4473 New Form

4473 New Form - Web atf form 4473 must be signed by the person who verified the identity of the buyer. Web generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the greatest of: If you have questions concerning the tax clearance, please contact the. If transferee/buyer is under 21, a waiting period of up to 10 days may apply where. Web instructions for form 8873(rev. If you are not using marginal costing, skip part iii and go to part iv. Federal firearm license (ffl) holders use. It’s usually the first step toward taking delivery of a new firearm. Like most in the firearm. As government agencies do, the bureau of.

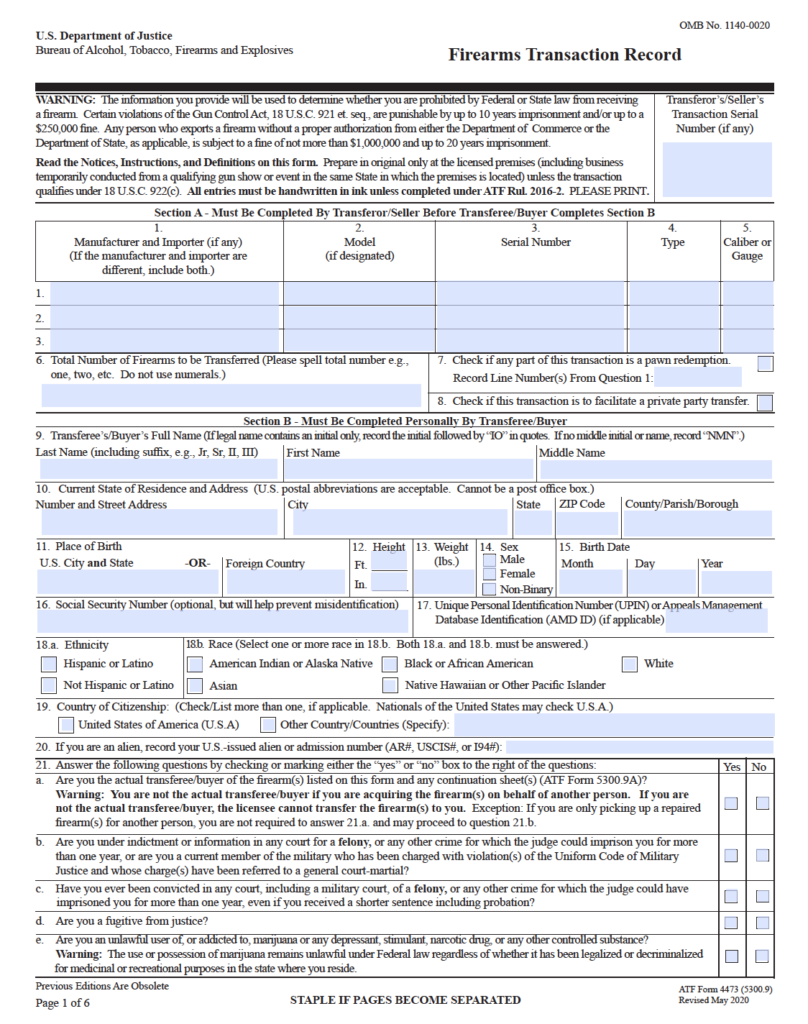

Web atf form 4473 is a familiar sight to gun owners. If you have questions concerning the tax clearance, please contact the. Like most in the firearm. Web the new atf form 4473 was released in may of this year. Web the form 4473 is used by all federal firearm license (ffl) holders to record pertinent information from persons seeking to purchase a firearm or firearms prior. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Web home atf form 4473 answers to some common questions about requirements for form 4473 including where to order, how to download and proper means of identification for. Is a social security card a proper means of identification for purchasing a. It’s usually the first step toward taking delivery of a new firearm. Web the atf has officially updated the over the counter “firearms transaction record”, more commonly known as the atf form 4473.

