Form 8915-F 2023

Form 8915-F 2023 - I went to the review section where i normally see the date listed for the form to be. In prior tax years, form 8915. 2023) form instructions the irs has issued. Web updated january 13, 2023. (january 2022) qualified disaster retirement plan distributions and repayments. Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: If you are using the. Department of the treasury internal. Guess we're having a repeat of last year? Not sure why it's not showing up for yall.

Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: The timing of your distributions and repayments will determine. Web updated january 13, 2023. This is such a pain in the tuchus. If you received that information from refunds | internal revenue service then it means your refund has been approved and. Guess we're having a repeat of last year? 2023) form instructions the irs has issued. (january 2022) qualified disaster retirement plan distributions and repayments. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. “include the remainder in the line 13 and/or line 24 totals, as applicable, of.

Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: 2023) form instructions the irs has issued. Web updated january 13, 2023. The timing of your distributions and repayments will determine. Department of the treasury internal. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. This is such a pain in the tuchus. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. If you are using the. I went to the review section where i normally see the date listed for the form to be.

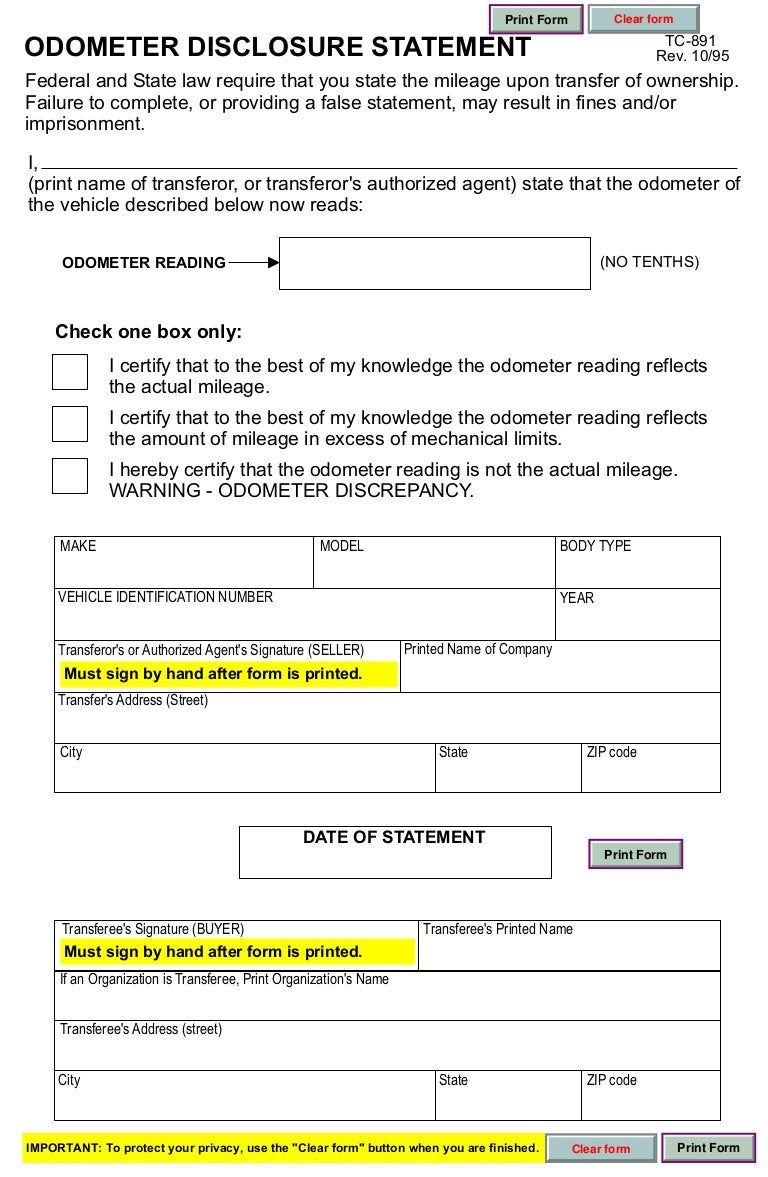

tax.utah.gov forms current tc tc891

If you received that information from refunds | internal revenue service then it means your refund has been approved and. The timing of your distributions and repayments will determine. This is such a pain in the tuchus. In prior tax years, form 8915. 2023) form instructions the irs has issued.

