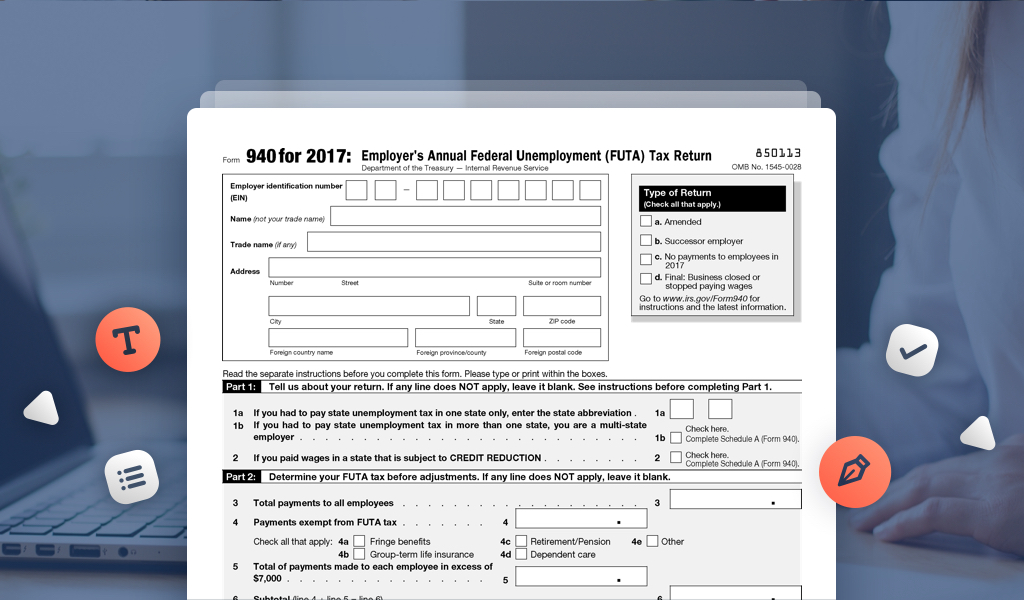

Form 940 2017

Form 940 2017 - Complete, edit or print tax forms instantly. Ad download or email irs 940 & more fillable forms, register and subscribe now! Sign it in a few clicks draw your signature, type. Employer's report for unemployment compensation c. Use form 940 to report your annual federal. No need to install software, just go to dochub, and sign up instantly and for free. Get ready for tax season deadlines by completing any required tax forms today. Web get forms, instructions, and publications. Easily fill out pdf blank, edit, and sign them. Web cocodoc collected lots of free form 940 2017 for our users.