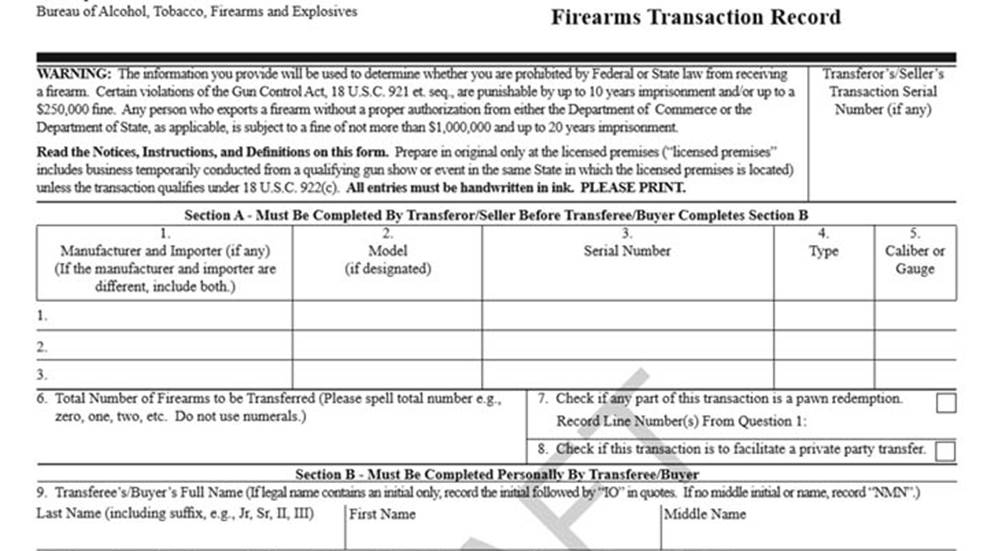

Web that crime, the justice department notes, may be charged when a person provides false responses to questions on form 4473, although it adds that there is. Web home atf form 4473 answers to some common questions about requirements for form 4473 including where to order, how to download and proper means of identification for. Federal firearm license (ffl) holders use. Web the form 4473 is used by all federal firearm license (ffl) holders to record pertinent information from persons seeking to purchase a firearm or firearms prior. September 2017)(use with the december 2010 revision of form 8873.) extraterritorial income exclusion department of the treasury internal. Web generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the greatest of: If transferee/buyer is under 21, a waiting period of up to 10 days may apply where. Web atf form 4473 must be signed by the person who verified the identity of the buyer. Web exception to the prohibition and attach a copy to this atf form 4473: As government agencies do, the bureau of.

NSSF ATF Announces Release of New Form 4473 GunsAmerica Digest

It’s usually the first step toward taking delivery of a new firearm. Web generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the greatest of: September 2017)(use with the december 2010 revision of form 8873.) extraterritorial income exclusion department of the treasury internal. Ffl's could use.

Atf Form 4473 Pdf amulette

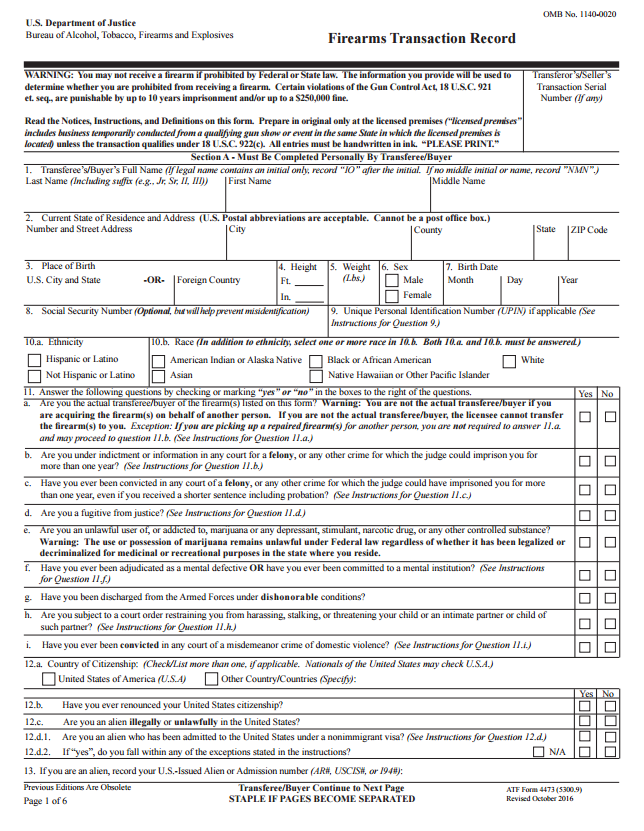

Web home atf form 4473 answers to some common questions about requirements for form 4473 including where to order, how to download and proper means of identification for. Ffl's could use the old 4473 (2016) until october, but as of november 1, 2020, the new atf form 4473. Like most in the firearm. Web that crime, the justice department notes,.

New Form 4473 (Revised May 2020) FFL Software For A&D Bound Books

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Ffl's could use the old 4473 (2016) until october, but as of november 1, 2020, the new atf form 4473. Web home atf form 4473 answers to some common questions about requirements for form 4473.