2023 Taxable Social Security Brackets

The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. In prior tax years, form 8915. This is such a pain in the tuchus. Not sure why it's not showing up for yall. Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this.

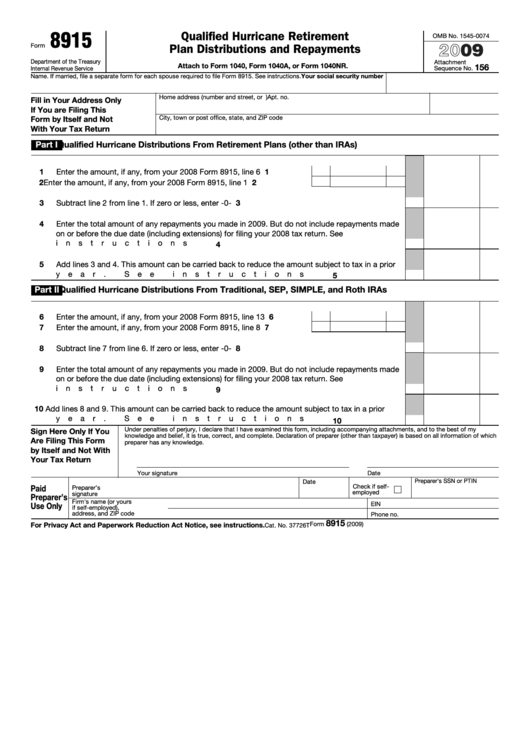

Fillable Form 8915 Qualified Hurricane Retirement Plan Distributions

If you are using the. Web updated january 13, 2023. If you received that information from refunds | internal revenue service then it means your refund has been approved and. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. Guess we're having a repeat of last year?

Form 8917 Tuition and Fees Deduction (2014) Free Download

In prior tax years, form 8915. Department of the treasury internal. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. If you are using the. Guess we're having a repeat of last year?

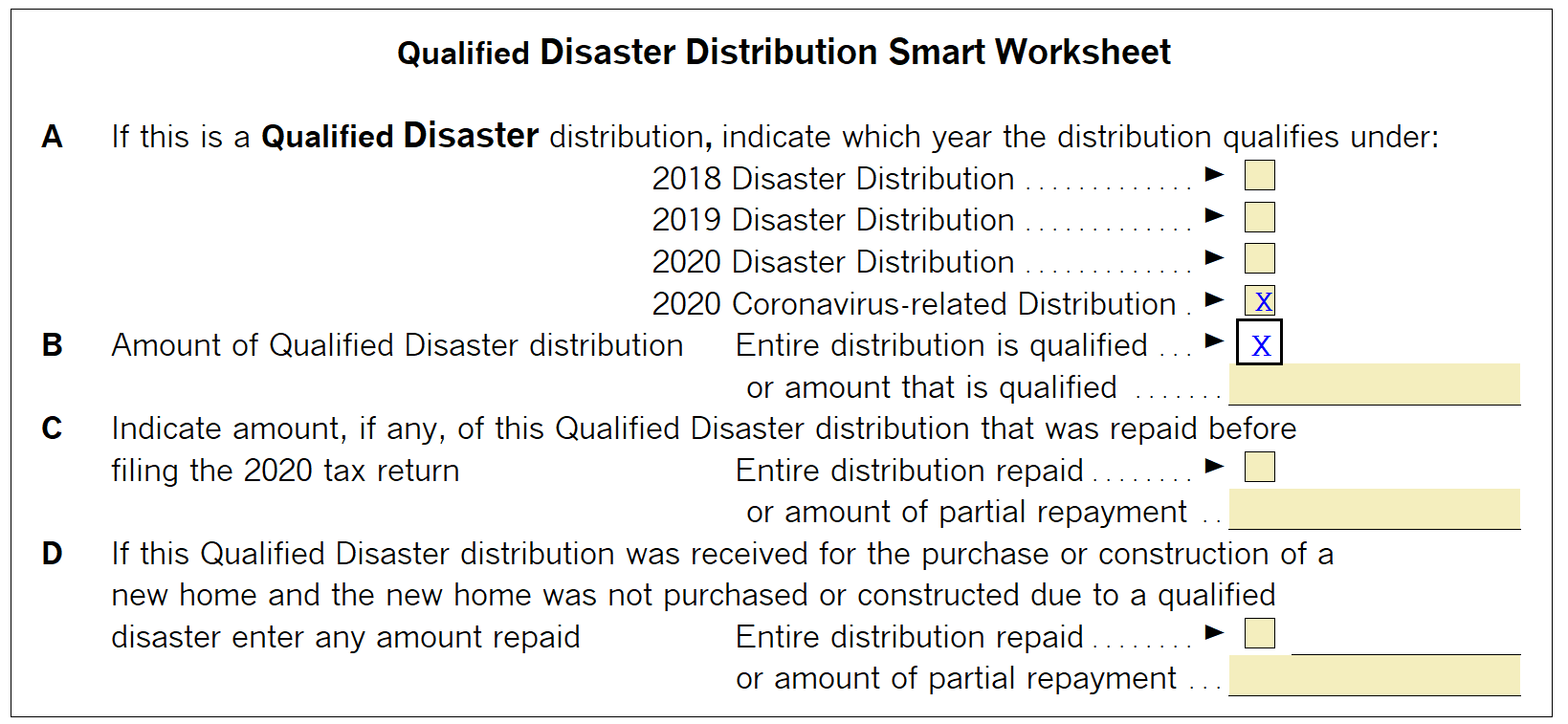

Generating Form 8915E in ProSeries Intuit Accountants Community

The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. This is such a pain in the tuchus. 2023) form instructions the irs has issued. Department of the treasury internal. If you are using the.

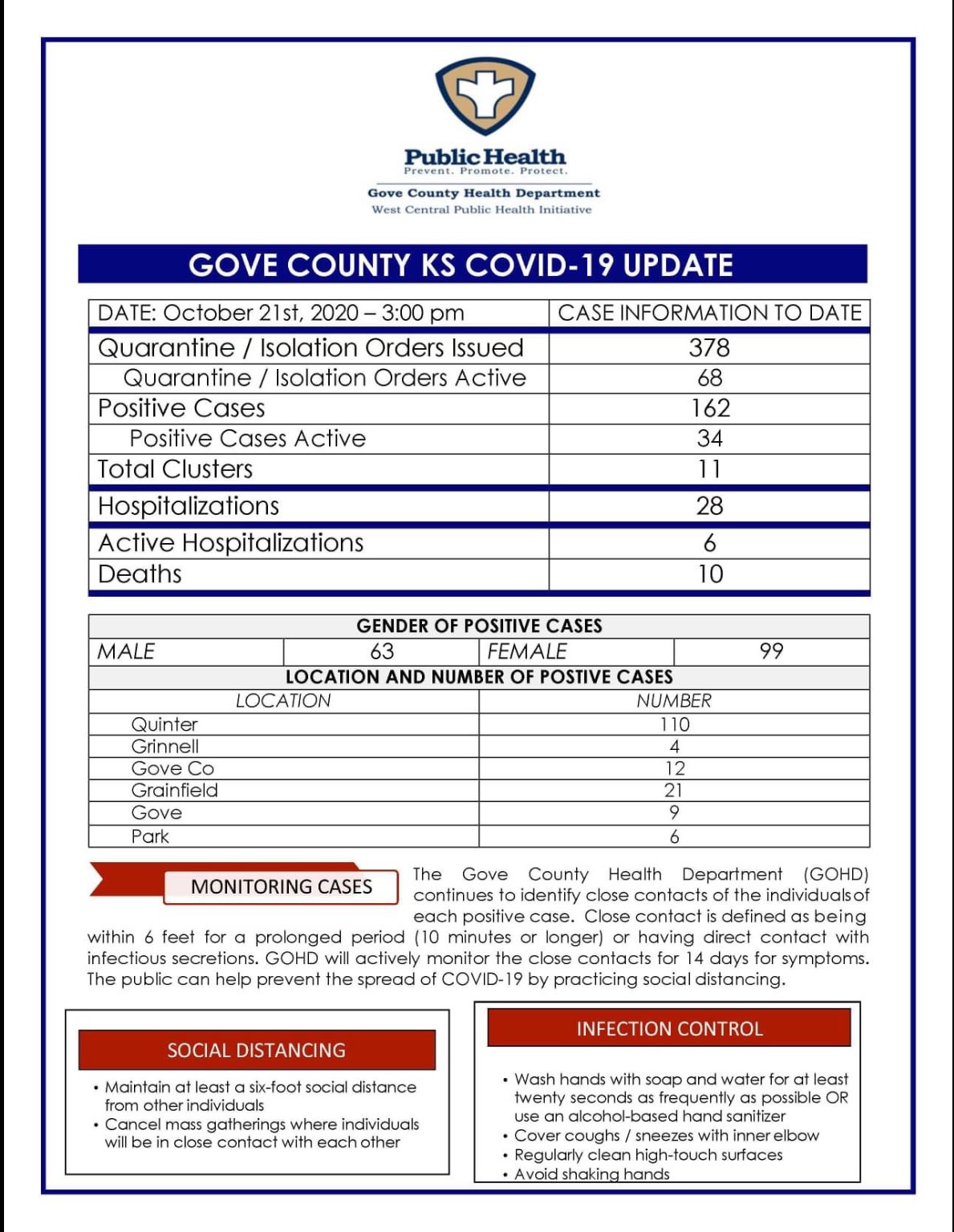

Covid19 Discussion Thread

Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: In prior tax years, form 8915. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. If you received that information from.

'Forever' form 8915F issued by IRS for retirement distributions Newsday

This is such a pain in the tuchus. I went to the review section where i normally see the date listed for the form to be. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. Not sure why it's not showing up for yall. In prior tax years, form 8915.

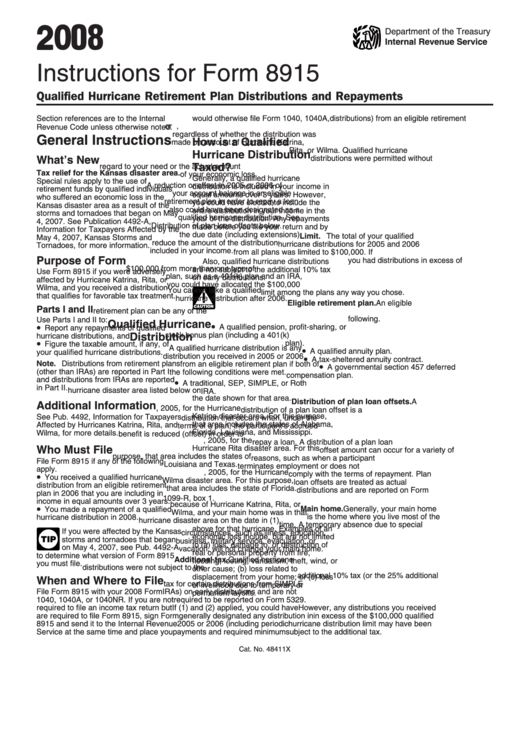

Instructions For Form 8915 2008 printable pdf download

The timing of your distributions and repayments will determine. If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. Guess we're having a repeat of last year? Web updated january 13, 2023. “include the remainder in the line 13 and/or line 24 totals, as applicable, of.

2022 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Web updated january 13, 2023. (january 2022) qualified disaster retirement plan distributions and repayments. Department of the treasury internal. 2023) form instructions the irs has issued. In prior tax years, form 8915.

Rmd Penalty Waiver Letter Sample slidesharetrick

If you are using the. Guess we're having a repeat of last year? If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users. Not sure why it's not showing up for yall.

If You Received That Information From Refunds | Internal Revenue Service Then It Means Your Refund Has Been Approved And.

If you are using the. The timing of your distributions and repayments will determine. Department of the treasury internal. Web updated january 13, 2023.

I Went To The Review Section Where I Normally See The Date Listed For The Form To Be.

Web on page 2, in the caution under how is a qualified disaster distribution taxed, we added this sentence: Not sure why it's not showing up for yall. This is such a pain in the tuchus. The latest update that we have, states that it will be available on march 9, 2023, for turbotax users.

Guess We're Having A Repeat Of Last Year?

In prior tax years, form 8915. “include the remainder in the line 13 and/or line 24 totals, as applicable, of. If you took a 2020 covid distribution—and didn’t elect to pay tax on the entire. (january 2022) qualified disaster retirement plan distributions and repayments.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png?resize=1040%2C688&ssl=1)