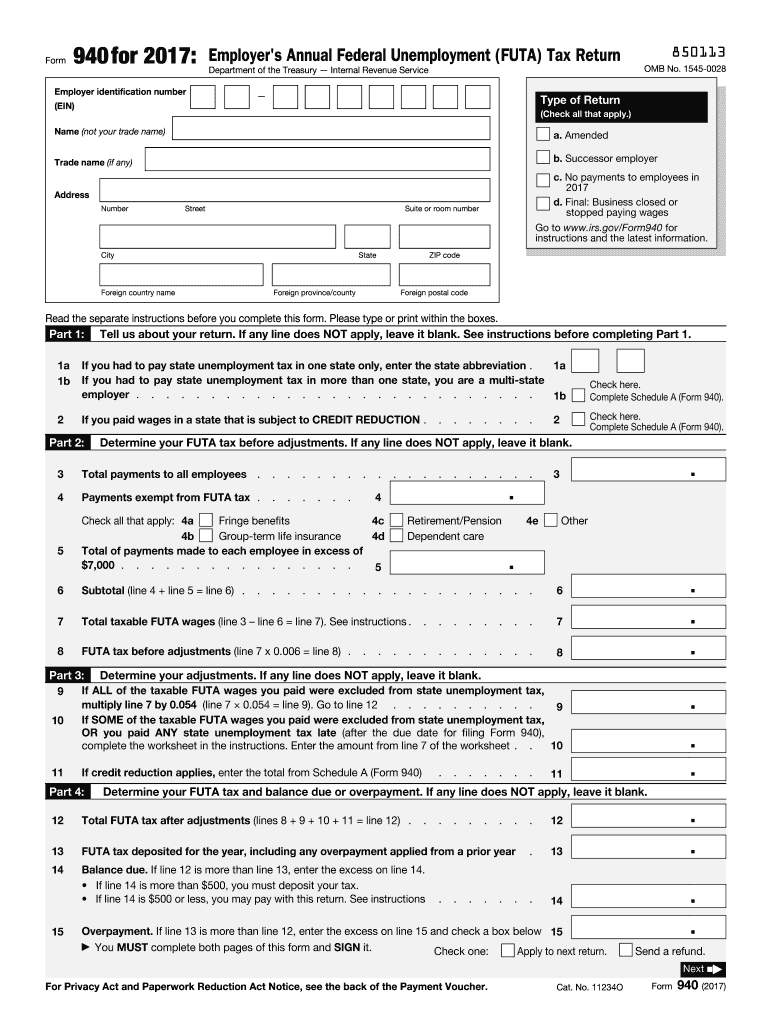

Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. You can edit these pdf forms online and download them on your computer for free. You can pay taxes for form 940 electronically using eftps. Web form 1040 department of the treasury—internal revenue service (99) u.s. Use form 940 to report your annual federal. Web the first page of form 940 is shown here, and the second page is shown next. Web get the schedule a form 940 for 2017 accomplished. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web form 940 (2020) employer's annual federal unemployment (futa) tax return.

Web get the schedule a form 940 for 2017 accomplished. For more information about a cpeo’s. Employer's annual federal unemployment (futa) tax. Complete, edit or print tax forms instantly. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. Form 940 refers to _____. Easily fill out pdf blank, edit, and sign them. Web cocodoc collected lots of free form 940 2017 for our users. No need to install software, just go to dochub, and sign up instantly and for free. Web form 1040 department of the treasury—internal revenue service (99) u.s.

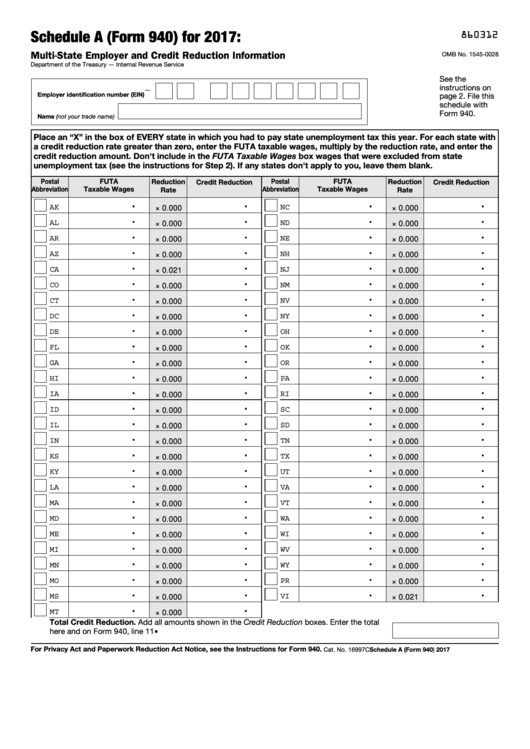

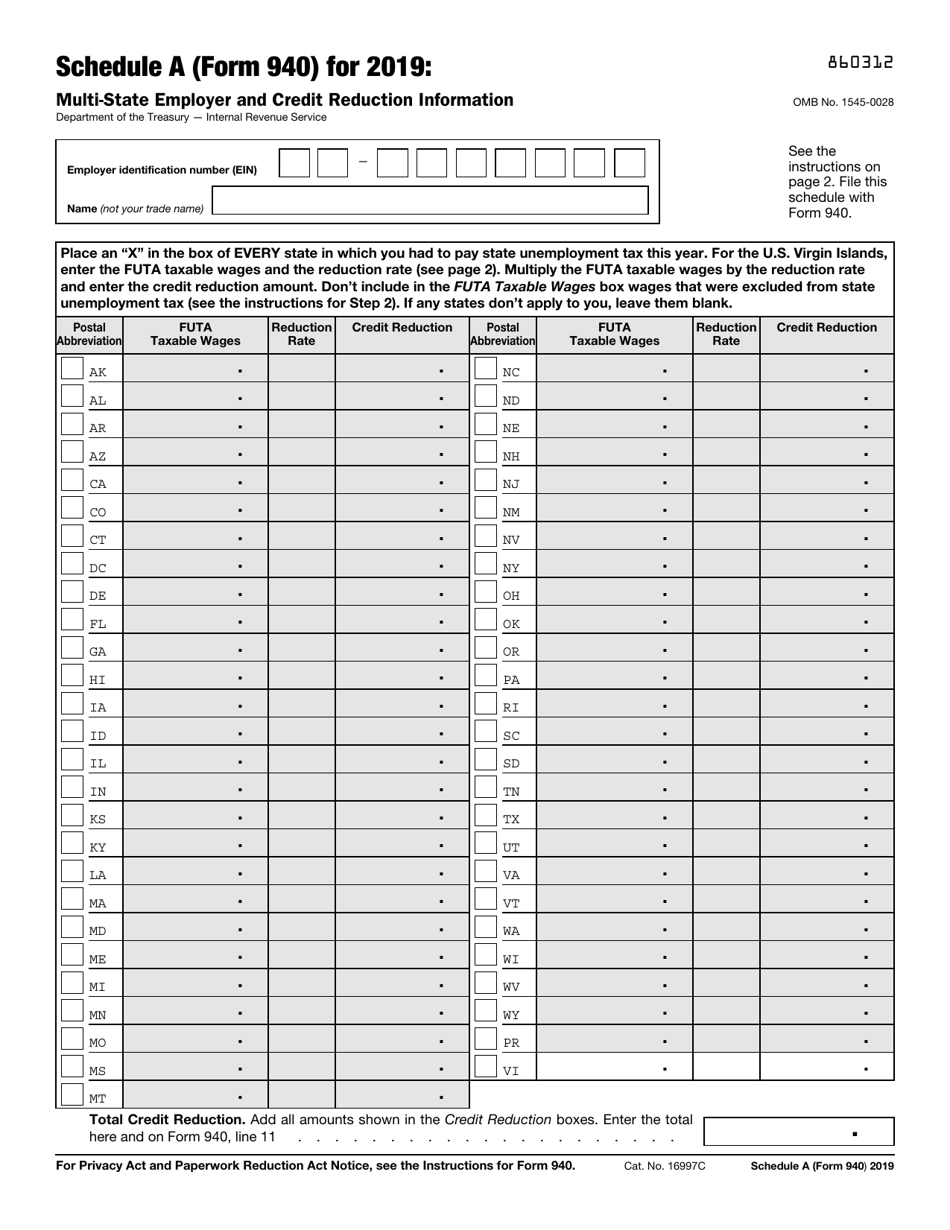

Fillable Schedule A (Form 940) MultiState Employer And Credit

Get ready for tax season deadlines by completing any required tax forms today. Web form 940 for 2015: Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Complete, edit or print tax forms instantly. Web edit, sign, and share form 940 2017 online.

IRS Form 940 Schedule A Download Fillable PDF or Fill Online Multi

Easily fill out pdf blank, edit, and sign them. Web generally, federal law provides employers with a 5.4 percent futa tax credit toward the 6.0 percent regular tax when they file their employer’s annual federal unemployment. Web this is the easiest way to electronically fill out the forms and prevent losing any information that you’ve entered. Web nonresidents of california.