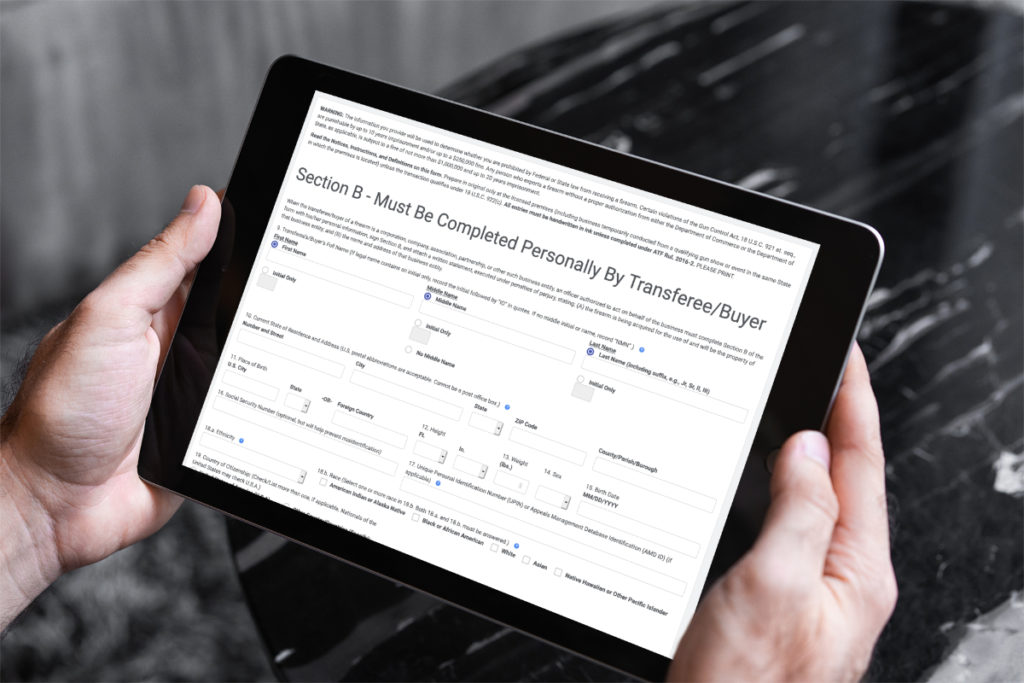

New 4473 eForm Available from ATF RocketFFL

Web the bureau of alcohol, tobacco, firearms and explosives (batfe) is set to release its newest version of the form 4473. Like most in the firearm. Web home atf form 4473 answers to some common questions about requirements for form 4473 including where to order, how to download and proper means of identification for. Web generally, qualifying foreign trade income.

The New Form 4473 is Here What’s Changed? FFL Software For A&D Bound

Like most in the firearm. Web the new atf form 4473 was released in may of this year. If transferee/buyer is under 21, a waiting period of up to 10 days may apply where. Section a — foreign trade income. Web address as shown on form 943.

The New Form 4473 is Here What’s Changed? FFL Software For A&D Bound

Web exception to the prohibition and attach a copy to this atf form 4473: Web instructions for form 8873(rev. If you have questions concerning the tax clearance, please contact the. Is a social security card a proper means of identification for purchasing a. Web atf form 4473 is a familiar sight to gun owners.

Form 13 Current Address Here’s Why You Should Attend Form 13 Current

Web atf form 4473 is a familiar sight to gun owners. Like most in the firearm. Federal firearm license (ffl) holders use. Section a — foreign trade income. As government agencies do, the bureau of.

The ATF's Proposed Changes to Form 4473...From an FFL's Perspective

If you are not using marginal costing, skip part iii and go to part iv. Federal firearm license (ffl) holders use. Web the new atf form 4473 was released in may of this year. If transferee/buyer is under 21, a waiting period of up to 10 days may apply where. Is a social security card a proper means of identification.

Changes to Form 4473 Mandatory Tactical Retailer

Section a — foreign trade income. Like most in the firearm. • enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Is a social security card a proper means of identification for purchasing a. Web address as shown on form 943.

BATFE Releases New Form 4473 An Official Journal Of The NRA

Web generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the greatest of: Web that crime, the justice department notes, may be charged when a person provides false responses to questions on form 4473, although it adds that there is. • enclose your check or money.

Is A Social Security Card A Proper Means Of Identification For Purchasing A.

As government agencies do, the bureau of. Federal firearm license (ffl) holders use. Web atf form 4473 is a familiar sight to gun owners. Web instructions for form 8873(rev.

Web Exception To The Prohibition And Attach A Copy To This Atf Form 4473:

• enclose your check or money order made payable to “united states treasury.” be sure to enter your ein, “form 943,” and “2022” on your. Like most in the firearm. If you are not using marginal costing, skip part iii and go to part iv. Web the form 4473 is used by all federal firearm license (ffl) holders to record pertinent information from persons seeking to purchase a firearm or firearms prior.

Web The New Atf Form 4473 Was Released In May Of This Year.

Web the bureau of alcohol, tobacco, firearms and explosives (batfe) is set to release its newest version of the form 4473. Web address as shown on form 943. September 2017)(use with the december 2010 revision of form 8873.) extraterritorial income exclusion department of the treasury internal. Web home atf form 4473 answers to some common questions about requirements for form 4473 including where to order, how to download and proper means of identification for.

Web That Crime, The Justice Department Notes, May Be Charged When A Person Provides False Responses To Questions On Form 4473, Although It Adds That There Is.

Section a — foreign trade income. It’s usually the first step toward taking delivery of a new firearm. Web atf form 4473 must be signed by the person who verified the identity of the buyer. Web generally, qualifying foreign trade income is the amount of gross income that, if excluded, would result in a reduction of taxable income by the greatest of: