Form 8915 F Instructions

Form 8915 F Instructions - Previous versions of form 8915 only lasted. Screens for these forms can be. .1 who must file.2 when and where to file.2 what is a qualified. You can choose to use worksheet 1b even if you are not required to do so. This is the amount of early withdrawal. Web before you begin (see instructions for details): Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. See worksheet 1b, later, to determine whether you must use worksheet 1b. Web from the main menu of the tax return select: Generally this will match the distribution that was taxable but if you took.

Web from the main menu of the tax return select: This is the amount of early withdrawal. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. .1 who must file.2 when and where to file.2 what is a qualified. See worksheet 1b, later, to determine whether you must use worksheet 1b. Previous versions of form 8915 only lasted. Web before you begin (see instructions for details): Screens for these forms can be. You can choose to use worksheet 1b even if you are not required to do so.

Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. You can choose to use worksheet 1b even if you are not required to do so. Create an 1040 file with any name. Web from the main menu of the tax return select: Screens for these forms can be. Web before you begin (see instructions for details): There were no disaster distributions allowed in 2021. Web before you begin (see instructions for details): See worksheet 1b, later, to determine whether you must use worksheet 1b.

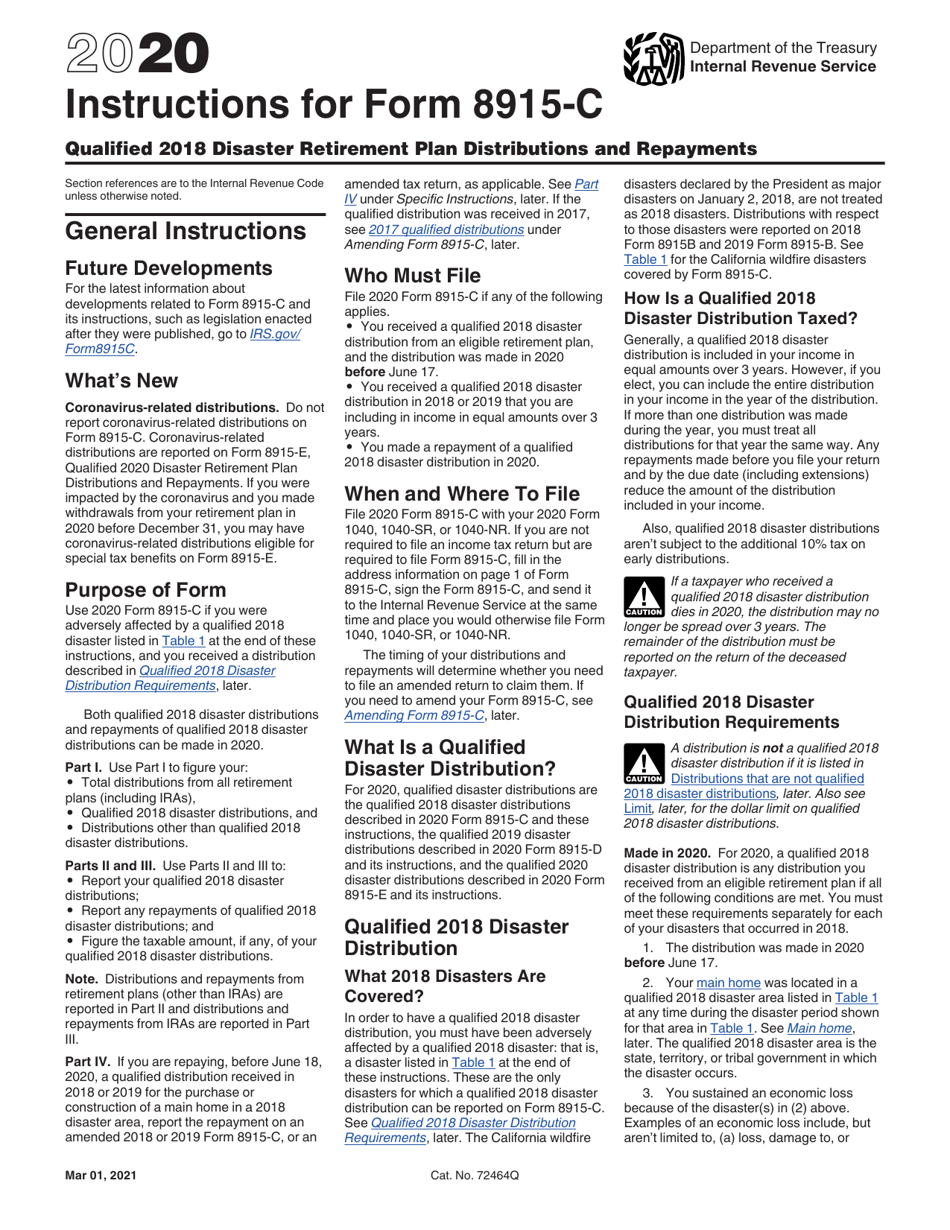

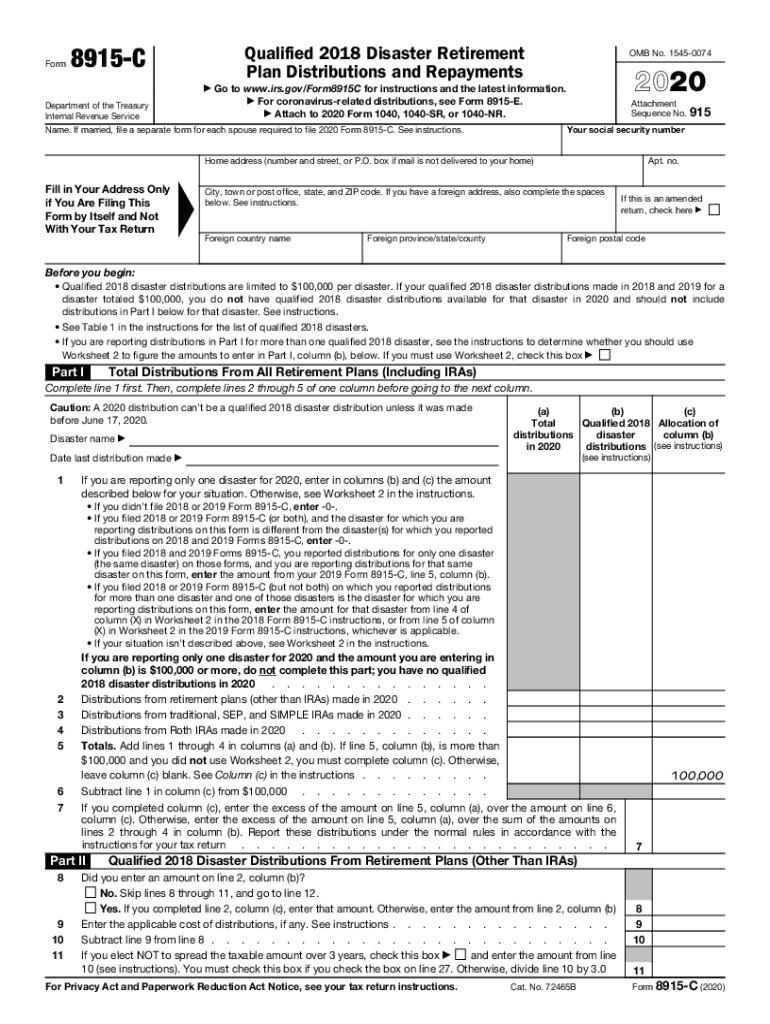

Download Instructions for IRS Form 8915C Qualified 2018 Disaster

Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. There were no disaster distributions allowed in 2021. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Previous versions of form 8915 only lasted. Generally this will match the distribution that was taxable but if you took.

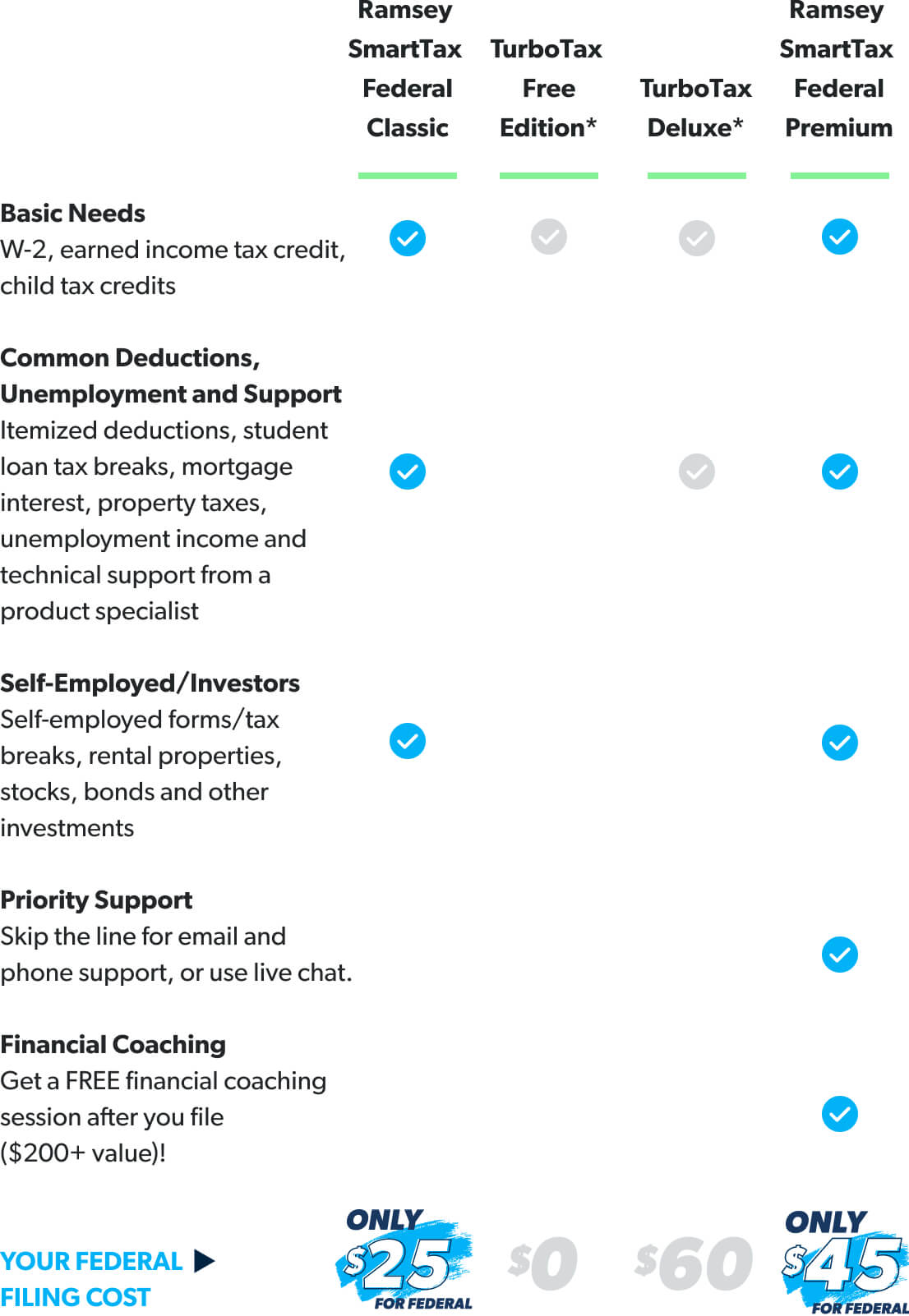

form 8915 e instructions turbotax Renita Wimberly

Create an 1040 file with any name. Web before you begin (see instructions for details): There were no disaster distributions allowed in 2021. Generally this will match the distribution that was taxable but if you took. .1 who must file.2 when and where to file.2 what is a qualified.

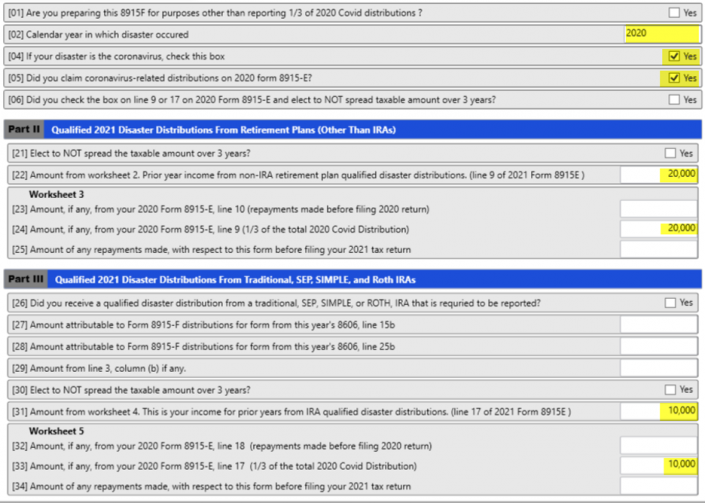

Basic 8915F Instructions for 2021 Taxware Systems

Web before you begin (see instructions for details): There were no disaster distributions allowed in 2021. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. You can choose to use worksheet 1b even if you are not required to do so. See worksheet 1b, later, to determine whether you must.

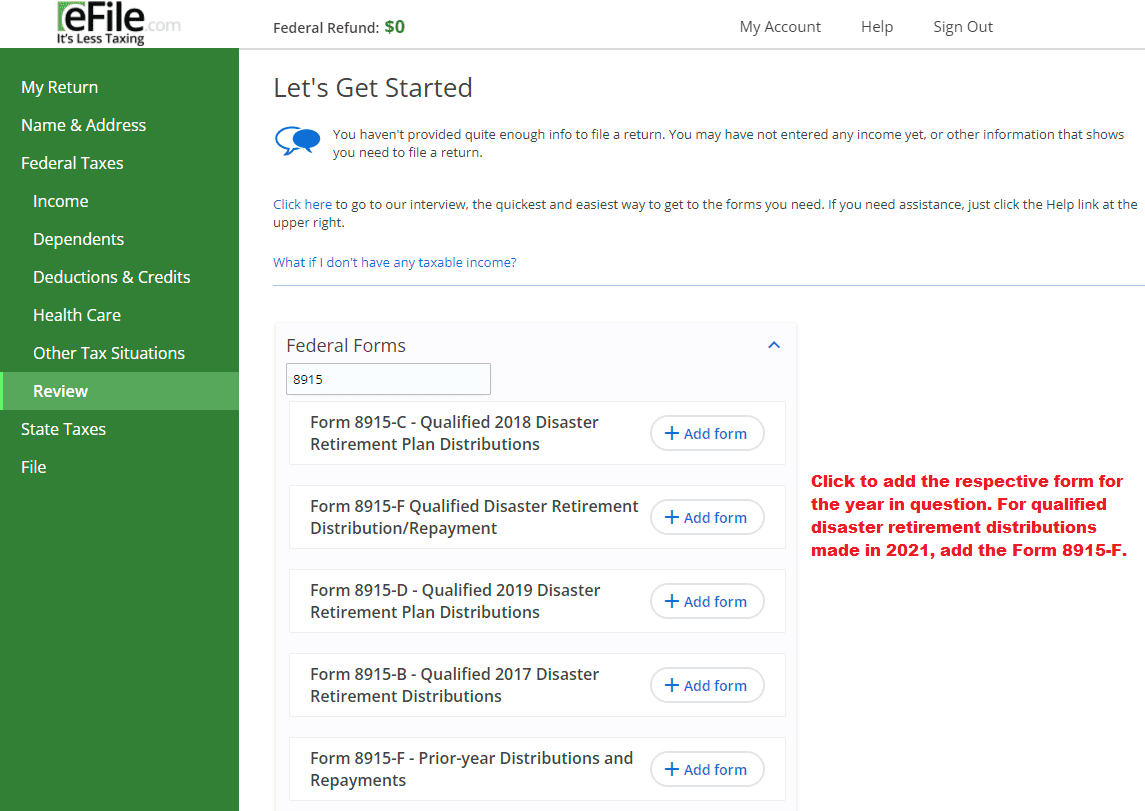

DiasterRelated Early Distributions via Form 8915

Screens for these forms can be. Generally this will match the distribution that was taxable but if you took. Previous versions of form 8915 only lasted. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Web from the main menu of the tax return select:

form 8915 e instructions turbotax Renita Wimberly

You can choose to use worksheet 1b even if you are not required to do so. Web from the main menu of the tax return select: Do not enter the prior year distribution on 1099, roth, 8608 or 5329. There were no disaster distributions allowed in 2021. Web before you begin (see instructions for details):

Irs Instructions 8915 Form Fill Out and Sign Printable PDF Template

There were no disaster distributions allowed in 2021. Web from the main menu of the tax return select: Generally this will match the distribution that was taxable but if you took. Create an 1040 file with any name. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the.

Form 8915e TurboTax Updates On QDRP Online & Instructions To File It

See worksheet 1b, later, to determine whether you must use worksheet 1b. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. Web before you begin (see instructions for details): Web from the main menu of the tax return select: Screens for these forms can be.

Fill Free fillable Form 8915F Qualified Disaster Retirement Plan

There were no disaster distributions allowed in 2021. Do not enter the prior year distribution on 1099, roth, 8608 or 5329. See worksheet 1b, later, to determine whether you must use worksheet 1b. Screens for these forms can be. This is the amount of early withdrawal.

8915c Fill out & sign online DocHub

There were no disaster distributions allowed in 2021. Web before you begin (see instructions for details): .1 who must file.2 when and where to file.2 what is a qualified. See worksheet 1b, later, to determine whether you must use worksheet 1b. You can choose to use worksheet 1b even if you are not required to do so.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

Screens for these forms can be. There were no disaster distributions allowed in 2021. This is the amount of early withdrawal. .1 who must file.2 when and where to file.2 what is a qualified. Web before you begin (see instructions for details):

Previous Versions Of Form 8915 Only Lasted.

There were no disaster distributions allowed in 2021. Generally this will match the distribution that was taxable but if you took. Create an 1040 file with any name. Do not enter the prior year distribution on 1099, roth, 8608 or 5329.

See Worksheet 1B, Later, To Determine Whether You Must Use Worksheet 1B.

This is the amount of early withdrawal. Screens for these forms can be. Web from the main menu of the tax return select: Web before you begin (see instructions for details):

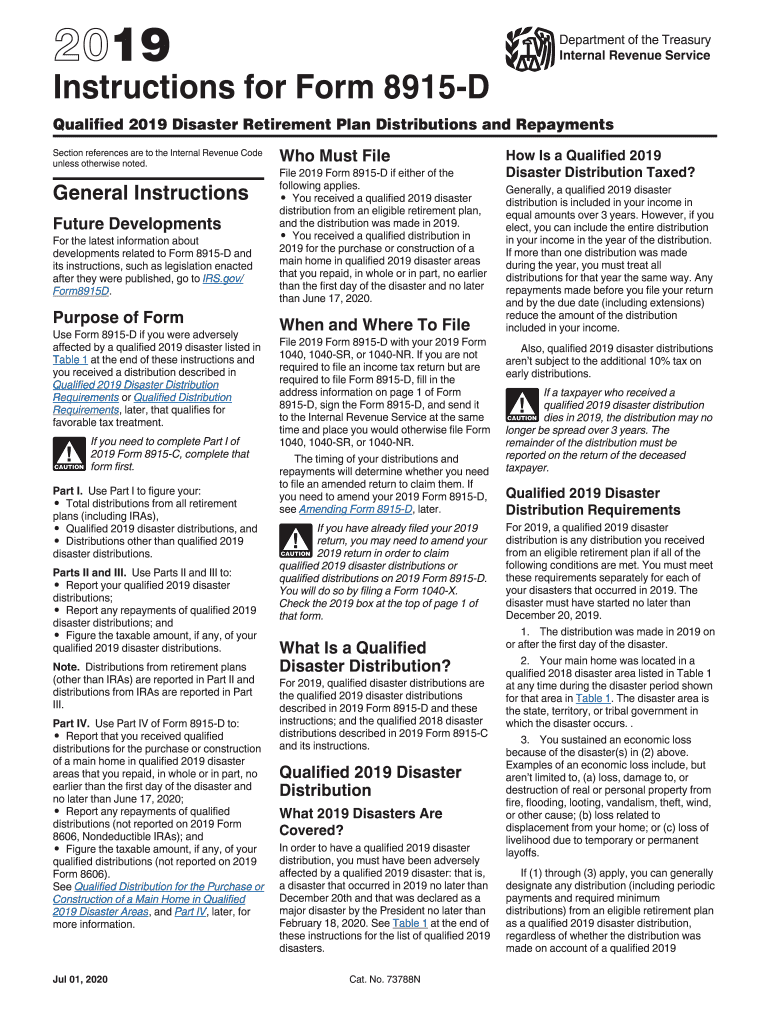

.1 Who Must File.2 When And Where To File.2 What Is A Qualified.

You can choose to use worksheet 1b even if you are not required to do so. Web if you made a repayment in 2022 after you filed your 2021 return, the repayment will reduce the. Web before you begin (see instructions for details):