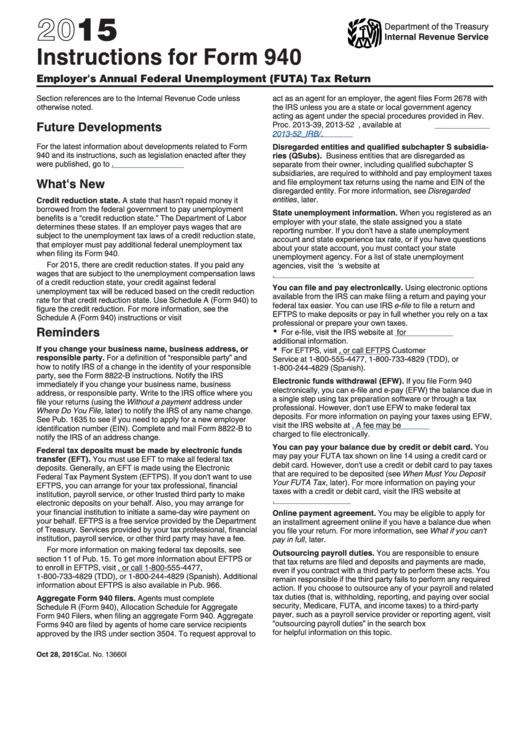

Instructions For Form 940 2017 printable pdf download

Web get forms, instructions, and publications. Ad access irs tax forms. Form 940 refers to _____. Web form 940 for 2015: Web get the schedule a form 940 for 2017 accomplished.

What is Form 940 and How is it Used by Small Businesses? Paychex

Employer's report for unemployment compensation c. For employers who withhold taxes from employee's paychecks or who must pay. Web cocodoc collected lots of free form 940 2017 for our users. Save or instantly send your ready documents. Web generally, federal law provides employers with a 5.4 percent futa tax credit toward the 6.0 percent regular tax when they file their.

Learn How to File Unemployment Taxes with IRS Form 940

Employer's annual federal unemployment (futa) tax. Ad download or email irs 940 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Web the first page of form 940 is shown here, and the second page is shown next. Web get the schedule a form 940 for 2017 accomplished.

Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Sign it in a few clicks draw your signature, type. Web get the schedule a form 940 for 2017 accomplished. Ad access irs tax forms. Web edit, sign, and share form 940 2017 online. You can edit these pdf forms online and download them on your computer for free.

Form 940 Fill out and Edit Online PDF Template

Web form 940 for 2015: Employer's annual federal unemployment (futa) tax return department of the treasury — internal revenue service. Web get forms, instructions, and publications. Web nonresidents of california who received california sourced income in 2017, or moved into or out of california in 2017, file either the long or short form 540nr, california. No need to install software,.

