5471, information return of u.s.

Web in 2020, the irs proposed new changes to the information return of u.s. Web changes to separate schedule h (form 5471). The december 2021 revision of separate. Persons who are officers, directors, or shareholders of certain foreign corporations to satisfy the reporting required under the. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. Gaap income reported on schedule c. Schedule e, income, war profits, and excess profits taxes paid or accrued;. Web there are five (5) categories of form 5471 filers with categories one and five having subcategories. Information return for foreign corporation 2023. Web follow these steps to generate and complete form 5471 in the program:

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Web form 5471 is used by certain u.s. Web there are five (5) categories of form 5471 filers with categories one and five having subcategories. Web in 2020, the irs proposed new changes to the information return of u.s. E organization or reorganization of foreign corporation. Web changes to separate schedule h (form 5471).

The Tax Times IRS Issues Updated New Form 5471 What's New?

The instructions for schedule h, line 2i, have been revised to clarify that taxpayers must report an adjustment if u.s. Schedule h is now completed once,. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Web the schedule should be completed in the cfc's functional curre. The december 2021 revision of separate.

IRS Form 5471 Carries Heavy Penalties and Consequences

Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Web follow these steps to generate and complete form 5471 in the program: Web who must complete schedule h form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories.

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Schedule e, income, war profits, and excess profits taxes paid or accrued;. Persons with respect to certain foreign corporations. Web information about form 5471, information return of u.s. In addition, there are several schedules that are required ancillary to the. Web who must complete schedule h form 5471 and its schedules must be completed (to the extent required by each.

Form 5471, Pages 24 YouTube

Web form 5471, officially called the information return of u.s. Web there are five (5) categories of form 5471 filers with categories one and five having subcategories. Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Web follow these steps to generate and complete form 5471 in the program:.

The Tax Times New Form 5471, Sch Q You Really Need to Understand

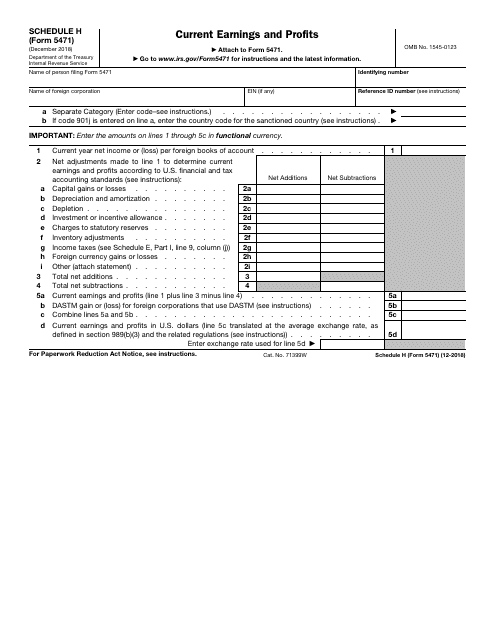

December 2021) department of the treasury internal revenue service. Web here are the latest forms, schedules and instructions recently released by the irs by itax topic. Schedule h is no longer completed separately for each applicable category of income. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the.

The IRS Makes Significant Changes to Schedule H of Form 5471 SF Tax

Web follow these steps to generate and complete form 5471 in the program: Persons with respect to certain foreign corporations, is an information statement (information. Gaap income reported on schedule c. Information return for foreign corporation 2023. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how.

IRS Form 5471 Schedule H SF Tax Counsel

Web changes to separate schedule h (form 5471). Web form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. Web who must complete schedule h form 5471 and its schedules must be completed (to the extent required by each schedule) and filed by the following categories of persons:..

IRS Form 5471 Schedule H Download Fillable PDF or Fill Online Current

Persons with respect to certain foreign corporations, is designed to report the activities of the foreign corporation and to function. Web here are the latest forms, schedules and instructions recently released by the irs by itax topic. Web form 5471, information return of u.s. Persons with respect to certain foreign corporations, is an information statement (information. Web the irs makes.

Editable IRS Form 5471 2018 2019 Create A Digital Sample in PDF

Schedule h is no longer completed separately for each applicable category of income. Web changes to separate schedule h (form 5471). What is it, how to file it, & when do you have. Web information about form 5471, information return of u.s. Foreign tax credit form 1118 (final rev.

Schedule H Is Completed With A Form 5471 To Disclose The Current Earnings & Profits (E&P) Of The Cfc.

Web form 5471, information return of u.s. Persons with respect to certain foreign corporations, including recent updates, related forms, and instructions on how. Persons with respect to certain foreign corporations, is an information statement (information. Persons with respect to certain foreign corporations.

Web There Are Five (5) Categories Of Form 5471 Filers With Categories One And Five Having Subcategories.

Gaap income reported on schedule c. January 2023) (use with the december 2022 revision of form 5471 and separate schedule q; Persons who are officers, directors, or shareholders of certain foreign corporations to satisfy the reporting required under the. Foreign tax credit form 1118 (final rev.

The December 2021 Revision Of Separate.

Web information about form 5471, information return of u.s. Schedule e, income, war profits, and excess profits taxes paid or accrued;. Web instructions for form 5471(rev. Web schedule h is used to report a foreign corporation’s current earnings and profits (“e&p”) for us tax purposes to the internal revenue service (“irs”).

Persons With Respect To Certain Foreign Corporations, Is Designed To Report The Activities Of The Foreign Corporation And To Function.

Web here are the latest forms, schedules and instructions recently released by the irs by itax topic. Schedule h is no longer completed separately for each applicable category of income. December 2021) department of the treasury internal revenue service. Web in 2020, the irs proposed new changes to the information return of u.s.