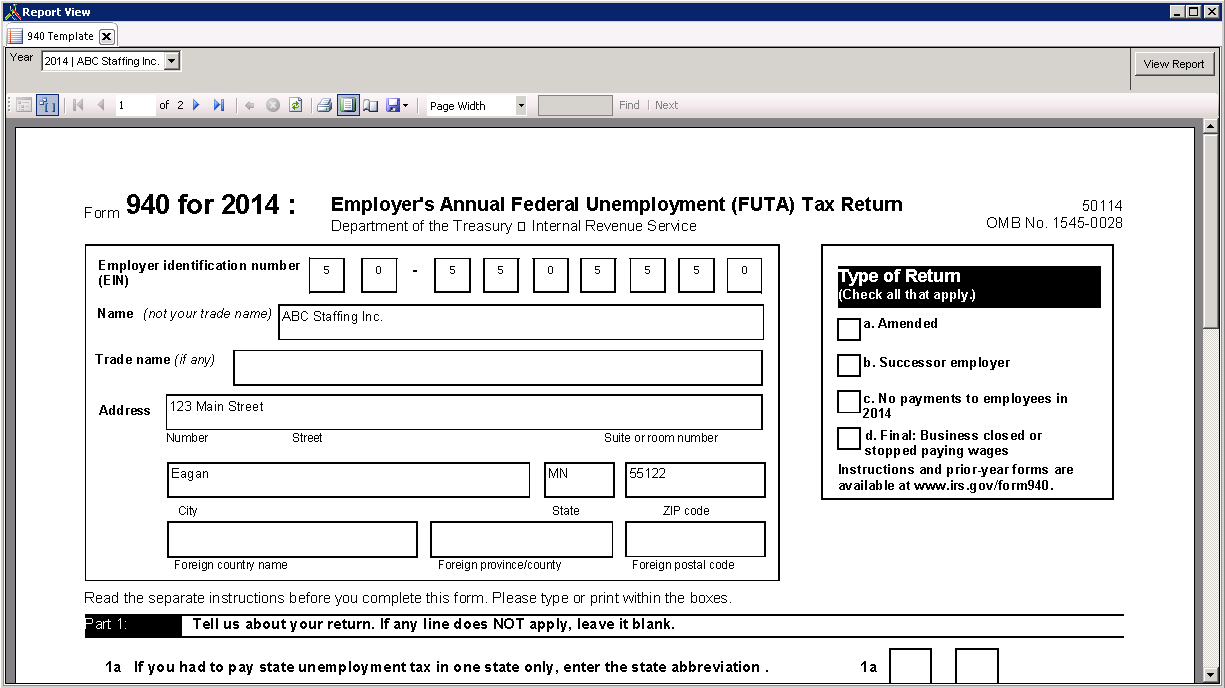

Standard Report 940 Template Avionte Classic

Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web get forms, instructions, and publications. Employer's annual federal unemployment (futa) tax. Employer's report for unemployment compensation c. Web form 940 for 2015:

Form 940 Instructions StepbyStep Guide Fundera

Web edit, sign, and share form 940 2017 online. Web form 940 (2020) employer's annual federal unemployment (futa) tax return. Web generally, federal law provides employers with a 5.4 percent futa tax credit toward the 6.0 percent regular tax when they file their employer’s annual federal unemployment. Web nonresidents of california who received california sourced income in 2017, or moved.

2017 Form IRS 940 Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. Use form 940 to report your annual federal. For employers who withhold taxes from employee's paychecks or who must pay. Edit your form 940 for 2017 online type text, add images, blackout confidential details, add comments, highlights and more. Web this is the easiest way to electronically fill out the forms and prevent.

Web Form 940 (2020) Employer's Annual Federal Unemployment (Futa) Tax Return.

Web form 1040 department of the treasury—internal revenue service (99) u.s. Ad download or email irs 940 & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. Download your adjusted document, export it to the cloud, print it from the editor, or share it with other people via a shareable.

Employer's Annual Federal Unemployment (Futa) Tax Return Department Of The Treasury — Internal Revenue Service.

Web cocodoc collected lots of free form 940 2017 for our users. Web generally, federal law provides employers with a 5.4 percent futa tax credit toward the 6.0 percent regular tax when they file their employer’s annual federal unemployment. Easily fill out pdf blank, edit, and sign them. Web edit, sign, and share form 940 2017 online.

Employer's Annual Federal Unemployment (Futa) Tax.

For employers who withhold taxes from employee's paychecks or who must pay. Employer's report for unemployment compensation c. Web cpeos must generally file form 940 and schedule r (form 940), allocation schedule for aggregate form 940 filers, electronically. You can pay taxes for form 940 electronically using eftps.

You Can Edit These Pdf Forms Online And Download Them On Your Computer For Free.

Web the first page of form 940 is shown here, and the second page is shown next. Sign it in a few clicks draw your signature, type. Use form 940 to report your annual federal. Form 940 refers to _____.